Optical Lens For Infrared Device Market Size, Share, & Forecast 2034

Optical Lens For Infrared Device Market By Type (Fixed Focus, Zoom, Varifocal), By Application (Automotive, Defense, Security and Surveillance, Thermography, Medical, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

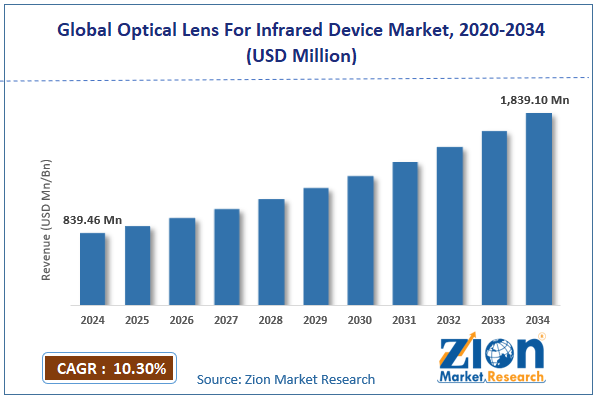

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 839.46 Million | USD 1839.10 Million | 10.30% | 2024 |

Optical Lens For Infrared Device Industry Perspective:

The global optical lens for infrared device market size was around USD 839.46 million in 2024 and is projected to reach USD 1839.10 million by 2034, with a compound annual growth rate (CAGR) of roughly 10.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global optical lens for infrared device market is estimated to grow annually at a CAGR of around 10.30% over the forecast period (2025-2034)

- In terms of revenue, the global optical lens for infrared device market size was valued at around USD 839.46 million in 2024 and is projected to reach USD 1839.10 million by 2034.

- The optical lens for infrared device market is projected to grow significantly owing to the growth of autonomous vehicles and ADAS systems, surging demand for medical infrared diagnostics and imaging, and the rise in consumer electronics with IR sensing (wearables, smartphones).

- Based on type, the fixed focus segment is expected to lead the market, while the zoom segment is expected to grow considerably.

- Based on application, the defense segment is the largest, while the security and surveillance segment is projected to record sizeable revenue over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Optical Lens For Infrared Device Market: Overview

Optical lenses for infrared devices are precision-engineered components designed to transmit and focus infrared radiation rather than visible light. They are usually made from specialized materials such as zinc selenide, silicone, chalcogenide glass, and germanium, which offer optimal thermal stability and IR transparency. The global optical lens for infrared device market is likely to expand rapidly, fueled by growing military and defense thermal imaging deployments, automotive night-vision adoption in ADAS and premium cars, and industrial automation for predictive maintenance and process monitoring. Defense agencies are rapidly integrating IR lenses into drones, scopes, and for border surveillance and target acquisition. The growing geopolitical stresses and advancement programs are fueling budget growth for ISR systems. This creates sustained demand for high-precision and rugged IR optics worldwide.

Moreover, automakers are furnishing IR cameras using chalcogenide or germanium lenses for wildlife, pedestrian, and obstacle detection beyond headlights. The rise of luxury EVs and Level-2+/3 autonomy is augmenting this integration. The move from passive safety to predictive safety makes infrared optics strategic. Furthermore, power plants, factories, and refineries use IR optics in thermography to detect overheating, insulation failures, and leakage. IR lenses allow continuous non-contact inspection in high-temperature and hazardous zones. Reliability-centered maintenance and Industry 4.0 expand this installed base.

Despite the growth, the global market is constrained by factors such as high material & processing costs, as well as export controls and defense regulations. Infrared lenses require germanium, silicone, chalcogenide, and zinc selenide, all of which are supply-constrained and high-priced. The polishing, tolerance, and coating requirements further increase the per-unit cost. This prevents penetration in cost-sensitive and consumer applications. Likewise, military-grade IR optics are majorly regulated under ITAR and dual-use export architectures. These rules increase lead times, block some regions completely, and limit cross-border shipments. This compliance pressure slows commercial growth and deal execution.

Nonetheless, the global optical lens for infrared device industry stands to gain from a few key opportunities, such as AI-assisted thermal analytics bundling and the integration of automotive night-vision and ADAS. Embedding AI with IR lenses allows automatic hotspot tagging, anomaly detection, and behavior interference. This moves revenue from pure hardware to value-added smart modules. Vendors that co-design optics with AI stacks gain lock-in and margin. Trucks and premium cars are integrating IR lenses for night-time pedestrian, obstacle, and animal detection. NCAP and regulatory safety scoring increase further attach rates. As IR moves from luxury to mid-segment trims, the demand scales operationally.

Optical Lens For Infrared Device Market: Growth Drivers

How is the optical lens for infrared devices driven by the explosive growth in industrial thermography & predictive maintenance?

Utilities, refineries, data centers, and factories are adopting IR vision for non-contact detection of faults in cables, motors, busbars, and drives. A 2024 ISA survey found that 71% of brownfield plants budgeted thermal inspection upgrades by 2026 under pressure from insurance and uptime.

In 2025, FLIR and ABB introduced an IR inspection cell for high-voltage substations using in-situ glass-protected lenses certified for arc-flash zones. As plants move from reactive to predictive maintenance, IR cameras move from specialist rentals to standard assets, driving demand for MWIR and LWIR lenses for extreme environments and impacting the growth of the optical lens for infrared device market.

How is the optical lens market for infrared devices being remarkably fueled by the expansion of healthcare & life-science imaging?

Infrared lenses are currently used in contact-free patient monitoring, burn assessment, inflammation diagnostics, and neonatal screening, strengthened by post-COVID-19 normalization of thermal protocols. WHO polling shows over 65 nations still maintain IR hospital entry screening in 2024-25, forming a structurally installed base.

In 2025, a Korean med-tech company obtained FDA clearance for an IR dermal oncology triage camera using high-NA germanium lenses. Adoption of IR lenses in fertility labs and incubators is also increasing to prevent light stress, and once embedded in medical protocols, IR lens procurement becomes recurring and long-cycle.

Restraints

Dominance of a few top-tier players suppresses price competition, and access negatively impacts the market progress

The IR optics industry is dominated by incumbents with capital, defense approvals, and know-how, creating a high entry barrier. A 2024 audit found that the top six vendors accounted for 55-60% of LWIR optical assembly revenue. Large primes secure long-term defense-related supply contracts, blocking new suppliers from winning volume. In 2025, a European start-up excited IR bids after losing to bundled strategic discounting, denoting a structural concentration that limits buyer choice and slows advancements.

Opportunities

How do autonomous mobile robots (AMRs/UGVs/UAVs) for dark/harsh missions create promising avenues for the optical lens and infrared device industry?

Mines, warehouses, tunnels, refineries, and defense UAV/UGV deployments need perception in obscurants – IR is the only passive modality that holds. According to the research (2024), it predicts >480 AMR shipments by 2028, with a growing IR-enabled inspection including thermal bands. In 2025, Boston Dynamics demo’d a refinery-grade IR-enabled inspection dog with IP-rated LWIR optics. First-responder drones are being mandated in wildfire corridors in the United States West & South Europe since the 2024 wildfire season. Each unmanned node adds 1-3 IR optical channels, compounding unit pull. These efforts by companies are ultimately augmenting the growth of the optical lens for infrared device industry.

Challenges

ITAR/EAR/EU dual-use friction on shipping and deal timing restricts the market growth

Weapon-adjacent IR lenses trip export vetting—usually resulting in 3-9-month licensing delays on Middle East shipments, as mentioned in 2023-25. In late 2025, BIS widened controls on MWIR assemblies associated with seekers. Documentation, end-user attestation, and traceability increase SG&A pressure; some buyers abandon procurement mid-cycle due to compliance drag. Regulatory latency erodes velocity and kills option value in cross-border deals.

Optical Lens For Infrared Device Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Optical Lens For Infrared Device Market |

| Market Size in 2024 | USD 839.46 Million |

| Market Forecast in 2034 | USD 1,839.10 Million |

| Growth Rate | CAGR of 10.30% |

| Number of Pages | 214 |

| Key Companies Covered | Thorlabs, Edmund Optics, Jenoptik, II-VI Incorporated, L3Harris Technologies, Teledyne FLIR, LightPath Technologies, Leica Microsystems, Schneider Kreuznach, Ophir Optics, HOYA Corporation, Tamron Co., Umicore, Sunny Optical Technology, Excelitas Technologies, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Optical Lens For Infrared Device Market: Segmentation

The global optical lens for infrared devices market is segmented by type, application, and region.

Based on type, the global optical lens for infrared device industry is divided into fixed focus, zoom, and varifocal. The fixed-focus segment captured leading market share because it is simpler, easier, and cheaper to embed in thermal cameras, industrial sensors, and riflescopes. With no moving parts, they offer enhanced durability and stability, making them suitable for perimeter security, defense, and fixed-distance monitoring. Their high-volume use in embedded and cost-sensitive platforms sustains their dominance.

Conversely, the zoom segment held a second-leading share due to its ability to track targets and vary focal length at changing distances. They are highly preferred for ISR payloads, long-range surveillance, emergency response, and border control, where a flexible field of view is mission-critical. Despite their greater complexity and cost, vehicle-mounted systems are being deployed, and demand for border maintenance is growing.

Based on application, the global optical lens for infrared device market is segmented into automotive, defense, security and surveillance, thermography, medical, and others. The defense segment holds a dominant share, as IR lenses are essential in thermal weapon sights, ISR gimbals, order-surveillance optics, UAV payloads, and missile seekers. Defense budgets are recession-insulated and multi-year, promising stable premium ruggedized builds and stable volume. Geopolitical stresses and current technological cycles structurally sustain the demand for a defense-led IR lens.

However, the security and surveillance segment ranks second, as airports, cities, industrial assets, and ports deploy thermal cameras for uninterrupted visibility. IR lenses outshine visible optics in fog, at night, and in smoke, making them vital for perimeter, intrusion, and asset protection grids.

Optical Lens For Infrared Device Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Optical Lens for Infrared Device Market?

Asia Pacific is anticipated to retain its leading role in the global optical lens for infrared device market due to the most significant defense and border security spending in major countries, a larger manufacturing base, and faster adoption in ADAS and night-vision pipelines. India, China, and South Korea have multi-year procurement pipelines for thermal sights, perimeter systems, and UAV IR payloads. Asia accounted for nearly 35-40% of global defense IR optics consumption in 2024, driven by ongoing border tensions. Government-supported budget shield demand from macro shocks, making it a highly stable volume base.

Moreover, Japan, China, and South Korea host vertically integrated IR lens fabs, sensor-optics co-pack plants, and coating lines. Asia accounts for nearly 45-50% of worldwide IR lens production volume due to labor, proximity to substrate chemistry, and tooling. This home-region production compresses lead times, reduces costs, and reduces supply friction compared to imports. Japan, China, and Korea are the leading hubs for OEMs integrating IR night-vision and thermal pedestrian detection. The region's automotive share of worldwide IR lens pull surpassed 30% in 2024, outshining North America and Europe. Local Tier-1s co-develop lenses with ADAS stacks, amplifying scaling and industrialization.

North America ranks as the second-leading region in the global optical lens for infrared device industry, driven by a well-developed security & critical infrastructure surveillance grid, high penetration in premium OEM trims and automotive pilots, and industrial thermography and predictive maintenance. Thermal lenses are widely used in energy assets, airport security, prisons, homeland border surveillance, and ports.

The region accounted for 22-25% of novel thermal surveillance deployments in 2023-24, driven by compliance-intensive industries. State and federal mandates augment upgrades and replacements. Canada and the United States host ADAS and premium research programs testing thermal night-vision for safety enhancement. North America registered for 18-20% of worldwide automotive IR lens demand in 2024, behind APAC but ahead of Europe. Luxury SUV penetration and AV pilots sustain specialized IR acceptance.

Refineries, utilities, semiconductor fabs, and aerospace plants depend on IR inspection to lessen downtime. The region registers for a 20-22% share of worldwide industrial IR lens consumption, backed by sophisticated digital reliability architectures. The high cost of failures and the early adoption of digitalization justify thermal adoption.

Optical Lens For Infrared Device Market: Competitive Analysis

The leading players in the global optical lens for infrared device market are:

- Thorlabs

- Edmund Optics

- Jenoptik

- II-VI Incorporated

- L3Harris Technologies

- Teledyne FLIR

- LightPath Technologies

- Leica Microsystems

- Schneider Kreuznach

- Ophir Optics

- HOYA Corporation

- Tamron Co.

- Umicore

- Sunny Optical Technology

- Excelitas Technologies

Optical Lens For Infrared Device Market: Key Market Trends

Shift toward compact molded and wafer-level IR optics:

Manufacturers are moving from traditionally ground germanium lenses to wafer-level and molded chalcogenide optics to shrink packaging cost and size. These frameworks streamline assembly, enable high-volume scaling, and enhance repeatability for embedded modules. The miniaturization trend opens IR lenses to drone, consumer, and wearable domains previously blocked by bulk and cost.

Rising automotive night-vision and ADAS attach rates:

Automakers are embedding IR lenses for long-range animal/pedestrian detection under adverse conditions and in low light. Initial penetration in luxury trims is now spreading to mid-segment ADAs, steadily increasing volume. The push for safety ratings and L3/L4 readiness strengthens IR lens inclusion in forward perception stacks.

The global optical lens for infrared device market is segmented as follows:

By Type

- Fixed Focus

- Zoom

- Varifocal

By Application

- Automotive

- Defense

- Security and Surveillance

- Thermography

- Medical

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Optical lenses for infrared devices are precision-engineered components designed to transmit and focus infrared radiation rather than visible light. They are usually made from specialized materials such as zinc selenide, silicone, chalcogenide glass, and germanium, which offer optimal thermal stability and IR transparency.

The global optical lens for infrared device market is projected to grow due to growth in thermal imaging adoption across defense and security, expansion of aerospace and satellite-based IR payloads, and advancements in coating technologies and IR materials.

According to a study, the global optical lens for infrared device market size was around USD 839.46 million in 2024 and is expected to grow to around USD 1839.10 million by 2034.

The CAGR value of the optical lens for infrared device market is expected to be around 10.30% during 2025-2034.

Macroeconomic factors will moderate near-term civil demand through cost scrutiny and capital deferrals, while security, defense, and regulated infrastructure spending keep the inclusive market structurally resilient.

Market trends and preferences are shifting toward AI-ready, compact, cost-optimized IR lenses that enable integration into security, automotive, medical, and embedded industrial systems rather than standalone thermal hardware.

North America is expected to lead the global optical lens for infrared device market during the forecast period.

China is a major contributor to the global market due to its dominant manufacturing base, large defense procurement, and extensive deployment in industrial and security applications.

The key players profiled in the global optical lens for infrared device market include Thorlabs, Edmund Optics, Jenoptik, II-VI Incorporated, L3Harris Technologies, Teledyne FLIR, LightPath Technologies, Leica Microsystems, Schneider Kreuznach, Ophir Optics, HOYA Corporation, Tamron Co., Umicore, Sunny Optical Technology, and Excelitas Technologies.

The report examines key aspects of the optical lens for infrared device market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed