Managed Security Services Market Size, Share, Trends, Growth & Forecast 2034

Managed Security Services Market By Security (Cloud Security, Endpoint Security, Network Security, Data Security, and Others), By Services (Managed SIEM, Managed UTM, Managed DDoS, Managed XDR, Managed IAM, Managed Risk & Compliance, and Others), By Enterprise Size (SMEs, Large Enterprises), By Vertical (BFSI, Healthcare, Manufacturing, IT and Telecom, Retail, Defense/Government, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

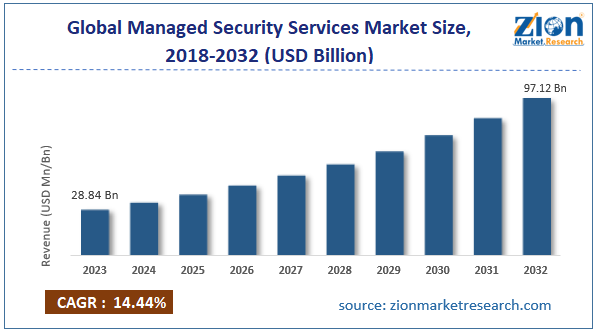

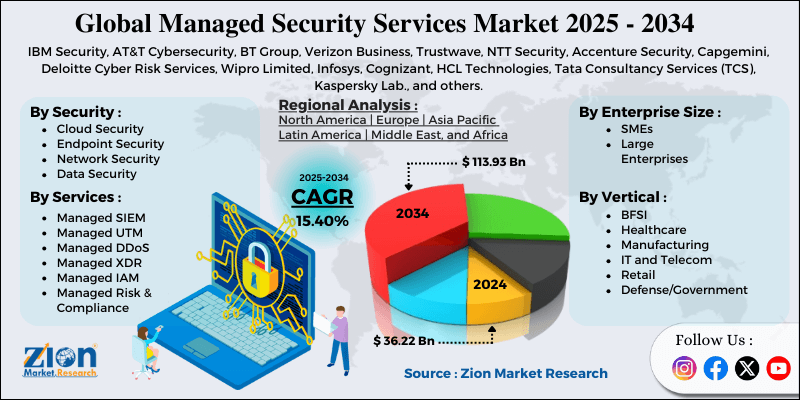

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 36.22 Billion | USD 113.93 Billion | 15.40% | 2024 |

Managed Security Services Industry Perspective:

The global managed security services market size was approximately USD 36.22 billion in 2024 and is projected to reach around USD 113.93 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.40% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global managed security services market is estimated to grow annually at a CAGR of around 15.40% over the forecast period (2025-2034)

- In terms of revenue, the global managed security services market size was valued at around USD 36.22 billion in 2024 and is projected to reach USD 113.93 billion by 2034.

- The managed security services market is projected to grow significantly due to the rising adoption of cloud-based applications and services, the growing proliferation of connected and IoT devices, and the escalating demand for cost-effective security solutions.

- Based on security, the network security segment is expected to lead the market, while the cloud security segment is expected to grow considerably.

- Based on services, the managed SIEM segment is the dominant segment, while the managed XDR segment is projected to witness sizable revenue growth over the forecast period.

- Based on enterprise size, the large enterprises segment is expected to lead the market, while the SMEs segment is expected to grow considerably.

- Based on vertical, the BFSI segment is expected to lead the market, followed by the IT and telecom segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Managed Security Services Market: Overview

Managed security services are outsourced services provided by dedicated security vendors to manage, monitor, and protect a business's data and IT infrastructure from cyber threats. These services include real-time threat detection, firewall management, incident response, vulnerability evaluation, compliance management, and intrusion prevention. The global managed security services market is expected to expand rapidly, driven by the increasing number of data breaches and cybersecurity threats, the rising adoption of cloud services, and the scarcity of skilled cybersecurity experts. The growing number of cyberattacks is driving organizations to toughen their security posture through MSS. These services offer real-time threat detection and constant monitoring. Businesses rely on MSS to prevent potential losses and ensure data protection.

Moreover, the shift to hybrid and cloud environments presents additional challenges for compliance and cloud security. This fuels businesses to outsource their security needs to professionals for enhanced protection. Furthermore, the lack of in-house cybersecurity talent makes MSS a helpful solution. Organizations address skill gaps while maintaining strong defense mechanisms.

Despite the growth, the global market is hindered by factors such as the high cost of advanced managed security services and concerns regarding third-party access and data privacy. Exhaustive MSS solutions with advanced capabilities could be costly. This hampers the adoption among small businesses with limited budgets. The cost factor remains a significant hindrance to broader adoption. Additionally, companies hesitate to share confidential data with external providers. This raises trust issues and reduces the likelihood of outsourcing. Data security issues remain a key hindrance to the adoption of MSS.

Nonetheless, the global managed security services industry stands to gain from a few key opportunities, like the expansion of MSS for small enterprises, growing demand for cloud-based MSS solutions, and the incorporation of predictive analytics and AI. SMEs look for scalable and affordable security solutions. MSS providers can develop cost-efficient suites to capture this segment. This offers ample growth prospects in the industry. Cloud adoption continues to grow, driving demand for specialized cloud security solutions. MSS providers can offer services tailored for multi-cloud and hybrid environments. This trend provides strong industry potential. Predictive analytics and AI can enhance MSS by identifying threats in advance. This allows proactive defense in place of reactive measures. Providers of MSS that leverage these solutions may gain a competitive advantage.

Managed Security Services Market: Growth Drivers

How is hybrid and cloud IT adoption driving growth in the managed security services market?

The augmented adoption of SaaS platforms, hybrid IT environments, and cloud computing has substantially increased the attack surface. Organizations struggle to secure multiple cloud environments, dynamic workloads, and complex integrations in geographies. MSSPs offer centralized visibility, security controls, and advanced analytics modified for hybrid and multi-cloud infrastructures. Their services also include managed XDR, CSPM, and zero-trust implementations to mitigate the growing risks associated with the cloud. As digital transformation grows, the demand for MSS in gaining cloud-first environments is rising speedily, impacting the managed security services market.

How are advances in automation, service breadth, and AI/ML fueling the managed security services market growth

The incorporation of ML, AI, and automation into security operations has revolutionized MSS capabilities. These solutions enable faster detection, reduce false positives, and facilitate automated incident response, thereby enhancing operational efficiency and effectiveness. MSSPs are now offering enhanced services, such as SOAR, XDR, and threat hunting, to improve security maturity.

Furthermore, the growth of AI-based analytics enables MSSPs to prevent and predict threats before they occur. As innovative tools and automation continue to progress, MSS adoption is expected to increase, driven by enhanced scalability and accuracy.

Managed Security Services Market: Restraints

Service quality gaps and a shortage of skilled MSSP resources hamper the market progress

Although MSS providers claim to resolve the talent gap, the industry itself faces a shortage of highly skilled professionals, which adversely affects service quality. Overloading SOC teams at MSSPs may result in delayed threat detection, poor response times, and high false positives. News reports highlighted cases where breaches occurred despite MSS contracts due to inadequate incident handling by the provider. These restrictions erode client trust and hinder long-term market growth.

Managed Security Services Market: Opportunities

How do cloud security and zero-trust architecture-as-a-service create promising avenues for the managed security services industry's growth?

The growing adoption of SaaS platforms, cloud services, and hybrid environments creates an increased demand for cloud-focused security solutions. MSSPs offering zero-trust architecture and managed cloud security posture management stand to gain substantially. In 2024, MSS vendors introduced managed zero-trust technologies to help businesses meet their operational and regulatory security needs. This trend provides MSSPs with recurring streams of revenue as organizations shift to cloud-native ecosystems, thereby boosting the managed security services industry.

Managed Security Services Market: Challenges

High competition and price pressure limit the market growth

The MSS sector is becoming highly competitive, with regional providers, global players, and niche experts competing on service and price differentiation. This price pressure compels MSSPs to compress margins while investing in modernized tools and expertise. News reports have underscored mergers and acquisitions in the MSS market, as vendors are required to reduce and consolidate in response to pricing pressures. Balancing cost-effectiveness with service quality remains a vital challenge for MSSPs worldwide.

Managed Security Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Managed Security Services Market |

| Market Size in 2024 | USD 36.22 Billion |

| Market Forecast in 2034 | USD 113.93 Billion |

| Growth Rate | CAGR of 15.40% |

| Number of Pages | 212 |

| Key Companies Covered | IBM Security, AT&T Cybersecurity, BT Group, Verizon Business, Trustwave, NTT Security, Accenture Security, Capgemini, Deloitte Cyber Risk Services, Wipro Limited, Infosys, Cognizant, HCL Technologies, Tata Consultancy Services (TCS), Kaspersky Lab., and others. |

| Segments Covered | By Security, By Services, By Enterprise Size, By Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Managed Security Services Market: Segmentation

The global managed security services market is segmented by security, service, enterprise size, vertical, and region.

Based on security, the global managed security services industry is segmented into cloud security, endpoint security, network security, data security, and other categories. The network security segment holds a dominant market share, as it forms the foundation of enterprise cybersecurity, safeguarding vital communication channels and preventing unauthorized access.

On the other hand, the cloud security segment holds a second-leading share due to the rapid shift to hybrid infrastructures and cloud environments, creating new opportunities.

Based on services, the global market is segmented as managed SIEM, managed UTM, managed DDoS, managed XDR, managed IAM, managed risk & compliance, and others. The managed SIEM holds a leading share, as it offers centralized monitoring, real-time threat detection, and log management across the entire IT ecosystem.

Conversely, the managed XDR holds a secondary rank because it offers response and extended detection capabilities across networks, endpoints, and cloud environments.

Based on enterprise size, the global managed security services market is segmented into SMEs and large enterprises. The large enterprises segment holds the largest share of the market, as they have complex IT networks and are more vulnerable to cyber threats, requiring comprehensive security solutions.

Nonetheless, the SMEs segment holds a secondary position, as they are largely adopting MSS to compensate for their restricted in-house security resources.

Based on vertical, the global market is segmented as BFSI, healthcare, manufacturing, IT and telecom, retail, defense/government, and others. The BFSI segment captures a leading share, as financial institutions manage highly sensitive data and face constant threats, such as phishing and fraud.

However, the IT and telecom segment holds a second-leading position, as they operate vast digital networks and cloud infrastructure that are primary targets for cyberattacks.

Managed Security Services Market: Regional Analysis

Why does North America hold a dominant position in the global Managed Security Services Market?

North America is expected to maintain its leading position in the global managed security services market due to the high frequency of cyberattacks, the robust presence of MSS providers, and significant IT spending and digital transformation. North America faces the leading number of cyberattacks worldwide, making MSS a priority for regional businesses. The United States experienced the most expensive breaches globally, averaging more than USD 9 million per case, according to IBM reports. This continuous threat fuels businesses to adopt exhaustive managed security services for 24/7 protection.

Moreover, the region is home to major MSS players, including AT&T Cybersecurity, Verizon, and IBM, which promise advanced service availability. These companies heavily invest in SOC centers, AI-based security solutions, and MDR services, thereby driving growth in the industry. Their presence increases the effectiveness and simplification for local businesses.

Additionally, North America holds a leadership position in worldwide IT spending, with the U.S. alone accounting for more than 35% of the global expenses in 2024. Speedy digitalization in sectors such as healthcare, BFSI, and retail presents new attack surfaces. The adoption of MSS increases as businesses secure IoT, cloud, and hybrid infrastructures.

Europe ranks as the second-largest region in the global managed security services industry, driven by the growing cybersecurity threats in key sectors, the rise in cloud adoption, and the increased adoption in the manufacturing and BFSI industries. European industries, including healthcare, BFSI, and government, experience a surge in phishing and ransomware attacks. Ransomware attacks progressed by 45% in the region, according to the ENISA (2024) Threat Landscape report.

Businesses adopt MSS for incident response and real-time threat monitoring to reduce reputational and financial damage. Europe is experiencing speedy migration to hybrid and cloud IT environments, with cloud spending in the region anticipated to surpass USD 142 billion by 2025. This inclination creates significant security challenges, forcing businesses to outsource to MSS providers, holding expertise in cloud security. Digital initiatives, such as Industry 4.0, also strengthen the demand for MSS.

Additionally, the regional BFSI sector broadly invests in MSS to meet PSD2 compliance and avoid fraud. Likewise, manufacturing companies implementing Industry 4.0 solutions adopt MSS for IoT and OT security. These verticals register for a majority share of MSS profit in Europe.

Managed Security Services Market: Competitive Analysis

The leading players in the global managed security services market are:

- IBM Security

- AT&T Cybersecurity

- BT Group

- Verizon Business

- Trustwave

- NTT Security

- Accenture Security

- Capgemini

- Deloitte Cyber Risk Services

- Wipro Limited

- Infosys

- Cognizant

- HCL Technologies

- Tata Consultancy Services (TCS)

- Kaspersky Lab.

Managed Security Services Market: Key Market Trends

Mounting demand for Managed Detection and Response (MDR):

Businesses are shifting beyond conventional monitoring towards advanced MDR services that offer proactive threat hunting and speedy incident response. MDR blends AI-based analytics with human expertise to identify well-developed threats. This trend is transforming MSS by prioritizing remediation and real-time detection.

Rising focus on Compliance Management as a Service:

As global regulations toughen, businesses seek MSS providers that deliver Compliance-as-a-Service (CaaS) solutions. These services help companies meet standards such as HIPAA, GDPR, and PCI DSS smoothly. Compliance-focused MSS offerings are growing as a competitor differentiator in the industry.

The global managed security services market is segmented as follows:

By Security

- Cloud Security

- Endpoint Security

- Network Security

- Data Security

- Others

By Services

- Managed SIEM

- Managed UTM

- Managed DDoS

- Managed XDR

- Managed IAM

- Managed Risk & Compliance

- Others

By Enterprise Size

- SMEs

- Large Enterprises

By Vertical

- BFSI

- Healthcare

- Manufacturing

- IT and Telecom

- Retail

- Defense/Government

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Managed security services are outsourced services provided by dedicated security vendors to manage, monitor, and protect a business's data and IT infrastructure from cyber threats. These services include real-time threat detection, firewall management, incident response, vulnerability evaluation, compliance management, and intrusion prevention.

The global managed security services market is projected to grow due to the increasing adoption of BYOD policies and remote work, rapid digital transformation across enterprises, and heightened awareness about cybersecurity among SMEs.

According to study, the global managed security services market size was worth around USD 36.22 billion in 2024 and is predicted to grow to around USD 113.93 billion by 2034.

The CAGR value of the managed security services market is expected to be approximately 15.40% from 2025 to 2034.

Emerging trends in the managed security services market include cloud-native security, AI-driven threat detection, automated incident response, MDR expansion, and Compliance-as-a-Service offerings.

North America is expected to lead the global managed security services market during the forecast period.

The United States is a major contributor to the global managed security services market.

The key players profiled in the global managed security services market include IBM Security, AT&T Cybersecurity, BT Group, Verizon Business, Trustwave, NTT Security, Accenture Security, Capgemini, Deloitte Cyber Risk Services, Wipro Limited, Infosys, Cognizant, HCL Technologies, Tata Consultancy Services (TCS), and Kaspersky Lab.

Leading players are adopting strategic initiatives such as partnerships, mergers and acquisitions, geographic market expansion, and service portfolio expansion to grow their market presence.

The report examines key aspects of the managed security services market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed