IT Consulting Services Market Size, Share, Trends, Growth 2034

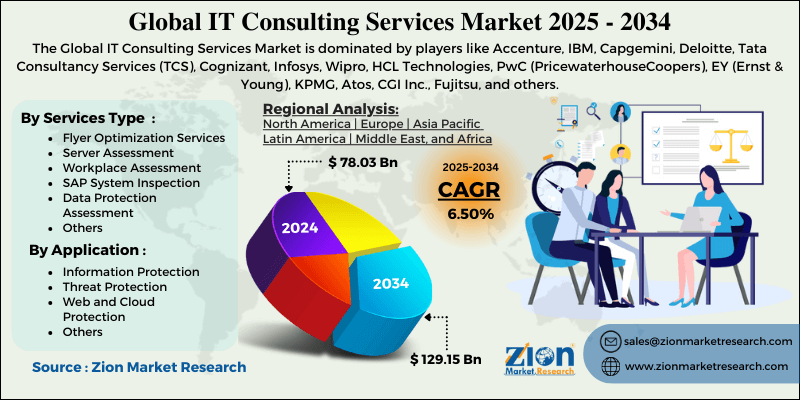

IT Consulting Services Market By Services Type (Flyer Optimization Services, Server Assessment, Workplace Assessment, SAP System Inspection, Data Protection Assessment, and Others), By Application (Information Protection, Threat Protection, Web and Cloud Protection, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

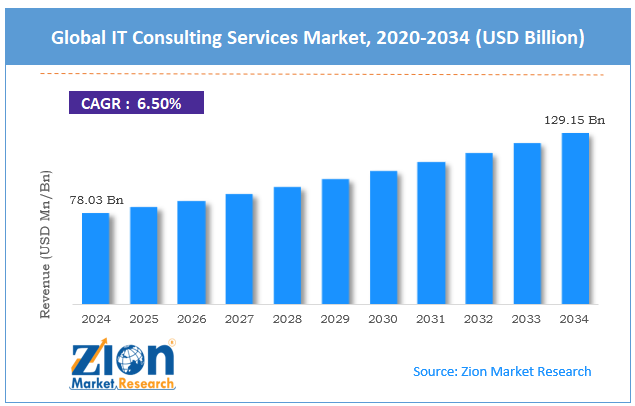

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 78.03 Billion | USD 129.15 Billion | 6.50% | 2024 |

IT Consulting Services Market: Industry Perspective

The global IT consulting services market size was approximately USD 78.03 billion in 2024 and is projected to reach around USD 129.15 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global IT consulting services market is estimated to grow annually at a CAGR of around 6.50% over the forecast period (2025-2034)

- In terms of revenue, the global IT consulting services market size was valued at around USD 78.03 billion in 2024 and is projected to reach USD 129.15 billion by 2034.

- The IT consulting services market is projected to grow significantly due to the rising adoption of cloud computing solutions, the growth of big data analytics and AI integration, and the increased need for virtual collaboration and remote work.

- Based on service type, the data protection assessment segment is expected to lead the market, while the server assessment segment is expected to grow considerably.

- Based on application, the web and cloud protection segment is the largest, while the information protection segment is projected to experience substantial revenue growth over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

IT Consulting Services Market: Overview

IT consulting services help companies plan, implement, and manage technology solutions to enhance efficiency, business performance, and security. These services encompass domains such as cybersecurity, cloud computing, system integration, digital transformation, and IT infrastructure management, enabling them to stay competitive in the evolving landscape. The global IT consulting services market is poised for significant growth, driven by digital transformation initiatives, the adoption of cloud computing, and increasing cybersecurity needs. Companies are amplifying digital transformation to enhance customer engagement and improve efficiency. IT consultants provide expertise to streamline processes and implement modern solutions. This trend is fueling substantial demand for implementation and advisory services.

Businesses are shifting to cloud-based platforms for scalability and flexibility. IT consultants assist with migration, planning, and managing cloud environments. This makes cloud strategy a key focus for consulting companies. Furthermore, the growth in cyber threats has made security a priority for organizations. IT consultants help businesses assess risks, ensure compliance, and strengthen defenses. This creates constant demand for cybersecurity advisory services.

Nevertheless, the global market faces limitations due to factors such as high service costs and a shortage of skilled experts. It consulting services can be costly, restricting accessibility for small enterprises. Several companies hesitate to invest because of budget limitations. Hence, cost is a key barrier to broader adoption. The consulting sector experiences a lack of qualified professionals in the progressing technologies. This absence impacts companies' ability to deliver specialized solutions. It also presents project implementation for customers.

Still, the global IT consulting services industry benefits from several favorable factors like cloud migration support, automation and AI implementation, and cybersecurity consulting services. As businesses shift to the cloud, consultants can offer planning, migration, and management services. Cloud transformation remains a top priority for many businesses. This creates strong prospects for the consulting companies.

Additionally, companies are utilizing AI-based automation to boost efficiency and reduce costs. Consultants can offer specialization in deploying AI tools and automation architecture. This domain is projected to experience significant growth. Growing cyber threats provide opportunities for consultants to deliver compliance solutions and security assessments. Businesses rely on specialists to protect data and infrastructure. This domain is expected to continue experiencing notable demand.

IT Consulting Services Market: Growth Drivers

How is cost optimization & legacy modernization boosting the IT consulting services market?

Several enterprises continue to depend on obsolete IT systems that are difficult to maintain and expensive, creating a strong demand for modernization. Consulting companies offer expertise in API integration, re-platforming, and migrating monolithic applications to cloud-native environments and microservices. Cost optimization tactics, comprising automation and vendor consolidation, further fuel engagement with It consultants. These projects typically involve business case development and change management to ensure smooth adoption and measurable ROI.

How is the IT consulting services market fueled by analytics & automation, and generative AI adoption?

Advanced analytics and generative AI are revolutionizing business processes, resulting in a surge in consulting projects that focus on AI strategy and implementation. IT consultants help businesses identify use cases, integrate AI into existing workflows, and develop models, while promising data governance and quality. The adoption of MLOps and automation frameworks has become vital for scaling AI in enterprise systems. This shift towards AI-based transformation ranks IT consulting services as key enablers of enterprise competitiveness, impacting the global IT consulting services market.

IT Consulting Services Market: Restraints

Increasing competition and price pressure hamper the market's progress

The IT consulting industry has become highly competitive, with companies like Deloitte, IBM, and Accenture competing against niche and regional players. This intense competition has led to pricing pressure, prompting consulting companies to reduce their margins to win contracts. Customers are increasingly opting for cost-efficient solutions, preferring vendors that offer offshore models or bundled services. The presence of low-cost service providers in Southeast Asia and India has further strengthened the pricing war. While competition benefits customers through low costs, it hampers profitability for consulting companies and restricts their ability to invest in advanced solutions and innovations.

IT Consulting Services Market: Opportunities

How does digital transformation in emerging markets create promising avenues for the growth of the IT consulting services industry?

The rapid digitalization in Latin America, the Asia Pacific, and Africa presents a key opportunity for IT consulting companies. Enterprise and governments in these regions are adopting cloud, e-commerce, innovative city projects, and fintech at scale. Consulting companies can tap into growth by modifying affordable solutions for SMEs and collaborating with local partners. This growth into emerging nations offers long-term growth potential for global players, thereby impacting the worldwide IT consulting services industry.

IT Consulting Services Market: Challenges

Organizational resistance to digital change restricts the growth of the market

Despite investing in IT consulting, many businesses fail to implement recommendations due to fear of disruption and cultural resistance. Employees often resist the adoption of AI and automation due to concerns about job replacement. Nearly 70% of digital transformation programs fail due to a lack of stakeholder alignment and poor change management, according to reports. Consultants should allocate extra resources and time to address these behavioral intricacies, which can notably impact profitability. Overcoming this resistance needs a strong focus on leadership buy-in and organizational culture.

IT Consulting Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IT Consulting Services Market |

| Market Size in 2024 | USD 78.03 Billion |

| Market Forecast in 2034 | USD 129.15 Billion |

| Growth Rate | CAGR of 6.50% |

| Number of Pages | 211 |

| Key Companies Covered | Accenture, IBM, Capgemini, Deloitte, Tata Consultancy Services (TCS), Cognizant, Infosys, Wipro, HCL Technologies, PwC (PricewaterhouseCoopers), EY (Ernst & Young), KPMG, Atos, CGI Inc., Fujitsu, and others. |

| Segments Covered | By Services Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IT Consulting Services Market: Segmentation

The global IT consulting services market is segmented based on service type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on service type, the global IT consulting services industry is divided into flyer optimization services, server assessment, workplace assessment, SAP system inspection, data protection assessment, and others. The data protection assessment segment holds a substantial market share, as businesses face increasing cyber threats and stringent compliance requirements. Businesses require expert consulting to implement secure architectures, assess vulnerabilities, and ensure data privacy and protection. With the increasing reliance on remote work models and cloud computing, protecting sensitive information has become a top priority. This demand makes the said domain a critical and sought-after consulting service worldwide.

On the other hand, the server assessment segment holds a second-leading position in the market due to its crucial role in maintaining the reliability and efficiency of IT infrastructure. Companies depend on servers for data storage, business continuity, and application hosting, making regular performance assessments vital. IT consultations offer optimization strategies, scalability, and migration plans through these assessments. As hybrid infrastructure and cloud adoption continue to grow, the importance of cost-effective management and server health also increases.

Based on application, the global IT consulting services market is segmented into information protection, threat protection, web and cloud protection, and others. The web and cloud protection segment holds a dominant market share, as businesses are increasingly adopting web-based platforms and cloud infrastructures for their operations. This inclination necessitates robust security measures to prevent data breaches, unauthorized access, and malware. IT consultants play a crucial role in designing secure cloud frameworks and implementing advanced protection tools. With the rising use of remote work, SaaS, and hybrid environments, web and cloud protection has become a key consulting priority.

Conversely, information protection holds a second rank in the market, as businesses handle vast volumes of sensitive data, including customer and financial information. Maintaining the integrity and confidentiality of this data is crucial for maintaining trust and ensuring compliance. IT consultants help businesses establish robust encryption policies, effective data governance strategies, and secure access controls. As data privacy regulations become increasingly stringent worldwide, information protection remains a vital focus for consulting services.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

IT Consulting Services Market: Regional Analysis

Why is North America outperforming other regions in the global IT Consulting Services Market?

North America is projected to maintain its dominant position in the global IT consulting services market, driven by digital transformation, strong technology adoption, high IT spending by companies, and rapid adoption of cloud and hybrid infrastructure. North America is leading the digital transformation, with businesses rapidly implementing advanced solutions, including cloud computing, AI, and analytics. The region's high digital readiness amplifies the demand for IT consulting services in all sectors.

Moreover, businesses in the region allocate central budgets for IT consulting services and modernization. The United States alone accounts for the largest share of worldwide IT spending, surpassing $1.3 trillion annually. This surge in expenditure fuels continuous demand for consulting services to adopt advanced IT tactics. Furthermore, cloud migration is a key trend among North American companies since they aim for cost optimization and scalability. Businesses offer cloud strategy, management services, and migration to help this transition.

Europe maintains its position as the second-largest region in the global IT consulting services industry, driven by a strong focus on Industry 4.0 and digitalization, the rise in cloud adoption among enterprises, and the growth of IT consulting in the healthcare and BFSI sectors. European nations are heavily investing in Industry 4.0 and digital transformation initiatives in the financial, automotive, and manufacturing sectors. Enterprises and governments are increasing their investments in automation, AI adoption, and IoT.

According to the European Commission, more than €165 billion was allocated for digital initiatives under the Digital Europe Program. European businesses are speedily moving to cloud-based infrastructures to enhance efficiency and scalability. Consulting companies assist with cloud migration, cybersecurity for cloud environments, and the design of hybrid infrastructure. According to the reports, more than 45% of European companies have adopted cloud services as a core part of their IT strategy.

Additionally, the BFSI sector, along with healthcare, is fueling IT consulting demand in Europe. Cybersecurity, digital banking, and compliance solutions are vital for these industries. The European BFSI industry alone registers for a majority share of IT service spending, anticipated to surpass USD 120 billion yearly.

IT Consulting Services Market: Competitive Analysis

The leading players in the global IT consulting services market are:

- Accenture

- IBM

- Capgemini

- Deloitte

- Tata Consultancy Services (TCS)

- Cognizant

- Infosys

- Wipro

- HCL Technologies

- PwC (PricewaterhouseCoopers)

- EY (Ernst & Young)

- KPMG

- Atos

- CGI Inc.

- Fujitsu

IT Consulting Services Market: Key Market Trends

Increased demand for hybrid and cloud solutions:

Organizations are speedily adopting cloud-based and hybrid IT infrastructures to improve flexibility and scalability. IT consulting companies are emphasizing cloud migration, security solutions, and optimization to meet this demand. This trend is increasing considerably as digital transformation and remote work become permanent business models.

Focus on digital transformation for SMEs:

Medium and small-sized businesses are embracing digital tools to stay competitive in the technology-driven industry. Consulting companies are creating scalable and affordable solutions tailored for SMEs, encompassing cloud and automation adoption. This move presents new opportunities in a previously underserved market segment.

The global IT consulting services market is segmented as follows:

By Services Type

- Flyer Optimization Services

- Server Assessment

- Workplace Assessment

- SAP System Inspection

- Data Protection Assessment

- Others

By Application

- Information Protection

- Threat Protection

- Web and Cloud Protection

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

IT consulting services help companies plan, implement, and manage technology solutions to enhance efficiency, business performance, and security. These services encompass domains such as cybersecurity, cloud computing, system integration, digital transformation, and IT infrastructure management, enabling them to stay competitive in the evolving landscape.

The global IT consulting services market is projected to grow due to growing digital transformation initiatives, speedy technological advancements in IT infrastructure, and rising demand for IT cost optimization and efficiency.

According to study, the global IT consulting services market size was worth around USD 78.03 billion in 2024 and is predicted to grow to around USD 129.15 billion by 2034.

The CAGR value of the IT consulting services market is expected to be approximately 6.50% from 2025 to 2034.

The Web and Cloud Protection segment is expected to dominate the IT Consulting Services Market by 2034, driven by the need for secure online environments and the continued rise of cloud adoption.

The major challenges restraining the IT Consulting Services Market include a shortage of skilled professionals, high service costs, data security concerns, and integration complexities.

North America is expected to lead the global IT consulting services market during the forecast period.

The key players profiled in the global IT consulting services market include Accenture, IBM, Capgemini, Deloitte, Tata Consultancy Services (TCS), Cognizant, Infosys, Wipro, HCL Technologies, PwC (PricewaterhouseCoopers), EY (Ernst & Young), KPMG, Atos, CGI Inc., and Fujitsu.

The competitive landscape of the IT Consulting Services Market is characterized by a mix of regional players, global giants, and niche consulting companies competing through strategic partnerships, technological expertise, and industry-specific solutions.

The report examines key aspects of the IT consulting services market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed