Liquid Filtration Market Size, Share, Trends, Growth Report 2034

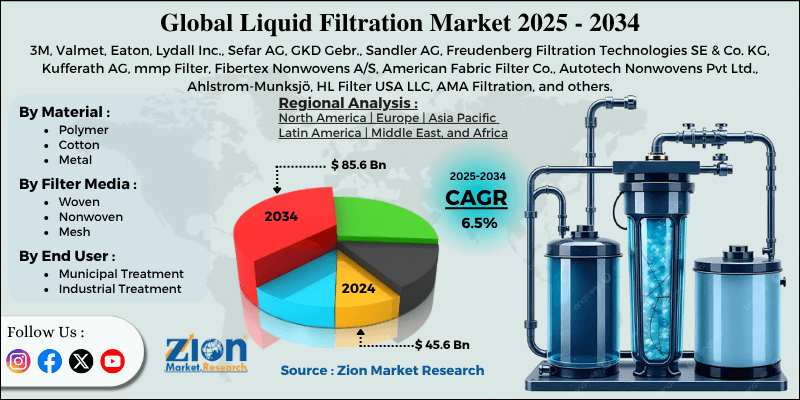

Liquid Filtration Market By Material (Polymer, Cotton, and Metal), By Filter Media (Woven, Nonwoven, and Mesh), By End-User (Municipal Treatment and Industrial Treatment), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 45.6 Billion | USD 85.6 Billion | 6.5% | 2024 |

Liquid Filtration Industry Perspective:

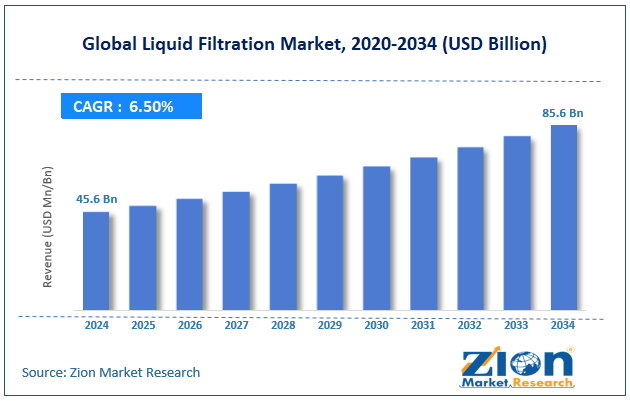

The global liquid filtration market size was worth around USD 45.6 billion in 2024 and is predicted to grow to around USD 85.6 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global liquid filtration market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2025-2034).

- In terms of revenue, the global liquid filtration market size was valued at around USD 45.6 billion in 2024 and is projected to reach USD 85.6 billion by 2034.

- The increasing urbanization & industrialization are expected to drive the liquid filtration market over the forecast period.

- Based on the material, the polymer segment is expected to capture the largest market share over the projected period.

- Based on the filter media, the woven segment holds the major market share.

- Based on the end user, the industrial treatment segment holds the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Liquid Filtration Market: Overview

Liquid filtration is a physical method that cleans a liquid by passing it through a porous filter medium that captures solid particles and other impurities. The filter medium captures solid contaminants, allowing clean liquid, known as filtrate, to flow through. This advanced technology ensures that products are clean and meet environmental standards in various industries, including chemical, water treatment, food and beverage, and pharmaceuticals. The liquid filtration market is driven by several variables, including stringent environmental & regulatory requirements, growing urbanization and industrialization, water scarcity & sustainability concerns, technological advancements, the expansion of key end-user industries, and others. However, the high initial capital investment poses a significant challenge to the industry's growth.

Liquid Filtration Market Dynamics

Growth Drivers

How do stringent environmental regulations drive the liquid filtration market growth?

A growing number of government rules need effective wastewater treatment and pollutant management. This is why so many sectors are using liquid filtration technology. For instance, the European Union's Water Framework Directive requires companies to have robust protocols for managing wastewater, which significantly reduces pollution levels. The U.S. Environmental Protection Agency's upcoming 2024 rules also highlight the need for sophisticated filtration systems in industrial processes, which will lead to big expenditures in this important field. The urgent need for high-performance filtration systems is also highlighted by the fact that water shortages are a major problem, and the pharmaceutical, food, and beverage sectors are growing very quickly.

Companies are becoming increasingly dedicated to strict contamination control procedures to make sure their products are safe and of high quality. The FDA's guidelines for Good Manufacturing Practices (GMP) in pharmaceutical production, for instance, make it quite clear that new liquid filtration technologies are crucial for maintaining sterility throughout the entire process. Businesses that want to do well in a regulated and competitive market must invest in these technologies. It's not simply an option; it's a strategic imperative.

Restraints

Why does the high initial capital investment hinder the liquid filtration market growth

The high initial capital investment and ongoing maintenance costs pose a major challenge to the liquid filtration market. This difficulty is exacerbated by a lack of understanding of the long-term cost benefits of improved filtration systems. Furthermore, maintaining and replacing filtering systems can be resource-intensive, especially in industries with high liquid flow.

According to statistics, approximately 60% of SMEs in developing economies see cost as a major impediment to implementing contemporary filtering technologies. In addition, problems with the disposal of used filters and membranes, which may contain dangerous substances, hamper compliance with environmental requirements.

Opportunities

How does the rising product launch, such as membranes, offer a potential opportunity for the liquid filtration industry's growth?

The growing product launch is expected to offer a lucrative opportunity for the liquid filtration market over the forecast period. For instance, in September 2025, Pall Corporation, a leading manufacturer of filtration, separation, and purification solutions, introduced the Membralox GP-IC ceramic membrane system, a breakthrough ceramic membrane featuring progressive permeability along the length of the filter. This novel design enhances processing efficiency, reduces capital and operational costs, and enables the recovery of up to 95% of value-added products, thereby improving overall filtration performance.

Membralox GP-IC membranes have a high surface area and multi-channel architecture, providing up to 45% greater filtration capacity than traditional ceramic filters of comparable size. This enables more efficient system loop design with smaller filter modules, thereby reducing capital and operating costs.

Challenges

Increasing competition from alternative technology poses a major challenge to market expansion

The liquid filtration sector competes with other technologies that offer alternative methods for separating liquids from solids or contaminants. Some of the most essential competing technologies include membrane separation procedures (such as reverse osmosis, ultrafiltration, and nanofiltration), centrifugation, settling and sedimentation, flotation, and advanced chemical treatment or coagulation methods.

Membrane filtration, which includes reverse osmosis and ultrafiltration, is gaining popularity due to its accuracy, reduced energy consumption, and effectiveness in treating wastewater and reusing water. These include innovative and IoT-enabled capabilities that enable it to monitor things in real-time. Filtration technologies are changing to be competitive with these other options. They are now using eco-friendly materials, smart sensors, and modular designs that can be scaled up or down. Thus, the facts above are expected to pose a significant challenge for the liquid filtration market.

Liquid Filtration Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Liquid Filtration Market |

| Market Size in 2024 | USD 45.6 Billion |

| Market Forecast in 2034 | USD 85.6 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 215 |

| Key Companies Covered | 3M, Valmet, Eaton, Lydall Inc., Sefar AG, GKD Gebr., Sandler AG, Freudenberg Filtration Technologies SE & Co. KG, Kufferath AG, mmp Filter, Fibertex Nonwovens A/S, American Fabric Filter Co., Autotech Nonwovens Pvt Ltd., Ahlstrom-Munksjö, HL Filter USA LLC, AMA Filtration, and others. |

| Segments Covered | By Material, By Filter Media, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Liquid Filtration Market: Segmentation

The global liquid filtration industry is segmented based on material, filter media, end-user, and region.

Based on the material, the global liquid filtration market is bifurcated into polymer, cotton, and metal. The polymer segment is expected to capture the largest market share over the projected period. The segment growth is owing to the superior material properties. Polymers such as polypropylene, polyester, and polyamide have high tenacity, low water absorption, and excellent chemical and heat resistance, all of which are essential for longevity and efficiency in hostile filtration conditions. Also, polymer utilization is increasing due to its adaptability and performance in the municipal water treatment, pharmaceuticals, chemical, and food and beverage industries.

Based on the filter media, the global liquid filtration industry is bifurcated into woven, nonwoven, and mesh. The woven segment holds the major market share. This expansion is primarily driven by strong demand for woven filter media from important industries such as chemical, municipal, mining, pharmaceutical, and food and beverage. Woven textiles are preferred for their durability, high mechanical strength, and capacity to tolerate rigorous operating conditions, making them ideal for industrial liquid filtering applications.

Based on the end-user, the global liquid filtration market is bifurcated into municipal treatment and industrial treatment. The industrial treatment segment holds the largest market share over the projected period. The growing expansion of the end-use sector drives the market growth.

Liquid Filtration Market: Regional Analysis

Why does North America dominate the liquid filtration market over the projected period?

North America is expected to dominate the global liquid filtration market. The region's strong focus on sustainability and adherence to environmental regulations, along with government programs, helps the industry flourish. For instance, the United States Environmental Protection Agency (EPA) said it will spend $1.2 billion on water infrastructure construction in 2024. This will encourage more people to opt for advanced filtration systems. 3M and Parker Hannifin, two prominent companies, invest substantial amounts of funds in research and development to create new products for North American industries.

Besides, the Asia Pacific is expected to grow at the highest CAGR during the forecast period. The regional expansion of the market is owing to the increasing water and wastewater industry and increasing investment in the pharmaceutical sector.

Liquid Filtration Market: Competitive Analysis

The global liquid filtration market is dominated by players like:

- 3M

- Valmet

- Eaton

- Lydall Inc.

- Sefar AG

- GKD Gebr.

- Sandler AG

- Freudenberg Filtration Technologies SE & Co. KG

- Kufferath AG

- mmp Filter

- Fibertex Nonwovens A/S

- American Fabric Filter Co.

- Autotech Nonwovens Pvt Ltd.

- Ahlstrom-Munksjö

- HL Filter USA LLC

- AMA Filtration

The global liquid filtration market is segmented as follows:

By Material

- Polymer

- Cotton

- Metal

By Filter Media

- Woven

- Nonwoven

- Mesh

By End User

- Municipal Treatment

- Industrial Treatment

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Liquid filtration is a physical method that cleans a liquid by passing it through a porous filter medium that captures solid particles and other impurities. The filter medium captures solid contaminants, allowing clean liquid, known as filtrate, to flow through.

Several variables, including stringent environmental & regulatory requirements, growing urbanization and industrialization, water scarcity & sustainability concerns, technological advancements, the expansion of key end-user industries, and others, drive the liquid filtration market.

The high initial capital investment poses a significant challenge to the liquid filtration industry's growth.

Based on the material, the polymer segment is expected to dominate the liquid filtration market growth during the projected period.

The increasing product innovation and rising industrialization pose a major impact factor for the liquid filtration industry's growth over the projected period.

According to the report, the global liquid filtration market size was worth around USD 45.6 billion in 2024 and is predicted to grow to around USD 85.6 billion by 2034.

The global Liquid Filtration market is expected to grow at a CAGR of 6.5% during the forecast period.

The global liquid filtration industry growth is expected to be driven by the North American region. It is currently the world’s highest revenue-generating market due to the presence of major players and stringent regulations imposed by the government.

The global liquid filtration market is dominated by players like 3M, Valmet, Eaton, Lydall, Inc., Sefar AG, GKD Gebr., Sandler AG, Freudenberg Filtration Technologies SE & Co. KG, Kufferath AG, mmp Filter, Fibertex Nonwovens A/S, American Fabric Filter Co., Autotech Nonwovens Pvt Ltd., Ahlstrom-Munksjö, HL Filter USA LLC, and AMA Filtration, among others.

The liquid filtration market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed