Food Logistics Market Size, Share & Industry Analysis Report 2034

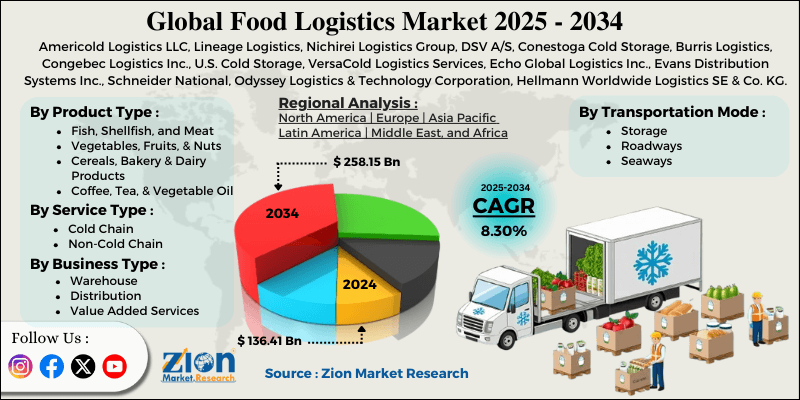

Food Logistics Market By Product Type (Fish, Shellfish, and Meat, Vegetables, Fruits, and Nuts, Cereals, Bakery and Dairy Products, Coffee, Tea, and Vegetable Oil, and Others), By Service Type (Cold Chain, Non-Cold Chain), By Business Type (Warehouse, Distribution, Value Added Services), By Transportation Mode (Storage, Roadways, Seaways, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

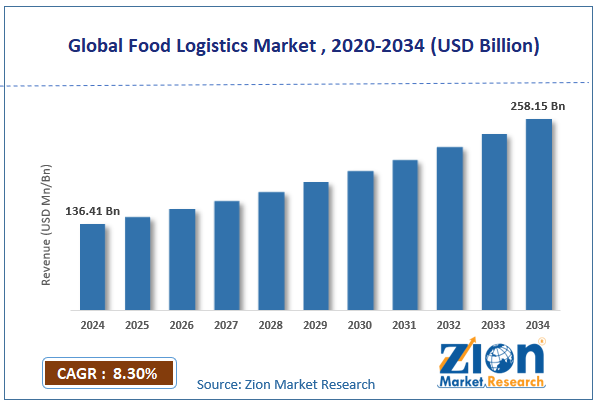

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 136.41 Billion | USD 258.15 Billion | 8.30% | 2024 |

Food Logistics Industry Perspective:

What will be the size of the global food logistics market during the forecast period?

The global food logistics market size was around USD 136.41 billion in 2024 and is projected to reach USD 258.15 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global food logistics market is estimated to grow annually at a CAGR of around 8.30% over the forecast period (2025-2034)

- In terms of revenue, the global food logistics market size was valued at around USD 136.41 billion in 2024 and is projected to reach USD 258.15 billion by 2034.

- The food logistics market is projected to grow significantly, driven by the expansion of grocery e-commerce, technological advancements in tracking and tracing, and increased trade in perishable goods.

- Based on product type, the fish, shellfish, and meat segment is expected to lead the market, while the vegetables, fruits, and nuts segment is expected to grow considerably.

- Based on service type, the non-cold chain segment is the dominating segment, while the cold chain segment is projected to witness sizeable revenue over the forecast period.

- Based on business type, the distribution segment dominates the market, while the warehouse segment is expected to grow rapidly in the near future.

- Based on transportation mode, the roadways segment is expected to lead the market, followed by the seaways segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Food Logistics Market: Overview

Food logistics encompasses planning, storage, transportation, and distribution of food from producers to end consumers, while maintaining freshness and safety. It comprises temperature-controlled storage, adequate transportation, inventory management, and strict hygiene principles to prevent contamination and spoilage. The global food logistics market is likely to expand rapidly, fueled by growing demand for perishable foods, the growth of e-commerce food delivery, and the globalization of food trade. Growing consumption of vegetables, fresh fruits, dairy products, and meat increases the need for efficient food logistics. These products need fast transportation and strict temperature control. This primarily fuels growth in cold chain logistics.

Moreover, food delivery apps and online grocery platforms require reliable, fast logistics networks. Consumers expect next-day or same-day delivery with well-maintained freshness. This augments demand for last-mile logistics and advanced warehousing. Furthermore, international sourcing and export of food products have elevated cross-border movement. This requires specialized logistics, documentation, and compliance. Hence, worldwide food logistics services continue to progress.

Despite growth, the global market is constrained by factors such as high operational costs and a shortage of skilled workers. Cold storage, fuel, and refrigeration majorly increase logistics costs. Energy consumption adds to long-term expenditure. This notably impacts profit margins for logistics providers. Likewise, food logistics require skilled professionals to monitor, handle, and ensure compliance. A shortage of qualified staff affects service quality and slows operational efficiency.

Nonetheless, the global food logistics industry stands to gain from several key opportunities, including digitalization, smart logistics, and sustainable logistics solutions. Data automation and analytics can enhance demand forecasting. Smart systems reduce operational inefficiencies and delays. This ultimately enhances cost control and service quality. Additionally, energy-efficient warehouses and eco-friendly transport reduce emissions. Sustainability initiatives attract customers and investors, supporting long-term market growth.

Food Logistics Market: Dynamics

Growth Drivers

How are sustainability and environmental pressures propelling the worldwide food logistics market?

Sustainability is a key driver of the food logistics market, as companies adopt green logistics practices to reduce waste and emissions. Hybrid and electric vehicles, optimized routes, and eco-friendly packaging are becoming standard. Environmental initiatives also reduce operational costs while attracting conscious users—companies that integrate sustainability gain competitive advantages and regulatory favor. Green practices are now integral to long-term food logistics strategy.

How do digitalization and real-time tracking fuel the food logistics market?

Sensors, IoT devices, and AI analytics are transforming food logistics by enabling real-time monitoring of shipments. Humidity, temperature, and location data enhance supply chain efficiency and reduce spoilage. Route optimization and predictive analytics lower costs and simplify operations. Technology adoption enables companies to respond quickly to fluctuations in demand. Digital visibility is now an essential factor for compliance, trust, and operational success.

Restraints

High infrastructure and operational costs negatively impact the market progress

Food logistics need significant investment in temperature-controlled vehicles, monitoring systems, and warehouses. Maintaining cold chains and specialized storage incurs additional maintenance costs and recurring energy use. Small players often struggle with these costs due to high capital requirements. Growing fuel prices and inflation further increase operational expenditure. These prices may hamper market entry and slow growth for several companies.

Opportunities

How do technological innovations in supply chain visibility open lucrative opportunities for the food logistics market?

Blockchain, IoT, and AI-based analytics are changing supply chain management. Improved visibility allows real-time monitoring of temperature, delivery status, and humidity. Predictive analytics can enhance inventory, improve decision-making, and reduce spoilage. Companies can offer traceability and transparency, meeting surging consumer expectations. Technology adoption offers opportunities in the food logistics industry to achieve cost savings and operational excellence in the supply chain.

Challenges

Increasing compliance and regulatory complexity limit the market growth

Food logistics experience constantly changing regulations regarding traceability, safety, and environmental impact. Companies should navigate complex import and export laws and hygiene norms. Compliance needs investment in documentation, technology, and personnel training. Failure to comply with these regulations may result in recalls, fines, or reputational damage. Regulatory complexity remains a persistent operational challenge for global logistics providers.

Food Logistics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Logistics Market |

| Market Size in 2024 | USD 136.41 Billion |

| Market Forecast in 2034 | USD 258.15 Billion |

| Growth Rate | CAGR of 8.30% |

| Number of Pages | 215 |

| Key Companies Covered | Americold Logistics LLC, Lineage Logistics, Nichirei Logistics Group, DSV A/S, Conestoga Cold Storage, Burris Logistics, Congebec Logistics Inc., U.S. Cold Storage, VersaCold Logistics Services, Echo Global Logistics Inc., Evans Distribution Systems Inc., Schneider National, Odyssey Logistics & Technology Corporation, Hellmann Worldwide Logistics SE & Co. KG, Matson Logistics, and others. |

| Segments Covered | By Product Type, By Service Type, By Business Type, By Transportation Mode, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Food Logistics Market: Segmentation

The global food logistics market is segmented based on product type, service type, business type, transportation mode, and region.

Why is the Fish, Shellfish, and Meat segment projected to dominate the food logistics market?

Based on product type, the global food logistics industry is divided into fish, shellfish, and meat, vegetables, fruits, and nuts, cereals, bakery and dairy products, coffee, tea, and vegetable oil, and others. The fish, shellfish, and meat segment accounts for 27% of the total market, driven by high worldwide demand for protein-rich foods and the surging need for specialized cold-chain transportation and storage to maintain safety and freshness during transit.

Conversely, the vegetables, fruits, and nuts segment ranks second in the market with 24% share. This denotes the perishability and volume of fresh produce, which require controlled-environment logistics to prevent spoilage without compromising quality.

Why does the Non-Cold Chain segment hold leadership in the food logistics market?

Based on service type, the global market is segmented into cold chain and non-cold chain. The non-cold chain segment dominates with 65% of the total market. It handles non-perishable foods, such as packaged cereals and edible oils, which constitute the bulk of global food shipments. Lower costs, a broad product base, and simpler infrastructure underpin its dominance.

On the other hand, the cold chain segment holds a second position with 35% market share. It emphasizes temperature-sensitive and perishable products, such as dairy, seafood, fresh produce, and meat. Growth is driven by rising food safety requirements, surging demand for freshness, and the expansion of refrigerated logistics networks.

What factors help the Distribution segment lead the food logistics market?

Based on business type, the global food logistics market is segmented into warehouse, distribution, and value-added services. The distribution segment captures 55% of the market. It encompasses order fulfillment, transportation, and delivery of food products from manufacturers to consumers and retailers. The need for efficient, timely movement in supply chains drives its leadership.

Nonetheless, the warehouse segment is the fastest-growing, accounting for 35% of the market. It offers inventory management, storage, and handling of food products, promising quality and reducing spoilage. Growth is supported by investments in strategically located, temperature-controlled storage facilities.

What are the key reasons for the leadership of the Roadways segment in the food logistics market?

Based on transportation mode, the global market is segmented into storage, roadways, seaways, and others. The roadways segment holds a substantial 70% share of the market. It offers reliable, flexible door-to-door delivery for both non-perishable and perishable foods. Extensive networks, investments in refrigerated vehicles, and last-mile connectivity back its leadership.

However, the seaways segment ranks second, with 20% market share. It is cost-effective for transporting large volumes and for international shipments, particularly when using refrigerated containers. Sea transport is vital for cross-continental and bulk logistics despite longer transit times.

Food Logistics Market: Regional Analysis

Why does North America hold a dominant position in the global Food Logistics Market?

North America is anticipated to retain its leading role in the global food logistics market, with a 6.8% CAGR, driven by advanced infrastructure and industry dominance, high consumer demand and e-commerce growth, and well-developed cold chain and food safety regulations. North America dominates owing to well-developed transportation networks, ports, and refrigerated storage facilities, which facilitate the efficient movement of food. The region accounts for nearly 1/3 of the worldwide market due to this infrastructure advantage. Efficient highways, cold chain facilities, and rail systems promise reliable and fast delivery of non-perishable and perishable foods.

Moreover, strong consumer spending power fuels demand for perishable and fresh foods, surging logistics providers to adopt automation, tracking, and temperature-controlled distribution. Furthermore, North America has a well-established cold chain, which is essential for the logistics of dairy, meat, fresh produce, and seafood. Strict food safety regulations compel companies to maintain investments in refrigerated warehouses and transport, thereby reducing spoilage and ensuring product quality.

Why does Europe rank second in the global Food Logistics Market?

Europe ranks second in the global food logistics industry, with an 8.3% CAGR, driven by substantial regional market share and logistics networks, high demand for processed and fresh foods, and advanced cold-chain and food-safety regulations. Europe registers for nearly 30% of the worldwide market, making it a leading regional contributor after North America. The region benefits from an integrated transport network of rail, road, sea, and air that supports effective pan-EU food distribution. Dense population centers in economies facilitate frequent, short-distance deliveries, thereby enhancing logistics operations. European consumers have a strong demand for high-value processed foods and fresh produce, and surging logistics volume. Higher living standards and urbanization support frequent grocery purchases and diverse dietary preferences. This demand drives logistics providers to improve warehousing, delivery solutions, and routing in markets.

Additionally, Europe’s cold chain infrastructure is well established to support perishable goods such as meat, dairy, produce, and seafood. Strict food safety regulations need temperature control, compliance, and traceability at every logistics stage. These regulatory demands fuel investment in controlled storage, refrigerated transport, and advanced monitoring systems.

Food Logistics Market: Competitive Analysis

The leading players in the global food logistics market are:

- Americold Logistics LLC

- Lineage Logistics

- Nichirei Logistics Group

- DSV A/S

- Conestoga Cold Storage

- Burris Logistics

- Congebec Logistics Inc.

- U.S. Cold Storage

- VersaCold Logistics Services

- Echo Global Logistics Inc.

- Evans Distribution Systems Inc.

- Schneider National

- Odyssey Logistics & Technology Corporation

- Hellmann Worldwide Logistics SE & Co. KG

- Matson Logistics

What are the key trends in the global Food Logistics Market?

E‑commerce and last‑mile delivery growth:

Direct-to-consumer food and online grocery delivery are growing rapidly, surging demand for efficient last-mile logistics solutions. This trend needs temperature-controlled deliveries, speedy delivery networks, and advanced fulfillment strategies. Changing consumer purchasing habits and urbanization are augmenting this shift towards home delivery.

Sustainability and green logistics:

Environmental concerns are driving the adoption of eco-friendly practices, such as electric vehicles, optimized routes, and biodegradable packaging. Logistics providers are lowering carbon emissions and waste while enhancing energy efficiency in cold transport and storage. Sustainability is becoming a competitive requirement instead of merely a branding initiative.

The global food logistics market is segmented as follows:

By Product Type

- Fish, Shellfish, and Meat

- Vegetables, Fruits, and Nuts

- Cereals, Bakery and Dairy Products

- Coffee, Tea, and Vegetable Oil

- Others

By Service Type

- Cold Chain

- Non-Cold Chain

By Business Type

- Warehouse

- Distribution

- Value Added Services

By Transportation Mode

- Storage

- Roadways

- Seaways

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed