Flexible Paper Packaging Market Size, Share, Trends, Growth 2034

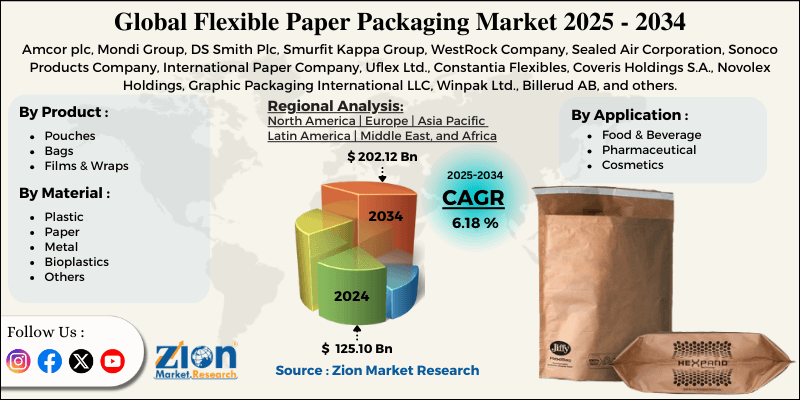

Flexible Paper Packaging Market By Product (Pouches, Bags, Films & Wraps, and Others), By Material (Plastic, Paper, Metal, Bioplastics, and Others), By Application (Food & Beverage, Pharmaceutical, Cosmetics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

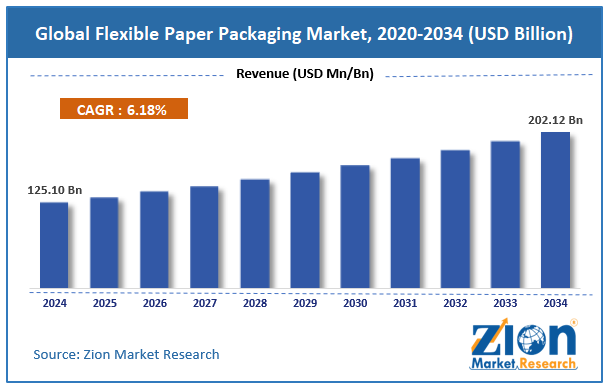

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 125.10 Billion | USD 202.12 Billion | 6.18% | 2024 |

Flexible Paper Packaging Market: Industry Perspective

The global flexible paper packaging market size was worth around USD 125.10 billion in 2024 and is predicted to grow to around USD 202.12 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.18% between 2025 and 2034.

Flexible Paper Packaging Market: Overview

Flexible paper packaging is an ecological packaging solution that uses adaptable and lightweight materials to preserve and protect products while reducing environmental impact. It is extensively used in sectors like food, personal care, and household items due to its recyclability, biodegradability, and ability to blend with barrier coatings for oxygen, moisture, and grease resistance. The global flexible paper packaging market is likely to expand rapidly, driven by growing sustainability awareness, the lightweight nature and cost-efficiency of flexible paper packaging, and improvements in barrier coating technologies. The rising environmental concerns and consumer inclination for eco-friendly packaging are forcing companies to adopt paper-based solutions. Flexible paper packaging offers compostability, biodegradability, and recyclability, making it a strong replacement for disposable plastics.

Moreover, paper packaging is usually lighter than rigid substitutes. With unstable prices of raw materials, lightweight formats provide enhanced economics for retailers and manufacturers. Advancements in bio-based, water-based, and compostable barrier coatings have significantly improved paper's resistance to grease, moisture, and oxygen. This increases the suitability of flexible paper packaging for a broader range of products, comprising frozen and perishable foods.

Despite the growth, the global market is impeded by factors such as low grease and moisture resistance, as well as durability restrictions for heavy products. Uncoated paper lacks both strong oil resistance and moisture. While costings can address this problem, they increase production prices. Likewise, paper-based packaging may be less durable for sharp-edged or heavy goods, limiting its use in bulk packaging and industrial sectors.

Nonetheless, the global flexible paper packaging industry stands to gain from a few key opportunities, like the growth in food and beverages and the integration of smart packaging solutions. The ever-increasing consumption of processed and packaged foods offers substantial demand for flexible paper pouches, bags, and wraps. Additionally, embedding NFC tags, QR codes, and interactive printing into paper packaging may improve customer engagement and traceability.

Key Insights:

- As per the analysis shared by our research analyst, the global flexible paper packaging market is estimated to grow annually at a CAGR of around 6.18% over the forecast period (2025-2034)

- In terms of revenue, the global flexible paper packaging market size was valued at around USD 125.10 billion in 2024 and is projected to reach USD 202.12 billion by 2034.

- The flexible paper packaging market is projected to grow significantly due to the growth in online retail sectors and e-commerce, the expansion of the food and beverage industry, and stringent governmental regulations on plastic use.

- Based on product, the pouches segment is expected to lead the market, while the bags segment is expected to grow considerably.

- Based on material, the paper segment is the dominating segment, while the plastic segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the food & beverage segment is expected to lead the market compared to the pharmaceutical segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Flexible Paper Packaging Market: Growth Drivers

How are circular-economy initiatives and investment in recycling infrastructure spurring the flexible paper packaging market?

Recycling systems for paper are presently more developed than or flexible plastics, with the rates of fiber recovery surpassing 65% in several developed nations. Industry and government coalitions are funding upgrades to recycling facilities to manage fiber-based flexible packaging, comprising those with dainty barrier coatings. This boosts the adoption and makes them more practical from an end-of-life standpoint.

Associations between material suppliers, recyclers, and converters are amplifying. For instance, Unilever and Mondi associated in 2023 to introduce a completely recycled paper laundry detergent pouch in Turkey. This denotes that circular-ready solutions are feasible in high-barrier applications.

How is the global flexible paper packaging market fueled by multilayer paper technologies and advances in barrier coatings?

Historically, paper packaging's most significant restriction was its inability to offer acceptable moisture, grease, and oxygen barriers. Nonetheless, advancements like water-based dispersions, vapor-deposited nanolayers, and bio-based coatings are transforming this. Firms like AR Packaging and Huhtamaki have introduced recyclable paper laminates that rival plastics in barrier performance, increasing their use in pet food, frozen foods, and dairy items.

These innovations also allow the development of mono-material paper packaging that can enter standard recycling streams without specialized separation. This offers opportunities for high-fat and high-moisture products like chocolate, cheese, and ready meals, fueling the flexible paper packaging market.

Flexible Paper Packaging Market: Restraints

Standards, regulatory inconsistency, and certification across regions create barriers to market progress

There is still no global standard that classifies which flexible paper constructions are compostable and recyclable in all jurisdictions. Variations in municipal recycling competencies, EPR rules, labeling laws, and composting standards (home vs. industrial) create compliance difficulties for worldwide brands. What is agreed in Germany or Scandinavia may be rejected in some parts of Latin America, Asia, or the United States municipal systems.

This collage increases commercial and legal risk. Companies may face greenwashing claims when packaging advertised as recyclable is not accepted locally, and product SKUs may require industry-specific packaging strategies, which can raise costs and operational complexity.

Flexible Paper Packaging Market: Opportunities

How does growth in e-commerce and direct-to-consumer (D2C) shipping create promising avenues for the flexible paper packaging industry?

Padded pouches and flexible paper mailers are emerging as sustainable alternatives to bubble and polybag mailers. Their curbside acceptance and recyclability attract both customers and brands. The key e-commerce platforms, such as Amazon, have already mandated that their 'Ships in Own Container' and specific packaging formats be curbside recyclable. Initiatives that prefer paper-based options are also preferred. This fuels fresh advancements like fiber-based cushioning layers and tear-resistant kraft mailers, impacting the global flexible paper packaging industry.

Flexible Paper Packaging Market: Challenges

Supply chain vulnerability for premium fiber and pulp limits the market growth

Food-grade virgin pulp and licensed sustainable fibers face challenges from other sectors, such as corrugated and tissue board, which may lead to price hikes and scarcity during demand surges.

In 2022-2023, pulp prices elevated more than 15% in some markets, partially because of strong containerboard demand and supply disturbances in South America. Similar instability may recur with the growing demand for quality flexible papers. Limited local pulp production in some regions also intensifies dependency on imports, which may be impacted by geopolitical instability and shipping delays.

Flexible Paper Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flexible Paper Packaging Market |

| Market Size in 2024 | USD 125.10 Billion |

| Market Forecast in 2034 | USD 202.12 Billion |

| Growth Rate | CAGR of 6.18% |

| Number of Pages | 213 |

| Key Companies Covered | Amcor plc, Mondi Group, DS Smith Plc, Smurfit Kappa Group, WestRock Company, Sealed Air Corporation, Sonoco Products Company, International Paper Company, Uflex Ltd., Constantia Flexibles, Coveris Holdings S.A., Novolex Holdings, Graphic Packaging International LLC, Winpak Ltd., Billerud AB, and others. |

| Segments Covered | By Product, By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Flexible Paper Packaging Market: Segmentation

The global flexible paper packaging market is segmented based on product, material, application, and region.

Based on product, the global flexible paper packaging industry is divided into pouches, bags, films & wraps, and others. The pouches segment holds a leading position in the market due to its adaptability in different industries, mainly personal care, food & beverages, and pet food. They offer optimal product protection when assimilated with barrier coatings, increasing their suitability for semi-moist and dry products. The lightweight, space-efficient, and re-sealable nature of pouches improves convenience for customers and decreases transportation costs for producers.

Based on material, the global flexible paper packaging market is segmented into plastic, paper, metal, bioplastics, and others. The paper segment dominates the market since it ideally aligns with the worldwide move towards eco-friendly and sustainable materials. It is biodegradable, recyclable, and compostable, making it an attractive option for leading companies seeking to reduce their ecological footprint. Improvements in print quality, paper strength, and barrier coatings have increased its use to protect a broader range of products, like dry foods, snacks, and e-commerce packages.

Based on application, the global market is segmented into food & beverage, pharmaceutical, cosmetics, and others. The food & beverage segment holds leadership because of the wide demand for lightweight, sustainable, and cost-efficient packaging for bakery items, snacks, ready-to-eat meals, and beverages. Flexible paper formats like wraps, pouches, and bags offer brilliant branding opportunities. Moreover, with barrier coatings, the brands can efficiently extend shelf life and preserve freshness. The growing consumption of packaged foods, fueled by changing lifestyles and urbanization, has amplified the segmental dominance.

Flexible Paper Packaging Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Flexible Paper Packaging Market?

Asia Pacific is anticipated to retain its leading role in the global flexible paper packaging market due to manufacturing growth, rapid industrialization, strong food consumption, and the expansion of the retail and e-commerce industry. APAC, especially India, China, and Southeast Asian nations, has witnessed speedy industrial growth, driving the demand for packaging in diverse sectors. The region houses several larger manufacturer hubs for beverages, food, and consumer goods.

The changing lifestyles, growing urbanization, and rising middle-class populations have surged the consumption of packaged food and drinks. Nations like India and China are experiencing an annual F&B sector gain above 7%, fueling packaging needs. Flexible paper pouches, bags, and wraps are substituting plastics to meet the rising regulatory and consumer demands.

Also, APAC holds the fastest progressing e-commerce market, with India, Southeast Asia, and China dominating worldwide online sales growth. Asia Pacific's e-commerce market is anticipated to hit $3.5 trillion by 2027, necessitating the need for massive quantities of sustainable, protective, and brandable packaging. Mailers and paper-based courier bags are widely used as alternatives to plastic in last-mile deliveries.

Europe ranks as the second-leading region in the global flexible paper packaging industry as a result of strong sustainability policies and regulations, advanced recycling infrastructure, and high consumer demand for environmentally-friendly products. Europe holds the most stringent packaging waste norms, comprising the EU Packaging and Packaging Waste Directive, which commands recycling targets of 65 percent for all packaging by 2025. This regulatory architecture strongly prefers paper-based technologies instead of plastics. Several nations have adopted heavy taxes and bans on disposable plastics, amplifying the move towards flexible paper packaging.

Europe boasts an advanced recycling network, with an average rate of 71% for paper recycling, the highest worldwide, according to the CEPI. This makes paper-based packaging an appealing choice for manufacturers, since it obeys circular economy objectives. This robust processing capabilities and collection promises high recovery rates for post-consumer paper packaging.

European consumers are highly environmentally conscious, with more than 80% favoring sustainable packaging, according to a 2024 survey by Eurobarometer. This cultural choice has forced the leading companies to adopt flexible paper packaging to maintain industry competitiveness. The leading FMCG companies and regional retailers are rebranding with eco-conscious packaging to attract these customers.

Flexible Paper Packaging Market: Competitive Analysis

The leading players in the global flexible paper packaging market are:

- Amcor plc

- Mondi Group

- DS Smith Plc

- Smurfit Kappa Group

- WestRock Company

- Sealed Air Corporation

- Sonoco Products Company

- International Paper Company

- Uflex Ltd.

- Constantia Flexibles

- Coveris Holdings S.A.

- Novolex Holdings

- Graphic Packaging International LLC

- Winpak Ltd.

- Billerud AB

Flexible Paper Packaging Market: Key Market Trends

Increasing adoption of barrier-coated papers:

Manufacturers are using bio-based, advanced water-based, and compostable coatings to improve paper's resistance to oxygen, grease, and moisture. This enables flexible paper packaging to expand into perishable food and high-moisture categories. Companies like Huhtamaki and Mondi are forerunners in recyclable coated papers.

Move toward plastic-free packaging solutions:

The leading worldwide brands are introducing 100% paper-based flexible packaging without plastic laminations to meet consumer sustainability and regulatory demands. Some of the examples comprise mailers, pouches, and wraps that are compostable or recyclable. This complies with the rising plastic-free initiative in packaging.

The global flexible paper packaging market is segmented as follows:

By Product

- Pouches

- Bags

- Films & Wraps

- Others

By Material

- Plastic

- Paper

- Metal

- Bioplastics

- Others

By Application

- Food & Beverage

- Pharmaceutical

- Cosmetics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Flexible paper packaging is an ecological packaging solution that uses adaptable and lightweight materials to preserve and protect products while reducing environmental impact. It is extensively used in sectors like food, personal care, and household items due to its recyclability, biodegradability, and ability to blend with barrier coatings for oxygen, moisture, and grease resistance.

The global flexible paper packaging market is projected to grow due to increasing demand for eco-friendly and sustainable packaging, improvements in paper packaging materials, and growing brand emphasis on customized and premium packaging.

According to study, the global flexible paper packaging market size was worth around USD 125.10 billion in 2024 and is predicted to grow to around USD 202.12 billion by 2034.

The CAGR value of the flexible paper packaging market is expected to be around 6.18% during 2025-2034.

Asia Pacific is expected to lead the global flexible paper packaging market during the forecast period.

The key players profiled in the global flexible paper packaging market include Amcor plc, Mondi Group, DS Smith Plc, Smurfit Kappa Group, WestRock Company, Sealed Air Corporation, Sonoco Products Company, International Paper Company, Uflex Ltd., Constantia Flexibles, Coveris Holdings S.A., Novolex Holdings, Graphic Packaging International, LLC, Winpak Ltd., and Billerud AB.

There are opportunities for partnerships and investments in developing recyclable barrier technologies, sustainable raw material sourcing, and smart packaging features. Collaborations between FMCG brands, packaging manufacturers, and e-commerce companies can accelerate market penetration and innovation.

Technological advancements in digital printing, barrier coatings, and paper strength enhancement are increasing the aesthetics and functionality of flexible paper packaging. These innovations allow improved shelf life, stronger sustainability credentials, and wider product applications.

The flexible paper packaging market is facing moderate price increases due to rising energy and pulp costs, along with investments in modernized coating technologies. However, rising production efficiencies and regional availability of raw material are stabilizing prices in competitive markets.

The report examines key aspects of the flexible paper packaging market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed