Flavors Market Size, Share, Growth, Global Trends Report, 2032

Flavors Market By Type (Natural and Synthetic), By Application (Beverages, Bakery, Confectionery, Dairy, Savory & Snacks and Others), and By Region: Global Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.73 Billion | USD 26.8 Billion | 4.06% | 2023 |

Flavors Market Insights

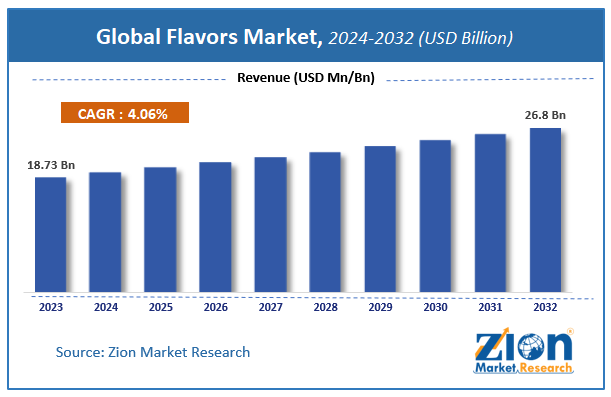

According to a report from Zion Market Research, the global Flavors Market was valued at USD 18.73 Billion in 2023 and is projected to hit USD 26.8 Billion by 2032, with a compound annual growth rate (CAGR) of 4.06% during the forecast period 2024-2032.

This report explores market strengths, weaknesses, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and future prospects that may emerge in the Flavors Market industry over the next decade.

Global Flavors Market: Overview

Flavors are used in various products such as bakery, confectionery, meat, snacks, seafood, and poultry. By type, the flavors market is bifurcated into natural and synthetic flavors. The rise in disposable income and change in food habits are the factors that drive the growth of the flavors market. The beverages industry has a significant impact on the growth of the flavors market.

An increase in demand for ready-to-eat meals & fast foods is a key driver for the flavors industry across the globe. Moreover, innovative technologies, the introduction of new flavors, and a heavy inflow of investment in R&D activities are the other factors that supplement the growth of the flavors market. There is an upcoming trend of using natural flavors owing to a rise in health awareness. Furthermore, the high demand for flavors across European countries to produce commercialized clean-label or green food products that are free of additives and other harmful chemicals has propelled the growth of the natural flavors market.

However, stringent government regulations and adverse effects of synthetic flavors on human health are expected to hamper the market growth. Innovation in flavors and their growth in demand across emerging economies are expected to open new avenues for market players in the future.

Many companies with their promising R&D initiatives are expecting a positive response from the flavor industry. In August 2018, Campbell Soup introduced V8+ Hydrate, a new kind of beverage using sweet potatoes, thereby validating new trends across the flavors market. Experts believe that the introduction of the new product is aimed at responding to the consumer demands for healthy food products with enhanced nutritional value.

COVID-19 Impact Analysis

The food & beverages industry is anticipated to experience the differential impact of this rapidly spreading COVID-19 on each stage of its value chain through mediums of the affected workforce at the industrial level, raw material supply, trade & logistics, demand-supply volatility, and uncertain consumer demand at retail outlets. Products and inventory levels across the industry spectrum are expected to be impacted.

Key players and vendors are facing challenges in raw material supply, owing to poor logistics, traffic control, and restrictions on public movement in affected countries across the globe, which leads to supply disruptions. Trade restrictions imposed by several countries across the globe to prevent further spread of coronavirus have significantly affected global logistics and transportation, which, in turn, has impacted the flavors market.

Flavors Market: Growth Factors

There has been an increase in the demand for health products, such as energy drinks, fruit-flavored drinks, and nuts in the last few years. The rise in health awareness among the population is the key factor that fuels the growth of health products, also known as green-label products. Furthermore, an increase in the incidence of diseases, such as obesity, diabetes, and high blood pressure drives the growth of health-related food products among consumers. Many food companies, such as Coca-Cola or Pepsi, target audiences through their zero-sugar products. Thus, there has been an increase in the per capita income of the global population to address the high costs of health and wellness products, which drives the growth of the market.

Many cases of adverse effects of manufactured food products have been reported, especially the flavors used in them. Thus, different governments across the globe have set up regulatory guidelines to regulate the flavor market. Such regulations, especially in Europe and North America, have led to a decline in the growth of the flavor industry, particularly synthetic flavors.

The global flavors market is mainly driven by rapid growth in demand for convenience food across the globe. Secondly, changing lifestyle and eating habits is also expected to propel the demand for flavor market in near future. However, growing concerns towards health issues coupled with stringent rules and regulations are likely to impede the growth of the global flavors market. Nonetheless, emerging economies are likely to open new opportunities to the major players of the market.

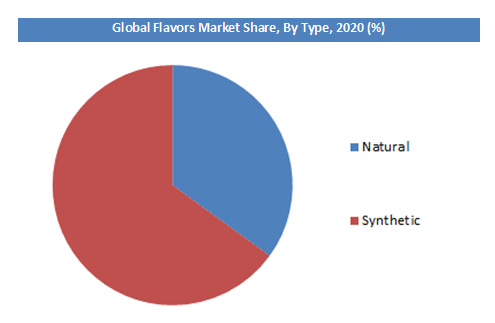

The natural and synthetic flavors are the key types of global flavors market. Among these two, the natural flavor dominated the globe flavors market in 2015. It accounted over 50% shares of the overall market in 2015. Furthermore, the shifting preference of customer towards natural flavors is expected to maintain the dominance of natural flavor in the market in near future.

Flavors Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flavors Market |

| Market Size in 2023 | USD 18.73 Billion |

| Market Forecast in 2032 | USD 26.8 Billion |

| Growth Rate | CAGR of 4.06% |

| Number of Pages | 210 |

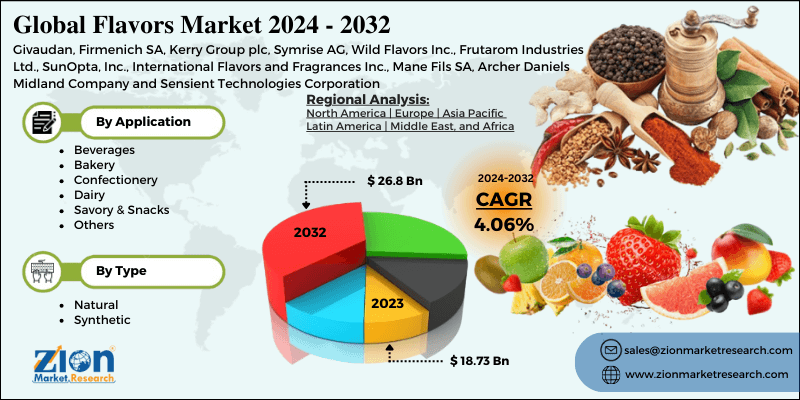

| Key Companies Covered | Givaudan, Firmenich SA, Kerry Group plc, Symrise AG, Wild Flavors Inc., Frutarom Industries Ltd., SunOpta, Inc., International Flavors and Fragrances Inc., Mane Fils SA, Archer Daniels Midland Company and Sensient Technologies Corporation |

| Segments Covered | By Type, By Application, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Flavors Market: Segmentation Analysis

By Type Segment Analysis

The main types available in the flavors market are natural flavors and synthetic flavors. Among them, the demand for natural flavors is relatively higher and the trend is anticipated to remain so over the next few years, notes the research report.

By Application Segment Analysis

Beverages hold the maximum share in terms of value in the flavor market. Herbs, honey, superfruits, and spices are some of the healthy flavors that drive the flavor trends in the beverage industry. The growth of the beverage flavors product market is expected to decline in some regions during the forecast period due to a rise in awareness among the population regarding the side effects of artificial flavors. Further, consumer preference for health drinks is projected to impede the growth of soft drinks and alcoholic beverages.

Flavors Market: Regional Analysis

In Asia-Pacific, beverage manufacturers mostly use natural flavors. In terms of value, Asia-Pacific is expected to retain the maximum market share in the beverage flavors product market. The consumers’ willingness to buy flavors that they never had before has led to increased innovation in the beverage sector. Technological advancements in production procedures and a rise in demand for fruit-flavored drinks are expected to provide lucrative growth opportunities to the beverage flavors industry. Request Free Sample

Request Free Sample

Flavors Market: Competitive Analysis

Some of the major players in the global Flavors market include:

- Givaudan

- Firmenich SA

- Kerry Group plc

- Symrise AG

- Wild Flavors Inc.

- Frutarom Industries Ltd.

- SunOpta, Inc

- International Flavors and Fragrances Inc.

- Mane Fils SA

- Archer Daniels Midland Company

- Sensient Technologies Corporation

The global Flavors Market is segmented as follows:

By Type

- Natural

- Synthetic

By Application

- Beverages

- Bakery

- Confectionery

- Dairy

- Savory & Snacks

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Flavors market size was worth around USD 18.73 billion in 2023 and is expected to reach USD 26.8 billion by 2032.

The global Flavors market is expected to grow at a CAGR of 4.06% during the forecast period.

Some of the key factors driving the global Flavors Market growth are surge in demand for RTE meal and fast foods, Increase in use of health products, and Technological strides.

North America is expected to dominate the Flavors market over the forecast period.

Major players in the Flavors market are Givaudan, Firmenich SA, Kerry Group plc, Symrise AG, Wild Flavors Inc., Frutarom Industries Ltd., SunOpta, Inc, International Flavors and Fragrances Inc., Mane Fils SA, Archer Daniels Midland Company and Sensient Technologies Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed