Fish Farming Market Size, Share, Growth, Opportunities 2034

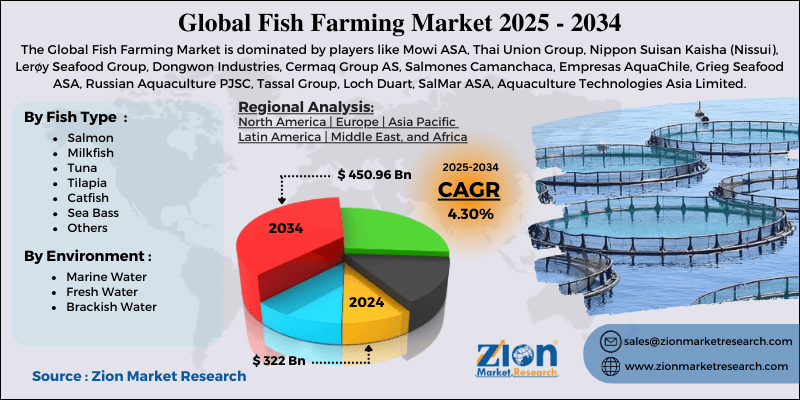

Fish Farming Market By Fish Type (Salmon, Milkfish, Tuna, Tilapia, Catfish, Sea Bass, and Others), By Environment (Marine Water, Fresh Water, Brackish Water), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

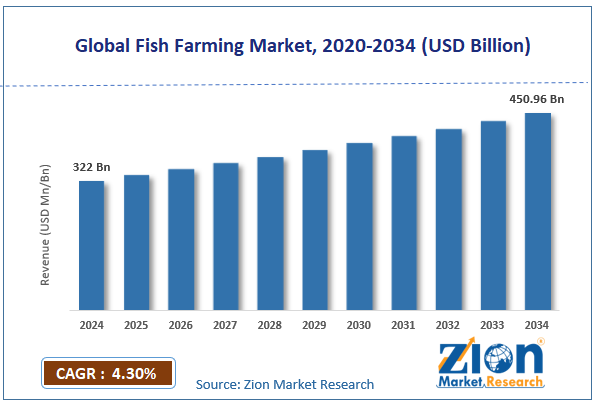

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 322 Billion | USD 450.96 Billion | 4.30% | 2024 |

Fish Farming Industry Perspective:

What will be the size of the global fish farming market during the forecast period?

The global fish farming market size was around USD 322 billion in 2024 and is projected to reach USD 450.96 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fish farming market is estimated to grow annually at a CAGR of around 4.30% over the forecast period (2025-2034)

- In terms of revenue, the global fish farming market size was valued at around USD 322 billion in 2024 and is projected to reach USD 450.96 billion by 2034.

- The fish farming market is projected to grow significantly, driven by increasing global demand for seafood, technological advancements in aquaculture, and rising investments in sustainable farming.

- Based on fish type, the tilapia segment is expected to lead the market, while the salmon segment is expected to grow considerably.

- Based on the environment, the fresh water segment is the dominating segment, while the marine water segment is projected to witness sizeable revenue over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Fish Farming Market: Overview

Fish farming, or aquaculture, is the practice of growing fish in controlled environments, such as tanks, ponds, or cages, to produce food. It helps meet the growing demand for seafood while reducing pressure on wild fish populations. The global fish farming market is poised for notable growth, driven by rising demand for seafood, declining wild fish stocks, and technological advancements. Worldwide population growth is increasing the demand for affordable protein sources. Fish is widely accepted for its cultural relevance and nutritional value. Fish farming helps meet this growing need for consumption consistency.

Moreover, overfishing has reduced the availability of wild-caught fish worldwide. This creates supply gaps in the seafood industry. Aquaculture fills these gaps by providing a reliable, controlled alternative. Furthermore, modern technologies enhance feeding efficiency, water quality control, and breeding. Automation reduces labor costs and production losses. These improvements raise overall farm productivity.

Nevertheless, the global market is constrained by factors such as high initial capital investment, disease and health risks, and environmental pollution. Fish farming needs expensive equipment and infrastructure. Small-scale farmers usually struggle to access financing. This restricts market entry for new vendors. Dense fish populations raise the risk of disease outbreaks. Poor biosecurity may result in significant losses of livestock. Likewise, disease management increases operational costs. Waste discharge may contaminate surrounding water bodies. Environmental damage results in stringent regulations. This increases monitoring costs and compliance.

Still, the global fish farming industry benefits from several favorable factors, such as demand for value-added fish products, growing demand for sustainable certification, and digital fish and smart farming. Processed and packaged fish products attract urban consumers. Value addition raises shelf life and profits. This opens access to premium markets. Eco-labels improve brand value and consumer trust. Certified products command higher prices. This creates incentives for responsible farming. Additionally, digital monitoring enhances feed efficiency and fish health. Data-driven decisions reduce losses. Smart systems improve operational control.

Fish Farming Market: Dynamics

Growth Drivers

How is innovation in aquafeed and fish nutrition fueling the worldwide fish farming market?

Feed innovation remains a critical growth driver, as feed costs account for approximately 60-70% of overall fish farming expenses. Recent improvements include plant-based proteins, algae-derived omega-3 feeds, and insect meal, which reduce reliance on fishmeal. These nutritionally enhanced feeds improve growth, survival ratios, and disease resistance. Improved feed efficiency has led to productivity gains of 20-30% in commercial farms. As costs and sustainability efficiency converge, feed innovation continues to drive the expansion of the fish farming market.

How are technological advancements in aquaculture systems impacting the fish farming market growth?

Modern fish farming is increasingly driven by innovations such as AI-based monitoring, recirculating aquaculture systems, and automated feeding technologies. These advancements improve feed conversion ratios, increase water efficiency to 90% in closed systems, and reduce mortality rates. Offshore and deep-water farming technologies are also allowing expansion beyond traditional coastal limits. Recent investments in smart aquaculture have significantly increased production while reducing operational risks. Hence, technology adoption is augmenting profitability and scalability in the sector.

Restraints

Disease outbreaks and fish mortality negatively impact the market progress

Fish farms are vulnerable to bacterial, viral, and parasitic diseases, which may cause significant losses. Mortality rates on affected farms may reach 30%, mainly in intensive systems. Disease management requires specialized knowledge, antibiotics, and vaccines, which raise operational costs. Outbreaks also risk undermining industry confidence and imposing export restrictions. Frequent health crisis remains a persistent constraint on scale and profitability.

Opportunities

How is the development of high-value and specialty species creating promising avenues for the fish farming industry growth?

Consumer demand for premium species such as trout, shrimp, and barramundi is increasing due to their nutritional benefits, taste, and industry appeal. Cultivating high-value or exotic fish yields higher profit margins than common species such as catfish or tilapia. Organic and sustainably farmed options are increasingly opted for by eco- and health-conscious consumers. Producers can increase revenue through value-added products such as ready-to-cook meals, branded seafood, and fillets. Entering specialty and high-value species markets offers a significant opportunity for differentiation and growth in the fish farming industry.

Challenges

Water scarcity and quality management restrict the market growth

Aquaculture largely depends on a consistent supply of oxygen-rich and clean water, making quality management crucial. Pollution, salinity variations, and harmful algal blooms may lower fish growth, raise mortality rates, and increase disease risk. Farms typically invest in recirculating systems and water treatment, thereby increasing operational and capital costs. Regulatory restrictions on water use and effluent discharge are becoming more stringent, increasing compliance burdens. Ensuring a sustainable water supply while maintaining productivity remains a significant challenge for the market.

Fish Farming Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fish Farming Market |

| Market Size in 2024 | USD 322 Billion |

| Market Forecast in 2034 | USD 450.96 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 214 |

| Key Companies Covered | Mowi ASA, Thai Union Group, Nippon Suisan Kaisha (Nissui), Lerøy Seafood Group, Dongwon Industries, Cermaq Group AS, Salmones Camanchaca, Empresas AquaChile, Grieg Seafood ASA, Russian Aquaculture PJSC, Tassal Group, Loch Duart, SalMar ASA, Aquaculture Technologies Asia Limited, Akai Foods Inc., and others. |

| Segments Covered | By Fish Type, By Environment, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fish Farming Market: Segmentation

The global fish farming market is segmented based on fish type, environment, and region.

Why is the Tilapia segment projected to dominate the fish farming market?

Based on fish type, the global fish farming industry is divided into salmon, milkfish, tuna, tilapia, catfish, sea bass, and others. The tilapia segment accounts for 25% of the total market due to its rapid growth and adaptability to diverse environments. It thrives in Africa, Asia, and Latin America, making it accessible for large-scale production. Its affordability and mild taste fuel high consumer demand.

Conversely, the salmon segment accounts for 15% of the total market, driven by strong demand and high market prices. It is valued mainly in Europe, North America, and Japan for its rich omega-3 content. It requires advanced farming systems in cold-water regions, limiting production volumes compared to tilapia. Despite low volume, its high market price promises strong demand.

What factors help the Fresh Water segment lead the fish farming market?

Based on the environment, the global fish farming market is segmented into marine water, fresh water, and brackish water. The fresh water segment accounts for 60% of the overall market due to the broader cultivation of species such as catfish, carp, and tilapia. It needs a comparatively simple infrastructure and is adaptable to ponds, rivers, and tanks. High production efficiency and low operational costs make it the most accessible form of aquaculture.

However, the marine water segment registers with 30% of the total market share. It comprises species like sea bass, salmon, and tuna. It is more technologically demanding and mainly needs offshore farms, coastal facilities, or cages. Despite high costs, it serves high-value markets and export-oriented products.

Fish Farming Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Fish Farming Market?

Asia Pacific is projected to maintain its dominant position in the global fish farming market, with a 6.4% CAGR, driven by its large production share, large consumer base, growing demand, and favorable natural conditions. Asia Pacific is the leading worldwide aquaculture producer, driven by the cultivation of carp, tilapia, shrimp, and catfish. Economies such as India, Vietnam, Indonesia, and China have extensive aquaculture facilities, ranging from small family farms to industrial operations. This scale enables APAC to dominate global output and consistently supply both international and domestic markets.

Moreover, the region’s massive population, exceeding 4 billion, drives high domestic demand for protein-rich, affordable foods. Growing urbanization and rising incomes have shifted diets toward more seafood consumption, especially in India, China, and Southeast Asia. This large, rapidly growing consumer base incentivizes farmers to expand production, making APAC the most dynamic sector for aquaculture growth.

Furthermore, APAC has extensive freshwater resources, including lakes, rivers, and coastlines, as well as warm climatic zones suitable for aquaculture. These natural conditions support both marine and freshwater farming with minimal energy input and allow year-round fish growth. Inland and coastal regions offer flexibility for farming a broad range of species, contributing to high overall output.

Why does Europe rank second in the global Fire Protection System Pipes Market?

Europe maintains its position as the second-largest region in the global fish farming industry, with a 5% CAGR, driven by strong production of high-value species, advanced technologies, farming practices, and regulatory frameworks and quality standards. Europe focuses on high-value species such as Atlantic salmon, sea bream, and sea bass, which generate high revenue per unit. Scotland, Norway, and Spain are the leading producers, especially in marine aquaculture and cold-water aquaculture. While overall production volume is lower than APAC, the focus on premium species augments regional market share and profitability.

Moreover, European farms use water-quality sensors and advanced feeders to enhance growth. Disease prevention solutions and selective breeding further increase yield and efficiency. These innovations reduce mortality, improve sustainability, and maintain consistent product quality for both the export and domestic markets. Additionally, Europe has stringent food safety, environmental, and animal welfare regulations for aquaculture operations. Compliance with regulations is expected to yield minimal environmental impact and high-quality, traceable seafood products. These standards help European aquaculture access premium international markets and build consumer trust worldwide.

Fish Farming Market: Competitive Analysis

The leading players in the global fish farming market are:

- Mowi ASA

- Thai Union Group

- Nippon Suisan Kaisha (Nissui)

- Lerøy Seafood Group

- Dongwon Industries

- Cermaq Group AS

- Salmones Camanchaca

- Empresas AquaChile

- Grieg Seafood ASA

- Russian Aquaculture PJSC

- Tassal Group

- Loch Duart

- SalMar ASA

- Aquaculture Technologies Asia Limited

- Akai Foods Inc.

What are the key trends in the global Fish Farming Market?

Expansion of cost‑effective & alternative feed sources:

Traditional fishmeal- and soy-based feeds are ecologically unsustainable and expensive, prompting the market to explore alternative feeds such as algae, single-cell proteins, and insect proteins. These feed innovations reduce costs and lower reliance on wild fish stocks. Improved nutrition from alternative feeds also supports enhanced growth and health of farmed fish.

Increased focus on value‑added products & high‑value species:

There is a growing industry emphasis on premium species and on value-added seafood products such as smoked fish, fillets, and ready-to-cook options. Higher consumer demand for convenience and quality is fueling producers to diversify product lines. This trend helps aquaculture businesses capture higher margins and enter new retail channels.

The global fish farming market is segmented as follows:

By Fish Type

- Salmon

- Milkfish

- Tuna

- Tilapia

- Catfish

- Sea Bass

- Others

By Environment

- Marine Water

- Fresh Water

- Brackish Water

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed