Disease Management Apps Market Size, Share, Trends, Growth and Forecast 2034

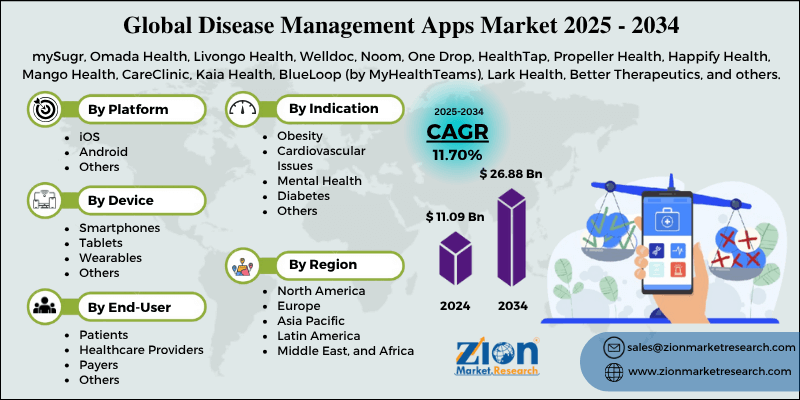

Disease Management Apps Market By Platform Type (iOS, Android, and Others), By Device (Smartphones, Tablets, Wearables, and Others), By Indication (Obesity, Cardiovascular Issues, Mental Health, Diabetes, and Others), By End-User (Patients, Healthcare Providers, Payers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

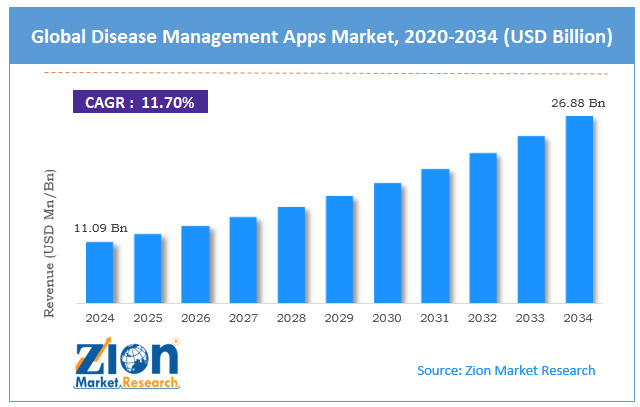

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.09 Billion | USD 26.88 Billion | 11.70% | 2024 |

Disease Management Apps Industry Perspective:

The global disease management apps market size was worth around USD 11.09 billion in 2024 and is predicted to grow to around USD 26.88 billion by 2034, with a compound annual growth rate (CAGR) of roughly 11.70% between 2025 and 2034.

Disease Management Apps Market: Overview

Disease management applications are digital tools that help patients manage, monitor, and enhance their health conditions, especially different types of chronic illnesses. These apps offer features like symptom tracking, medication reminders, integration with wearable devices for real-time information, and personalized health tips. The global disease management apps market is projected to witness substantial growth, driven by the growing incidences of chronic diseases, rising internet and smartphone penetration, and a move towards personalized and preventive healthcare. The rising cases of chronic illnesses like COPD, cardiovascular diseases, and diabetes are a leading growth propeller. Chronic diseases cause nearly 74% of the deaths globally, surging demand for app-based and remote disease management solutions, according to the WHO.

With more than 6.9 billion smartphone users across the globe, accessibility to mobile health solutions has notably enhanced, mainly in developing economies. This trend fuels the adoption of applications for disease monitoring and tracking. Moreover, healthcare systems are increasingly shifting to proactive care. Disease management applications support this shift by offering early detection solutions, altered health recommendations, and behavior modification prompts.

Although drivers exist, the global market faces challenges from factors such as data security and privacy concerns, as well as a lack of regulation and standardization. Users generally hesitate to share sensitive health information due to concerns about breaches. High-profile cybersecurity cases in healthcare, like the 2023 U.S. HCA breach, have raised alarm.

Moreover, the lack of regulatory clarity from goodies like EMA or FDA for disease management applications increases quality inconsistencies and hampers clinician trust and integration into formal care. Even so, the global Disease Management Apps industry is well-positioned due to AI-based predictive analytics, insurance collaborations, corporate wellness, and subscription-based models. There is a surging opportunity to incorporate artificial intelligence that can predict disease flare-ups, send alerts to providers, and recommend treatment changes, thereby enhancing app value and results.

In addition, employers and insurers are actively merging with app developers to offer wellness advantages, building B2B revenue models, and increasing industry penetration. Subscription tiers for extra features like doctor chat and AI coaching offer monetization possibilities while keeping entry-level access free, appealing to a larger consumer base.

Key Insights:

- As per the analysis shared by our research analyst, the global disease management apps market is estimated to grow annually at a CAGR of around 11.70% over the forecast period (2025-2034)

- In terms of revenue, the global disease management apps market size was valued at around USD 11.09 billion in 2024 and is projected to reach USD 26.88 billion by 2034.

- The disease management apps market is projected to grow significantly owing to increasing cases of chronic illnesses, mounting healthcare costs, and favorable government regulations and initiatives.

- Based on platform type, the Android segment is expected to lead the market, while the iOS segment is expected to grow considerably.

- Based on device, the smartphones segment is the dominating segment, while the wearables segment is projected to witness sizeable revenue over the forecast period.

- Based on indication, the diabetes segment leads the market, while the cardiovascular issues segment holds a second-leading position.

- Based on end-user, the patients segment is expected to lead the market compared to the healthcare providers segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Disease Management Apps Market: Growth Drivers

Shift toward value-based healthcare models propels the market growth

Insurers and governments across the globe are shifting to value-based care, where not procedures, but outcomes dictate reimbursements. Disease management apps are a key enabler, enhancing adherence and patient engagement, which in turn improve long-term results. This move motivates providers to incorporate digital apps as primary components of chronic disease management pathways.

In the U.S., the CMS increased remote patient monitoring in 2024, identifying disease management apps as reimbursement solutions for chronic care.

An increase in mental health and lifestyle disorders noticeably drives the market growth

Beyond traditional physical conditions, disease management applications are used mainly to manage lifestyle and mental health disorders, domains that have experienced massive growth after the COVID-19 pandemic. Apps like Wysa, Headspace, and Calm are offering cognitive behavioral therapy, therapist support through AI chatbots, and mood tracking.

The U.S. FDA granted innovative designation to Big Health's Daylight application for anxiety management, identifying it as a digital therapeutic. The blurring lines between physical and mental health management, combined with the scalability of app-based interventions, are creating a high-growth domain in these applications. These efforts, along with the enhancement of applications with AI, contribute to the growth of the disease management apps market.

Disease Management Apps Market: Restraints

Lack of outcome evidence and clinical validation hinders the market progress

Several disease management apps lack strict clinical validation, which restricts their acceptance by regulatory bodies. While multiple apps are available, only a few have gone through randomized controlled experiments or longitudinal analysis to prove their efficiency in enhancing clinical results.

According to the IQVIA Institute’s 2024 digital health report, out of 350,000 health applications, only 3.4% have been clinically accepted. This credibility gap increases hesitancy among healthcare professionals to suggest these applications to their patients, mainly to manage severe conditions like cancer, heart failure, or COPD.

Disease Management Apps Market: Opportunities

Rise in AI-based personalized health coaching positively impacts market growth

AI-based personalization is a growing trend, offering users modified recommendations depending on their behavioral patterns, biometric data, and health history. Disease management applications can utilize machine learning algorithms to provide personalized health plans, predictive alerts, and tailored medical reminders, thereby improving clinical outcomes and enhancing compliance. This notably impacts the progress of the disease management apps industry.

Amazon Web Services (AWS) introduced a customized AI toolkit, specifically designed for digital health apps, in March 2025, enabling the rapid development of training and predictive models.

Disease Management Apps Market: Challenges

Digital divide and unequal access limit the growth of the market

Despite rising mobile penetration, access disparities are a key challenge, mainly for the geriatric population, low-income populace, and people with disabilities. These groups usually lack technological access or the digital literacy needed to use disease management applications effectively.

The World Economic Forum’s 2024 Digital Inclusion Index revealed that more than 2.6 billion individuals worldwide still face digital access challenges, including skills gaps, high costs, or inadequate internet infrastructure.

Disease Management Apps Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Disease Management Apps Market |

| Market Size in 2024 | USD 11.09 Billion |

| Market Forecast in 2034 | USD 26.88 Billion |

| Growth Rate | CAGR of 11.70% |

| Number of Pages | 211 |

| Key Companies Covered | mySugr, Omada Health, Livongo Health, Welldoc, Noom, One Drop, HealthTap, Propeller Health, Happify Health, Mango Health, CareClinic, Kaia Health, BlueLoop (by MyHealthTeams), Lark Health, Better Therapeutics, and others. |

| Segments Covered | By Platform Type, By Device, By Indication, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Disease Management Apps Market: Segmentation

The global disease management apps market is segmented based on platform type, device, indication, end-user industry, and region.

Based on platform type, the global disease management apps industry is divided into iOS, Android, and others. The Android segment held a substantial share of the market owing to its broader global use, mainly in economies like Southeast Asia, Brazil, and India.

Conversely, the iOS segment held a second-leading position in the market, mainly due to its strong presence in developed markets like Canada, the United States, and parts of Europe. iOS consumers spend more on health-associated applications and are usually early adopters of digital health technologies.

Based on device, the global disease management apps market is segmented into smartphones, tablets, wearables, and others. The smartphones segment held a dominating share of the market as it is a primary device for tracking and using disease management applications. A majority of disease management apps are enhanced for smartphones because of their affordability and easy use, mainly in developing and developed nations.

On the other hand, the wearable segment held a second-leading share, fueled by the increasing adoption of fitness trackers and health-focused smartwatches like Garmin, Fitbit, and Apple Watch.

Based on indication, the global disease management apps market is segmented into obesity, cardiovascular issues, mental health, diabetes, and others. Diabetes remains the top indication for disease management apps due to its high global prevalence and the need for constant monitoring.

However, the cardiovascular issues held a considerable share, registering a mortality rate of over 17.9 million deaths yearly, according to the WHO. An aging population and increased awareness are further propelling growth in the segment.

Based on end-user, the global market is segmented into patients, healthcare providers, payers, and others. The patients segment accounted for the largest market share, as they are the key users of disease management apps for conditions like hypertension, diabetes, obesity, and asthma.

Nonetheless, the healthcare providers segment ranks second in the market. This group uses these applications to remotely monitor patient data, adjust treatments depending on real-time insights, and enhance communication.

Disease Management Apps Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is likely to maintain its leadership in the disease management apps market due to the increasing prevalence of chronic diseases, advanced digital health infrastructure, and heightened consumer awareness. North America holds the highest number of individuals with chronic disease, across the globe.

According to reports by the CDC, 6 in 10 adults in the U.S. live with at least one chronic illness, and 4 in 10 live with two or more, comprising heart disease, diabetes, and obesity. This escalates the demand for more digital solutions like disease management applications for daily monitoring and tracking. The region brags about its well-developed digital health infrastructure, with robust support for RPM, telemedicine, and EHR integration.

Regulations like the HITECH Act and government programs have motivated providers to use application-based health monitoring systems that support and aid clinical workflows. In addition, consumers in the region are proactive about health and more informed. According to HINTS, more than 80% of the United States adults seek health information through apps or online, denoting a digitally engaged population that actively adopts disease management solutions.

Europe continues to hold the second-highest share in the disease management apps industry, driven by the high prevalence of chronic illnesses, the emphasis on remote care and elderly patients, and government reimbursement for digital therapies. Europe faces a rising crisis of chronic diseases, with the WHO predicting more than 85% mortality in the region due to non-communicable diseases, comprising diabetes, cancer, and cardiovascular diseases. This led to a higher demand for digital self-management tools like apps that support long-term disease tracking and prevention.

Furthermore, with Europe's rapidly aging population aged 65+, there is a rising demand for solutions that aid chronic care management and independent living. Disease management applications fill this gap by reducing hospital dependency and allowing remote monitoring. Likewise,

Germany’s DiGA (Digital Health Applications) program allows the prescription of certified health apps, which are reimbursed by statutory health insurance. Over 40 apps have been approved under this system, including those managing diabetes, obesity, and mental health, encouraging mass adoption among patients and doctors.

Disease Management Apps Market: Competitive Analysis

The leading players in the global disease management apps market are:

- mySugr

- Omada Health

- Livongo Health

- Welldoc

- Noom

- One Drop

- HealthTap

- Propeller Health

- Happify Health

- Mango Health

- CareClinic

- Kaia Health

- BlueLoop (by MyHealthTeams)

- Lark Health

- Better Therapeutics

Disease Management Apps Market: Key Market Trends

Integration of predictive analytics and AI:

Disease management apps are actively using AI to predict disease flare-ups, provide personalized insights, and support early intervention. For instance, apps for heart conditions and diabetes now use AI algorithms to study heart rate patterns or blood glucose levels, thus enhancing patient engagement and clinical decision-making.

Gamification and behavioral coaching:

For long-term usage and to increase adherence, several applications now use gamification elements like reward systems, daily health challenges, and progress badges. Moreover, apps include AI chatbots and digital health coaches that offer motivational feedback, lifestyle tips depending on the user's behavior, and personalized routines.

The global disease management apps market is segmented as follows:

By Platform Type

- iOS

- Android

- Others

By Device

- Smartphones

- Tablets

- Wearables

- Others

By Indication

- Obesity

- Cardiovascular Issues

- Mental Health

- Diabetes

- Others

By End-User

- Patients

- Healthcare Providers

- Payers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Disease management applications are digital tools that help patients manage, monitor, and enhance their health conditions, especially different types of chronic illnesses. These apps offer features like symptom tracking, medication reminders, integration with wearable devices for real-time information, and personalized health tips.

The global disease management apps market is projected to grow due to the growing geriatric population globally, integration of predictive analysis and AI, and escalating internet penetration.

According to study, the global disease management apps market size was worth around USD 11.09 billion in 2024 and is predicted to grow to around USD 26.88 billion by 2034.

The CAGR value of the disease management apps market is expected to be around 11.70% during 2025-2034.

North America is expected to lead the global disease management apps market during the forecast period.

The key players profiled in the global disease management apps market include mySugr, Omada Health, Livongo Health, Welldoc, Noom, One Drop, HealthTap, Propeller Health, Happify Health, Mango Health, CareClinic, Kaia Health, BlueLoop (by MyHealthTeams), Lark Health, and Better Therapeutics.

The report examines key aspects of the disease management apps market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed