Membrane Separation Technology Market Size, Share, Trends, Growth 2034

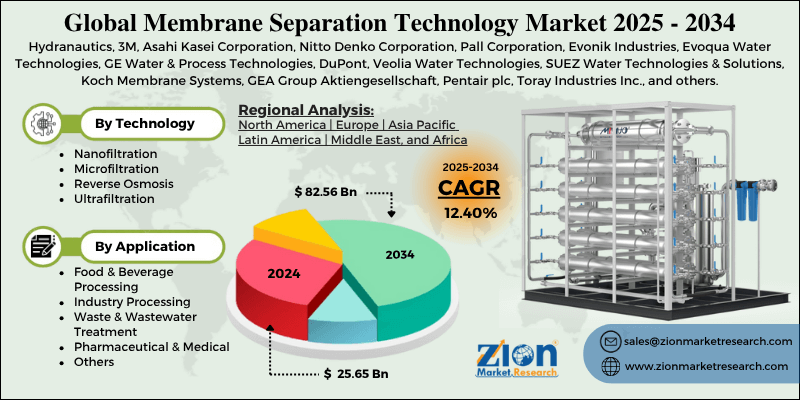

Membrane Separation Technology Market By Technology (Nanofiltration, Microfiltration, Reverse Osmosis, and Ultrafiltration), By Application (Food & Beverage Processing, Industry Processing, Waste & Wastewater Treatment, Pharmaceutical & Medical, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

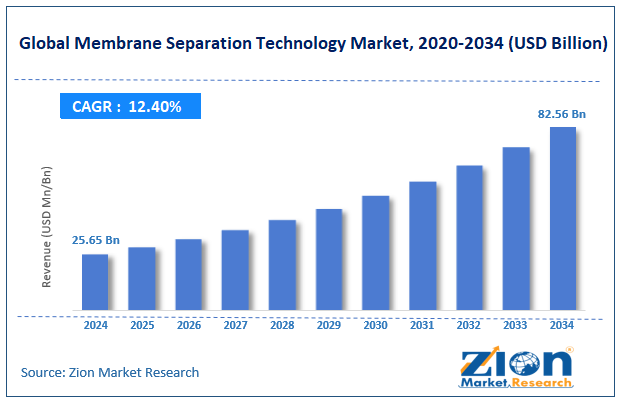

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.65 Billion | USD 82.56 Billion | 12.40% | 2024 |

Membrane Separation Technology Industry Perspective:

The global membrane separation technology market size was worth around USD 25.65 billion in 2024 and is predicted to grow to around USD 82.56 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.40% between 2025 and 2034.

Membrane Separation Technology Market: Overview

Membrane separation technology refers to a membrane-based solution designed for substance separation. The membrane selectively permits the transportation of substances through the filter, showing different properties. The technology allows end-users to achieve an exact concentration of desired solutions, solvents, and solutes.

Membrane separation technology is broadly categorized into 4 types that are microfiltration, ultrafiltration, nanofiltration, and reverse osmosis. Each division is based on the separation mechanism of the membrane and the pore size.

According to market research, the selection of membrane separation technology depends on the final desired output. For instance, microfiltration is preferred in the food & beverage industry for dairy and bottled water processing.

The industry for membrane separation technology is expected to generate a higher growth rate during the forecast period. The increasing demand for water filtration solutions across residential, commercial, and industrial units will emerge as one of the leading growth drivers for the market players.

During the projection period, industry leaders are expected to invest in higher research & development (R&D) to improve filtration results and expand the overall application of the technology.

Key Insights:

- As per the analysis shared by our research analyst, the global membrane separation technology market is estimated to grow annually at a CAGR of around 12.40% over the forecast period (2025-2034)

- In terms of revenue, the global membrane separation technology market size was valued at around USD 25.65 billion in 2024 and is projected to reach USD 82.56 billion by 2034.

- The membrane separation technology market is projected to grow at a significant rate due to the rising demand for water-filtering solutions.

- Based on the technology, the reverse osmosis segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the waste & wastewater treatment segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Membrane Separation Technology Market: Growth Drivers

Rising demand for water filtering solutions to propel market expansion rate in the future

The global membrane separation technology market is expected to be led by the rising demand for water filtering solutions. Membrane separation technology has proven highly effective in removing unwanted substances and contaminants from water with several end-user applications.

For instance, water filtration solutions are critical aspects of residential areas since these technologies ensure that water quality is maintained as per standards. Drinking water must be free of toxic elements to ensure the overall well-being of the citizens.

In September 2023, Cloud Water Filters announced the launch of Cloud RO, their flagship under-sink reverse osmosis water filter. Customers can monitor water quality using the Cloud application offered by the company.

The growing awareness of the importance of drinking water quality, increased government efforts to filter water at the municipal level, and increased spending capacity of customers to install advanced water filters.

In addition, the demand for industrial and commercial-scale water filters using membrane separation methods has also grown steadily in the last few years.

In March 2025, DuPont Water Solutions announced the launch of Water Application Value Engine (WAVE) Pro. The tool will assist water professionals in developing the water treatment design process for ultrafiltration.

Food & beverages (F&B) industry to continue generating high return on investment (ROI) for market players

The food & beverages sector is one of the leading users of membrane separation technology. The growing investments in the F&B industry, as food demand worldwide continues to soar, are expected to generate demand for more efficient membrane-based substance separation solutions. The dairy industry relies heavily on separation and filtration techniques, ensuring quality, consistency, and safety of the final goods.

Permionics, for instance, is a leading brand operating for over 5 decades, supplying spiral membrane systems for dairy products. The global membrane separation technology market is likely to be affected by the increasing number of beverage production facilities across the globe.

For instance, in January 2025, Diageo North America, a premium drinks company, announced the launch of a new manufacturing and warehousing facility spread across 360,000 square feet in the US.

Membrane Separation Technology Market: Restraints

High initial cost of investment and expensive maintenance to limit market expansion rate

The global membrane separation technology industry is expected to be restricted by the high initial cost of investment. For instance, municipal-scale membrane separation systems, such as wastewater treatment, can cost more than USD 200,000 depending on the overall features of the device.

Similarly, although residential-scale filters cost far less than their larger counterparts, they can still prove expensive for middle and low-income groups. The maintenance and operational expenses of membrane separation solutions also add to the overall associated cost of using the technology.

Membrane Separation Technology Market: Opportunities

Growing focus on air filtration solutions to generate growth opportunities for industry players

The global membrane separation technology market players are increasingly investing in developing air filtration and separation solutions. The growing concerns over air pollution and its impact on the ecological system have called for an urgent demand for effective filtration techniques to reduce the release of harmful gases and particulate matter in the environment.

In January 2025, Arkema, one of the world’s leading multinational companies offering specialty materials and chemicals, announced a novel partnership with OOYOO, a start-up addressing carbon dioxide capture. The companies have partnered to develop gas separation membranes for capturing carbon. Arkema will provide expertise in developing high-performance polymers while OOYOO will be responsible for developing the membrane design.

Furthermore, market players are excessively inclined toward developing sustainable, low-cost, and low-maintenance membrane solutions for further applications. Governments worldwide are intensifying guidelines to curb the emission of harmful gases and matters across industries such as automotive, logistics, and others. This, in turn, will create a higher demand for membrane separation solutions in the long term.

Membrane Separation Technology Market: Challenges

Competition from alternative technologies and membrane fouling to challenge market growth trajectory

The global membrane separation technology industry is expected to be challenged by the increasing competition from alternative technologies. For instance, chemical treatments have become widely common in managing and treating wastewater.

In addition, membrane fouling over more extended use of separating membranes continues to impact market revenue worldwide. Industry players must focus on reducing the impact of particle accumulation on the membranes for improved results during the forecast period.

Membrane Separation Technology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Membrane Separation Technology Market |

| Market Size in 2024 | USD 25.65 Billion |

| Market Forecast in 2034 | USD 82.56 Billion |

| Growth Rate | CAGR of 12.40% |

| Number of Pages | 211 |

| Key Companies Covered | Hydranautics, 3M, Asahi Kasei Corporation, Nitto Denko Corporation, Pall Corporation, Evonik Industries, Evoqua Water Technologies, GE Water & Process Technologies, DuPont, Veolia Water Technologies, SUEZ Water Technologies & Solutions, Koch Membrane Systems, GEA Group Aktiengesellschaft, Pentair plc, Toray Industries Inc., and others. |

| Segments Covered | By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Membrane Separation Technology Market: Segmentation

The global membrane separation technology market is segmented based on technology, application, and region.

Based on the technology, the global market segments are nanofiltration, microfiltration, reverse osmosis, and ultrafiltration. In 2024, the highest growth was listed in the reverse osmosis segment. It held control over 41.01% of the total revenue.

The wider use of reverse osmosis (RO) technology across commercial and residential units for water filtration is helping the segment thrive. Furthermore, RO is also extensively used in the food & beverages sector and the pharmaceutical industry.

Based on the application, the membrane separation technology industry divisions are food & beverage processing, industry processing, waste & wastewater treatment, pharmaceutical & medical, and others.

In 2024, the highest revenue was generated in the waste & wastewater treatment segment, accounting for more than 45% of the final results. The increasing demand for drinking water and growing emphasis on maintaining water quality worldwide are aiding the segmental demand rate. The pharmaceutical & medical segment will emerge as a significant revenue generator during the forecast period.

Membrane Separation Technology Market: Regional Analysis

North America to deliver the most optimal results during the forecast period

The global membrane separation technology market will be led by North America during the forecast period. The US is expected to emerge as the highest revenue generator. The presence of some of the most influential developers of membrane separation technology in the US helps the region dominate the regional market.

In March 2023, US-based DuPont announced the commercial launch of DuPont™ Multibore™ PRO. It is the next generation of multi-capillary PES In-Out Ultrafiltration (UF) membranes by the company. The technology offers new ways to reduce the number of modules required in water purification systems.

In October 2023, Osmoses, an emerging company founded by alumni of Stanford and Massachusetts Institute of Technology (MIT), announced that it had secured funding of USD 11 million to further advance its patented novel membrane technology used for purifying gas molecules.

The North American market enjoys the benefits of well-established and strict standards for water and air quality across residential, commercial, or industrial units. The increasing demand for efficient water filtration solutions for residential homes across North America will be crucial to the overall regional market revenue.

Membrane Separation Technology Market: Competitive Analysis

The global membrane separation technology market is led by players like:

- Hydranautics

- 3M

- Asahi Kasei Corporation

- Nitto Denko Corporation

- Pall Corporation

- Evonik Industries

- Evoqua Water Technologies

- GE Water & Process Technologies

- DuPont

- Veolia Water Technologies

- SUEZ Water Technologies & Solutions

- Koch Membrane Systems

- GEA Group Aktiengesellschaft

- Pentair plc

- Toray Industries Inc.

The global membrane separation technology market is segmented as follows:

By Technology

- Nanofiltration

- Microfiltration

- Reverse Osmosis

- Ultrafiltration

By Application

- Food & Beverage Processing

- Industry Processing

- Waste & Wastewater Treatment

- Pharmaceutical & Medical

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Membrane separation technology refers to a membrane-based solution designed for substance separatio

The global membrane separation technology market is expected to be led by the rising demand for water filtering solutions.

According to study, the global membrane separation technology market size was worth around USD 25.65 billion in 2024 and is predicted to grow to around USD 82.56 billion by 2034.

The CAGR value of the membrane separation technology market is expected to be around 12.40% during 2025-2034.

The global membrane separation technology market will be led by North America during the forecast period.

The global membrane separation technology market is led by players like Hydranautics, 3M, Asahi Kasei Corporation, Nitto Denko Corporation, Pall Corporation, Evonik Industries, Evoqua Water Technologies, GE Water & Process Technologies, DuPont, Veolia Water Technologies, SUEZ Water Technologies & Solutions, Koch Membrane Systems, GEA Group Aktiengesellschaft, Pentair plc, and Toray Industries, Inc.

The report explores crucial aspects of the membrane separation technology market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed