Fire Protection System Pipes Market Size, Share, Value & Forecast 2034

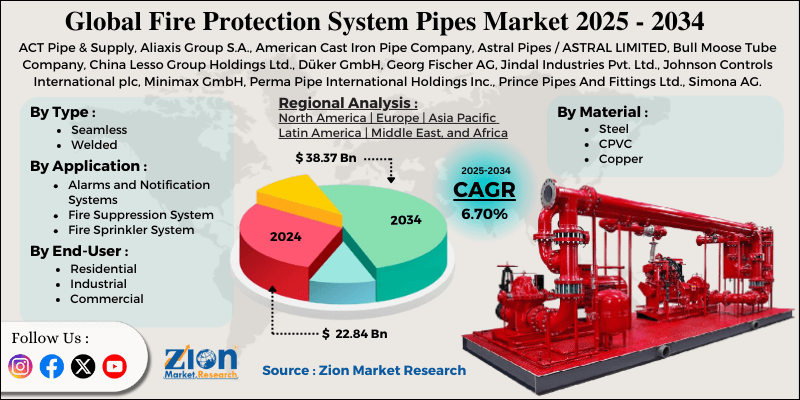

Fire Protection System Pipes Market By Type (Seamless, Welded), By Material (Steel, CPVC, Copper, and Others), By Application (Alarms and Notification Systems, Fire Suppression System, Fire Sprinkler System, and Others), By End-User (Residential, Industrial, Commercial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

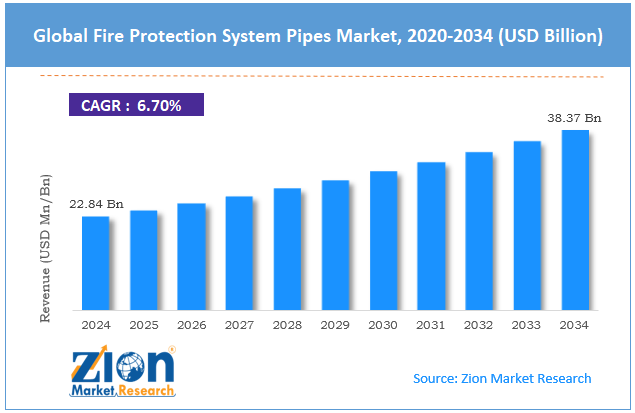

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.84 Billion | USD 38.37 Billion | 6.70% | 2024 |

Fire Protection System Pipes Industry Perspective:

What will be the size of the global fire protection system pipes market during the forecast period?

The global fire protection system pipes market size was around USD 22.84 billion in 2024 and is projected to reach USD 38.37 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fire protection system pipes market is estimated to grow annually at a CAGR of around 6.70% over the forecast period (2025-2034)

- In terms of revenue, the global fire protection system pipes market size was valued at around USD 22.84 billion in 2024 and is projected to reach USD 38.37 billion by 2034.

- The fire protection system pipes market is projected to grow significantly, driven by increasing construction activity globally, urbanization, rising infrastructure development, and technological advancements in fire protection materials.

- Based on type, the welded segment is expected to lead the market, while the seamless segment is expected to grow considerably.

- Based on material, the steel segment is the dominating segment, while the copper segment is projected to witness sizeable revenue over the forecast period.

- Based on the application, the fire sprinkler system segment leads, while the fire suppression system segment is expected to grow rapidly.

- Based on end-user, the commercial segment is expected to lead the market, followed by the industrial segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by the Asia Pacific.

Fire Protection System Pipes Market: Overview

Fire protection system pipes are an essential component of fire safety infrastructure, dedicated to distributing water and other extinguishing agents throughout a building to control or suppress fires. These pipes are usually made of steel, specialized plastics, or copper and are configured in networks such as standpipes, hydrant systems, and sprinkler systems. The global fire protection system pipes market is likely to expand rapidly, fueled by regulatory compliance and strict safety codes, construction growth and urbanization, and infrastructure modernization. Stringent building codes and fire safety norms need reliable fire protection systems. Pipes meeting these standards are crucial for compliance. This fuels consistent demand in commercial, residential, and industrial sectors.

Moreover, speedy urban development drives the construction of high-rise buildings, housing complexes, and malls. Each new structure needs fire protection piping systems. This growth ultimately increases market demand. Furthermore, older buildings and industrial facilities are being upgraded for efficiency and safety. Modern piping systems outshine outmoded networks, creating recurring industry opportunities.

Despite the growth, the global market is impeded by factors such as maintenance complexity and supply chain challenges. Fire protection pipes need regular inspections and repairs. Recurring costs and the need for skilled technicians make complexity demotivating for some building owners. Likewise, material shortages or transport delays can affect timely delivery. Proper schedules can be disturbed. Therefore, manufacturers experience operational and production barriers.

Nonetheless, the global fire protection system pipes industry stands to benefit from several key opportunities, including sustainable, green fire protection solutions and retrofitting and renovation projects. Eco-friendly pipe materials and water-efficient systems are gaining importance. Sustainability-focused projects seek such solutions. This eventually offers a growing niche industry. Additionally, aging buildings need upgraded fire safety networks. Modern pipes replace outdated infrastructure. Renovation projects augment recurring demand.

Fire Protection System Pipes Market: Dynamics

Growth Drivers

How are insurance and risk-financing pressures boosting the growth of the fire protection system pipes market?

Insurance companies primarily associate premiums and coverage with the presence of strong fire protection systems. buildings with certified fire protection piping qualify for low rates and better terms. Risk-based evaluations motivate the installation of high-class suppression systems. Financial incentives make fire protection investment more appealing for industrial and commercial properties. Owners view advanced piping as a way to reduce possible losses. Insurance considerations are hence a leading driver of the fire protection system pipes market.

How are technological improvements in pipe materials fueling growth in the fire protection system pipes market?

Advancements in materials like corrosion-resistant steel, CPVC, and composites improve installation, durability, and fire resistance. Advanced pipes smoothly integrate with smart building systems for predictive maintenance and IoT-based monitoring. These solutions lower lifecycle costs while promising reliable performance. Manufacturers are developing sustainable, hybrid materials for safety and efficiency. Improved functionality and cost-effectiveness raise adoption. Technological progress strengthens the industry demand.

Restraints

Complex installation and maintenance requirements hinder the market progress

Fire protection piping systems need skilled labor for proper installation and regular maintenance. Improper installation may compromise safety compliance and system performance. Maintenance schedules, testing, and inspections add to operational complexity—a shortage of trained personnel in developing markets limits adoption. Complexity also increases lifecycle costs for building owners. These are the key industry limitations that slow the overall market development.

Opportunities

How is the growth in retrofit and renovation projects creating promising avenues for the fire protection system pipes industry?

Several existing buildings need modernization to comply with updated fire safety codes. Retrofitting older constructions with modern fire protection piping is a crucial opportunity in the worldwide fire protection system pipes industry. Hotels, hospitals, and commercial complexes are a few major retrofit segments. Renovation projects allow industry players to introduce improved technologies and materials. Retrofit demand usually complements fresh construction growth. This offers a continuous revenue stream for service providers and manufacturers.

Challenges

The installation skill gap limits the market growth

Qualified professionals for the proper installation and maintenance of fire protection piping systems are in short supply in several regions. Poor skills may compromise safety compliance and system performance. Training programs are needed, but may not be broadly available—a shortage of skilled personnel slows adoption in the developing markets. Skill gaps also raise liability and operational risks. Workforce restrictions offer a crucial challenge for market development.

Fire Protection System Pipes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fire Protection System Pipes Market |

| Market Size in 2024 | USD 22.84 Billion |

| Market Forecast in 2034 | USD 38.37 Billion |

| Growth Rate | CAGR of 6.70% |

| Number of Pages | 216 |

| Key Companies Covered | ACT Pipe & Supply, Aliaxis Group S.A., American Cast Iron Pipe Company, Astral Pipes / ASTRAL LIMITED, Bull Moose Tube Company, China Lesso Group Holdings Ltd., Düker GmbH, Georg Fischer AG, Jindal Industries Pvt. Ltd., Johnson Controls International plc, Minimax GmbH, Perma Pipe International Holdings Inc., Prince Pipes And Fittings Ltd., Simona AG, Victaulic Company, and others. |

| Segments Covered | By Type, By Material, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fire Protection System Pipes Market: Segmentation

The global fire protection system pipes market is segmented based on type, material, application, end-use, and region.

Why will the welded pipes segment dominate the fire protection system pipes market?

Based on type, the global fire protection system pipes industry is divided into seamless and welded. The welded pipes segment accounts for approximately 73.6% of the total market due to their cost efficiency and widespread use in industrial projects and infrastructure.

On the other hand, the seamless pipes segment progresses with 26.4% of the total market. This is primarily used in specific high-performance applications where reliability and strength are prioritized.

How much market share does the steel pipes segment hold in the fire protection system pipes market?

Based on material, the global market is segmented into steel, CPVC, copper, and others. The steel pipes segment dominates with 46% of the overall market share due to their strong preference for durability, high strength, pressure resistance, and compliance with strict fire safety standards. This makes them ideal for large-scale industrial, commercial, and high-rise applications.

Conversely, the copper pipes segment holds 25% of the market share due to their good corrosion resistance, reliable performance in fire suppression systems, and suitability for specific installations. They are prominent for their thermal and longevity properties.

Will the fire sprinkler system continue to dominate the fire protection system pipes market?

Based on application, the global fire protection system pipes market is segmented into alarms and notification systems, fire suppression systems, fire sprinkler systems, and others. The fire sprinkler system segment leads with 50% market share. This leadership signifies extensive use of sprinkler networks in industrial, commercial, and residential buildings for automatic fire suppression through water distribution pipes.

However, the fire suppression system segment ranks second with a 30% market share. Pipes in this category are used in wider suppression solutions, comprising foam, gas, water, and other agents in high-risk facilities where automatic extinguishing is crucial.

Why will the commercial segment emerge as dominant in the fire protection system pipes market?

Based on end-user, the global market is segmented into residential, industrial, and commercial. Commercial buildings, such as hospitals, hotels, retail centers, and offices, require extensive fire protection piping. High occupancy and stringent safety regulations fuel strong demand. Hence, the segment holds a leading market share.

Nonetheless, the industrial segment, including chemical complexes, oil and gas plants, and factories, requires robust piping systems for high-risk environments. Fire suppression needs make the segment second-leading.

Fire Protection System Pipes Market: Regional Analysis

Why does North America hold a dominant position in the global Fire Protection System Market?

North America is anticipated to retain its leading role with a 6.3% CAGR in the global fire protection system pipes market, driven by a strong regulatory framework, a high revenue share, developed markets, and advanced infrastructure and retrofit activity. North America dominates due to strict fire safety regulations and building codes, particularly in the US under NFPA and local mandates. These regulations promise the continuous adoption of modern piping solutions, increasing industry penetration.

Moreover, the region accounts for a substantial share of global revenue, ranging from nearly 25.4% to more than 30% of the overall market, making it the leading regional contributor. Sophisticated industries in Canada and the U.S. mean a high base of installations for industrial, residential, and commercial fire safety systems.

Furthermore, North America’s broader infrastructure and current urban development drive both retrofitting and new installations of outmoded fire systems, especially in industrial facilities, logistical hubs, and high-rise buildings. Increased awareness of safety standards, along with upgrades in old buildings sustain demand for fire protection pipes.

What position will Asia Pacific hold in the fire protection system pipes industry?

Asia Pacific ranks as the second-largest region in the global fire protection system pipes industry, with a 6.4% CAGR, driven by rapid urbanization, heightened regulatory focus and safety awareness, and a large regional market. Commercial complexes, high-rise residential buildings, and industrial parks in APAC need extensive fire safety systems. The region’s construction scale outshines others, fueling substantial demand for pipe.

Moreover, governments are strengthening fire safety codes and mandating fire protection systems in existing and new buildings. Updated regulations and compliance initiatives in India, China, and neighboring nations are driving the adoption of certified pipes. Elevated corporate and public awareness of fire hazards augments industry growth. Additionally, APAC holds a leading share of the global market, making it the second-largest regional contributor. While North America remains the dominant region, APAC is the fastest-growing, narrowing the gap in revenue share as its industrial and construction sectors expand.

Fire Protection System Pipes Market: Competitive Analysis

The leading players in the global fire protection system pipes market are:

- ACT Pipe & Supply

- Aliaxis Group S.A.

- American Cast Iron Pipe Company

- Astral Pipes / ASTRAL LIMITED

- Bull Moose Tube Company

- China Lesso Group Holdings Ltd.

- Düker GmbH

- Georg Fischer AG

- Jindal Industries Pvt. Ltd.

- Johnson Controls International plc

- Minimax GmbH

- Perma Pipe International Holdings Inc.

- Prince Pipes And Fittings Ltd.

- Simona AG

- Victaulic Company

What are the key trends in the global Fire Protection System Pipes Market?

IoT‑enabled and smart fire safety integration:

Fire protection systems are being incorporated with IoT devices and smart sensors for real-time monitoring and automated diagnosis. These solutions allow predictive maintenance and faster response during emergencies. Hence, fire protection pipes are an integral part of connected building safety systems.

Shift to advanced materials:

Manufacturers are increasingly adopting lightweight, corrosion-resistant materials such as composite alloys and CPVC. These materials lower maintenance costs and enhance long-term reliability more than traditional steel. This trend is supported by demand for cost-effective, durable fire protection piping systems.

The global fire protection system pipes market is segmented as follows:

By Type

- Seamless

- Welded

By Material

- Steel

- CPVC

- Copper

- Others

By Application

- Alarms and Notification Systems

- Fire Suppression System

- Fire Sprinkler System

- Others

By End-User

- Residential

- Industrial

- Commercial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed