Fintech Market Size, Share, Trends, Growth and Forecast 2034

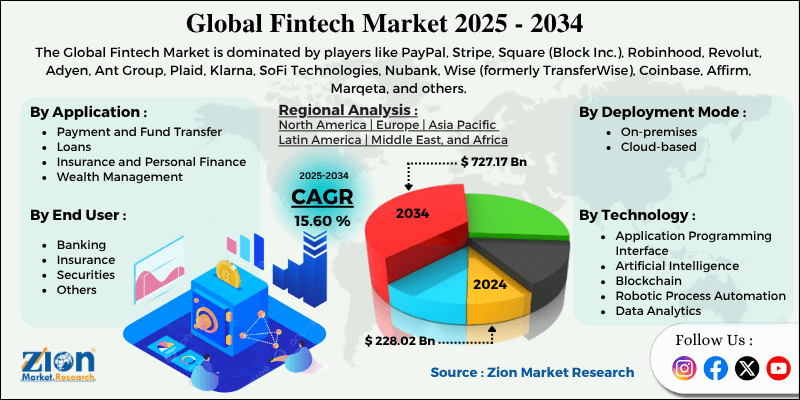

Fintech Market By Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), By Deployment Mode (On-premises, Cloud-based), By Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), By End-User (Banking, Insurance, Securities, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

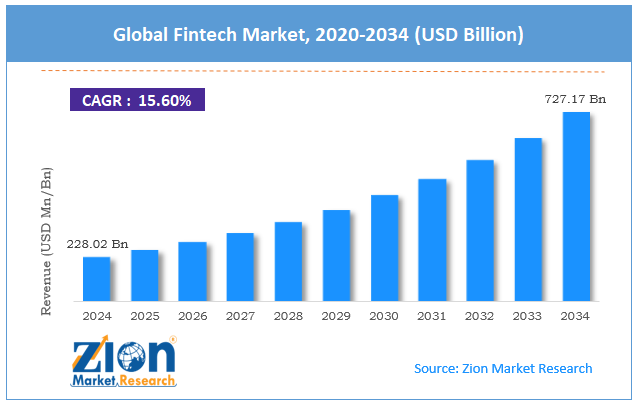

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 228.02 Billion | USD 727.17 Billion | 15.60% | 2024 |

Fintech Industry Perspective:

The global fintech market size was approximately USD 228.02 billion in 2024 and is projected to reach around USD 727.17 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.60% between 2025 and 2034.

Fintech Market: Overview

Fintech, or financial technology, refers to the integration of technology into financial services to enhance their delivery and effectiveness. It encompasses a broader range of advancements, including digital payments, mobile banking, robo-advisors, blockchain, AI-based financial planning, and peer-to-peer lending. The global fintech market is projected to witness substantial growth driven by the move towards digital payments, financial inclusion programs, and improvements in ML and AI. In 2024, the worldwide digital payments transaction value exceeded USD 10 trillion, fueled by contactless payments and mobile wallets. COVID-19 has accelerated this trend, and now micro-merchants in emerging nations are accepting digital payments via fintech applications.

Additionally, fintech allows underbanked and unbanked populations to access credit, savings, and insurance tools. For example, in India, more than 500 million bank accounts were opened under the 'Jan Dhan Yojana' program, with fintech companies integrating services through UPI and Aadhaar. Furthermore, AI is enabling credit scoring, personalized financial services, fraud detection, and robo-advisory services. AI in fintech is anticipated to register $42 billion by 2030. Machine Learning models optimize financial decisions and decrease underwriting time.

Although drivers exist, the global market is hindered by factors such as regulatory uncertainty and low digital literacy in developing regions. Fintech protocols differ significantly in nations. Problems such as data localization, crypto legality, and digital lending regulations pose legal and operational uncertainties. Startups often struggle to scale universally due to the high costs of compliance. Moreover, despite high internet penetration, financial and digital literacy remain low in Latin America, South Asia, and parts of Africa. This hinders the use of fintech services and usually demands expensive consumer education programs.

Even so, the global fintech industry is well-positioned due to the growth of embedded finance, sustainable fintech, and the expansion of BNPL. Non-financial companies are incorporating financial services into their platforms, including insurance, e-commerce, and lending. The embedded finance industry is expected to reach $800 billion by 2032. There is a surging demand for ESG-focused investments, green lending, and carbon tracking applications. Fintechs may lead in providing viable financial solutions, including digital platforms for climate-related disclosures. BNPL is gaining prominence among millennials and Gen Z for short-term credit. Worldwide BNPL transactions are expected to surpass $800 billion by 2030, offering a key revenue stream.

Key Insights:

- As per the analysis shared by our research analyst, the global fintech market is estimated to grow annually at a CAGR of around 15.60% over the forecast period (2025-2034)

- In terms of revenue, the global fintech market size was valued at around USD 228.02 billion in 2024 and is projected to reach USD 727.17 billion by 2034.

- The fintech market is projected to grow significantly due to the growing demand for contactless payments post-pandemic, the surging adoption of digital payments, and a higher preference for personalized financial services.

- Based on technology, the application programming interface segment is expected to lead the market, while the artificial intelligence segment is expected to grow considerably.

- Based on deployment mode, the cloud-based segment dominates the market, while the on-premises segment is expected to grow considerably over the estimated period.

- Based on application, the payment and fund transfer is the dominating segment, while the loans segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the banking segment is expected to lead the market compared to the insurance segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Fintech Market: Growth Drivers

How will the rising demand for digital wallets and contactless payments drive growth in the fintech market?

Consumer preference for contactless payments, which has remained robust since the pandemic, has largely persisted. According to reports, the worldwide digital payments industry reached USD 10.6 trillion as of 2024 and is projected to grow at a 15.2% CAGR. Services like Google Pay, Apple Pay, Alipay, and Paytm are experiencing remarkable transaction volumes.

Visa reported that more than 60% of its worldwide transactions are digital, and Mastercard associated with Samsung Wallet to increase tap-and-pay facilities in Southeast Asia, in April 2025.

Increased strategic investments and venture capital notably fuel the market growth

Institutional investment and venture capital played a vital role in boosting the growth of the fintech market. Worldwide fintech investments reached approximately USD 140 billion in 2024, with a strong focus on wealthtech, insurtech, embedded finance, and regtech, according to CB Insights. Notwithstanding macroeconomic headwinds, investor confidence in fintech remains strong due to its greater ROI potential and recurring revenue models.

High-profile funding rounds in 2025 include Klarna, which is increasing its funding by USD 1.1 billion to support global growth, and Plaid, which is securing USD 750 million to enhance its open banking API infrastructure.

Fintech Market: Restraints

Digital trust and limited financial literacy negatively impact market progress

Despite fintech's promise of inclusivity, its reach is often hindered by the lack of digital financial literacy, particularly among older demographics in developing regions. According to the World Bank report, more than 45% of adults in emerging nations still lack sufficient knowledge of digital tools, including online lending, mobile wallets, and digital insurance. This gap hinders adoption and makes consumers more susceptible to fraud.

Recent campaigns by governments, such as Digital Financial Literacy Week 2024 in India, have aimed to reduce the literacy gap; however, the complexity and scale of fintech offerings often outpace the education provided.

Fintech Market: Opportunities

The booming growth of embedded finance spurs the market progress

Embedded finance, where financial services are integrated directly into non-financial platforms, is gaining attention rapidly. This model enables companies to offer BNPL, insurance, loans, and payments in their infrastructure, bypassing conventional financial institutions.

In February 2025, Stripe and Affirm partnered with Shopify to expand their BNPL and embedded lending solutions to SMEs in Europe and North America. The shift towards 'finance as a feature' presents new monetization opportunities for non-financial and fintech platforms, influencing the advancement of the fintech industry.

Fintech Market: Challenges

Will investor caution and funding slowdowns restrict the growth of the fintech market?

Global macroeconomic pressures, including interest rate hikes and inflation, have significantly reduced venture capital funding in the fintech sector. Following the record-breaking investments of 2021-22, funding slowed substantially in 2023-24. Investors are now more selective, emphasizing unit economics and profitability over growth at all costs.

Leading players, such as Klarna, Chime, and Stripe, declared workforce deductions and delayed IPO plans in 2024 due to industry conditions, signaling a highly cautious investor landscape going into 2025.

Fintech Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fintech Market |

| Market Size in 2024 | USD 228.02 Billion |

| Market Forecast in 2034 | USD 727.17 Billion |

| Growth Rate | CAGR of 15.60% |

| Number of Pages | 213 |

| Key Companies Covered | PayPal, Stripe, Square (Block Inc.), Robinhood, Revolut, Adyen, Ant Group, Plaid, Klarna, SoFi Technologies, Nubank, Wise (formerly TransferWise), Coinbase, Affirm, Marqeta, and others. |

| Segments Covered | By Technology, By Deployment Mode, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fintech Market: Segmentation

The global fintech market is segmented based on technology, deployment mode, application, end-user, and region.

Based on technology, the global fintech industry is divided into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others. The application programming interface segment holds a notable share of the market due to the broader adoption of open banking regulations. This makes it a broadly used and dependable technology in fintech, presently.

What position will artificial intelligence segment hold in the fintech market?

The artificial intelligence segment held a leading share, as AI tools are becoming increasingly modernized. They notably enhance user experience, reduce operational costs, and automate decision-making.

Based on deployment mode, the global market is segmented as on-premises and cloud-based. The cloud-based segment holds a substantial market share. It offers low upfront costs, scalability, faster deployment, and easy integration with 3rd party services. The segment growth is further attributed to compliance support, cloud security, and AI integration competency.

On the other hand, the on-premises segment held a considerable market share, as it is widely used by large enterprises and traditional financial institutions that prioritize regulatory compliance, custom configurations, and data control.

Based on application, the global fintech market is segmented as payment and fund transfer, loans, insurance, personal finance, wealth management, and others. The payment and fund transfer segment dominates the market due to its broader consumer use, increasing integration in e-commerce and retail, and low transaction friction.

Nonetheless, loans segment holds a second rank in the global market, fueled by instant personal/business loans, digital lending platforms, and peer-to-peer lending. Faster loan approval, minimal paperwork, and AI-based credit scoring are the leading benefits.

Based on end-user, the global market is segmented into banking, insurance, securities, and others. The banking segment has registered a substantial market share, as neobanks and traditional banks are leveraging fintech solutions for digital account opening, core banking operations, fraud detection, credit underwriting, customer engagement, and payments.

However, the insurance segment ranks second, with the growth of Insurtech changing the way insurance products are priced, distributed, managed, and underwritten.

Fintech Market: Regional Analysis

What will help North America witness significant growth in the fintech market over the forecast period?

North America is likely to sustain its leadership in the fintech market due to robust fintech investment infrastructure, high smartphone penetration and digital adoption, and presence of leading fintech giants. North America attracts the largest share of fintech investments worldwide, with the United States alone accounting for more than $45 billion in fintech funding in 2023. Venture capital activity is majorly prevalent in hubs like New York, San Francisco, and Toronto. This funding environment propels speedy advancement, growth, and acquisition in the fintech industry.

Canada and the United States have remarkably high internet and smartphone penetration rates, with more than 91% of residents owning a smartphone. Consumers are increasingly tech-savvy, with a strong preference for e-wallets, mobile banking, and digital investment platforms. This behavior fuels the adoption of fintech solutions in diverse age groups.

Moreover, North America is home to numerous global fintech pioneers, including Robinhood, Stripe, PayPal, Square, and Coinbase. These companies not only lead domestic markets but also set international standards in investing, digital payments, and blockchain-driven finance. Their scale, technological capabilities, and brand value further blend the region's prominence.

The Asia Pacific region continues to hold the second-highest share in the fintech industry, driven by a strong user base, high smartphone penetration, rapid growth in digital payments, and increased platform integration. APAC holds the leading population of smartphone users, with more than 2.5 billion users in 2024. Nations like Indonesia, China, and India are forerunners in mobile-first fintech adoption. This greater value of consumers offers fintech companies with unmatched growth potential and scale.

Furthermore, the APAC region leads in transaction volumes, primarily due to the widespread adoption of WeChat Pay and Alipay in China, which collectively process over $30 trillion in transactions annually. India's UPI managed more than 12 billion transactions per month in 2025. This payment infrastructure makes APAC a fintech capital.

Additionally, fintech in the Asia Pacific is often integrated within super apps like Paytm, Grab, and Gojek, which blend shopping, ride-hailing, insurance, and payments. This multi-functionality strengthens user retention and engagement. Super apps are a key regional benefit that is not widely replicated in Western regions.

Fintech Market: Competitive Analysis

The major operating players in the global fintech market include:

- PayPal

- Stripe

- Square (Block Inc.)

- Robinhood

- Revolut

- Adyen

- Ant Group

- Plaid

- Klarna

- SoFi Technologies

- Nubank

- Wise (formerly TransferWise)

- Coinbase

- Affirm

- Marqeta

Fintech Market: Key Market Trends

Embedded finance is transforming consumer journeys:

Embedded finance, which offers lending, banking, or insurance services directly within non-financial platforms, is rapidly gaining prominence. E-commerce websites, social media platforms, and ride-sharing apps are offering Buy Now Pay Later (BNPL), micro-insurance, and digital wallets.

ESG-focused finance and green fintech:

Sustainable finance is emerging as a key theme, with fintechs offering green investments, carbon footprint tracking, and ESG-compliant lending. Platforms like Doconomy and Aspiration are gaining traction worldwide.

The global fintech market is segmented as follows:

By Technology

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

By Deployment Mode

- On-premises

- Cloud-based

By Application

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

By End User

- Banking

- Insurance

- Securities

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fintech, or financial technology, refers to the integration of technology into financial services to enhance their delivery and effectiveness. It encompasses a broader range of advancements, including digital payments, mobile banking, robo-advisors, blockchain, AI-based financial planning, and peer-to-peer lending.

The global fintech market is projected to grow due to the expansion of online retail and e-commerce, the growth of the underbanked and unbanked population, and the integration of fintech in traditional banking.

According to study, the global fintech market size was worth around USD 228.02 billion in 2024 and is predicted to grow to around USD 727.17 billion by 2034.

The CAGR value of the fintech market is expected to be approximately 15.60% from 2025 to 2034.

North America is expected to lead the global fintech market during the forecast period.

The key players profiled in the global fintech market include PayPal, Stripe, Square (Block, Inc.), Robinhood, Revolut, Adyen, Ant Group, Plaid, Klarna, SoFi Technologies, Nubank, Wise (formerly TransferWise), Coinbase, Affirm, and Marqeta.

The report examines key aspects of the fintech market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed