Global AI in Fintech Market Size, Share, Growth Analysis Report - Forecast 2034

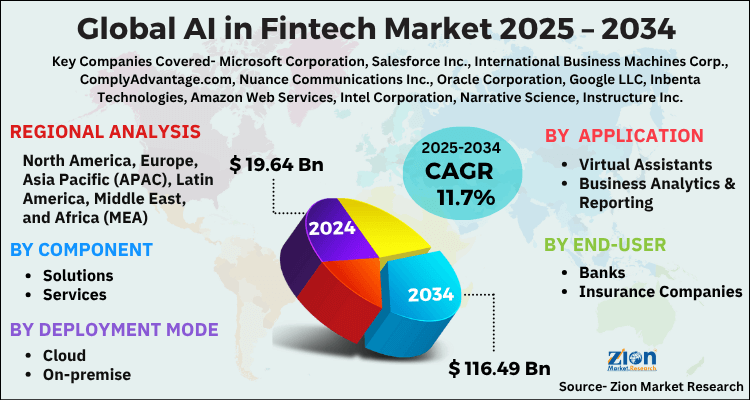

AI in Fintech Market By Component (Solutions, Services), By Deployment Mode (Cloud, On-premise), By Application (Virtual Assistants, Business Analytics & Reporting, Customer Behavioral Analytics, Risk Management, Fraud Detection, Compliance), By End-user (Banks, Insurance Companies, Investment Firms, Credit Unions, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 19.64 Billion | USD 116.49 Billion | 17.7% | 2024 |

AI in Fintech Market: Industry Perspective

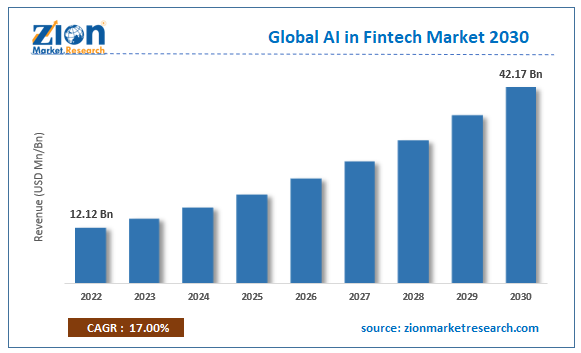

The global AI in fintech market size was worth around USD 19.64 Billion in 2024 and is predicted to grow to around USD 116.49 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 17.7% between 2025 and 2034.

The report analyzes the global AI in fintech market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the AI in fintech industry.

AI in Fintech Market: Overview

The fintech sector has always highlighted making use of technologies such as AI to make financial services more accessible, proficient, and user-friendly. Moreover, one of the major benefits offered by AI is that it can help fintech firms in making informed decisions. Additionally, AI-driven algorithms can process big data along with recognizing trends & patterns that humans cannot identify or recognize manually. This makes financial institutes & fintech firms make apt forecasts, thereby enhancing risk management strategies.

Key Insights

- As per the analysis shared by our research analyst, the global AI in fintech market is estimated to grow annually at a CAGR of around 17.7% over the forecast period (2025-2034).

- Regarding revenue, the global AI in fintech market size was valued at around USD 19.64 Billion in 2024 and is projected to reach USD 116.49 Billion by 2034.

- The AI in fintech market is projected to grow at a significant rate due to Increasing need for fraud detection, personalized services, and automation in financial services boosts adoption. Data analytics and machine learning advancements also contribute.

- Based on Component, the Solutions segment is expected to lead the global market.

- On the basis of Deployment Mode, the Cloud segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Virtual Assistants segment is projected to swipe the largest market share.

- By End-user, the Banks segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

AI in Fintech Market: Growth Factors

A surge in the penetration of AI in fintech firms for automating monotonous & tedious work to define the growth of the market globally

The use of AI in FinTech enables in automation of repetitive tasks, thereby prompting the growth of global AI in fintech market. Many financial institutions perform financial operations manually and it has proved to be time-consuming and error-prone, thereby prompting financial institutions to adopt AI-driven systems for automating manual tasks and thus help the staff focus on more complicated and value-based financial activities. With AI offering a seamless experience to consumers, there will likely be a prominent rise in the use of AI in fintech business in the coming years. Reportedly, AI-driven chatbots and virtual assistants offer consumers 24/7 support along with personalized recommendations, thereby enhancing customer satisfaction.

Furthermore, AI helps fintech firms as well as financial institutions understand the requirements & preferences of consumers, thereby assisting them in offering customized & personalized financial products & services. Many fintech firms making use of AI technologies have successfully raised funds for expanding their business across the globe. For instance, in November 2023, Black Ore, a U.S.-based AI fintech firm, acquired nearly $60 million in the form of funding from firms such as Oak HC/FT and 16z. Launching of new AI products will further contribute to the demand and use of AI in fintech business. Citing an instance, in August 2023, Tiger Brokers, a fintech firm, introduced an AI chatbox referred to as TigerGPT, an AI-driven investment assistant that helps investors in making correct decisions pertaining to financial investments. Such initiatives will determine the growth of the market across the globe in the years to come.

AI in Fintech Market: Restraints

Less demand for AI in fintech companies of emerging economies of APAC & LATAM can undermine the industry growth over the forecast period

Strict government laws regulating the use of AI in various financial institutions to curb the menace of hacking, data leaks, and other financial frauds can put brakes on the growth of AI in fintech industry. However, lesser use of AI in fintech firms across the developing countries of Asia and Latin America can deter the growth of the industry in the near future.

AI in Fintech Market: Opportunities

The necessity of providing a seamless experience of financial transactions to end-users can open new growth opportunities for the global market

Escalating the need for enhancing the consumer experience, reducing costs, and providing better analytics has helped firms unravel the application as well as the untapped growth potential of AI in fintech market across the globe. The large-scale use of AI in fintech firms helps Neobanks & robo-advisors in opening to a wide range of target customers along with providing customers with convenience as AI chatbots can answer all the queries of customers. Additionally, AI enables fintech organizations in effective bill tracking, market analytics, and personal finance management activities.

AI in Fintech Market: Challenges

Risks of data theft & data breaches can subvert the expansion of the global industry over the forecast timeframe

The machine learning algorithms in AI are sometimes biased as they are trained on a particular kind of data, thereby unfairly treating or discriminating customers such as offering loans on credit to customers based on demographics, income, age, transaction limit, and loan payment history. This aspect can prove a huge challenge for large-scale penetration of AI in fintech industry across the globe. Growing concerns related to data security, data leaks, confidentiality, and privacy along with an increase in cyber-terrorism and cyber-attacks can decimate the growth of the industry globally.

AI in Fintech Market: Segmentation

The global AI in fintech market is sectored into component, deployment, application, and region.

In component terms, the AI in fintech market across the globe is segregated into solutions and services segments. Furthermore, the solutions segment, which led the component space in 2022, is predicted to continue leading the segment even during the forecast timeline. The expansion of the segment during 2023-2030 can be due to a rise in the installation of AI-based solutions in the BFSI sector owing to the need for extracting huge data accurately. Furthermore, flourishing retail banking activities and the humungous necessity of detecting financial frauds along with the need for improving consumer experience will steer the segmental surge.

Based on the application, the global AI in fintech industry is sectored into fraud detection, business analytics & reporting, customer analytics, and virtual assistants segments. Additionally, the business analytics & reporting segment, which acquired a key share of the global industry in 2022, is anticipated to record the fastest CAGR over the next eight years. The segmental expansion over the forecast timeline can be owing to the increased use of AI in business analytics & reporting activities across the fintech firms. Moreover, it helps fintech firms make informed business decisions along with improving their operational efficiency.

Based on the deployment, the global AI in fintech market is sectored into the cloud and on-premise segments. Additionally, the on-premise segment, which acquired a key share of the global market in 2022, is predicted to lead the segmental surge over the next eight years. The segmental expansion over the forecast timeframe can be owing to an increase in the on-premise deployment of AI tools in various small as well as large & medium-sized enterprises.

In terms of End-user, the global AI in fintech market is categorized into Banks, Insurance Companies, Investment Firms, Credit Unions, Others.

AI in Fintech Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | AI in Fintech Market |

| Market Size in 2024 | USD 19.64 Billion |

| Market Forecast in 2034 | USD 116.49 Billion |

| Growth Rate | CAGR of 17.7% |

| Number of Pages | 225 |

| Key Companies Covered | Microsoft Corporation, Salesforce Inc., International Business Machines Corp., ComplyAdvantage.com, Nuance Communications Inc., Oracle Corporation, Google LLC, Inbenta Technologies, Amazon Web Services, Intel Corporation, Narrative Science, Instructure Inc., Amelia U.S. LLC, Upstart Network Inc., Affirm Inc., and others., and others. |

| Segments Covered | By Component, By Deployment Mode, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

AI in Fintech Market: Regional Analysis

North America is predicted to retain its leading position in the global AI in Fintech market over the forecast timeline

North America, which contributed about three-fourths of the global AI in fintech market proceeds in 2022, will be a leading region over the forecast timespan. Moreover, the regional market expansion over the coming eight years is subject to the large-scale presence of AI tool suppliers along with a rise in the investment by various financial institutes for deploying AI software in their institutes. Apart from this, an increase in the favorable schemes introduced by governments towards AI use in the BFSI sector will further steer the expansion of the market in North America. Citing an instance, in 2022, the government of the U.S. spent nearly $4 billion on AI contracts. In addition to this, major industry players in countries such as the U.S. are forming strategic alliances to offer efficient AI services to fintech firms in the region. For the record, in the second half of 2022, Zest AI, a key AI firm in the U.S. helping firms make proper credit decisions, joined hands with Equifax, Inc., a U.S.-based customer credit firm, to help the latter effectively analyze big data by using its underwriting systems.

Asia-Pacific AI in fintech industry is set to record the fastest CAGR in the coming eight years. The regional industry expansion over 2023-2030 can be attributed to favorable government measures enlarging the use of AI in a spectrum of fintech firms in countries such as Japan, China, Taiwan Singapore, and South Korea. Additionally, key players have made huge investments in the sub-continent for promoting the use of AI in fintech firms for enhancing the operational efficiency of these fintech firms. For instance, in the first quarter of 2022, Finbots.AI, an AI firm headquartered in Singapore, declared series A funding of nearly $3 million for bringing improvements in AI products.

AI in Fintech Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the AI in fintech market on a global and regional basis.

The global AI in fintech market is dominated by players like:

- Microsoft Corporation

- Salesforce Inc.

- International Business Machines Corp.

- ComplyAdvantage.com

- Nuance Communications Inc.

- Oracle Corporation

- Google LLC

- Inbenta Technologies

- Amazon Web Services

- Intel Corporation

- Narrative Science

- Instructure Inc.

- Amelia U.S. LLC

- Upstart Network Inc.

- Affirm Inc.

- and others.

The global AI in fintech market is segmented as follows;

By Component

- Solutions

- Services

By Deployment Mode

- Cloud

- On-premise

By Application

- Virtual Assistants

- Business Analytics & Reporting

- Customer Behavioral Analytics

- Risk Management

- Fraud Detection

- Compliance

By End-user

- Banks

- Insurance Companies

- Investment Firms

- Credit Unions

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global AI in fintech market is expected to grow due to Increasing need for fraud detection, personalized services, and automation in financial services boosts adoption. Data analytics and machine learning advancements also contribute.

According to a study, the global AI in fintech market size was worth around USD 19.64 Billion in 2024 and is expected to reach USD 116.49 Billion by 2034.

The global AI in fintech market is expected to grow at a CAGR of 17.7% during the forecast period.

North America is expected to dominate the AI in fintech market over the forecast period.

Leading players in the global AI in fintech market include Microsoft Corporation, Salesforce Inc., International Business Machines Corp., ComplyAdvantage.com, Nuance Communications Inc., Oracle Corporation, Google LLC, Inbenta Technologies, Amazon Web Services, Intel Corporation, Narrative Science, Instructure Inc., Amelia U.S. LLC, Upstart Network Inc., Affirm Inc., and others., among others.

The report explores crucial aspects of the AI in fintech market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed