Distributed Antenna System (DAS) Market Size, Share, Trends, Growth 2034

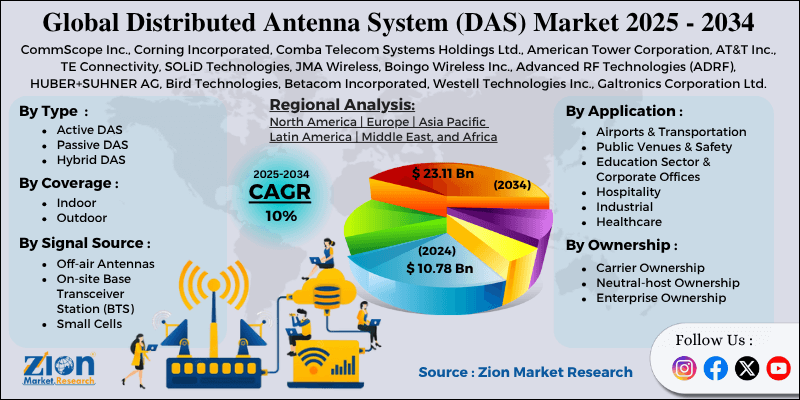

Distributed Antenna System (DAS) Market By Type (Active DAS, Passive DAS, Hybrid DAS), By Coverage (Indoor, Outdoor), By Ownership (Carrier Ownership, Neutral-host Ownership, Enterprise Ownership), By Signal Source (Off-air Antennas, On-site Base Transceiver Station (BTS), Small Cells), By Application (Airports & Transportation, Public Venues & Safety, Education Sector & Corporate Offices, Hospitality, Industrial, Healthcare, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

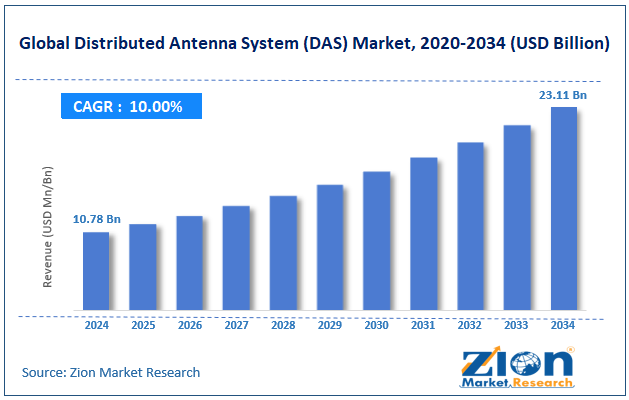

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.78 Billion | USD 23.11 Billion | 10% | 2024 |

Distributed Antenna System (DAS) Industry Perspective:

The global distributed antenna system (DAS) market size was approximately USD 10.78 billion in 2024 and is projected to reach around USD 23.11 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global distributed antenna system (DAS) market is estimated to grow annually at a CAGR of around 10% over the forecast period (2025-2034)

- In terms of revenue, the global distributed antenna system (DAS) market size was valued at around USD 10.78 billion in 2024 and is projected to reach USD 23.11 billion by 2034.

- The distributed antenna system (DAS) market is projected to grow significantly due to the expansion of 5G network infrastructure, increasing smart city and IoT deployments, and growing demand in public venues and transportation hubs.

- Based on type, the active DAS segment is expected to lead the market, while the hybrid DAS segment is anticipated to experience significant growth.

- Based on coverage, the indoor segment is the dominant segment, while the outdoor segment is projected to witness sizable revenue growth over the forecast period.

- Based on ownership, the carrier ownership segment is expected to lead the market compared to the neutral-host ownership segment.

- Based on the signal source, the on-site base transceiver station (BTS) segment is the dominant segment. In contrast, the small cells segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the airports & transportation segment is expected to lead the market compared to the public venues & safety segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Distributed Antenna System (DAS) Market: Overview

A distributed antenna system is a network of spatially separated antennas connected to a common source, dedicated to enhancing wireless coverage and capacity in a specific area. It helps overcome signal issues caused by underground structures, high user density, or large buildings by distributing signals nearer to end users. The global distributed antenna system (DAS) market is expected to expand rapidly, driven by the deployment of 5G, growing adoption in commercial buildings, and increased smartphone penetration. The global rollout of 5G technology requires robust indoor connectivity infrastructure. DAS supports 5G's high-frequency signals, which struggle with building penetration.

Hence, it is a vital component in achieving full 5G performance in residential and commercial environments. Businesses are heavily investing in in-building wireless solutions to support unified communications and IoT. DAS enhances coverage in large buildings, such as hospitals, malls, and airports, fueling demand from the hospitality and corporate sectors. Moreover, the worldwide smartphone penetration reached over 80% in 2024, resulting in significant data and voice traffic indoors. DAS solutions help carriers manage this surge efficiently. The proliferation of mobile applications and streaming services further propels the demand.

Despite the growth, the global market is impeded by factors such as high initial installation costs and complex system design and integration. DAS deployment entails significant infrastructure and labor costs, primarily for fiber-based systems. Budget-sensitive sectors and small enterprises find these costs unaffordable, which restricts adoption, particularly in developing markets. Likewise, the DAS framework requires customized engineering and frequency planning. Incorporating multiple carriers and solutions can be technically complicated. This slows down implementation and increases reliance on skilled experts.

Nonetheless, the global distributed antenna system (DAS) industry stands to gain from several key opportunities, including the rising demand for 5G indoor coverage and the increasing demand in healthcare facilities. As 5G millimeter wave signals have restricted penetration, DAS offers a prime solution for indoor coverage. Malls and businesses seek reliable 5G indoors to support IoT and automation, creating substantial growth for system integrators. Additionally, hospitals need uninterrupted wireless connectivity for IoMT devices, telemedicine, and emergency response. DAS promises signal reliability in complex building structures. This healthcare digitalization trend is driving the installation of new systems.

Distributed Antenna System (DAS) Market Dynamics

Growth Drivers

How is the distributed antenna system (DAS) market fueled by the increased data traffic in high-density venues?

Airports, malls, convention centers, and stadiums are experiencing burgeoning data use, fueling the adoption of DAS to manage escalating user loads. During significant events, mobile networks often experience congestion due to simultaneous access by thousands of individuals. DAS effectively distributes signal coverage, promising quality service even during peak times.

According to ABI Research, more than USD 3.5 billion was spent worldwide in 2024 on the installation of distributed antenna systems for high-capacity applications. This trend is anticipated to surge as smart event infrastructure and connected fan experiences become the standard.

How is the rising adoption of smart building and IoT infrastructure propelling the distributed antenna system (DAS) market?

The proliferation of IoT devices and smart buildings is driving the demand for strong and unified connectivity that DAS can deliver. This substantially fuels the growth of the distributed antenna system (DAS) market. Hospitals, smart offices, and campuses rely on a distributed antenna system to assure continuous signals for sensors, automation systems, and wearables. Governments are also encouraging smart infrastructure; for example, the EU Smart Cities Initiative (2024) focuses on digital connectivity as a fundamental requirement. Subsequently, businesses are investing in distributed antenna systems to future-proof their networks against the surging demands of IoT.

Restraints

The complexity of system design and integration negatively impacts the market progress

DAS networks require careful design and integration to function effectively across multiple frequency bands and operators. This complexity can lead to increased project schedules and maintenance intricacies. For instance, incorporating LTE, 5G, and legacy 3G signals in a single distributed antenna system typically requires modernized RF engineering expertise. This technical complexity is demoralizing, as it often lacks in-house knowledge or access to skilled contractors, and it slows industry growth in some regions.

Opportunities

How is the expansion of healthcare and educational facilities opening up lucrative opportunities for the advancement of the distributed antenna system (DAS) market?

Educational campuses and hospitals are increasingly reliant on high-speed and seamless wireless connectivity, presenting opportunities for growth in DAS solutions. Universities are also adopting a distributed antenna system for their smart campus infrastructure, which encompasses security, online learning, and connectivity for staff and students. The worldwide distributed antenna system (DAS) industry benefits from a regulatory push for reliable emergency communications, thus propelling DAS adoption.

Challenges

Cybersecurity and data privacy concerns restrict the market growth

As DAS networks progressively handle critical communication for businesses and public safety, they become vulnerable to cyber threats. The growth of connected IoT devices and integrated DAS solutions raises potential vulnerabilities. According to the Gartner 2024 report, approximately 25 percent of smart building network breaches were associated with in-building wireless infrastructure. Promising cybersecurity and compliance with data privacy norms contribute to complexity and costs, making businesses cautious over DAS investments.

Distributed Antenna System (DAS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Distributed Antenna System (DAS) Market |

| Market Size in 2024 | USD 10.78 Billion |

| Market Forecast in 2034 | USD 23.11 Billion |

| Growth Rate | CAGR of 10% |

| Number of Pages | 216 |

| Key Companies Covered | CommScope Inc., Corning Incorporated, Comba Telecom Systems Holdings Ltd., American Tower Corporation, AT&T Inc., TE Connectivity, SOLiD Technologies, JMA Wireless, Boingo Wireless Inc., Advanced RF Technologies (ADRF), HUBER+SUHNER AG, Bird Technologies, Betacom Incorporated, Westell Technologies Inc., Galtronics Corporation Ltd., and others. |

| Segments Covered | By Type, By Coverage, By Ownership, By Signal Source, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Distributed Antenna System (DAS) Market: Segmentation

The global distributed antenna system (DAS) market is segmented based on type, coverage, ownership, signal source, application, and region.

Based on type, the global distributed antenna system (DAS) industry is divided into active DAS, passive DAS, and hybrid DAS. The active DAS segment dominates the market, fueled by its enhanced signal amplification, suitability for large venues, and scalability.

Based on coverage, the global market is segmented into indoor and outdoor. The indoor DAS segment holds a leading share, impacted by the growing demand for enhanced in-building connectivity across enterprise and commercial spaces.

Based on ownership, the global market is segmented into carrier ownership, neutral-host ownership, and enterprise ownership. The carrier ownership segment holds a leadership position in the market, driven by telecom operators' substantial investments in coverage and network quality.

Based on signal source, the global distributed antenna system (DAS) market is segmented into off-air antennas, on-site base transceiver station (BTS), and small cells. The on-site base transceiver station (BTS) segment captured a substantial share, backed by its ability to provide reliable, strong, and dedicated signals for high-capacity environments.

Based on application, the global market is segmented into airports & transportation, public venues & safety, education sector & corporate offices, hospitality, industrial, healthcare, and others. The airports & transportation segment led the market due to the growing need for uninterrupted connectivity in complex and high-traffic infrastructure environments.

Distributed Antenna System (DAS) Market: Regional Analysis

What gives North America a competitive edge in the global Distributed Antenna System (DAS) Market?

North America is expected to maintain its leading position in the global distributed antenna system (DAS) market due to its advanced telecommunications infrastructure, early adoption of 5G technology, and presence of major telecom vendors and operators. North America, particularly the United States and Canada, boasts the most developed telecommunications infrastructure worldwide. High-speed networks, early adoption of 5G technology, and extensive fiber-optic infrastructure all impact regional dominance. Canada and the U.S. are the leading countries to roll out 5G networks at scale, creating strong demand for DAS to provide dense-area and indoor coverage. 5G networks run on higher frequency bands that struggle with penetration, increasing the significance of DAS.

Additionally, North America is home to global telecom giants such as AT&T, Verizon, and T-Mobile, which actively invest in DAS to enhance network quality and capacity. These operators collaborate with DAS vendors to implement modernized solutions in healthcare, commercial, and transportation sectors.

Europe ranks as the second-largest region in the global distributed antenna system (DAS) industry, driven by increasing mobile and data traffic, the expansion of 4G and 5G networks, and growing demand from commercial and enterprise sectors. The region boasts a substantial subscriber base, with over 3.5 billion mobile connections in 2024, driving increased demand for high-speed and uninterrupted connectivity. DAS systems are deployed to manage network congestion in densely populated urban centers, transportation hubs, and stadiums. The growing demand for video streaming, smartphone penetration, and IoT adoption further underscores the need for reliable coverage.

Economies such as South Korea, Japan, and China are aggressively rolling out 5G, while 4G networks continue to expand in Southeast Asia and India. DAS is vital for overcoming signal attenuation in the high-frequency bands of 5G. By 2024, the Asia Pacific region is expected to account for 35% of worldwide DAS deployments, indicating a rapid advancement in its network infrastructure. Furthermore, hospitals, businesses, shopping malls, and airports are investing in DAS to improve connectivity for customers, employees, and visitors. The growing adoption of IoT, cloud services, and BYOD policies fuels the deployment of enterprise-level DAS.

Distributed Antenna System (DAS) Market: Competitive Analysis

The leading players in the global distributed antenna system (DAS) market are:

- CommScope Inc.

- Corning Incorporated

- Comba Telecom Systems Holdings Ltd.

- American Tower Corporation

- AT&T Inc.

- TE Connectivity

- SOLiD Technologies

- JMA Wireless

- Boingo Wireless Inc.

- Advanced RF Technologies (ADRF)

- HUBER+SUHNER AG

- Bird Technologies

- Betacom Incorporated

- Westell Technologies Inc.

- Galtronics Corporation Ltd.

Distributed Antenna System (DAS) Market: Key Market Trends

Growth of neutral-host DAS solutions:

Neutral-host DAS networks, which enable multiple operators to share a single infrastructure, are gaining prominence. This reduces deployment costs and streamlines network management for high-density venues. Stadiums, airports, and urban complexes vastly prefer this cost-effective model.

AI-optimized and cloud-managed DAS:

Modern DAS systems utilize cloud-based monitoring and AI-based optimization to enhance network efficiency and reduce operational costs. These solutions enable real-time performance tracking, automated signal management, and predictive maintenance. Cloud-managed DAS improves flexibility and scalability for enterprises and operators.

The global distributed antenna system (DAS) market is segmented as follows:

By Type

- Active DAS

- Passive DAS

- Hybrid DAS

By Coverage

- Indoor

- Outdoor

By Ownership

- Carrier Ownership

- Neutral-host Ownership

- Enterprise Ownership

By Signal Source

- Off-air Antennas

- On-site Base Transceiver Station (BTS)

- Small Cells

By Application

- Airports & Transportation

- Public Venues & Safety

- Education Sector & Corporate Offices

- Hospitality

- Industrial

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A distributed antenna system is a network of spatially separated antennas connected to a common source, dedicated to enhancing wireless coverage and capacity in a specific area. It helps overcome signal issues caused by underground structures, high user density, or large buildings by distributing signals nearer to end users.

The global distributed antenna system (DAS) market is projected to grow due to growing mobile data traffic and connectivity demand, rising adoption in enterprise and commercial buildings, and increasing demand for private LTE and CBRS networks.

According to study, the global distributed antenna system (DAS) market size was worth around USD 10.78 billion in 2024 and is predicted to grow to around USD 23.11 billion by 2034.

The CAGR value of the distributed antenna system (DAS) market is expected to be around 10% during 2025-2034.

Key opportunities favoring the growth of the DAS market include the rising number of smart city projects, expansion of 5G networks, adoption of IoT and smart building technologies, growing demand from enterprises and public venues, and increased investments in healthcare and transportation infrastructure.

Technological advancements, such as AI-optimized networks, 5G integration, and cloud-managed DAS, are enhancing capacity, coverage, and operational efficiency, driving the market growth.

Regulatory factors, such as building codes, spectrum allocation policies, and safety compliance, along with environmental considerations for energy-efficient deployments, are influencing the growth of the DAS market.

North America is expected to lead the global distributed antenna system (DAS) market during the forecast period.

The key players profiled in the global distributed antenna system (DAS) market include CommScope Inc., Corning Incorporated, Comba Telecom Systems Holdings Ltd., American Tower Corporation, AT&T Inc., TE Connectivity, SOLiD Technologies, JMA Wireless, Boingo Wireless Inc., Advanced RF Technologies (ADRF), HUBER+SUHNER AG, Bird Technologies, Betacom Incorporated, Westell Technologies Inc., and Galtronics Corporation Ltd.

The report examines key aspects of the distributed antenna system (DAS) market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed