WLAN Market Size, Share, Trends, Growth and Forecast 2034

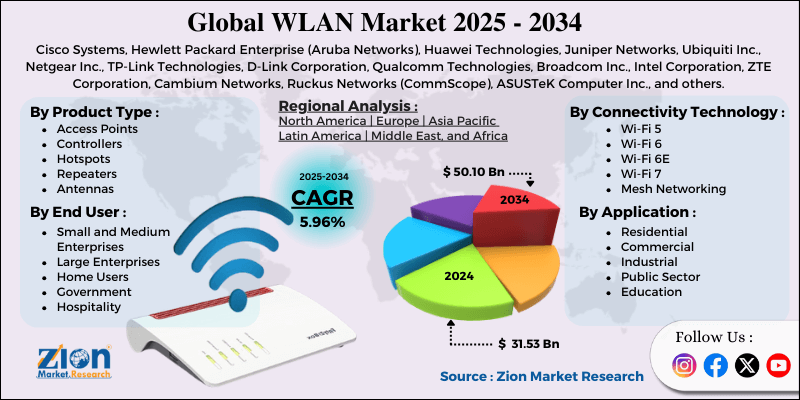

WLAN Market By Product Type (Access Points, Controllers, Hotspots, Repeaters, Antennas), By Connectivity Technology (Wi-Fi 5, Wi-Fi 6, Wi-Fi 6E, Wi-Fi 7, Mesh Networking), By Application (Residential, Commercial, Industrial, Public Sector, Education), By End Use (Small and Medium Enterprises, Large Enterprises, Home Users, Government, Hospitality), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

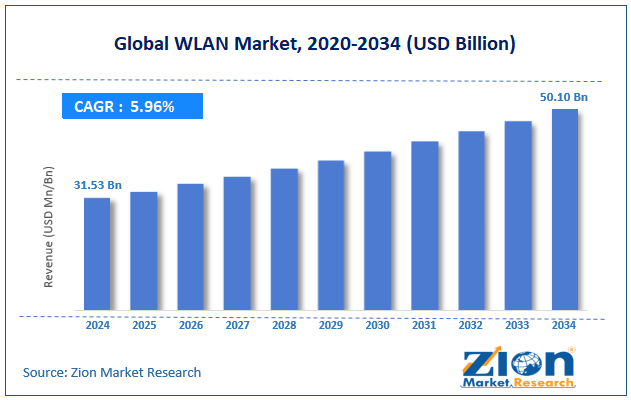

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 31.53 Billion | USD 50.10 Billion | 5.96% | 2024 |

WLAN Industry Perspective:

The global WLAN market size was approximately USD 31.53 billion in 2024 and is projected to reach around USD 50.10 billion by 2034, with a compound annual growth rate (CAGR) of approximately 5.96% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global WLAN market is estimated to grow annually at a CAGR of around 5.96% over the forecast period (2025-2034)

- In terms of revenue, the global WLAN market size was valued at around USD 31.53 billion in 2024 and is projected to reach USD 50.10 billion by 2034.

- The WLAN market is projected to grow significantly due to advancements in IoT device adoption, the expansion of smart city projects and smart homes, and improvements in Wi-Fi 6 and Wi-Fi 7 technologies.

- Based on product type, the access points segment is expected to lead the market, while the controllers segment is expected to grow considerably.

- Based on connectivity technology, the Wi-Fi 6 segment is the dominant segment, while the Wi-Fi 6E segment is projected to witness substantial revenue growth over the forecast period.

- Based on the application, the commercial segment is expected to lead the market compared to the residential segment.

- Based on end use, the large enterprises segment holds a dominating share, followed by the small and medium enterprises segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

WLAN Market: Overview

The Wireless Local Area Network (WLAN) technology enables devices to connect and communicate over a wireless medium within a confined area, such as a campus, office, home, or public hotspot. It eliminates the need for physical cabling by using radio waves, typically based on IEEE 802.11 (Wi-Fi) standards, to provide uninterrupted internet access and data sharing. The global WLAN market is expected to expand rapidly, driven by increasing internet penetration, enterprise digital transformation, and the growing demand for remote work and education. The increasing adoption of the internet worldwide, with more than 5.3 billion users projected for 2025, will notably impact WLAN demand. Enterprises, homes, and public venues are primarily reliant on Wi-Fi as the backbone of digital communication. Expanding broadband availability is expected to drive strong growth in WLAN infrastructure.

Moreover, businesses are advancing through virtual collaboration, cloud computing, and wireless-first workplace tactics. WLAN supports unified communications, enhances productivity, and promotes mobility. The rising demand for wireless enterprise infrastructure fuels investment in high-performing WLAN solutions. Post-pandemic e-learning and hybrid work trends have permanently surged dependency on wireless connectivity. WLAN allows high-speed and secure internet access for virtual classrooms and video conferencing. The move towards flexible workspaces boosts the global market demand.

Despite the growth, the global market is hindered by factors such as high deployment costs and concerns over privacy and security. Moreover, installing enterprise-grade WLAN solutions comprises high capital expenditure on access points, infrastructure, and security systems. For small and medium-sized businesses and developing economies, cost remains a key obstacle, hindering the surging demand. Additionally, WLAN networks are vulnerable to risks such as data theft, unauthorized access, and hacking. A 2024 cybersecurity report revealed that more than 15% of corporate Wi-Fi networks experienced breaches. Security vulnerabilities offer hesitation in sensitive industries like defense and government.

Nonetheless, the global WLAN industry stands to gain from several key opportunities, including the adoption of Wi-Fi 7 and beyond, as well as the growth of edge computing. Wi-Fi 7 promises multi-gigabit speeds, enhanced spectrum efficacy, and low latency. This creates an opportunity for high-bandwidth applications, such as immersive entertainment and metaverse platforms. Vendors advancing in Wi-Fi 7 stand to gain a competitive benefit. Furthermore, edge computing applications need low-latency and reliable connectivity close to the data source. WLAN allows unified communication between edge servers and devices. This trend supports the role of WLAN in next-generation enterprise networks.

WLAN Market: Growth Drivers

How is Hybrid work and BYOD demand fueling the growth of the WLAN market?

The shift to remote and hybrid work has permanently increased the demand for high-performance WLAN networks. Employees usually connect several devices, like headsets, laptops, and smartphones, which multiply bandwidth requirements. According to the IDC reports, business users connect 3-4 devices concurrently, straining outdated networks. The growing use of video conferencing platforms like Microsoft Teams and Zoom is accelerating WLAN upgrades. To ensure secure access and unified collaboration, businesses are investing heavily in next-generation WLAN infrastructure.

How is the growth of video and AR/VR impacting the WLAN market growth?

Video conferencing and streaming dominate WLAN use, offering higher traffic loads than ever. Cisco's Visual Networking Index predicts that video will account for more than 80% of global internet traffic by 2022, a trend that is expected to continue. Businesses are adopting Wi-Fi 6/6E to support high-bandwidth, low-latency needs for video-heavy workloads.

Newer applications, such as remote assistance, immersive collaboration, and AR/VR training, further contribute to the demand. Together, these trends are driving businesses to upgrade their WLAN systems to support the transformation of digital workloads, which in turn is impacting the WLAN market.

WLAN Market: Restraints

Network congestion in high-density environments unfavorably impacts the market progress

WLANs often struggle in high-density settings, such as airports, universities, and stadiums, where thousands of users compete for bandwidth. Even with Wi-Fi 6E, coverage and interference challenges persist, resulting in degraded performance. Cisco's 2023 business networking report noted that 36% of IT leaders positioned 'unpredictable user experience in high-density areas' as a key WLAN pain point. Recent significant events have underscored cases of slow connectivity, despite upgraded systems. This congestion issue remains a barrier for businesses that require smooth and efficient large-scale deployments.

WLAN Market: Opportunities

How do private networks and industry-specific solutions open lucrative opportunities for the advancement of the WLAN market?

Private business WLAN and virtual-specific offerings are progressing as key opportunities. Businesses are deploying dedicated and secure networks for hospitals, campuses, and factories. GSMA intelligence mentioned a 33% rise in YoY rise in Wi-Fi and 5G deployments in 2024, underscoring growing interest in customized networks. Vendors offering end-to-end solutions for specific industries may capture high-value deals. This approach reinforces the long-term revenue potential and penetration of the WLAN industry.

WLAN Market: Challenges

Competition from alternative connectivity technologies restricts the market growth

The growth of private LTE, 5G, and LPWAN networks offers intense competition for WLAN. Private cellular networks provide more comprehensive coverage, high-quality service for critical and industrial applications, and reliable, low-latency connections. GSMA Intelligence stated a 33% YoY growth in private 5G networks in 2024. Businesses are broadly assessing alternatives for factory automation, smart campuses, and logistics. This trend diverts investment away from WLAN solutions, restricting industry expansion.

WLAN Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | WLAN Market |

| Market Size in 2024 | USD 31.53 Billion |

| Market Forecast in 2034 | USD 50.10 Billion |

| Growth Rate | CAGR of 5.96% |

| Number of Pages | 212 |

| Key Companies Covered | Cisco Systems, Hewlett Packard Enterprise (Aruba Networks), Huawei Technologies, Juniper Networks, Ubiquiti Inc., Netgear Inc., TP-Link Technologies, D-Link Corporation, Qualcomm Technologies, Broadcom Inc., Intel Corporation, ZTE Corporation, Cambium Networks, Ruckus Networks (CommScope), ASUSTeK Computer Inc., and others. |

| Segments Covered | By Product Type, By Connectivity Technology, By Application, By End-Use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

WLAN Market: Segmentation

The global WLAN market is segmented based on product type, connectivity technology, application, end-use, and region.

Based on product type, the global WLAN industry is divided into access points, controllers, hotspots, repeaters, and antennas. The access points segment has registered a significant share, as the core hardware enables smooth connectivity for campuses, enterprises, and smart environments, driven by the rising adoption of Wi-Fi 6/7, which in turn drives demand.

On the other hand, the controllers segment held a second-leading share, as they offer centralized management, security, and scalability for complex enterprise WLAN deployments, particularly with the growth of cloud-managed solutions.

Based on connectivity technology, the global market is segmented into Wi-Fi 5, Wi-Fi 6, Wi-Fi 6E, Wi-Fi 7, and mesh networking. The Wi-Fi 6 segment dominates the market due to its extensive adoption. It offers higher efficacy, faster speeds, and support for dense device environments in businesses, public networks, and education.

Conversely, the Wi-Fi 6E segment holds second place, driven by its use of the 6GHz spectrum to deliver higher capacity and lower latency, thereby increasing its suitability for 8K streaming, AR/VR, and advanced enterprise applications.

Based on application, the global WLAN market is segmented into residential, commercial, industrial, public sector, and education. The commercial segment holds a leading share, as retail, enterprise, and hospitality industries invest heavily in WLAN to facilitate cloud applications, digital transformation, and unified consumer connectivity.

Nevertheless, the residential segment is expected to progress considerably, driven by the increasing adoption of smart homes, the demand for high-bandwidth entertainment, and the need for reliable Wi-Fi networks to support remote work.

Based on end-use, the global market is segmented into small and medium enterprises, large enterprises, home users, government, and hospitality. The large enterprises segment held a significant market share, as they deploy large-scale, high-performance networks to support cloud services, secure connectivity for multiple users, and facilitate the integration of IoT devices.

However, the small and medium enterprises segment holds a second-leading position, fueled by the growing adoption of cost-effective cloud-managed wireless local area network solutions to improve flexibility, business productivity, and mobility.

WLAN Market: Regional Analysis

Why is North America outperforming other regions in the global WLAN Market?

North America is expected to maintain its leading position in the global WLAN market due to high internet penetration, a robust enterprise and cloud ecosystem, and the increasing adoption of smart homes and consumer IoT. North America has the highest internet penetration rates globally, with more than 92% of the regional population expected to be connected by 2025. The region consistently leads in adopting advanced Wi-Fi standards, such as Wi-Fi 6E and Wi-Fi 6, backed by a strong network of network providers and chipset manufacturers. This early adoption keeps the region ahead in the development of the WLAN ecosystem.

Furthermore, Canada and the United States host thousands of global enterprises that are inclined towards wireless-first strategies. Gartner reports that by 2024, more than 65% of regional enterprises will have adopted cloud-managed WLANs to enhance flexibility and stability. With the rising reliance on hybrid work models and digital workplaces, enterprises continue to invest in the WLAN ecosystem.

Additionally, North America is a leader in the adoption of smart homes, with more than 100 million households projected to be connected by 2025. WLAN is the foundation for IoT devices, including entertainment systems and smart appliances. The region's high adoption of consumer technology and disposable income drives WLAN demand in the residential sector.

The Asia Pacific ranks as the second-leading region in the global WLAN industry, driven by rapid internet penetration, government smart city and public Wi-Fi initiatives, and strong growth in IoT and smart devices. The Asia Pacific has witnessed explosive internet growth, with more than 2.9 billion internet users projected for 2025. Economies such as Indonesia, China, and India are driving digital adoption by expanding mobile and broadband services. This rise in connectivity affects WLAN demand in both the enterprise and residential sectors.

Moreover, governments in the region are heavily investing in public Wi-Fi programs and smart city projects. India's Digital India program aims to offer Wi-Fi access in 250,000 villages, while China is incorporating Wi-Fi into its smart city architectures. These programs majorly expand WLAN infrastructure in rural and urban settings. Additionally, the region leads in IoT and smartphone adoption, with India and China registering for more than 40% of worldwide smartphone shipments in 2024. WLAN is vital for allowing smart homes, connected consumer ecosystems, and industrial IoT. Growing demand for IoT-based appliances boosts WLAN sector expansion.

WLAN Market: Competitive Analysis

The leading players in the global WLAN market are:

- Cisco Systems

- Hewlett Packard Enterprise (Aruba Networks)

- Huawei Technologies

- Juniper Networks

- Ubiquiti Inc.

- Netgear Inc.

- TP-Link Technologies

- D-Link Corporation

- Qualcomm Technologies

- Broadcom Inc.

- Intel Corporation

- ZTE Corporation

- Cambium Networks

- Ruckus Networks (CommScope)

- ASUSTeK Computer Inc.

WLAN Market: Key Market Trends

Integration with smart devices and IoT:

WLAN is playing a vital role in connecting smart homes, consumer electronics, and IoT systems. With the growing number of connected devices, strong WLAN networks are needed to manage substantial data traffic effectively. This integration creates opportunities for enterprise-grade and high-capacity WLAN deployments.

AI-driven network optimization and enhanced security:

With the rise of cyber threats, WLAN providers are integrating advanced encryption, automated threat detection, and AI-based monitoring. These features promise secure connectivity for healthcare, enterprises, and public sectors. AI-based network optimization also enhances performance by dynamically managing traffic and decreasing congestion.

The global WLAN market is segmented as follows:

By Product Type

- Access Points

- Controllers

- Hotspots

- Repeaters

- Antennas

By Connectivity Technology

- Wi-Fi 5

- Wi-Fi 6

- Wi-Fi 6E

- Wi-Fi 7

- Mesh Networking

By Application

- Residential

- Commercial

- Industrial

- Public Sector

- Education

By End-Use

- Small and Medium Enterprises

- Large Enterprises

- Home Users

- Government

- Hospitality

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Wireless Local Area Network (WLAN) technology enables devices to connect and communicate over a wireless medium within a confined area, such as a campus, office, home, or public hotspot. It eliminates the need for physical cabling by using radio waves, typically based on IEEE 802.11 (Wi-Fi) standards, to provide uninterrupted internet access and data sharing.

The global WLAN market is projected to grow due to the increasing demand for enterprise mobility solutions, the rise in online learning and remote work trends, and the expansion of public Wi-Fi infrastructure.

According to study, the global WLAN market size was worth around USD 31.53 billion in 2024 and is predicted to grow to around USD 50.10 billion by 2034.

The CAGR value of the WLAN market is expected to be approximately 5.96% from 2025 to 2034.

Emerging trends in the WLAN market include AI-driven network optimization, the adoption of Wi-Fi 7, advanced security protocols, mesh networking, and the integration of IoT/edge computing.

Macroeconomic factors, such as rising IT investments, GDP growth, and infrastructure spending, will drive WLAN adoption. Conversely, supply chain disruptions and inflation may slow market expansion.

North America is expected to lead the global WLAN market during the forecast period.

The key players profiled in the global WLAN market include Cisco Systems, Hewlett Packard Enterprise (Aruba Networks), Huawei Technologies, Juniper Networks, Ubiquiti Inc., Netgear Inc., TP-Link Technologies, D-Link Corporation, Qualcomm Technologies, Broadcom Inc., Intel Corporation, ZTE Corporation, Cambium Networks, Ruckus Networks (CommScope), and ASUSTeK Computer Inc.

The WLAN market is highly competitive, led by global players such as Aruba and Cisco, with innovation, cloud-managed solutions, and next-generation Wi-Fi driving market dynamics.

The report examines key aspects of the WLAN market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed