B2B Cross Border Payments Market Size, Share, Trends, Growth 2034

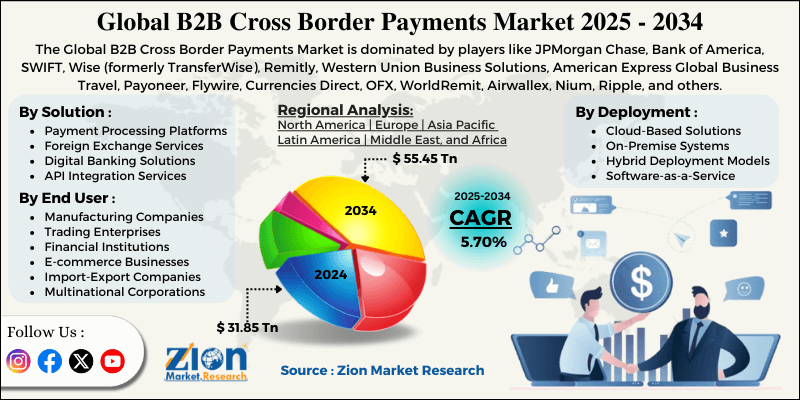

B2B Cross Border Payments Market By Solution (Payment Processing Platforms, Foreign Exchange Services, Compliance and Regulatory Solutions, Digital Banking Solutions, API Integration Services, Blockchain-Based Payments), By Deployment (Cloud-Based Solutions, On-Premise Systems, Hybrid Deployment Models, Software-as-a-Service, Platform-as-a-Service, Infrastructure-as-a-Service), By End User (Manufacturing Companies, Trading Enterprises, Financial Institutions, E-commerce Businesses, Import-Export Companies, Multinational Corporations), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

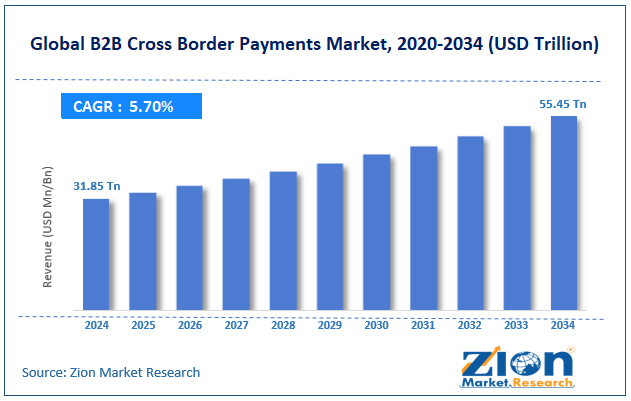

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 31.85 Trillion | USD 55.45 Trillion | 5.70% | 2024 |

B2B Cross Border Payments Industry Perspective:

The global B2B cross border payments market size was worth approximately USD 31.85 trillion in 2024 and is projected to grow to around USD 55.45 trillion by 2034, with a compound annual growth rate (CAGR) of roughly 5.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global B2B cross border payments market is estimated to grow annually at a CAGR of around 5.70% over the forecast period (2025-2034).

- In terms of revenue, the global B2B cross border payments market size was valued at approximately USD 31.85 trillion in 2024 and is projected to reach USD 55.45 trillion by 2034.

- The B2B cross border payments market is projected to grow significantly due to the expansion of international trade activities and the rise of digital payment technology initiatives.

- Based on the solution, the payment processing platforms segment is expected to lead the market, while the blockchain-based payments segment is anticipated to experience significant growth.

- Based on deployment, the cloud-based solutions segment is the dominating segment, while the hybrid deployment models segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the manufacturing companies segment is expected to lead the market compared to the multinational corporation segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

B2B Cross Border Payments Market: Overview

B2B cross border payments represent critical financial infrastructure components that facilitate monetary transactions between businesses across different countries and currencies through sophisticated digital platforms and traditional banking networks. The process involves currency exchange, adherence to regulatory rules, identification of money laundering risks, and real-time transaction monitoring. Modern B2B cross-border payment services utilize innovative technologies, including artificial intelligence, machine learning, and blockchain, to reduce costs, expedite processing, and enhance transaction transparency.

The market covers different payment methods, such as wire transfers, digital wallets, payment cards, and even new cryptocurrency options, giving businesses choices based on their needs and risk preferences. Banks and financial technology companies are always working on creating new payment routes, building banking partnerships, and designing direct settlement systems to make international trade smoother. Rules and standards in different countries ensure cross-border payments follow anti-fraud and data protection measures. This builds trust and keeps global business transactions secure.

The increasing globalization of business operations and the growing demand for faster, more cost-effective international payment solutions are expected to drive substantial growth in the B2B cross border payments market throughout the forecast period.

B2B Cross Border Payments Market: Growth Drivers

How is the growth of international trade and global business expansion driving the B2B cross border payments market growth?

The B2B cross border payments market is growing rapidly due to rising international trade and global business expansion. Companies build supply chains, distribution networks, and partnerships across multiple countries, creating constant demand for smooth and reliable payment systems.

As businesses expand globally, they need an advanced payment infrastructure that can manage multiple currencies, meet regulatory rules, and offer real-time tracking. Government policies, trade agreements, and international partnerships support cross-border trade, boosting the need for better payment systems. Exporters, manufacturers, and service providers now depend on seamless systems that handle large transactions efficiently. Emerging markets joining global supply chains further increase demand for multi-currency platforms, while innovation in payment technologies helps businesses reduce costs and settlement delays.

Technological advancements and digital transformation initiatives

Rapid technological progress and digital transformation are reshaping the B2B cross border payments industry. Businesses now rely on financial technology solutions, digital banking platforms, and advanced tools that make global payments faster, safer, and more affordable. Artificial intelligence helps detect fraud, while automated compliance monitoring ensures businesses meet regulations easily. Real-time payment processing allows quicker transactions, reducing waiting times for companies.

Blockchain and digital currencies are also creating new possibilities, cutting out traditional intermediaries and lowering costs. These innovations are being applied to e-commerce platforms, supply chain finance, and trade solutions. As businesses adopt digital-first strategies, modern cross-border payment systems are becoming essential for international trade and global growth.

Restraints

How are regulatory complexity and compliance challenges restricting the B2B cross border payments market progress?

A major challenge for the B2B cross border payments market is the complex and varied regulatory environment across countries. Businesses must follow anti-money laundering rules, sanctions checks, and data protection laws that differ by region. These compliance demands create barriers for around 25% to 40% of potential users, especially smaller firms with fewer resources.

Many companies view cross-border payments as complicated and risky due to unclear regulations, lengthy verification processes, and the fear of penalties. In order to manage this, businesses require costly investments in compliance tools, legal expertise, and monitoring systems. Without streamlined processes, global payment growth remains limited, especially in industries where risk management is critical.

Opportunities

Digital currency adoption and blockchain technology integration

The B2B cross border payments market is gaining new opportunities through digital currency adoption and blockchain technology. Financial institutions and financial technology companies are now using distributed ledger systems, smart contracts, and cryptocurrency-based payment solutions. These tools reduce transaction costs, improve settlement speed, and increase transparency in international payments. Digital currencies are becoming more accepted, while clearer regulations around blockchain applications are attracting more businesses.

Advanced systems also provide features like programmable payments, automated reconciliation, and built-in foreign exchange services, making global transactions easier and more reliable. As companies seek competitive advantages, blockchain-enabled payment solutions provide them with a more efficient way to manage global transactions and enhance traditional payment systems.

Challenges

How are currency volatility and foreign exchange risks limiting the growth of the market?

One of the biggest challenges in the B2B cross border payments industry is managing currency fluctuations and foreign exchange risks. Exchange rate changes make it difficult for businesses to predict the exact cost of international transactions, creating uncertainty in financial planning. This is especially tough for companies in emerging markets with unstable currencies.

Unfavorable currency shifts can lead to unexpected losses, affecting cash flow and budgets. Without strong risk management and hedging tools, businesses remain vulnerable to these challenges. To solve this, payment platforms need real-time exchange rate monitoring, integrated FX services, and advanced forecasting features. These tools help reduce financial uncertainty, improve planning, and build confidence in international payment systems for businesses of all sizes.

B2B Cross Border Payments Market: Segmentation

The global B2B cross border payments market is segmented based on solution, deployment, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the solution, the global B2B cross border payments industry is divided into payment processing platforms, foreign exchange services, compliance and regulatory solutions, digital banking solutions, API integration services, and blockchain-based payments. Payment processing platforms lead the market due to their comprehensive functionality, widespread business adoption, and essential role in facilitating international transactions across various industries and business sizes.

Based on deployment, the global B2B cross border payments market is classified into cloud-based solutions, on-premises systems, hybrid deployment models, software-as-a-service, platform-as-a-service, and infrastructure-as-a-service. Cloud-based solutions are expected to lead the market during the forecast period due to their scalability advantages, cost-effectiveness, and ability to support distributed business operations and remote access requirements.

Based on end-user, the global market is segmented into manufacturing companies, trading enterprises, financial institutions, e-commerce businesses, import-export companies, and multinational corporations. Manufacturing companies hold the largest market share due to their extensive international supply chains, high transaction volumes, and complex payment requirements for raw materials, components, and finished goods distribution.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

B2B Cross Border Payments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | B2B Cross Border Payments Market |

| Market Size in 2024 | USD 31.85 Trillion |

| Market Forecast in 2034 | USD 55.45 Trillion |

| Growth Rate | CAGR of 5.70% |

| Number of Pages | 214 |

| Key Companies Covered | JPMorgan Chase, Bank of America, SWIFT, Wise (formerly TransferWise), Remitly, Western Union Business Solutions, American Express Global Business Travel, Payoneer, Flywire, Currencies Direct, OFX, WorldRemit, Airwallex, Nium, Ripple, and others. |

| Segments Covered | By Solution, By Deployment, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

B2B Cross Border Payments Market: Regional Analysis

What factors are contributing to North America's dominance in the global B2B cross border payments market?

North America leads the global B2B cross border payments market because of its advanced financial systems, strong regulations, and early adoption of digital payment technologies. Approximately 55% of global B2B payment transactions originate from this region, with the United States at the center due to its extensive trade network and robust financial technology industry.

Businesses here prefer advanced payment solutions, as they ensure reliability, competitive pricing, and compliance with rules across various markets. The region also benefits from mature banking systems, strong technology infrastructure, and skilled professionals who support leadership. Strict regulations and financial oversight encourage innovation and adoption of new payment tools. Growing international trade, digital transformation, and booming e-commerce keep driving demand for cross-border services. North American firms often lead with new technology in processing, foreign exchange, and compliance, serving both local and global markets.

Recently, businesses have preferred solutions that connect with enterprise systems and allow real-time tracking. Payments are also being combined with trade finance and supply chain tools, creating end-to-end solutions. This integration enables companies to manage risks more effectively and enhance overall efficiency in their global operations.

Asia Pacific is expected to show strong growth.

Asia Pacific’s B2B cross border payments market is expanding quickly as trade increases, digital adoption rises, and companies use modern financial technologies. The region is becoming a hub due to its strong manufacturing base, growing exports, and increasing number of multinational companies establishing operations. Standardized regulatory frameworks across many Asia Pacific countries help the market by making payment systems secure, efficient, and compliant. Businesses are moving beyond traditional banking as they see the clear benefits of digital solutions.

Regional trade deals and economic partnerships create opportunities for connected systems that support smooth global commerce. Rising awareness of sustainability has also raised the demand for transparent and efficient payment systems. Government support and business confidence are driving wider use of advanced technologies and improved systems.

Leading banks in the Asia Pacific are also working with global financial technology firms to launch new products and speed up payment innovation. These efforts are not only strengthening regional financial networks but also improving access for smaller businesses. As more companies join global supply chains, demand for dependable and cost-effective payment services will continue to grow strongly.

Recent Market Developments:

- In March 2025, the European Central Bank announced new digital euro guidelines that facilitate business-to-business cross-border transactions, providing enhanced security features and reducing settlement times for international commercial payments across European Union member states.

B2B Cross Border Payments Market: Competitive Analysis

The leading players in the global B2B cross border payments market are:

- JPMorgan Chase

- Bank of America

- SWIFT

- Wise (formerly TransferWise)

- Remitly

- Western Union Business Solutions

- American Express Global Business Travel

- Payoneer

- Flywire

- Currencies Direct

- OFX

- WorldRemit

- Airwallex

- Nium

- Ripple

The global B2B cross border payments market is segmented as follows:

By Solution

- Payment Processing Platforms

- Foreign Exchange Services

- Compliance and Regulatory Solutions

- Digital Banking Solutions

- API Integration Services

- Blockchain-Based Payments

By Deployment

- Cloud-Based Solutions

- On-Premise Systems

- Hybrid Deployment Models

- Software-as-a-Service

- Platform-as-a-Service

- Infrastructure-as-a-Service

By End User

- Manufacturing Companies

- Trading Enterprises

- Financial Institutions

- E-commerce Businesses

- Import-Export Companies

- Multinational Corporations

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

B2B cross-border payments represent critical financial infrastructure components that facilitate monetary transactions between businesses across different countries and currencies through sophisticated digital platforms and traditional banking networks.

The global B2B cross border payments market is projected to grow due to increasing international trade activities, rising adoption of digital payment technologies, and growing demand for cost-effective financial transaction solutions.

According to a study, the global B2B cross border payments market size was worth around USD 31.85 trillion in 2024 and is predicted to grow to around USD 55.45 trillion by 2034.

The CAGR value of the B2B cross border payments market is expected to be around 5.70% during 2025-2034.

North America is expected to lead the global B2B cross border payments market during the forecast period.

The major players profiled in the global B2B cross border payments market include JPMorgan Chase, Bank of America, SWIFT, Wise, Remitly, Western Union Business Solutions, American Express Global Business Travel, Payoneer, Flywire, Currencies Direct, OFX, WorldRemit, Airwallex, Nium, and Ripple.

The report examines key aspects of the B2B cross border payments market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

The growth of the B2B cross border payments market is impacted by regulatory and compliance factors such as anti-money laundering requirements, sanctions screening protocols, data protection regulations, and financial transparency standards, promoting secure and compliant international transaction alternatives.

Macroeconomic factors such as international trade trends, currency exchange rate fluctuations, global economic stability, and business investment patterns will significantly influence the B2B cross border payments market growth through transaction demand levels, pricing strategies, and market penetration in different economic sectors.

To stay competitive in the B2B cross border payments market, stakeholders should adopt a comprehensive strategy focusing on technological innovation, regulatory compliance, and customer experience excellence. These comprise investment in payment processing efficiency, development of enhanced security features, and expansion into emerging markets and business applications, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed