Prepaid Card Market Size, Share, Trends, Growth 2032

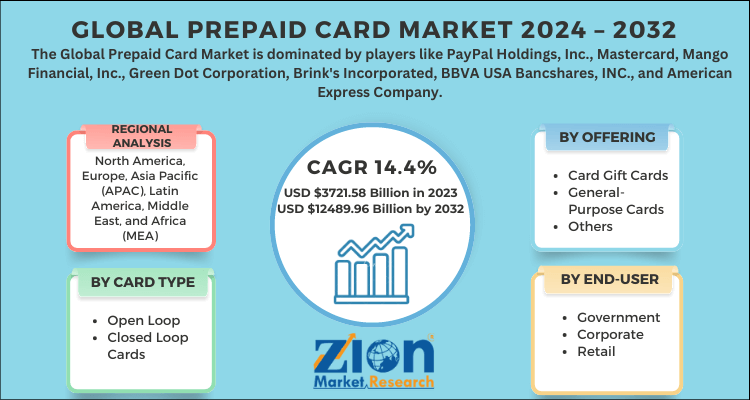

Prepaid Card Market By Card Type (Open Loop and Closed Loop Cards), By Offering (Card Gift Cards, General-Purpose Cards, and Others), By End-User (Government, Corporate, and Retail), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

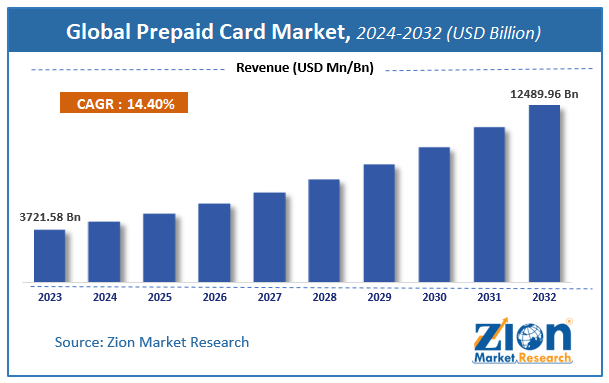

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3721.58 Billion | USD 12489.96 Billion | 14.4% | 2023 |

Description

Prepaid Card Industry Perspective:

According to the report published by Zion Market Research, the global Prepaid Card Market size was valued at USD 3721.58 Billion in 2023 and is predicted to reach USD 12489.96 Billion by the end of 2032. The market is expected to grow with a CAGR of 14.4% during the forecast period.

The report analyzes the global Prepaid Card Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Prepaid Card industry.

Global Prepaid Card Market: Overview

The prepaid card refers to the payment cards with stored value. These cards have no link to the external bank account. These cards were initially introduced as a more effective replacement for paper-based gift certificates and food coupons initially. Now prepaid cards have evolved into a mainstream market. Also, it is evolving as a part of reward strategy or employee engagement in business entities. Prepaid cards have emerged as an alternative to cheques and cash, where customers and businesses use them as an electronic means of payment.

Global Prepaid Card Market: Growth Factors

The global prepaid card market is likely to witness significant growth prospects during the forecast period due to the rise in demand for cash alternatives globally. Furthermore, the high penetration rate of internet services in both the underdeveloped and developing populations is further widening the scope of prepaid cards. In addition, prepaid cards are more in demand as funds can be easily added with the help of different avenues. However, the significant spike in unbanked and underbanked population is further anticipating the market to flourish over the forecast period.

The governments of several regions are emphasizing facilitating distributing benefits and dispersing wages along with making other payments with the help of prepaid cards. However, this not only highlights their versatility but also presents the exponential potential of prepaid cards. Retailers are selling their cards to enhance customer loyalty and brand awareness, thereby prepaid cards have emerged as a key factor in expanding and retaining the customer base. Prepaid cards are also exhibiting a great scope in travel and tourism. These prepaid cards are good means of travel cards and have emerged as a convenient and safe alternative to check and cash while traveling, thereby contributing significantly towards the growth of the global prepaid card market.

The emergence of e-commerce sales is also likely to promulgate the adoption rate of prepaid cards. However, the outbreak of the Covid-19 pandemic has positively impacted the growth of the global prepaid card market as the sudden pandemic outbreak encourages people to use a contactless cost-effective and secured cash alternative option. Thereby prepaid cards emerged as the convenient mode of payment that executes every transaction with more ease. Corporate centers are also tapping on the prepaid card potential to maintain their daily transactions. For instance, TechVentures launched 'Haappy'. It is a corporate expense card that is controlled by administrators remotely from a web interface on mobile. This card assists companies to approve expenses, setting limits on fund cards, and tracking down their daily expenses in real-time. Generally, these prepaid cards are being used as inexpensive, safe, and good banking substitutes that cater to financial transaction requirements.

Global Prepaid Card Market: Segmentation

The global prepaid card market can be segmented into card type end-user, offering, and region.

By card type, the market can be segmented into open loop and closed loop cards.

By end-user, the market can be segmented into government, corporate, and retail.

By offering, the market can be segmented into incentive government benefits for disbursement card gift cards, general-purpose cards, and others.

Recent Developments:

- In May 2024, Ethiopian Berhan Bank partnered with Mastercard to launch a prepaid card designed for online international transactions. The card allows customers to make digital payments at merchants, point-of-sale terminals, e-commerce platforms, and ATMs, with a top-up limit of up to US$4,000.

- In May 2024, Eastern Bank partnered with Mastercard to introduce a prepaid card tailored for medical tourism, enabling Bangladeshi patients to access healthcare services in India. The dual-currency card offers benefits such as a 10% discount on inpatient hospital care across more than 120 hospitals in major Indian cities, including Delhi, Chennai, Mumbai, Bengaluru, Pune, Ahmedabad, Jaipur, and Lucknow, along with additional perks such as free dental and eye checkups.

- In April 2024, Airtel Payments Bank announced the launch of National Common Mobility Card (NCMC)–enabled prepaid cards in partnership with the National Payments Corporation of India (NPCI). The cards can be used for RuPay-accepting merchant payments, online transactions, and offline NCMC transit payments across metros, buses, parking facilities, and other transit services throughout India.

Prepaid Card Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Prepaid Card Market |

| Market Size in 2023 | USD 3721.58 Billion |

| Market Forecast in 2032 | USD 12489.96 Billion |

| Growth Rate | CAGR of 14.4% |

| Number of Pages | 201 |

| Key Companies Covered | PayPal Holdings, Inc., Mastercard, Mango Financial, Inc., Green Dot Corporation, Brink's Incorporated, BBVA USA Bancshares, INC., and American Express Company |

| Segments Covered | By card type, By end-user, By offering and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Prepaid Card Market: Regional analysis

North America accounts for the largest share in the global prepaid card market due to the significant increase in the adoption of prepaid cards by different organizations along with many government authorities. In addition, the growing popularity of prepaid cards in the region is further increasing its adoption rate.

Asia Pacific is likely to witness a significant growth rate in the forthcoming years due to the growing number of prepaid card applications in the corporates, institutes, retail establishments, and government.

Prepaid Card Market: Competitive Analysis

The global prepaid card market is led by players like:

- PayPal Holdings, Inc

- Mastercard

- Mango Financial, Inc

- Green Dot Corporation

- Brink's Incorporated

- BBVA USA Bancshares, INC

- American Express Company

The global prepaid card market is segmented as follows:

By Card Type

- Open Loop

- Closed Loop Cards

By Offering

- Card Gift Cards

- General-Purpose Cards

- Others

By End-User

- Government

- Corporate

- Retail

Global Prepaid Card Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed