Automotive Plastic Compounding Market Size, Share, Trends, Growth and Forecast 2034

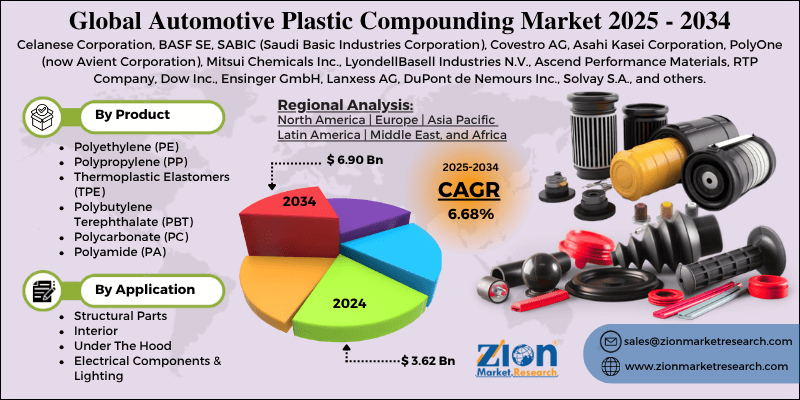

Automotive Plastic Compounding Market By Product (Polyethylene (PE), Polypropylene (PP), Thermoplastic Elastomers (TPE), Polybutylene Terephthalate (PBT), Polycarbonate (PC), Polyamide (PA), and Others), By Application (Structural Parts, Interior, Under The Hood, Electrical Components & Lighting, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

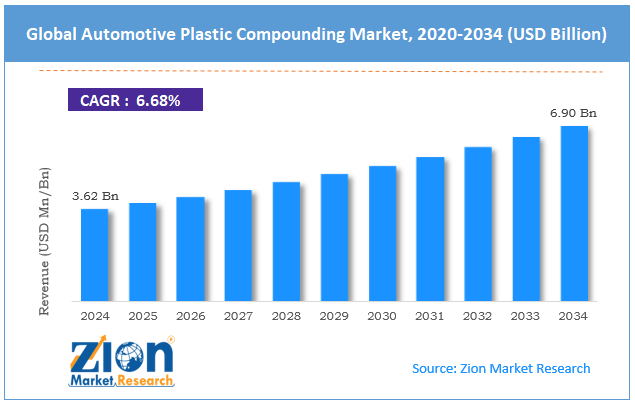

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.62 Billion | USD 6.90 Billion | 6.68% | 2024 |

Automotive Plastic Compounding Industry Perspective:

The global automotive plastic compounding market size was worth around USD 3.62 billion in 2024 and is predicted to grow to around USD 6.90 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.68% between 2025 and 2034.

Automotive Plastic Compounding Market: Overview

Automotive plastic compounding is the process of producing specially curated plastic compounds for applications in automotive vehicles. The process of plastic compounding involves mixing different polymers with special additives in a molten state. The end goal is to produce a highly customized plastic material with special properties. Plastic compounding for the automotive industry enables companies and vehicle manufacturers to enhance the overall properties of base materials.

Additionally, the resulting mixture can further be customized to meet specific requirements for final applications. Demand for automotive plastic compounding is growing at a steady pace, primarily driven by the rising demand for automotives across the globe.

Additionally, increasing government support to the regional automotive industry will further facilitate market expansion. The emergence of electric vehicles (EVs) and self-driving cars may generate more growth opportunities for the market players along with the global expansion of the automotive industry. A major drawback for the market players is the high risk of supply chain disruptions for raw materials, such as polymers and resins.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive plastic compounding market is estimated to grow annually at a CAGR of around 6.68% over the forecast period (2025-2034)

- In terms of revenue, the global automotive plastic compounding market size was valued at around USD 3.62 billion in 2024 and is projected to reach USD 6.90 billion by 2034.

- The automotive plastic compounding market is projected to grow at a significant rate due to the increasing expansion of the automotive industry worldwide.

- Based on the product, the Polypropylene (PP) segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the interior segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Automotive Plastic Compounding Market: Growth Drivers

Increasing expansion of the automotive industry worldwide to propel market growth rate

The global automotive plastic compounding market is expected to be driven by the growing expansion of the automobile sector across the globe. Major vehicle manufacturers are increasingly investing in foreign markets to expand their consumer base.

Furthermore, the changing lifestyle of the ordinary population, growing disposable income, and higher access to financial assistance for purchasing vehicles have further amplified demand for both affordable and luxury vehicles, including cars and motorbikes.

For instance, in February 2025, Mahindra South Africa, a leading subsidiary of an Indian automotive company, signed a Memorandum of Understanding (MoU) with the Industrial Development Corporation (IDC) of South Africa. The company is expected to conduct a feasibility test to determine the possibility of developing a Completely Knocked Down (CKD) vehicle assembly facility in the region.

The growing expansion of the automotive industry across emerging and developed markets will facilitate higher demand for plastic compounding from the industry.

Growing introduction of new and improved plastic compounds offers higher avenues for further growth

Market players are increasingly investing in developing new plastic compounds with superior performance and durability. One of the major areas of focus for industry leaders is using sustainable solutions in the plastic compounding process.

For instance, in May 2024, Cabot Corporation, a global supplier of specialty chemicals and performance materials, announced the launch of REPLASBLAK® universal circular black masterbatches. It is made using certified sustainable material. The two new products in the launch contain International Sustainability & Carbon Certification (ISCC PLUS) certified content, thus marking the introduction of an environmentally friendly solution in the global automotive plastic compounding market.

In September 2024, Asahi Kasei, a Japan-based technology company, announced the launch of LASTAN. It is a flame-retardant and highly flexible nonwoven fabric for enhanced electric vehicle battery safety.

The material has applications in busbar protection sleeves, top covers, and other applications concerning EV battery packs. Moreover, growing advancements in plastic compounding technologies will further facilitate the development of next-generation compounds with improved applications.

Automotive Plastic Compounding Market: Restraints

Risk of supply chain disruptions to impact market revenue during the projection period

The global automotive plastic compounding industry is expected to be restricted due to the escalating geopolitical turmoil across the globe. The changing international trading relationships can impact the supply of essential raw materials required for plastic compounding. In addition, supply chain disruption can also lead to price volatility, further affecting market revenue in the long term.

Automotive Plastic Compounding Market: Opportunities

Ongoing expansion of electric and autonomous vehicles to generate growth opportunities for industry players

The global automotive plastic compounding market is expected to generate growth opportunities due to the rising expansion of electric and autonomous vehicles across the globe. The EV segment, at present, is one of the fastest-growing segments of the global automotive industry.

The rising production of affordable EVs with higher driving ranges and superior safety or infotainment systems has created more demand for electric vehicles worldwide. In May 2025, Sabic, a leading provider of diversified chemicals and materials, launched a high-heat specialty thermoplastic.

According to company reports, the material is suitable for challenging electrical applications in automotives, including components of EVs. The polyetherimide (PEI) resin is currently marketed as an Ultem brand. In addition, automotive companies are focusing on developing self-driving cars with enhanced driving features.

For instance, in March 2025, Nissan Motor Co., Ltd. unveiled its recent autonomous-drive (AD) technology. Japan registered the first event, which involved a driverless car navigating a public road in a complex urban environment. The ongoing innovation in EVs and autonomous vehicles will create growth avenues for plastic compounding companies.

Automotive Plastic Compounding Market: Challenges

Complexity and high cost of producing advanced compounds to challenge market expansion

The global automotive plastic compounding industry is expected to be challenged by the complexity associated with manufacturing advanced solutions.

In addition, the process can be expensive, further affecting the overall market adoption rate. The use of precise engineering processes and technically advanced machinery or equipment increases the complexity of producing specialty plastic compounds.

Automotive Plastic Compounding Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Plastic Compounding Market |

| Market Size in 2024 | USD 3.62 Billion |

| Market Forecast in 2034 | USD 6.90 Billion |

| Growth Rate | CAGR of 6.68% |

| Number of Pages | 213 |

| Key Companies Covered | Celanese Corporation, BASF SE, SABIC (Saudi Basic Industries Corporation), Covestro AG, Asahi Kasei Corporation, PolyOne (now Avient Corporation), Mitsui Chemicals Inc., LyondellBasell Industries N.V., Ascend Performance Materials, RTP Company, Dow Inc., Ensinger GmbH, Lanxess AG, DuPont de Nemours Inc., Solvay S.A., and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Plastic Compounding Market: Segmentation

The global automotive plastic compounding market is segmented based on product, application, and region.

Based on the product, the global market segments are Polyethylene (PE), Polypropylene (PP), Thermoplastic Elastomers (TPE), Polybutylene Terephthalate (PBT), Polycarbonate (PC), Polyamide (PA), and others. In 2024, the highest revenue was listed in the Polypropylene (PP) segment, which dominated nearly 68% of the total revenue. The increasing focus on developing lightweight and fuel-efficient vehicles is helping the segment thrive. During the projection period, the Polycarbonate (PC) segment is expected to deliver a higher CAGR.

Based on the application, the global automotive plastic compounding industry divisions are structural parts, interior, under the hood, electrical components & lighting, and others. In 2024, around 45% of the final revenue was listed in the interior segment. The rising focus on developing attractive, high-grade, and aesthetically pleasing interiors of vehicles is propelling segmental expansion. Special focus is directed toward automotive interiors such as seating, door panels, and dashboards.

Automotive Plastic Compounding Market: Regional Analysis

Asia-Pacific is expected to generate the highest growth rate during the forecast period

The global automotive plastic compounding market will be driven by Asia-Pacific during the forecast period. In 2024, around 45% of the global revenue was registered in Asia-Pacific, with India, China, and Japan emerging as the leading markets.

The growing expansion of the regional automotive industry, with China’s dominance in the EV sector worldwide, has created massive growth opportunities for the regional players. Furthermore, rising government support for the EV sector will further escalate demand for high-performance plastic compounds.

Europe is another major market with the Netherlands, Germany, and France acting as leading regional market growth propellers. In April 2025, Benvic, a France-based customized thermoplastic solutions provider, announced a partnership with TotalEnergies Corbion.

The companies have partnered to launch low-carbon compounds for applications in the electronics and automotive sectors. The partnership will facilitate the functionality and performance enhancement of polylactic acid bioplastics. Europe is expected to deliver a higher focus on developing sustainable plastic compounds, creating novel growth opportunities for industry players.

Furthermore, advancements in plastic compounding technology in the form of the development of circular masterbatch solutions, the use of graphene nanoplatelet masterbatch, and energy-efficient compounding lines will further escalate regional revenue, according to research.

Automotive Plastic Compounding Market: Competitive Analysis

The global automotive plastic compounding market is led by players like:

- Celanese Corporation

- BASF SE

- SABIC (Saudi Basic Industries Corporation)

- Covestro AG

- Asahi Kasei Corporation

- PolyOne (now Avient Corporation)

- Mitsui Chemicals Inc.

- LyondellBasell Industries N.V.

- Ascend Performance Materials

- RTP Company

- Dow Inc.

- Ensinger GmbH

- Lanxess AG

- DuPont de Nemours Inc.

- Solvay S.A.

The global automotive plastic compounding market is segmented as follows:

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Elastomers (TPE)

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polyamide (PA)

- Others

By Application

- Structural Parts

- Interior

- Under The Hood

- Electrical Components & Lighting

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive plastic compounding is the process of producing specially curated plastic compounds for applications in automotive vehicles.

The global automotive plastic compounding market is expected to be driven by the growing expansion of the automobile sector across the globe.

According to study, the global automotive plastic compounding market size was worth around USD 3.62 billion in 2024 and is predicted to grow to around USD 6.90 billion by 2034.

The CAGR value of the automotive plastic compounding market is expected to be around 6.68% during 2025-2034.

The global automotive plastic compounding market will be driven by Asia-Pacific during the forecast period.

The global automotive plastic compounding market is led by players like Celanese Corporation, BASF SE, SABIC (Saudi Basic Industries Corporation), Covestro AG, Asahi Kasei Corporation, PolyOne (now Avient Corporation), Mitsui Chemicals, Inc., LyondellBasell Industries N.V., Ascend Performance Materials, RTP Company, Dow Inc., Ensinger GmbH, Lanxess AG, DuPont de Nemours, Inc., and Solvay S.A.

The report explores crucial aspects of the automotive plastic compounding market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed