Automotive Brakes and Clutches Market Size, Share & Forecast 2034

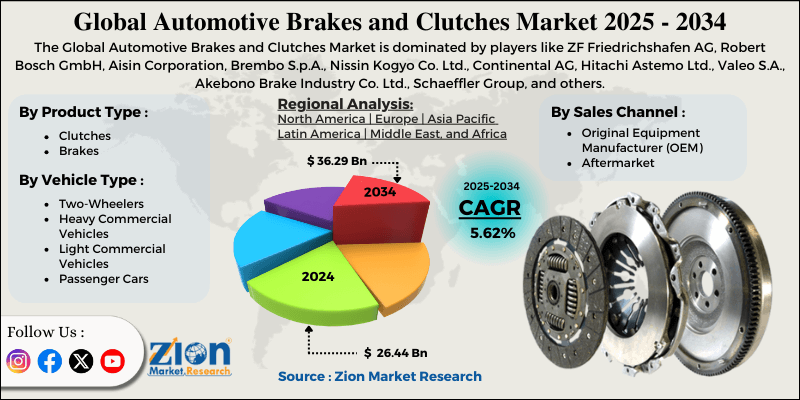

Automotive Brakes and Clutches Market By Product Type (Clutches and Brakes), By Vehicle Type (Two-Wheelers, Heavy Commercial Vehicles, Light Commercial Vehicles, and Passenger Cars), By Sales Channel (Original Equipment Manufacturer (OEM) and Aftermarket), and By Region – Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034-

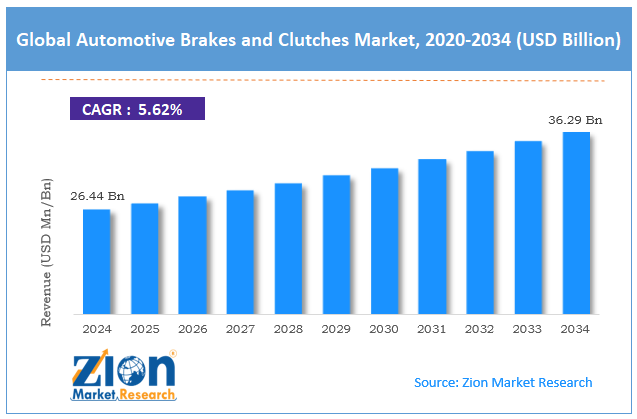

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.44 Billion | USD 36.29 Billion | 5.62% | 2024 |

Automotive Brakes And Clutches Industry Perspective:

What will be the size of the global automotive brakes and clutches market during the forecast period?

The global automotive brakes and clutches market size was worth around USD 26.44 billion in 2024 and is predicted to grow to around USD 36.29 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.62% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive brakes and clutches market is estimated to grow annually at a CAGR of around 5.62% over the forecast period (2025-2034)

- In terms of revenue, the global automotive brakes and clutches market size was valued at around USD 26.44 billion in 2024 and is projected to reach USD 36.29 billion by 2034.

- The automotive brakes and clutches market is projected to grow at a significant rate due to the rising emergence of vehicle safety regulations across the globe

- Based on the product type, the brakes segment is growing at a high rate and will continue to dominate the global market, as per industry projections

- Based on the sales channel, the original equipment manufacturer (OEM) segment is anticipated to command the largest market share

- Based on region, the Asia-Pacific is projected to dominate the global market during the forecast period

Automotive Brakes And Clutches Market: Overview

The automotive brakes and clutches market covers braking systems (such as disc brakes), clutch assemblies (including clutches), and other related products that provide vehicle safety and motion control. The major components of braking systems include disc brakes, drum brakes, brake pads, calipers, rotors, electronic brake modules, safety brakes, and integrated electronic brake systems. The major components of clutch systems include dry clutches, wet clutches, dual clutch transmissions, pressure plates, and friction facings. During the forecast period, demand for automotive brakes and clutches is projected to grow steadily, driven by several favorable factors.

For instance, the rapid emergence of vehicle safety regulations worldwide and increasing aftermarket demand for parts & services will help fuel market revenue. The electrification of the automotive industry is projected to open new doors for extended growth in the market. The automotive brakes and clutches sector may face growth constraints due to price pressures and the technological complexities of parts production.

Automotive Brakes And Clutches Market: Dynamics

Growth Drivers

How will the emergence of vehicle safety regulations affect the growth of the automotive brakes and clutches market?

The global automotive brakes and clutches market is expected to grow due to the rising adoption of vehicle safety regulations worldwide. According to industry research, commercial and noncommercial vehicle manufacturers will be required to install safety systems in their passenger vehicles because of increasing regulatory requirements to implement safety systems such as Anti-lock Braking System (ABS), Electronic Braking System (EBS), and Autonomous Emergency Braking (AEB). This trend has coincided with a substantial increase in the installed base of braking systems in both commercial and non-commercial passenger vehicles (PCV). As of 2024, more than 90% of new PCVs sold in developed markets were equipped with ABS or EBS; therefore, this trend will directly support the continued growth of the automotive brake and clutch industry.

Increase in aftermarket demand for parts and services will facilitate improved revenue in the industry

According to official findings, brake pads are typically replaced every 30,000 to 70,000 km, and clutch systems can last 80,000 to 120,000 km, depending on use. The ongoing need to replace components to ensure vehicle longevity and occupant safety will remain the primary source of revenue for providers of global Automotive Brake and clutch solutions.

How will continued growth in hybrid vehicles support future demand in the automotive brakes and clutches market?

In 2024, hybrid vehicles accounted for more than 20% of total EV sales. Most hybrid vehicles use advanced clutch and brake technology. According to industry research, the continued demand for hybrid vehicles will directly impact the global automotive brakes and clutches market, as these vehicles offer significant advantages over traditional fuel-powered vehicles.

Restraints

Price pressures to limit market expansion during the forecast period

The global automotive brakes and clutches industry is expected to be limited due to price pressures that exist in the industry. Advanced technologies used on a truck, like cutting-edge friction materials and electronic operations in braking systems, are associated with a 15%–25% increase in system costs as compared to conventional brakes, which leads to reduced demand from customers who primarily base their purchasing decisions on price and creates lower profit margins for manufacturers, thus affecting overall revenue generated by the market leaders.

Opportunities

How will increasing sales of electric vehicles create growth opportunities for the players in the automotive brakes and clutches market?

The global automotive brakes and clutches market is projected to generate growth opportunities due to the rising sales of electric vehicles (EVs). These automotives leverage regenerative braking systems that are more advanced than traditionally used brakes. Furthermore, EVs also drive sales for brake-by-wire systems and electronic parking brake solutions, which are anticipated to grow at an annual rate of more than 8% within the years 2025 and 2034. These factors are likely to favor EV-based brake providers during the projection period.

Aftermarket digitalization to generate novel expansion avenues for industry players

Automotive brakes & clutches service providers operating in the aftermarket segment are increasingly incorporating digital solutions to enhance business operations and meet evolving consumer demands. According to industry research, digitally enabled predictive maintenance systems may help to decrease brake-related downtime by as much as 30%, enhancing fleet efficiency. This, in turn, may facilitate higher revenue for service-based automotive solutions providers.

Challenges

How will technological complexity challenge suppliers in the automotive brakes and clutches market?

The vendors in the global automotive brakes and clutches industry will be affected by the increasing technological complexity required to develop a complete, integrated braking module for sale to Original Equipment Manufacturers (OEMs). For example, increased system integration support costs have increased the Research & Development (R&D) dollars Tier-1 suppliers need to invest to develop their products, typically by 20% to 30% over the last five years for smaller manufacturers.

Automotive Brakes and Clutches Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Brakes and Clutches Market |

| Market Size in 2024 | USD 26.44 Billion |

| Market Forecast in 2034 | USD 36.29 Billion |

| Growth Rate | CAGR of 5.62% |

| Number of Pages | 217 |

| Key Companies Covered | ZF Friedrichshafen AG, Robert Bosch GmbH, Aisin Corporation, Brembo S.p.A., Nissin Kogyo Co. Ltd., Continental AG, Hitachi Astemo Ltd., Valeo S.A., Akebono Brake Industry Co. Ltd., Schaeffler Group, and others. |

| Segments Covered | By Product Type, By Vehicle Type, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Brakes And Clutches Market: Segmentation

The global automotive brakes and clutches market is segmented based on product type, vehicle type, sales channel, and region.

Based on product type, the global market segments are clutches and brakes. According to market research, braking systems made up approximately 65% of the automotive brakes and clutches revenue in 2024 due to the rise in global regulatory demands and the advancement of technological equipment. About 35% of automotive brakes and clutches revenue came from demand from manual transmission vehicles, commercial vehicle sales, and hybrid powertrains.

Based on vehicle type, the global automotive brakes and clutches industry is divided into two-wheelers, heavy commercial vehicles, light commercial vehicles, and passenger cars.

Based on sales channel, the global market is divided into original equipment manufacturer (OEM) and aftermarket. In 2024, the highest revenue was listed in the original equipment manufacturer (OEM) segment. Brakes and clutches are the most integral components of all vehicles. They are pre-installed in all new automobiles by the automakers, helping fuel segmental demand. Growing awareness of vehicle safety will help fuel greater revenue in the market during the projection period.

Automotive Brakes And Clutches Market: Regional Analysis

Why will Asia-Pacific lead the automotive brakes and clutches market during the projection period?

The global automotive brakes and clutches market is expected to be led by Asia-Pacific during the projection period. It is anticipated to deliver a CAGR of more than 5.56% during the forecast period. Growth in Asia-Pacific will be driven by the rising production of modern vehicles across major Asian countries such as India, China, and Japan. According to official reports, China produced more than 30 million vehicles in 2024. These countries are expected to spend heavily on upgrading automotive manufacturing infrastructure, further contributing to growing regional demand for brakes and clutches.

Europe is projected to emerge as the second-highest revenue generator in the automotive brakes and clutches industry in the coming years. It is anticipated to register a CAGR of more than 5.15% between 2025 and 2034. European countries such as Germany, Spain, and the Czech Republic are expected to help the region thrive during the projection period. Factors such as the growing demand for electric vehicles, increasing automobile production, and the rising focus on advanced braking and clutch systems will help fuel regional expansion. Additionally, the European luxury vehicle segment is projected to help the region achieve an unprecedented growth rate during the projection period.

Automotive Brakes And Clutches Market: Competitive Analysis

The global automotive brakes and clutches market is led by players such as:

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Aisin Corporation

- Brembo S.p.A.

- Nissin Kogyo Co. Ltd.

- Continental AG

- Hitachi Astemo Ltd.

- Valeo S.A.

- Akebono Brake Industry Co. Ltd.

- Schaeffler Group

Automotive Brakes And Clutches Market: Key Market Trends

Lightweight and high-performance friction materials

The automotive brakes and clutches industry is witnessing a growing trend toward the increased use of lightweight, high-performance friction materials rather than the traditionally used, heavier counterparts. This includes applications of novel solutions in discs, brake pads, and clutch facings for improved performance.

Supply chain volatility

Increasing steel and composite material prices have created price fluctuations of raw materials (base metal and composite) as much as 18% year-on-year, causing manufacturers to rethink their production planning and pricing processes.

The global automotive brakes and clutches market is segmented as follows:

By Product Type

- Clutches

- Brakes

By Vehicle Type

- Two-Wheelers

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Passenger Cars

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

List of Contents

Automotive Brakes And ClutchesIndustry Perspective:Key Insights:Automotive Brakes And Clutches OverviewAutomotive Brakes And Clutches DynamicsReport ScopeAutomotive Brakes And Clutches SegmentationAutomotive Brakes And Clutches Regional AnalysisAutomotive Brakes And Clutches Competitive AnalysisAutomotive Brakes And Clutches Key Market TrendsThe global automotive brakes and clutches market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed