Aromatic Compounds Market Size, Share, Trends, Growth & Forecast 2034

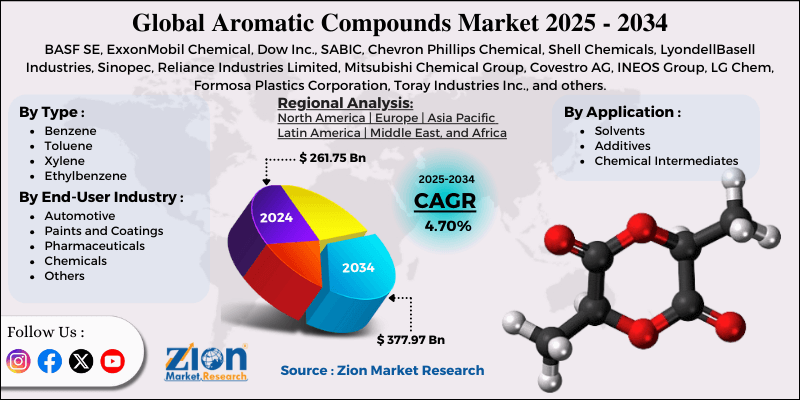

Aromatic Compounds Market By Type (Benzene, Toluene, Xylene, Ethylbenzene, and Others), By Application (Solvents, Additives, Chemical Intermediates, and Others), By End-User Industry (Automotive, Paints and Coatings, Pharmaceuticals, Chemicals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

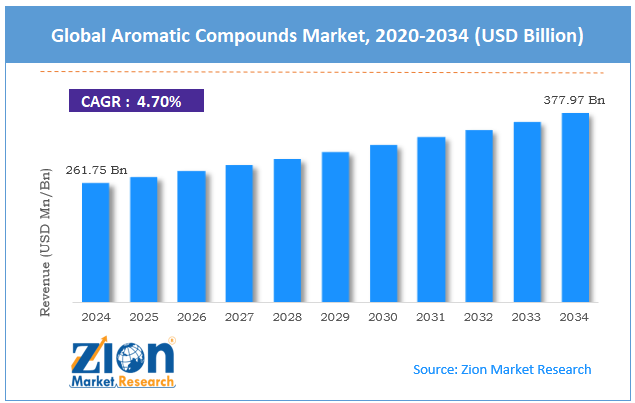

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 261.75 Billion | USD 377.97 Billion | 4.70% | 2024 |

Aromatic Compounds Industry Perspective:

The global aromatic compounds market size was approximately USD 261.75 billion in 2024 and is projected to reach around USD 377.97 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global aromatic compounds market is estimated to grow annually at a CAGR of around 4.70% over the forecast period (2025-2034)

- In terms of revenue, the global aromatic compounds market size was valued at around USD 261.75 billion in 2024 and is projected to reach USD 377.97 billion by 2034.

- The aromatic compounds market is projected to grow significantly due to the increasing use in agrochemicals and pharmaceuticals, rising consumption in paints and coatings, and the expansion of infrastructure and construction projects.

- Based on type, the benzene segment is expected to lead the market, while the toluene segment is expected to grow considerably.

- Based on application, the chemical intermediates segment is the largest, while the solvents segment is projected to experience substantial revenue growth over the forecast period.

- Based on end-user industry, the chemicals segment is expected to lead the market, followed by the automotive segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Aromatic Compounds Market: Overview

Aromatic compounds belong to organic chemicals classified by one or more planar ring structures with delocalized π-electrons, most usually represented by benzene and its derivatives. They are renowned for their distinctive odors, wide range of industrial applications, and stability. The global aromatic compounds market is expected to expand rapidly, driven by growing demand from the petrochemical industry, the rise in the polymers and plastics sectors, and the expansion of the automotive industry. Aromatic compounds are vital feedstocks for petrochemical derivatives like aniline, phenol, and styrene. The worldwide petrochemical industry surpassed $600 billion in 2023, with a steady CAGR anticipated by 2030, propelling aromatic consumption.

Aromatic derivatives, such as terephthalic acid and styrene, play a vital role in the production of polyester and plastic. With plastic production worldwide exceeding 400 million tonnes per year, the demand for aromatics is expected to continue rising. Moreover, aromatics are used in the production of synthetic rubber, lightweight plastics, and coatings, which facilitates automotive production. The growing adoption of electric vehicles and worldwide car sales surpassing 90 million units each year are driving consumption.

Despite the growth, the global market is hindered by factors such as environmental concerns and toxicity, varying crude oil prices, and a growing inclination towards green chemistry. Many aromatics, comprising benzene, are harmful and carcinogenic. Strict norms on their use and emissions offer intricacies for manufacturers. Furthermore, since aromatics are derived from crude oil, fluctuations in global oil prices affect the cost of raw materials, leading to unpredictable margins.

Additionally, rising industry and consumer preference for bio-based substitutes puts pressure on petrochemical-based aromatics. Nonetheless, the global aromatic compounds industry stands to gain from a few key opportunities, like bio-based aromatic compounds, improvements in recycling solutions, and the rise in EVs. The development of aromatics from renewable sources, such as biomass and lignin, offers ecological growth opportunities. Likewise, the chemical recycling of plastics back into aromatic monomers offers a circular economy, ensuring a stable supply and reducing waste. Additionally, EVs require advanced costings and lightweight composites derived from aromatics, creating new demand segments.

Aromatic Compounds Market Dynamics

Growth Drivers

How are technological advancements in aromatic derivatives driving the aromatic compounds market?

Advancements in aromatic compound derivatives are offering fresh application domains in electronics, chemicals, and performance materials. Recent improvements comprise bio-based aromatics production, which resolves sustainability issues without compromising performance. In 2024, Covestro announced pilot projects for generating circular aromatics from waste feedstock, supporting the EU's carbon-neutral targets. This technological progress is transforming the aromatic compounds market dynamics by offering more improved and greener aromatics applications.

How does an expanding role in pharmaceuticals and healthcare remarkably fuel the aromatic compounds market?

Aromatic compounds serve as vital intermediates in the production of antiseptics, anesthetics, pharmaceutical formulations, and active pharmaceutical ingredients. With the pharmaceutical industry exceeding USD 1.5 trillion worldwide in 2023, the role of aromatics has progressed remarkably. Benzene derivatives, such as aniline and phenol, are extensively used in the synthesis of paracetamol, aspirin, and antibiotics.

The COVID-19 pandemic increased the demand for APIs and aromatic-based disinfectants, which is expected to continue as healthcare systems strengthen post-2023. In early 2024, Novartis and Pfizer announced long-term procurement contracts with suppliers for aromatic-based intermediates, promising drug security and highlighting the crucial role these intermediates play in the pharmaceutical industry.

Restraints

Supply chain disruptions and geopolitical risks hamper the market progress

The global market is vulnerable to supply chain instability stemming from geopolitical tensions, logistical challenges, and trade restrictions. The Russia-Ukraine war in 2022-2023 disturbed petrochemical feedstock and crude oil supplies, increasing costs for European manufacturers.

Likewise, in early 2024, shipping delays in the Suez Canal and the Red Sea resulted in spikes in freight prices for aromatic derivatives. These supply chain stocks increase the difficulty for sectors dependent on aromatics to maintain production continuity. According to the reports, chemical manufacturers in Asia experienced shipment delays of nearly 6 weeks, affecting aromatic exports to North America and Europe.

Opportunities

How are growing applications in specialty chemicals creating promising avenues for the aromatic compounds industry?

Beyond conventional petrochemicals, aromatics are primarily used in specialty chemicals, such as coatings, adhesives, and performance materials. The worldwide specialty chemicals industry surpassed $900 billion in 2023, with aromatics playing a crucial role in high-performance composites and resins. Aromatic-based polymers play a vital role in electronics, advanced coatings, and aerospace applications.

In 2024, BASF announced growth in its aromatic intermediates product line, targeting specialty chemical manufacturers in Asia and Europe. This diversification into specialty markets helps aromatics gain resilience against regulatory risks and crude oil volatility, which impacts the growth of the aromatic compounds industry.

Challenges

Increasing competition from substitutes limits the market growth

Industries are steadily adopting alternatives for aromatics, mainly in coatings and packaging. Alternatives like water-based coatings, bio-based polymers, and safer solvents are decreasing dependency on toluene, benzene, and xylene. The bio-based plastics industry alone registered $ 10 billion in 2023 and is progressing at more than 12% CAGR. NatureWorks and Avantium are increasingly developing renewable PLA and PET as substitutes for aromatic-based plastics. This substitutional trend poses a significant long-term challenge to traditional aromatic industries.

Aromatic Compounds Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aromatic Compounds Market |

| Market Size in 2024 | USD 261.75 Billion |

| Market Forecast in 2034 | USD 377.97 Billion |

| Growth Rate | CAGR of 4.70% |

| Number of Pages | 217 |

| Key Companies Covered | BASF SE, ExxonMobil Chemical, Dow Inc., SABIC, Chevron Phillips Chemical, Shell Chemicals, LyondellBasell Industries, Sinopec, Reliance Industries Limited, Mitsubishi Chemical Group, Covestro AG, INEOS Group, LG Chem, Formosa Plastics Corporation, Toray Industries Inc., and others. |

| Segments Covered | By Type, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aromatic Compounds Market: Segmentation

The global aromatic compounds market is segmented based on type, application, end-user industry, and region.

Based on type, the global aromatic compounds industry is categorized into benzene, toluene, xylene, ethylbenzene, and other compounds. The benzene segment held a leading position in the market due to its vital role as a feedstock in the production of phenol, styrene, and cyclohexane. These derivatives are crucial for manufacturing resins, plastics, rubbers, and synthetic fibers, which are used in the construction, automotive, and packaging industries. Moreover, benzene's stable demand is driven by continuous consumption in the chemical and pharmaceutical sectors, reinforcing its segmental dominance.

Based on application, the global aromatic compounds market is segmented into solvents, additives, chemical intermediates, and others. The chemical intermediates segment held a leading share of the market, as aromatics such as xylene, benzene, and toluene are primary feedstocks for producing phenol, styrene, ethylbenzene, and other chemicals. These intermediates are crucial for the manufacture of plastics, adhesives, resins, and rubber, thereby fueling broader industrial demand. The continuous growth of the petrochemical, construction, and automotive sectors strengthens the segmental prominence.

Based on end-user industry, the global market is segmented into automotive, paints and coatings, pharmaceuticals, chemicals, and others. The chemicals industry is the dominant segment, as aromatics such as xylene, benzene, and toluene are vital feedstocks for generating a wide range of chemical products. These comprise resins, synthetic fibers, plastics, adhesives, and rubber, which are essential for several downstream sectors. Consistent growth in specialty chemicals, petrochemicals, and industrial manufacturing suggests that the chemical industry will remain the leading consumer of these compounds.

Aromatic Compounds Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Aromatic Compounds Market?

The Asia Pacific is expected to maintain its leading position in the global aromatic compounds market, driven by its dominance in petrochemical and chemical manufacturing, the growth of the automotive and consumer goods sectors, and the expansion of the polyester and textile industries. APAC houses the leading petrochemical and chemical production facilities, especially in India, China, and South Korea. China alone registered for more than 40% of the worldwide chemical production, with aromatic compounds forming a significant share of petrochemical outputs. The presence of integrated petrochemical complexes ensures easy access to feedstocks like toluene, benzene, and xylene, thereby decreasing costs and driving production.

Likewise, the growing consumer goods and automotive industries in APAC primarily drive the demand for aromatic compounds. Vehicle production in India and China combined exceeded 35 million units in 2023, with aromatics used in the production of synthetic rubber, coatings, and plastics. Speedy rise in electronics, consumer appliances, and packaging further contributes to the need for aromatic-based resins and polymers.

Furthermore, the Asia Pacific region holds a leadership position in the polyester and textile market, particularly in China, Vietnam, and India. Aromatic compounds, such as para-xylene, are crucial for the production of polyester fibers, which in turn support the manufacturing of industrial fabrics, clothing, and packaging materials. The region accounts for more than 60% of the worldwide polyester output, driving a remarkable consumption of aromatic feedstock.

North America ranks as the second-leading region in the global aromatic compounds industry, due to its strong petrochemical and chemical industry base, high demand from the aerospace and automotive sectors, and the rise in specialty chemicals and pharmaceuticals. North America, especially the United States, has a well-developed petrochemical and chemical industry, producing toluene, benzene, and xylene on a large scale. The region's chemical production value exceeded $900 billion in 2023, with aromatics accounting for a remarkable share. Advanced refinery infrastructure and access to shale-obtained feedstocks promise cost-efficacy and high-volume aromatic compound production.

Furthermore, the aerospace and automotive industries in North America fuel primary aromatic consumption for synthetic rubber, plastics, adhesives, and coatings. The United States registered production of over 15 million units in 2023, while aerospace manufacturing added $250 billion to the economy; both were significantly reliant on aromatic-derived materials. This steady industrial demand reinforces the region's second-place ranking in the market.

The area is also a hub for specialty chemicals and pharmaceuticals, where aromatic compounds serve as vital intermediates in the production of these products. The United States pharmaceutical industry surpassed $600 billion in 2023, with aromatic-based APIs and intermediates extensively used. High R&D investments and production capabilities drive stable demand for aromatic compounds in these sectors.

Aromatic Compounds Market: Competitive Analysis

The leading players in the global aromatic compounds market are:

- BASF SE

- ExxonMobil Chemical

- Dow Inc.

- SABIC

- Chevron Phillips Chemical

- Shell Chemicals

- LyondellBasell Industries

- Sinopec

- Reliance Industries Limited

- Mitsubishi Chemical Group

- Covestro AG

- INEOS Group

- LG Chem

- Formosa Plastics Corporation

- Toray Industries Inc.

Aromatic Compounds Market: Key Market Trends

Regional capacity expansion and production shifts in the Asia Pacific:

The APAC region, particularly India and China, continues to invest significantly in aromatic production capacities. New refineries and petrochemical complexes are being established to meet the increasing demand for exports and domestic consumption. This regional focus promises supply stability and reinforces the leadership of APAC in the worldwide market.

Improvements in recovery and processing:

Improvements in catalytic reforming, purification technologies, and solvent recovery are enhancing the efficiency of aromatic compound production. Improved processing methods lower energy consumption, reduce production costs, and minimize waste. Companies that adopt these solutions gain a competitive advantage while meeting stringent environmental standards.

The global aromatic compounds market is segmented as follows:

By Type

- Benzene

- Toluene

- Xylene

- Ethylbenzene

- Others

By Application

- Solvents

- Additives

- Chemical Intermediates

- Others

By End-User Industry

- Automotive

- Paints and Coatings

- Pharmaceuticals

- Chemicals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aromatic compounds belong to organic chemicals classified by one or more planar ring structures with delocalized π-electrons, most usually represented by benzene and its derivatives. They are renowned for their distinctive odors, wide range of industrial applications, and stability.

The global aromatic compounds market is projected to grow due to the increasing demand in the petrochemical industry, the rise of transportation and automotive sectors, and improvements in processing and refining.

According to study, the global aromatic compounds market size was worth around USD 261.75 billion in 2024 and is predicted to grow to around USD 377.97 billion by 2034.

The CAGR value of the aromatic compounds market is expected to be around 4.70% during 2025-2034.

Stringent environmental regulations on the handling of toxic chemicals, emissions, and solvent usage are driving the shift toward sustainable, safer aromatic alternatives, thereby limiting production.

Macroeconomic factors, including industrial growth, crude oil price volatility, and global trade dynamics, will directly impact production demand, costs, and market growth for aromatic compounds.

North America is expected to lead the global aromatic compounds market during the forecast period.

The key players profiled in the global aromatic compounds market include BASF SE, ExxonMobil Chemical, Dow Inc., SABIC, Chevron Phillips Chemical, Shell Chemicals, LyondellBasell Industries, Sinopec, Reliance Industries Limited, Mitsubishi Chemical Group, Covestro AG, INEOS Group, LG Chem, Formosa Plastics Corporation, and Toray Industries, Inc.

Stakeholders should focus on technological innovation, capacity expansion, strategic partnerships, and sustainable production to maintain a competitive edge in the market.

The report examines key aspects of the aromatic compounds market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed