Green and Bio-Based Solvents Market Size, Share, Trends, Growth and Forecast 2034

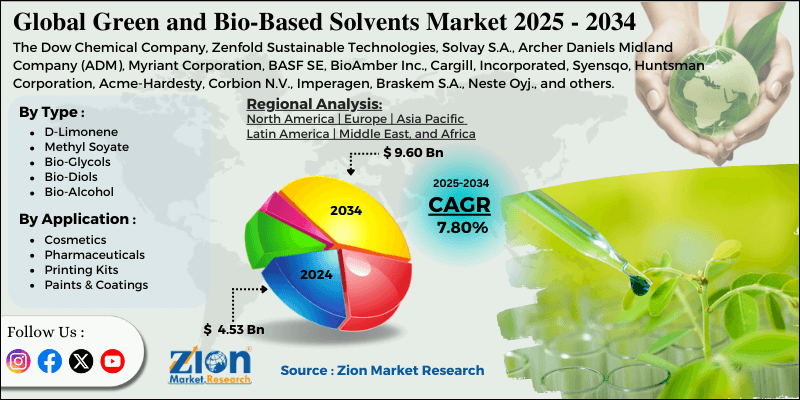

Green and Bio-Based Solvents Market By Type (D-Limonene, Methyl Soyate, Bio-Glycols, Bio-Diols, Bio-Alcohol, and Others), By Application (Cosmetics, Pharmaceuticals, Printing Kits, Industrial & Domestic Cleaners, Paints & Coatings, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

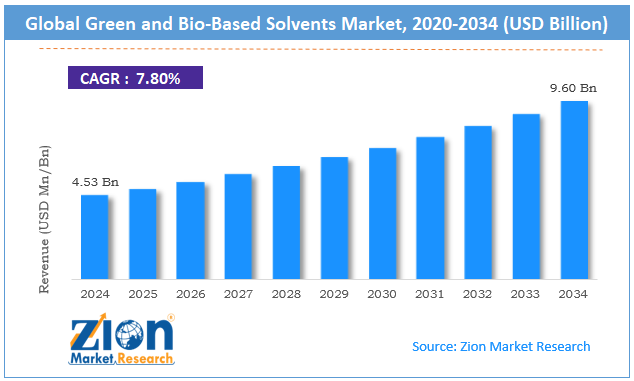

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.53 Billion | USD 9.60 Billion | 7.80% | 2024 |

Green and Bio-Based Solvents Industry Perspective:

The global green and bio-based solvents market size was worth around USD 4.53 billion in 2024 and is predicted to grow to around USD 9.60 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.80% between 2025 and 2034.

Green and Bio-Based Solvents Market: Overview

Green and bio-based solvents are an emerging section of the broader solvent industry. It deals with the production and application of solvents that are environmentally friendly and do not pose a significant threat to the ecosystem, including the health of living organisms. Traditionally used solvents across industries such as paint & printing, cosmetic & personal care, chemical & materials, and other sectors are toxic and in some cases extremely hazardous.

In addition to this, they remain in the environment for a longer time and are non-biodegradable. The growing environmental concerns regarding the excessive use of traditional harmful solvents have fueled greater demand for non-toxic and biodegradable elements, including green and bio-based variants. Some examples of green solvents include water, supercritical fluids, and ionic liquids.

Bio-based solvents, on the other hand, are a special segment of green solvents as they are primarily produced using renewable sources such as algae and plants. Some of the most common forms of bio-based solvents include ethanol, glycerol, and lactic acid.

During the forecast period, the increasing demand for cleaner and environmentally friendly solvent solutions in end-user industries will fuel the market growth rate. However, increasing competition from traditional solvent solutions may impact overall revenue from the industry.

Key Insights:

- As per the analysis shared by our research analyst, the global green and bio-based solvents market is estimated to grow annually at a CAGR of around 7.80% over the forecast period (2025-2034)

- In terms of revenue, the global green and bio-based solvents market size was valued at around USD 4.53 billion in 2024 and is projected to reach USD 9.60 billion by 2034.

- The green and bio-based solvents market is projected to grow at a significant rate due to the increasing demand for biofuel in the automotive industry.

- Based on the type, the d-limonene segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the industrial & domestic cleaners segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Green and Bio-Based Solvents Market: Growth Drivers

Increasing demand for biofuel in the automotive industry to propel market expansion rate

The global green and bio-based solvents market is expected to grow due to the rising demand for environmentally friendly biofuels in the automotive sector. Ethanol, a biosolvent, has gained widespread popularity as the next-generation fuel for powering automotive. Government regulations concerning the use of ethanol in commercial and passenger vehicles have also improved in the last few years.

For instance, pure ethanol is used to power racing cars in certain parts of the world. Ethanol blends containing some ethanol and remaining gasoline are the most popular ethanol variants used by automobile companies.

In October 2024, Novonesis, previously known as Novozymes, announced the launch of Innova Eclipse. It is the latest yeast innovation aiming to improve outputs from the ethanol-producing industry. The technology will allow ethanol producers to optimize the fermentation process and ensure higher cost-efficiency.

In January 2025, the U.S. Department of Energy (DOE) Advanced Research Projects Agency-Energy (ARPA-E) announced USD 38 million for funding 9 projects for developing novel technologies that will significantly reduce the use of synthetic nitrogen fertilizer in the production of sorghum and corn, essential for producing ethanol.

Increasing shift of chemical producers in the world toward bio-based solvents to generate significant growth revenue

Chemical companies, including some leading chemical producers worldwide, are increasingly shifting toward plant-based alternatives to keep up with the changing end-user demand and evolving government mandates.

For instance, in August 2024, BASF, one of the world’s most dominant chemical companies, announced that it will switch its (Meth)Acrylate portfolio to bio-based Ethyl Acrylate (EA) offering low Production Carbon Footprint.

In April 2024, Merch, a global and dominant science company, launched Cyrene. The new solution in the global green and bio-based solvents market is a highly sustainable dipolar aprotic solvent produced from renewable cellulose sources. The company was encouraged to innovate as a result of meeting strict regulations concerning environmental sustainability and employee safety in European nations.

Green and Bio-Based Solvents Market: Restraints

High upfront costs of development and application to limit market expansion

The global green and bio-based solvents industry is expected to be restricted by the high initial cost of investment for researching and developing environmentally friendly, non-toxic solvents.

The overall production rate of final goods depends on the availability and quality of raw materials, especially in the case of high-grade green and bio-based solvents. Additionally, the production complexities along with challenges associated with scaling the output volumes of such solvents can further act as a growth barrier.

Green and Bio-Based Solvents Market: Opportunities

Increased demand for organic and chemical-free solvents for the personal care industry to create growth opportunities

The global green and bio-based solvents market is projected to generate growth opportunities due to the increasing demand for organic solvents in the cosmetics and personal care industry. In most cases, companies producing makeup products or skin care items use solvents produced using chemical ingredients. However, a large number of the end-users are allergic to certain chemical ingredients.

On the other hand, organic raw materials containing skin care products are known to have several advantages in improving skin health and reducing the negative impact on the environment.

In February 2025, Wanhua Chemical announced the launch of bio-based 1,3-butylene glycol at the PCHi exhibition. The chemical is designed to be used in moisturizers and solvents across products such as sunscreens, cleansers, and serums.

In April 2024, Advancion Corporation introduced a novel bio-based multifunctional amino alcohol, especially to be used in the beauty and personal care industry. The new solution developed by the company consists of 50% bio-based ingredients and delivers exceptional end results, including pigment dispersion, emulsion stabilization, and high-efficiency neutralization.

Green and Bio-Based Solvents Market: Challenges

Growing competition from traditionally used solvents and regulatory limitations impede the market expansion rate

The global green and bio-based solvents industry is expected to be challenged by the increasing competition the market players are facing from producers of traditional solvents. Bio-based solvents may not show the expected results in certain applications compared to chemical-based solvents.

Moreover, the presence of a strict regulatory environment concerning the use of solvent types in end products such as chemicals, paints, and others may also impede market growth expansion trends.

Green and Bio-Based Solvents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Green and Bio-Based Solvents Market |

| Market Size in 2024 | USD 4.53 Billion |

| Market Forecast in 2034 | USD 9.60 Billion |

| Growth Rate | CAGR of 7.80% |

| Number of Pages | 215 |

| Key Companies Covered | The Dow Chemical Company, Zenfold Sustainable Technologies, Solvay S.A., Archer Daniels Midland Company (ADM), Myriant Corporation, BASF SE, BioAmber Inc., Cargill, Incorporated, Syensqo, Huntsman Corporation, Acme-Hardesty, Corbion N.V., Imperagen, Braskem S.A., Neste Oyj., and others. |

| Segments Covered | By Type, By Application, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Green and Bio-Based Solvents Market: Segmentation

The global green and bio-based solvents market is segmented based on type, application, and region.

Based on the type, the global market divisions are d-limonene, methyl soyate, bio-glycols, bio-diols, and others. In 2024, the highest revenue was generated by the d-limonene segment due to its extensive applications in major industrial settings.

D-limonene is produced from citrus peels and used extensively in adhesives and industrial cleansers. 1000 kilograms of citrus peels can produce up to 50 kg of Di-limonene. Methyl soyate is derived from soybean oil and offers cost-effective alternatives to petroleum-based solvents.

Based on the application, the green and bio-based solvents industry divisions are cosmetics, pharmaceuticals, printing kits, industrial & domestic cleaners, paints & coatings, and others.

In 2024, the highest demand rate was listed in the industrial & domestic cleaners segment, accounting for more than 30% of the market share. Industrial facilities worldwide are under intense regulatory governance to reduce the impact of business operations on the environment, leading to higher adoption of bio-based and green solvents.

Green and Bio-Based Solvents Market: Regional Analysis

North America to deliver the highest revenue during the forecast period

The global green and bio-based solvents market will be led by North America during the forecast period. In 2024, the US and Canada regions were the most dominant players in the regional market. In December 2024, the US Environmental Protection Agency (EPA) announced the launch of new rules for managing risks associated with perchloroethylene (PCE) and trichloroethylene (TCE) as per the 2016 Toxic Substances Control Act (TSCA) amendments.

TCE, a highly toxic chemical, is known to cause liver cancer, non-Hodgkin lymphoma, and kidney cancer, among other potential health hazards. The increasing demand for environmentally friendly solvents across major industries, including paints and coatings and automotive sectors, will promote regional market expansion.

Europe is a prominent market and is set to emerge as the fastest-growing region during the forecast period. Regional players are actively investing in new-age bio-based solvents with applications across industries.

The presence of strict government rules promoting employee safety and environmental consciousness will drive the regional demand rate. In March 2025, C1 Green Chemicals AG, a Berlin-based CleanTech startup, announced that it had secured EUR 20 million in funding to commercialize its green methanol catalysis technology.

Green and Bio-Based Solvents Market: Competitive Analysis

The global green and bio-based solvents market is led by players like:

- The Dow Chemical Company

- Zenfold Sustainable Technologies

- Solvay S.A.

- Archer Daniels Midland Company (ADM)

- Myriant Corporation

- BASF SE

- BioAmber Inc.

- Cargill

- Incorporated

- Syensqo

- Huntsman Corporation

- Acme-Hardesty

- Corbion N.V.

- Imperagen

- Braskem S.A.

- Neste Oyj.

The global green and bio-based solvents market is segmented as follows:

By Type

- D-Limonene

- Methyl Soyate

- Bio-Glycols

- Bio-Diols

- Bio-Alcohol

- Others

By Application

- Cosmetics

- Pharmaceuticals

- Printing Kits

- Industrial & Domestic Cleaners

- Paints & Coatings

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Green and bio-based solvents are an emerging section of the broader solvent industry.

The global green and bio-based solvents market is expected to grow due to the rising demand for environmentally friendly biofuels in the automotive sector.

According to study, the global green and bio-based solvents market size was worth around USD 4.53 billion in 2024 and is predicted to grow to around USD 9.60 billion by 2034.

The CAGR value of the green and bio-based solvents market is expected to be around 7.80% during 2025-2034.

The global green and bio-based solvents market will be led by North America during the forecast period.

The global green and bio-based solvents market is led by players like The Dow Chemical Company, Zenfold Sustainable Technologies, Solvay S.A., Archer Daniels Midland Company (ADM), Myriant Corporation, BASF SE, BioAmber Inc., Cargill, Incorporated, Syensqo, Huntsman Corporation, Acme-Hardesty, Corbion N.V., Imperagen, Braskem S.A., and Neste Oyj.

The report explores crucial aspects of the green and bio-based solvents market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed