AIOps Platform Market Size, Share, Value, Industry Trends 2034

AIOps Platform Market By Component (Platform, Services), By Deployment Mode (Cloud-Based, On-Premises, Hybrid), By Application (Application Performance Monitoring, Infrastructure Management, Network Management, Security Management, Log Analytics, and Others), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, Banking and Financial Services, Retail and E-commerce, Healthcare, Manufacturing, Government, and Others), By End-User (IT Operations Teams, DevOps Teams, Site Reliability Engineers, Network Operations, Security Operations), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

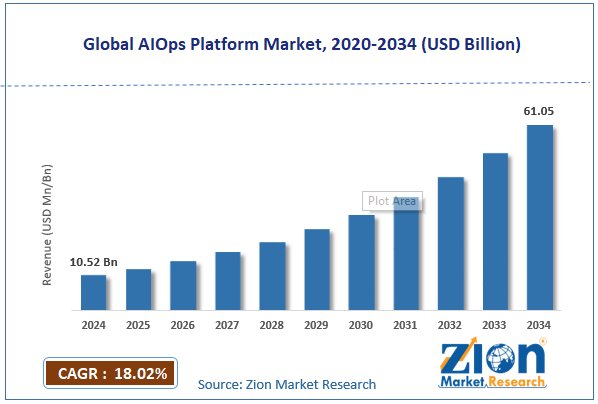

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.52 Billion | USD 61.05 Billion | 18.02% | 2024 |

AIOps Platform Industry Prospective

The global AIOps platform market size was worth approximately USD 10.52 billion in 2024 and is projected to grow to around USD 61.05 billion by 2034, with a compound annual growth rate (CAGR) of roughly 18.02% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global AIOps platform market is estimated to grow annually at a CAGR of around 18.02% over the forecast period (2025-2034).

- In terms of revenue, the global AIOps platform market size was valued at approximately USD 10.52 billion in 2024 and is projected to reach USD 61.05 billion by 2034.

- The AIOps platform market is projected to grow significantly due to rising IT infrastructure complexity, increasing cloud adoption, growing data volumes overwhelming traditional monitoring, expanding DevOps practices, and the critical need for faster incident resolution.

- Based on component, the platform segment is expected to lead the AIOps platform market, while the services segment is anticipated to experience significant growth.

- Based on deployment mode, the cloud-based segment is expected to lead the AIOps platform market, while the hybrid segment is anticipated to witness notable growth.

- Based on application, the application performance monitoring segment is the dominating segment, while the security management segment is projected to witness sizeable revenue over the forecast period.

- Based on organization size, the large enterprises segment is expected to lead the market compared to the small and medium enterprises segment.

- Based on industry vertical, the IT and telecommunications segment is expected to lead the market during the forecast period.

- Based on end-user, the IT operations teams segment is expected to lead compared to the DevOps teams segment.

- Based on region, North America is projected to dominate the global AIOps platform market during the estimated period, followed by Europe.

AIOps Platform Market: Overview

AIOps platforms are software tools that use artificial intelligence and machine learning to automate and manage day-to-day IT operations in a simple, efficient way. These platforms collect large volumes of data from servers, applications, networks, databases, and cloud systems to detect patterns and early signs of system issues. Machine learning models study normal system behavior and identify unusual activity linked to security risks, slow performance, or future equipment failures. Automated response features resolve many common problems by restarting services, adjusting system resources, or fixing known software errors without human effort. Root-cause tools trace the exact source of problems across connected systems, helping teams resolve issues much faster.

Predictive tools estimate future system needs and warn about rising usage before failures occur. Alert filtering reduces unnecessary warnings and groups related alerts for easier action. Dashboards display system health and performance in a clear visual format for daily monitoring and planning. These features help IT teams reduce downtime, improve system stability, and maintain smooth digital operations across business applications and cloud environments. The increasing complexity of IT infrastructure and growing adoption of cloud computing are expected to drive growth in the AIOps platform market throughout the forecast period.

AIOps Platform Market Dynamics

Growth Drivers

How are cloud migration and hybrid infrastructure complexity driving the AIOps platform market expansion?

The AIOps platform market grows fast as companies shift applications to cloud services and manage hybrid setups across data centers, clouds, and edge locations. Cloud use makes monitoring harder because applications run on many platforms, and each service creates log data and alerts in different formats. Multiple cloud plans spread workloads across big providers, which creates visibility issues as teams track performance across separate screens without one clear view. Containers and microservices increase system parts from hundreds of servers to thousands of changing units, which makes problem finding slow and difficult. Hybrid cloud and edge systems add remote locations and mixed tools, which require one common monitoring layer across offices, factories, stores, and platforms. Separate vendor tools and cloud use increase costs as auto-scaling grows resources quietly, and unexpected charges appear later in billing. These growing system layers increase daily workload for IT teams and raise strong demand for automated tools that simplify monitoring across complex cloud and hybrid environments.

Rising focus on digital transformation and customer experience

The global AIOps platform market shows strong growth as businesses focus on digital services and link application performance to customer revenue results. E-commerce companies lose sales within seconds when slow websites push shoppers away to faster competitor sites, which makes performance monitoring vital. Mobile applications face heavy competition, as users delete unstable apps after crashes, freezes, or slow response, which drives higher spending on reliability. Streaming services serve millions of viewers at once and need smart monitoring tools to fix video issues before users see buffering delays. Financial services handle real-time payments, where tiny delays affect trades and transactions, which demands tight performance control under heavy data loads. Customer demand for constant service, social media pressure, DevOps releases, and site reliability methods push companies to use AIOps for stable operations.

Restraints

How are data privacy concerns and regulatory compliance requirements creating key restraints for the AIOps platform market?

The AIOps platform industry faces difficulty as strict data protection laws and privacy rules limit how operational data moves across company systems and country borders. Personal details in application logs and system records create privacy risks when AIOps tools scan data for patterns and problem detection. European data laws restrict the export of operational data outside regional borders, complicating the use of cloud-based AIOps across global data centers. Healthcare and finance rules limit the sharing of sensitive records, which requires filtering of logs before data enters AIOps analysis systems. Data location rules force large companies to use separate AIOps systems in different countries, which reduces full system visibility. Security audits, encryption, demand data access control, and export rules raise costs, slow real-time analysis, and limit global AIOps expansion. These regulatory limits increase deployment costs, delay cloud integration plans, and reduce the flexibility needed for fast, unified AIOps operations across global business environments.

Opportunities

Growing adoption in small and medium enterprises

The AIOps platform industry shows a strong opportunity as small companies adopt cloud services and seek reliable technology operations with limited staff and growing digital dependence. Software service platforms remove heavy hardware spending and offer enterprise-level AIOps features through low monthly fees instead of large upfront investments. Managed service providers offer AIOps monitoring as a bundled service, allowing small firms to gain expert oversight without hiring large in-house operations teams. Small cloud-first businesses use modern systems, enabling AIOps setup without legacy equipment common in large, established organizations. Fast business growth increases system load beyond manual control and creates a strong need for automated operations management to prevent service failures. Online shops, remote teams, and digital startups rely on continuous system uptime, and AIOps tools protect revenue and daily operational continuity. Affordable vendor pricing plans and guided setup services further help small businesses start using AIOps tools without a heavy technical burden or large upfront spending.

Challenges

How is addressing skills shortages and learning-curve challenges affecting the AIOps platform market?

The AIOps platform market faces difficulty due to a shortage of skilled staff who understand both IT operations and data science needed for proper system use. Many companies struggle to find experts who can interpret algorithmic results and manage machine learning tools while maintaining operational knowledge. Training current IT teams takes a long time as workers learn data analysis model settings and new alert patterns beyond traditional system monitoring tasks. Operations teams often resist change as they prefer familiar tools and fear that automation may reduce job value and personal control. AIOps setup can feel complex due to data selection, alert tuning, integrations, and dashboard customization required before stable performance is achieved. Early use of the system can be frustrating due to false alerts during the learning phase, before models have adjusted to normal system behavior. Old tool investments, crowded vendor choices, integration complexity, and unclear return value further slow decision-making and adoption across many organizations.

AIOps Platform Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | AIOps Platform Market Research Report |

| Market Size in 2024 | USD 10.52 Billion |

| Market Forecast in 2034 | USD 61.05 Billion |

| Growth Rate | CAGR of 18.02% |

| Number of Pages | 220 |

| Key Companies Covered | Splunk Inc., IBM Corporation, Dynatrace, Micro Focus, BMC Software, New Relic, Datadog, AppDynamics, Moogsoft, BigPanda, Sumo Logic, LogicMonitor, ManageEngine, PagerDuty, and ScienceLogic |

| Segments Covered | By Component, By Deployment Mode, By Organization Size, By Application, By Industry Vertical, By End User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

AIOps Platform Market: Segmentation

The global AIOps platform market is segmented based on component, deployment mode, application, organization size, industry vertical, end-user, and region.

Based on the component, the AIOps platform industry is segmented into platform and services. Platform leads the market due to its core functionality, providing the engine for data analysis and automated operations, and its recurring revenue from subscriptions.

Based on deployment mode, the industry is divided into cloud-based, on-premises, and hybrid. Cloud-based leads the market due to lower initial costs without infrastructure investments, and faster deployment timelines with instant access to updates.

Based on application, the AIOps platform market is classified into application performance monitoring, infrastructure management, network management, security management, log analytics, and others. Application performance monitoring is expected to lead the market during the forecast period due to direct business impact on customer experience and revenue, and the critical importance of maintaining digital service availability.

Based on organization size, the market is segregated into small and medium enterprises and large enterprises. Large enterprises hold the largest market share due to greater IT infrastructure complexity requiring automation at scale, larger budgets for operations tools and innovation, and existing investments in monitoring systems that create natural upgrade paths to AIOps capabilities.

Based on industry vertical, the market is classified into IT and telecommunications, banking and financial services, retail and e-commerce, healthcare, manufacturing, government, and others. IT and telecommunications hold the largest market share due to their technology leadership, early adoption, massive infrastructure scale that generates overwhelming data volumes, and dependence on system reliability for business operations.

Based on end-user, the market is categorized into IT operations teams, DevOps teams, site reliability engineers, network operations, and security operations. IT operations teams hold the largest market share due to their traditional responsibility for system monitoring and incident response, and a broad mandate covering all infrastructure and application operations requiring AIOps capabilities.

AIOps Platform Market: Regional Analysis

North America leads due to technology innovation and early adoption

North America leads the AIOps platform market due to technology firms' IT systems and innovation culture supporting early artificial intelligence use. The United States hosts major cloud providers such as Amazon Web Services, Microsoft Azure, and Google Cloud, which operate large-scale systems that require automated operations tools. Technology hubs across North America gather AI talent, startup companies, and investment funding, which helps AIOps ideas move quickly from research into usable products. Large enterprises in the region operate highly complex IT environments that serve as testing grounds for AIOps platforms and shape product feature development. High labor costs increase the appeal of automation as AIOps platforms reduce the need for large teams constantly watching systems and handling alerts day and night. Digital transformation programs across many industries place a strong focus on customer experience and service stability, which supports spending on intelligent operations platforms. Banking firms, technology companies, and telecommunication providers in North America manage large data volumes, which drives heavy demand for automated operations management.

DevOps and site reliability engineering practices grew strongly in North America, creating demand for AIOps platforms that support automation, monitoring, and service control. Balanced regulation in the region supports innovation while protecting users, which allows AIOps companies to test, improve, and launch products with fewer delays. Early cloud adoption across North America created hybrid and multi-cloud systems, which increased complexity and raised the need for automated operations tools. A strong focus on clear business returns drives companies to value the automation, savings, uptime protection, and performance gains of AIOps platforms, despite the setup effort.

What is driving Europe's steady growth in the AIOps platform market?

Europe shows steady growth in the AIOps platform market as digital programs, regulations, and rising cloud use increase demand across many industries. Banking and finance centers in London, Frankfurt, and other cities operate critical systems that, if disrupted, can cause major losses and necessitate spending on monitoring tools. Manufacturing digital work across Germany, France, and Northern Europe links IT operations with production, where reliability affects output quality and delivery timing. Telecommunication networks serving dense populations across short distances need advanced network control, which AIOps platforms support through automated observation and performance tuning. Online retail growth among users with high service expectations adds pressure to keep applications stable during seasonal demand peaks and large promotions. Data protection rules under European law require close control of information handling and support the use of AIOps for system activity records.

Health system digital programs use electronic records and remote care tools where service reliability affects patient safety and daily hospital operations. Smart city projects in urban areas create data on traffic, power, and public services, which AIOps tools study for operations. Environmental regulations and green goals push data centers to improve energy efficiency, while AIOps platforms guide load balancing and resource planning. Shortage of skilled IT staff across Europe raises the value of automation as companies struggle to manage growing system loads with limited teams. Cross-border business inside the European Union uses shared digital systems where AIOps platforms offer one view across countries and locations.

Recent Developments

- In August 2025, Fabrix.ai announced recognition from Enterprise Management Associates (EMA) for its “agentic AI operations” platform, highlighting enterprise-ready AIOps integration and operational maturity across complex IT environments.

- In April 2025, Datadog was named a leader in AIOps by an independent analyst report for its ability to reduce alert noise and help IT teams focus on meaningful incidents using AI-driven correlation and filtering across diverse data sources.

AIOps Platform Market: Competitive Analysis

The leading players in the global AIOps platform market are

- Splunk Inc

- IBM Corporation

- Dynatrace

- Micro Focus

- BMC Software

- New Relic

- Datadog

- AppDynamics

- Moogsoft

- BigPanda

- Sumo Logic

- LogicMonitor

- ManageEngine

- PagerDuty

- ScienceLogic

The AIOps platform market is segmented as follows:

By Component

- Platform

- Services

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid

By Application

- Application Performance Monitoring

- Infrastructure Management

- Network Management

- Security Management

- Log Analytics

- Others

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- Banking and Financial Services

- Retail and E-commerce

- Healthcare

- Manufacturing

- Government

- Others

By End User

- IT Operations Teams

- DevOps Teams

- Site Reliability Engineers

- Network Operations

- Security Operations

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed