Women's Health App Market Size, Share, Trends, Growth and Forecast 2034

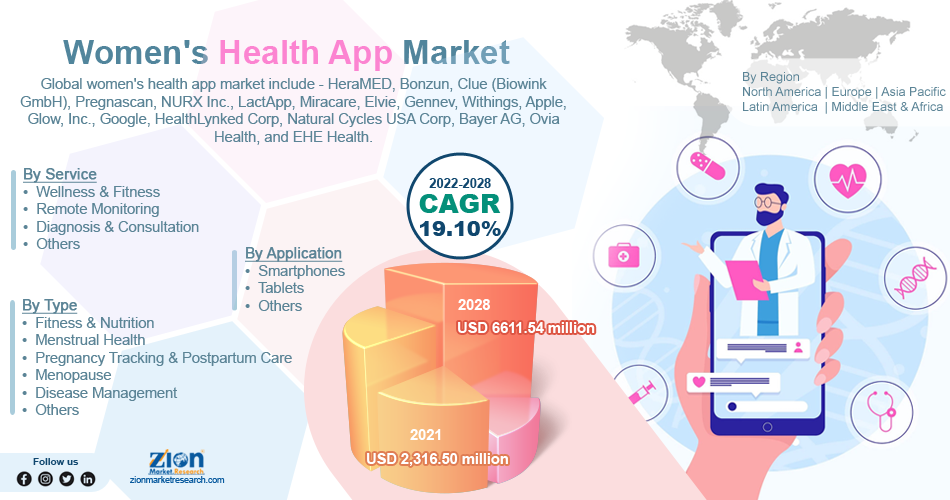

Women's Health App Market By Type (Fitness & Nutrition, Menstrual Health, Pregnancy Tracking & Postpartum Care, Menopause, Disease Management, and Others), By Service (Wellness & Fitness, Remote Monitoring, Diagnosis & Consultation, and Others) By Application (Smartphones, Tablets, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

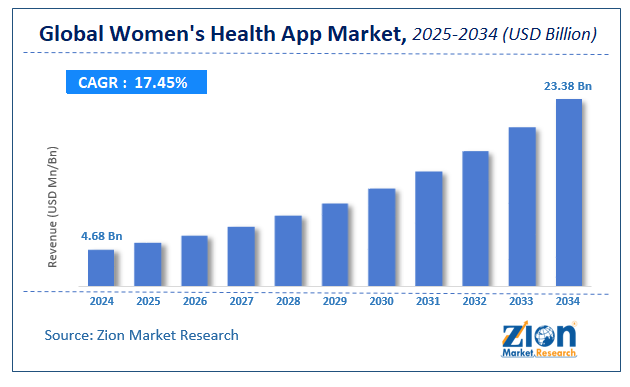

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.68 Billion | USD 23.38 Billion | 17.45% | 2024 |

Women's Health App Market: Industry Perspective

The global women's health app market size was worth USD 4.68 Billion in 2024 and is estimated to grow to USD 23.38 Billion by 2034, with a compound annual growth rate (CAGR) of approximately 17.45% between 2025 and 2034. The report analyzes the women's health app market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the women's health app market.

Women's Health App Market: Overview

Numerous health-related services are offered via women's health apps, which are accessible on smartphones and tablet computers. The entire menstrual health information is available on women's health apps, which are also used to track pregnancies. The women's health app has numerous trackers, including ones for menstruation, pregnancy, and general female health. Additionally, there are many different women's health apps available, including a tracker for women's periods & fertility, a pregnancy app, and a birth control app. Through a range of women's health applications made possible by current technology, women's health concerns are better managed. The increased penetration of smartphones and the rising prevalence of disorders among women are anticipated to fuel the global women’s health app market expansion. Changes in diet, stress and alcohol consumption are significant contributors to hormone abnormalities in women. Many postmenopausal disorders, including osteoarthritis (OA), anemia, obesity, irregular menstruation, depression, and fibromyalgia, are more common in women. The prevalence of OA is predicted to rise as the population ages and obesity rates rise. The market expansion is anticipated to be fueled by the increased prevalence of anemia and the introduction of disease-specific treatments. The market is anticipated to grow as female arthritis prevalence rises. By modifying daily routines and establishing healthy behaviors, arthritis can be reduced. The use of software for women's welfare is being aided by increasing public and private funding. The money will be invested to assist women's health, including financing for endometriosis, breast, & cervical cancer research, and reproductive health. Market expansion is being fueled by rising startup funding and the entry of new companies.

Key Insights

- As per the analysis shared by our research analyst, the global women's health app market is estimated to grow annually at a CAGR of around 17.45% over the forecast period (2025-2034).

- Regarding revenue, the global women's health app market size was valued at around USD 4.68 Billion in 2024 and is projected to reach USD 23.38 Billion by 2034.

- The women's health app market is projected to grow at a significant rate due to increasing awareness of menstrual, reproductive, and overall women’s health, smartphone penetration, and demand for personalized digital health solutions.

- Based on Type, the Menstrual Health segment is expected to lead the global market.

- On the basis of Platform, the Smartphones segment is growing at a high rate and will continue to dominate the global market.

- Based on the Age Group, the Teenagers segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

COVID-19 Impact:

The COVID-19 pandemic outbreak has accelerated the global uptake of digital technologies. Consumer preference for health-related digital services is growing, which is encouraging the populace to adopt mHealth apps. Due to cancellations or delays in doctor's appointments and the risk of infection, the pandemic increased the demand for fitness, mental health, and pregnancy & postpartum care applications. To track their health and get answers to their questions, expectant and new mothers began utilizing pregnancy and postnatal recovery apps.

Women's Health App Market: Growth Drivers

Increasing adoption of smartphones is likely to pave the way for global market growth

Internet and smartphone adoption is anticipated to soar in the coming years. At the end of 2019, the ITU estimates that 4 billion people used the internet worldwide. This number of internet users is anticipated to increase as a result of a number of causes, including the increasing adoption of smartphones, urbanization, the increasing uptake of 5G technology, and the increasing accessibility of mobile data. During the projected period, all of these factors are anticipated to propel the expansion of the global women's health app market.

Women's Health App Market: Restraints

Lack of regulation may hamper the global market growth

Lack of regulation in the health app industry is one of the issues that would limit the growth of the women's health app market. The market will face challenges since health apps are generally regarded as low risk because they are non-invasive, do not require implanting, and do not need regulatory controls to safeguard consumers from injury.

Women's Health App Market: Opportunities

Menstrual tracking apps attracting considerable popularity to bring up several growth opportunities

The market for women's health apps is predicted to experience tremendous growth thanks to the menstrual apps category. These apps support women who want to get pregnant by helping them track ovulation. A classic example is the game Clue. This tool offers tracking options for breakouts brought on by periods, PMS headaches, etc. Thus, the market for women's health applications has a lot of room for growth, thanks to these apps.

Women's Health App Market: Segmentation

The global women's health app market is segregated on the basis of type, service, application, and region.

By type, the market is divided into fitness & nutrition, menstrual health, pregnancy tracking & postpartum care, menopause, disease management and others. In 2021, the menstrual health market category held the biggest market share, contributing more than 37% of total revenue. This is a result of women's growing awareness of the significance of maintaining personal cleanliness during menstrual cycles. Globally widespread use of period monitoring apps and the addition of cutting-edge features & products by major providers are driving the segment's expansion. Due to the growing popularity of fitness applications and growing consumer interest in wellness therapies, the fitness and nutrition industry is expected to experience rapid expansion.

Based on service, the market is divided into wellness & fitness, remote monitoring, diagnosis & consultation and others.

By application, the market is divided into smartphones, tablets and others. Over the forecast period, the smartphone segment is expected to develop at the fastest rate. The population's increasing use of smartphones and internet connectivity is increasing the demand for women's health apps. These apps offer support with menstrual cycles, physical wellness, weight management, tracking & predicting ovulation, as well as a number of other health-related issues.

Recent Developments

-

In June 2022, menstrual tracking was introduced by the women's hygiene company Sirona on WhatsApp. By simply sending "Hello" to Sirona's WhatsApp business account, consumers can use the WhatsApp time monitoring tool to keep track of their period.

- In March 2021, ClueBirth Control, digital contraception that statistically predicts ovulation and is used to avoid pregnancy, was approved by the FDA for release.

Women's Health App Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Women's Health App Market |

| Market Size in 2024 | USD 4.68 Billion |

| Market Forecast in 2034 | USD 23.38 Billion |

| Growth Rate | CAGR of 17.45% |

| Number of Pages | 244 |

| Key Companies Covered | Flo Health Inc., Clue, Apple Inc., Glow Inc., Withings, Fitbit Inc., Natural Cycles, Wildflower Health, HelloBaby Inc., Ovia Health, and others. |

| Segments Covered | By Type, By Platform, By Age Group, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Women's Health App Market: Regional Landscape

Rising use of smartphones likely to help North America dominate the global market

North America is expected to dominate the global women's health app market with the largest share of more than 39% of the global revenue in 2021. This is due to the growing use of smartphones and the government's desire to reduce healthcare expenses. The region's market is growing due to the increased adoption of technologically improved products and regulatory reforms for the approval & use of mobile-based applications. Additionally fueling the market's expansion are increased awareness of reproductive health, the prevalence of OA, and better internet connectivity.

Over the forecast period, Asia Pacific regional market is expected to grow at a significant rate in the women's health app market because of the large populations of smartphone users in China & India, the expansion of the internet, and the rising demand for efficient healthcare technologies. The government's increased emphasis on women's wellness is also helping the market expand. As an illustration, the Indian government introduced the Swasthya Samiksha app, which enables the members of parliament to monitor data and indicators related to maternal and reproductive health in their individual constituencies.

Women's Health App Market: Competitive Landscape

- HeraMED

- Bonzun

- Clue (Biowink GmbH)

- Pregnascan

- NURX Inc.

- LactApp

- Miracare

- Elvie

- Gennev

- Withings

- Apple

- Glow

- HealthLynked Corp

- Natural Cycles USA Corp

- Bayer AG

- Ovia Health

- EHE Health.

Global Women's Health App market is segmented as follows:

By Type

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Menopause

- Disease Management

- Others

By Service

- Wellness & Fitness

- Remote Monitoring

- Diagnosis & Consultation

- Others

By Application

- Smartphones

- Tablets

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global women's health app market is expected to grow due to growing awareness of reproductive and menstrual health, smartphone penetration, and personalized digital health solutions.

According to a study, the global women's health app market size was worth around USD 4.68 Billion in 2024 and is expected to reach USD 23.38 Billion by 2034.

The global women's health app market is expected to grow at a CAGR of 17.45% during the forecast period.

North America is expected to dominate the women's health app market over the forecast period.

Leading players in the global women's health app market include Flo Health Inc., Clue, Apple Inc., Glow Inc., Withings, Fitbit Inc., Natural Cycles, Wildflower Health, HelloBaby Inc., Ovia Health, among others.

The report explores crucial aspects of the women's health app market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Womens Health App Industry PerspectiveWomens Health App OverviewKey InsightsCOVID-19 Impact:Womens Health App Growth DriversIncreasing adoption of smartphones is likely to pave the way for global market growth Womens Health App RestraintsLack of regulation may hamper the global market growthWomens Health App OpportunitiesMenstrual tracking apps attracting considerable popularity to bring up several growth opportunitiesWomens Health App SegmentationThe global womens health app market is segregated on the basis of type, service, application, and region.Recent DevelopmentsWomens Health App Report Scope Womens Health App Regional LandscapeRising use of smartphones likely to help North America dominate the global marketWomens Health App Competitive Landscape Global Womens Health App market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed