WLCSP Electroless Plating Market Size, Share, Trends, Growth & Forecast 2034

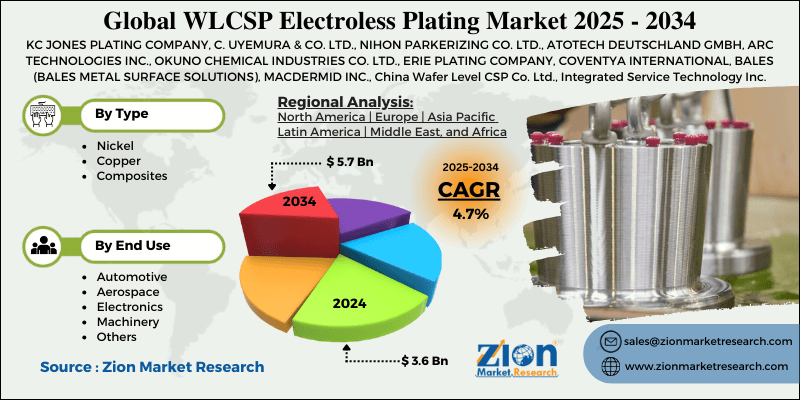

WLCSP Electroless Plating Market By Type (Nickel, Copper, and Composites), By End Use (Automotive, Aerospace, Electronics, Machinery, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.6 Billion | USD 5.7 Billion | 4.7% | 2024 |

WLCSP Electroless Plating Industry Perspective:

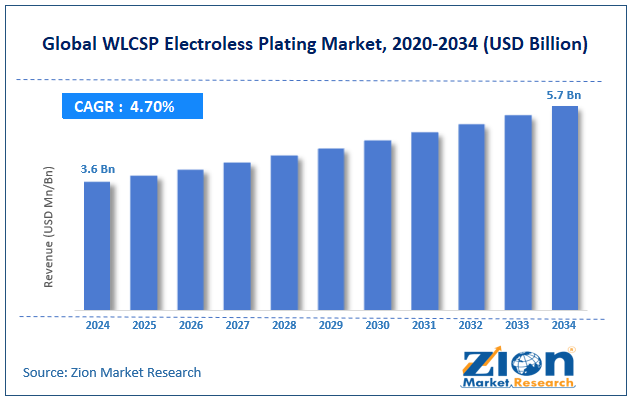

The global WLCSP electroless plating market size was worth around USD 3.6 billion in 2024 and is predicted to grow to around USD 5.7 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.7% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global WLCSP Electroless Plating market is estimated to grow annually at a CAGR of around 4.7% over the forecast period (2025-2034).

- In terms of revenue, the global WLCSP Electroless Plating market size was valued at around USD 3.6 billion in 2024 and is projected to reach USD 5.7 billion by 2034.

- Increasing consumer electronics demand globally is expected to drive the WLCSP Electroless Plating market over the forecast period.

- Based on the type, the copper segment is expected to capture the largest market share over the projected period.

- Based on the end-use, the electronics segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

WLCSP Electroless Plating Market: Overview

WLCSP is short for "wafer-level chip scale package." Electroless plating is a key step in semiconductor packaging. It employs chemical techniques, not electrical ones, to deposit protective metal coatings (such as nickel, copper, and gold/palladium) directly onto chip bond pads at the wafer level. Adding solderable, corrosion-resistant interfaces (UBMs) that connect directly to the PCB (solder bumps) enables the construction of compact, powerful processors. This is highly crucial for making electronics for cars and phones smaller and faster. The WLCSP electroless plating business is growing rapidly as more people seek to manufacture microelectronic devices that are smaller and more powerful.

For each of these, one requires advanced packaging options, such as wafer-level chip size packaging for small, efficient semiconductors. This approach is well-suited for depositing even layers of metal, such as gold and nickel, without using electricity. It costs less, protects better, and puts less stress on the metal than typical electroplating. This enables it to manufacture many components for consumer electronics, cars, and the Internet of Things (IoT).

WLCSP Electroless Plating Market Dynamics

Growth Drivers

How does the rapid expansion of consumer electronics propel the WLCSP electroless plating industry growth?

The rapid growth of consumer electronics is driving the WLCSP electroless plating market, as smartphones, tablets, wearables, and IoT devices increasingly rely on small, high-performance semiconductors. To ensure reliable operation and prevent overheating, these devices require precise, uniform metal deposition, such as nickel and gold layers. Manufacturers put wafer-level chip size packaging at the top of their list because it lets them pack more parts into smaller spaces while still working. This leads to sleeker designs that meet consumer demand for small, efficient devices. This surge aligns with broader trends, such as the rollout of 5G and the use of AI, which require better plating to speed up data processing and improve chip performance when densely packed. This is pushing high-volume production in Asia-Pacific centers. Because of this, the consumer electronics category is the biggest in the industry, with projected CAGRs of 4.85% to 10.3% through 2035 as more devices are sent around the world.

Restraints

High operating and maintenance costs are hampering the industry’s growth

High operating and maintenance costs make it more difficult for the WLCSP electroless plating market to grow, as they raise the total cost of ownership for semiconductor makers and OSATs. Electroless plating methods require constant, precise control of bath chemistry, which means frequent checks of pH, temperature, metal ion concentration, and reducing agents. This increases labor, analytical, and consumable costs. The chemicals used, such as high-purity nickel salts, palladium, gold, and hypophosphite-based reducing agents, are expensive and need to be replaced frequently because the bath wears out quickly.

Also, electroless baths generate complex wastewater streams that require costly treatment systems to comply with safety and environmental regulations, thereby increasing operational expenses. Plating equipment requires cleaning, filters must be changed, and downtime must be scheduled to prevent particle contamination and ensure uniform deposition at fine bump pitches. This means that maintenance costs are much greater. These ongoing costs cut into process margins for cost-sensitive, high-volume WLCSP applications. This makes other metallization methods, including electroplating or simpler UBM stacks, more cost-effective. Because of this, many manufacturers use electroless plating only when absolutely necessary, which slows the overall expansion of the WLCSP electroless plating sector.

Opportunities

Does the growing investment in semiconductor manufacturing offer a potential opportunity for the WLCSP electroless plating industry growth?

The WLCSP Electroless Plating Market continues to perform well as additional capital is invested in semiconductor manufacturing. The government and businesses are investing in new semiconductor production facilities, thereby increasing the adoption of electroless plating procedures. This investment is very important for meeting the growing global demand for semiconductors in many industries, such as telecommunications and automotive. It will also help improve production capacity. Reports say that the semiconductor market will be valued at more than $500 billion by 2026. This is a great time for the WLCSP Electroless Plating Market to grow, as manufacturers seek reliable, efficient plating solutions.

Challenges

Why does the competition from alternative packaging and metallization technologies pose a major challenge to WLCSP electroless plating market expansion?

The expansion of the WLCSP electroless plating market is being hindered by competition from other packaging and metallization technologies. This is because these technologies directly reduce the number of applications where electroless processes are technically or economically favorable. Advanced packaging formats like fan-out wafer-level packaging (FOWLP), flip-chip BGA, and system-in-package (SiP) are meeting the same miniaturization and performance needs that WLCSP once met.

However, they often use electroplating, sputtering, or redistribution-layer-based metallization instead of electroless plating. These alternatives can facilitate scaling up thicker metal layers, reduce the cost per unit for large-scale production, and provide greater design and material flexibility. As semiconductor companies focus on cost, throughput, and compatibility with multi-die integration, they may start using other technologies in places where WLCSP used to be. This action reduces new investments in electroless plating lines and limits the addressable market, slowing the overall growth of the WLCSP electroless plating sector.

WLCSP Electroless Plating Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | WLCSP Electroless Plating Market |

| Market Size in 2024 | USD 3.6 Billion |

| Market Forecast in 2034 | USD 5.7 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 217 |

| Key Companies Covered | KC JONES PLATING COMPANY, C. UYEMURA & CO. LTD., NIHON PARKERIZING CO. LTD., ATOTECH DEUTSCHLAND GMBH, ARC TECHNOLOGIES INC., OKUNO CHEMICAL INDUSTRIES CO. LTD., ERIE PLATING COMPANY, COVENTYA INTERNATIONAL, BALES (BALES METAL SURFACE SOLUTIONS), MACDERMID INC., China Wafer Level CSP Co. Ltd., Integrated Service Technology Inc., RAYMING Technology, CT SEMICONDUCTOR, Icleviathan Ltd., and others. |

| Segments Covered | By Type, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

WLCSP Electroless Plating Market: Segmentation

Type Insights

The copper segment dominates the market, capturing over 35% of the market share. Copper is often used in redistribution layers (RDLs) and connection structures because it conducts electricity well, doesn't easily lose signals, and is more resistant to electromigration than other metals. As consumer electronics, wearables, and IoT devices get smaller and more useful, manufacturers are increasingly using copper-based metallization and electroless plating to ensure uniform seed layers and reliable under-bump metallurgy.

Also, the growing use of high-density WLCSP designs in smartphones and advanced sensors requires highly accurate, conformal copper deposition to maintain signal quality and yield at lower bump pitches. The growth of advanced packaging production in Asia-Pacific, along with increased investment in 5G, automotive electronics, and high-speed computing devices, is driving demand for copper-related electroless plating processes. This is helping this part of the WLCSP electroless plating market grow.

End-Use Insights

The electronics segment is expected to hold the largest revenue share over the projected period. The main driver of this revenue growth is increased demand worldwide for small, high-functioning consumer electronics such as smartphones, tablets, wearables, and IoT devices. WLCSP with electroless plating reduces device size and improves electrical performance, benefiting all devices. Electroless plating is critical for providing robust under-bump metallurgy and solderable finishes that support fine-pitch connections in these densely packed devices, allowing manufacturers to meet stringent space and performance standards.

Furthermore, a rise in associated electronics areas, such as automotive electronics, telecommunications (especially 5G infrastructure), and high-performance computing, boosts demand for WLCSP solutions. Electroless plating processes are used in WLCSP production because these industries need reliability, good thermal performance, and a small size. The expanding scale of electronics production worldwide, particularly in the Asia-Pacific, enhances overall market profits as regional capacity grows to support a burgeoning electronics ecosystem.

Regional Insights

North America dominates the market with a revenue share of 47% in 2024. The main driver of regional growth is demand for advanced electronics, automotive, aerospace, and defense applications that value reliability and performance over cost. There is a strong semiconductor ecosystem in the area, with well-known IDMs, fabless companies, and advanced packaging R&D institutes that continue to invest in wafer-level packaging technologies for high-value devices.

WLCSP is also being used more in automotive electronics, ADAS modules, medical devices, and industrial electronics, where electroless plating is preferred because it deposits evenly and provides reliable under-bump metallurgy. Capacity expansions and process innovation are also being driven by increased investment in 5G infrastructure, data centers, and high-performance computing, as well as government-backed efforts to boost domestic semiconductor production. Compared with the Asia-Pacific region, North America has higher operating and regulatory costs, making it more difficult to expand volume at scale. However, the focus on high-margin, technology-intensive applications in North America supports revenue growth in the WLCSP electroless plating market.

Does the US domestic semiconductor investment drive the WLCSP Electroless Plating market?

Significant government and business expenditures in the US semiconductor manufacturing and packaging industries are driving the adoption of advanced packaging technologies, such as WLCSP. As new fabs, pilot lines, and advanced packaging facilities are built or updated in the United States, the need for reliable wafer-level metallization processes, especially electroless plating for under-bump metallurgy and surface finishing, grows. These investments support applications that require high reliability and performance, such as medical devices, aerospace and defense, automotive electronics, and high-performance computing. These applications often use WLCSP and require strict process control and long-term reliability, making electroless plating solutions like ENEPIG an ideal choice.

WLCSP Electroless Plating Market: Competitive Analysis

The global WLCSP Electroless Plating market is dominated by players like:

- KC JONES PLATING COMPANY

- C. UYEMURA & CO. LTD.

- NIHON PARKERIZING CO. LTD.

- ATOTECH DEUTSCHLAND GMBH

- ARC TECHNOLOGIES INC.

- OKUNO CHEMICAL INDUSTRIES CO. LTD.

- ERIE PLATING COMPANY

- COVENTYA INTERNATIONAL

- BALES (BALES METAL SURFACE SOLUTIONS)

- MACDERMID INC.

- China Wafer Level CSP Co. Ltd.

- Integrated Service Technology Inc.

- RAYMING Technology

- CT SEMICONDUCTOR

- Icleviathan Ltd.

The global WLCSP Electroless Plating market is segmented as follows:

By Type

- Nickel

- Copper

- Composites

By End Use

- Automotive

- Aerospace

- Electronics

- Machinery

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed