Welding Consumables Market Size, Share, Growth Report 2032

Welding Consumables Market By Type (SAW Wires, Fluxes, Flux-Cored Wires, Solid Wires, Stick Electrodes), By Technique (Arc Welding, Resistance Welding, Oxyfuel Welding, Ultrasonic Welding), By End-Use Industry (Oil & Gas, Power Generation, Marine, Construction, Automobile, Aerospace & Defense), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

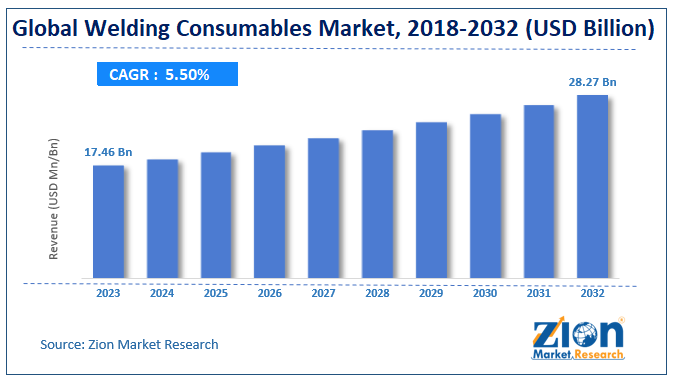

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.46 Billion | USD 28.27 Billion | 5.50% | 2023 |

Welding Consumables Market: Industry Perspective

The global welding consumables market size was worth around USD 17.46 billion in 2023 and is predicted to grow to around USD 28.27 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.50% between 2024 and 2032. The report covers forecasts and analyses for the welding consumables market on a global and regional level. The study provides historic data for 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion).

Key Insights

- As per the analysis shared by our research analyst, the welding consumables market is anticipated to grow at a CAGR of 5.50% during the forecast period (2024-2032).

- The global welding consumables market was estimated to be worth approximately USD 17.46 billion in 2023 and is projected to reach a value of USD 28.27 billion by 2032.

- The growth of the welding consumables market is being driven by experiencing steady growth due to several interconnected factors.

- Based on the type, the saw wires segment is growing at a high rate and is projected to dominate the market.

- On the basis of technique, the arc welding segment is projected to swipe the largest market share.

- In terms of end-use industry, the oil & gas segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Welding Consumables Market: Overview

Welding is an assembling and manufacturing process that joins materials such as thermoplastics and metals. Thermoplastics and metals are joined by fusion of intersecting materials. Welding is evolving widely in today’s era, commonly used welding technologies are submerged arc welding, flux-cored arc welding, gas metal arc welding, gas tungsten arc welding, and shielded metal arc welding. Welding consumables are used during the process and its usage depends on the technology. Commonly used consumables are SAW fluxes and wires, flux cored wires, solid wires, and stick electrodes. Solid wires and stick electrodes are consumed during the welding process. Whereas gases and flux are deployed to prevent base material oxidation. Consumables have applications in various end-user industries. However, different welding technologies are used as per the need of end-users.

The study includes drivers and restraints for the welding consumables market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the welding consumables market on a global level.

This report offers a comprehensive analysis of global welding consumables market along with, market trends, drivers, and restraints of the welding consumables market. This report includes a detailed competitive scenario and product portfolio of key vendors. To understand the competitive landscape in the market, an analysis of Porter’s five forces model for the market has also been included. The study encompasses a market attractiveness analysis, wherein all segments are benchmarked based on their market size, growth rate, and general attractiveness. This report is prepared using data sourced from in-house databases, and the secondary and primary research teams of industry experts.

Welding Consumables Market: Growth Drivers

Rapid industrialization and urbanization in developing economies worldwide have given rise to multiple numbers of small and large-scale industries, boosting the growth of the market. The construction sector is booming at a robust growth, primarily in developing countries such as India and China. Advanced welding automation technology in fabrication has fueled welding consumables market. The industry offers multiple opportunities in terms of profitability and growth for nascent organizations, resulting in expansion and gain a strong foothold in global welding consumables market. Further, lack of skilled workers in emerging regions is projected to boost the industry worldwide.

Flourishing construction and the automobile industry is preliminary driving welding consumables demand. Moreover, increasing applications in diverse end-use industries implementing various welding techniques, usage in maintenance & repair operations, rising investment in energy infrastructure will boost the product penetration. Additionally, foreign direct investments in wind and thermal sectors along with government investments in power generation industry will propel market growth. However, customer price sensitivity, stagnant growth of shipbuilding and aerospace industries, environmental impact, and slow adoption rate of advanced welding technologies may hinder market growth in the forecast period.

Welding Consumables Market: Segmentation

The study provides a decisive view of the welding consumables market by segmenting the market based on type, technique, end-use industry, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2018 to 2023.

Based on the type, the welding consumables market is segmented as SAW wires, fluxes, flux cored wires, solid wires, and stick electrodes. Stick electrodes account for highest revenue share owing to its wide-scale usage on dirty or rusty surfaces.

Based on technique, the welding consumables market is segmented as arc welding, resistance welding, Oxyfuel welding, and ultrasonic welding. Arc welding holds maximum share in the market owing to its benefits such as corrosion resistance, metal deposition uniformity, and high heat concentration.

Based on the end-use industry, the welding consumables market is segmented as is oil & gas, power generation, marine, construction, automobile, and aerospace & defense. The construction industry is projected to gain traction in the market during the forecast year. Welding consumables are widely used in infrastructure components fabrication such as commercial complexes, residential buildings, tunnels, railways, and bridges.

Recent Development

- In June 2025, ESAB Corporation, a prominent name in fabrication technology, revealed its intention to acquire German welding equipment manufacturer EWM GmbH. This strategic acquisition aims to enhance ESAB’s presence in Europe and broaden its expertise in heavy industrial welding and automation.

- In March 2025, Linde Engineering, a subsidiary of Linde plc, partnered to advance specialized welding wire methods aimed at enhancing speed and accuracy in ammonia tank construction, while tackling Stress Corrosion Cracking to ensure safer and more efficient storage.

- In July 2024, Lincoln Electric acquired Vanair Manufacturing, a U.S. company specializing in vehicle-mounted power solutions such as generators, compressors, and welders. This acquisition strengthened Lincoln Electric’s mobile power portfolio and broadened its footprint in the maintenance and repair sectors.

Welding Consumables Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Welding Consumables Market Research Report |

| Market Size in 2023 | USD 17.46 Billion |

| Market Forecast in 2032 | USD 28.27 Billion |

| Growth Rate | CAGR of 5.50% |

| Number of Pages | 110 |

| Key Companies Covered | Arcon Welding Equipment, Kemppi Oy, Tianjin Bridge Welding Materials Co. Ltd., Fronius International GmbH, Denyo Co. Ltd, Illinois Tool Works Inc, Panasonic Corporation, Obara Corporation, Hyundai Welding Co. Ltd, Air Liquide, The Lincoln Electric Company, Colfax Corporation, Voestalpine AG, Nikko Steel, PT. Yontomo Sukses Abadi, PT. Cahaya Las Mandiri, P.T. Intan Pertiwi Industri, Alfa Metalindo Indonesia, The Linde Group Inc, and Kobe Steel Ltd. |

| Segments Covered | By Type, By Technique, By End-Use Industry, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Welding Consumables Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East, and Africa. Each region has been further segmented into countries such as the U.S., Canada, Mexico, UK, France, Germany, Italy, Poland, Russia, China, India, Japan, India, Korea, Indonesia, Malaysia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait, and Oman.

The Asia Pacific will account for maximum share of global welding consumables market till 2032 with China being a major consumer of welding materials in the region. Growing investments by automobile manufacturers in the region coupled with increasing demand for welding materials in the construction industry will maintain dominance of the region in the market. Germany is recognized globally for its leading automobile manufacturers such as Audi, BMW, Volkswagen, and other luxury cars. These high-grade vehicle bodies are fabricated by advanced arc welding technologies, thus increasing the demand for welding consumables in Europe.

Welding Consumables Market: Competitive Analysis

The report covers a detailed competitive outlook including the market share and company profiles of the key participants operating in the global welding consumables market such as:

- Arcon Welding Equipment

- Kemppi Oy

- Tianjin Bridge Welding Materials Co. Ltd.

- Fronius International GmbH

- Denyo Co. Ltd

- Illinois Tool Works Inc

- Panasonic Corporation

- Obara Corporation

- Hyundai Welding Co. Ltd

- Air Liquide

- The Lincoln Electric Company

- Colfax Corporation

- Voestalpine AG

- Nikko Steel

- PT. Yontomo Sukses Abadi

- PT. Cahaya Las Mandiri

- P.T. Intan Pertiwi Industri

- Alfa Metalindo Indonesia

- The Linde Group Inc

- Kobe Steel Ltd.

The global welding consumables market market is segmented as follows:

By Type

- SAW wires

- Fluxes

- Flux cored wires

- Solid wires

- Stick electrodes

By Technique

- Arc welding

- Resistance welding

- Oxyfuel welding

- Ultrasonic welding

By End-Use Industry

- Oil & Gas

- Power generation

- Marine

- Construction

- Automobile

- Aerospace & Defense

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Welding is an assembling and manufacturing process that joins materials such as thermoplastics and metals.

According to study, the global welding consumables market size was worth around USD 17.46 billion in 2023 and is predicted to grow to around USD 28.27 billion by 2032.

The CAGR value of welding consumables market is expected to be around 5.50% during 2024-2032.

Asia Pacific has been leading the global welding consumables market and is anticipated to continue on the dominant position in the years to come.

The global welding consumables market is led by players like Arcon Welding Equipment, Kemppi Oy, Tianjin Bridge Welding Materials Co. Ltd., Fronius International GmbH, Denyo Co. Ltd, Illinois Tool Works Inc, Panasonic Corporation, Obara Corporation, Hyundai Welding Co. Ltd, Air Liquide, The Lincoln Electric Company, Colfax Corporation, Voestalpine AG, Nikko Steel, PT. Yontomo Sukses Abadi, PT. Cahaya Las Mandiri, P.T. Intan Pertiwi Industri, Alfa Metalindo Indonesia, The Linde Group Inc, and Kobe Steel Ltd.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed