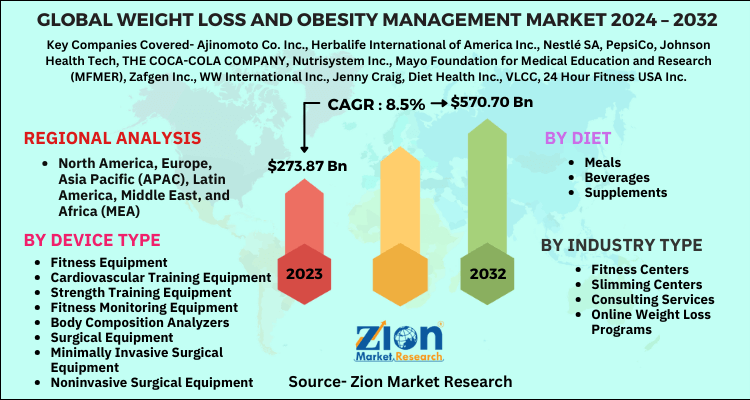

Global Weight Loss and Obesity Management Market Size, Share and Forecast 2032

Global Weight Loss and Obesity Management Market By Diet (Meals, Beverages, Supplements), Equipment (Fitness Equipment, Cardiovascular Training Equipment, Strength Training Equipment, Fitness Monitoring Equipment, Body Composition Analyzers, Surgical Equipment, Minimally Invasive Surgical Equipment, Noninvasive Surgical Equipment), Service (Fitness Centers, Slimming Centers, Consulting Services, Online Weight Loss Programs): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 273.87 Billion | USD 570.70 Billion | 8.5% | 2023 |

Global Weight Loss and Obesity Management Market Insights

According to a report from Zion Market Research, the global Global Weight Loss and Obesity Management Market was valued at USD 273.87 Billion in 2023 and is projected to hit USD 570.70 Billion by 2032, with a compound annual growth rate (CAGR) of 8.5% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Global Weight Loss and Obesity Management Market industry over the next decade.

Weight Loss and Obesity Management Market: Overview

Obesity is a medical condition characterized by the excessive accumulation and storage of fats within the body. The condition has a variety of effects on an individual's health, including increasing the risk of chronic diseases and shortening one's life expectancy. In these management programs, a variety of diets, devices, and drugs are used with the goal of controlling or reducing weight in obese people. There has been a steep increase in the number of obese around the globe due to the change in eating habits, more synthetic food consumption reduced physical activities, and increment in online activities.

Earlier children use to play on the grounds and indulge themselves in sports activities but nowadays digitalization has hampered these activities resulting in to rise in obese people across the globe. According to the WHO in 2016, around 650 million adults were obese. The obese stats had tripled over 50 years.

Weight Loss and Obesity Management Market: Growth Factors

One of the major factors driving the growth of the weight loss and obesity management market is the rise in the number of obese people around the world. The increase in the number of chronic diseases such as hypertension and diabetes, as a result of the adoption of unhealthy and sedentary lifestyle patterns, as well as the increase in the number of bariatric surgeries, is propelling the weight loss and obesity management market forward. People's increasing preference for junk food, physical inactivity, a hectic schedule, and rising stress levels are all contributing to an increase in fast food consumption, which has a negative impact on the weight loss and obesity management market.

Furthermore, the weight loss and obesity management market is influenced positively by the growth of the food sector, increasing adoption of online weight loss and weight management programs, government initiatives to raise awareness, and rising disposable income in developing economies. Also, the rise in the rate of childhood obesity and emerging nations provides profitable opportunities for weight loss and obesity management market players.

Diet Segment Analysis Preview

During the forecast period, beverages hold the largest market share. This is attributable to the fact that there is an increase in the obese population across the globe. There is increased awareness among consumers regarding low-calorie diets which have become fab. For instance, Diet Coke is a famous beverage that became an attraction center amongst customers. This is a low-calorie and sugar-free soft drink. Meals and supplements form the other type of diet segment.

Weight Loss and Obesity Management Market: Segment Analysis

Fitness equipment, which includes cardiovascular and strength training equipment, consisted of the major portion of the forecast period. The rapid expansion is due to a number of factors, including increased accessibility to gyms, continuous technological advancements in equipment, and easy availability of these items. Fitness Monitoring Equipment, Body Composition Analyzers, Surgical Equipment, Minimally Invasive Surgical Equipment, and Noninvasive Surgical Equipment among others form the equipment segment.

During the given forecast period Online Weight Loss Program is expected to grow at the highest rate. The rising prevalence of obesity, rising awareness about maintaining health and fitness for preventing health conditions such as diabetes and heart disease, the growing number of online weight loss programs, and increasing disposable income in developing economies are all contributing to this market segment's rapid growth. Fitness Centers, Slimming Centers, and Consulting Services, among others, form the service segment.

Global Weight Loss and Obesity Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Global Weight Loss and Obesity Management Market |

| Market Size in 2023 | USD 273.87 Billion |

| Market Forecast in 2032 | USD 570.70 Billion |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 150 |

| Key Companies Covered | Ajinomoto Co. Inc., Herbalife International of America Inc., Nestlé SA, PepsiCo, Johnson Health Tech, THE COCA-COLA COMPANY, Nutrisystem Inc., Mayo Foundation for Medical Education and Research (MFMER), Zafgen Inc., WW International Inc., Jenny Craig, Diet Health Inc., VLCC, 24 Hour Fitness USA Inc. |

| Segments Covered | By Diet, By Device Type, By Industry Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

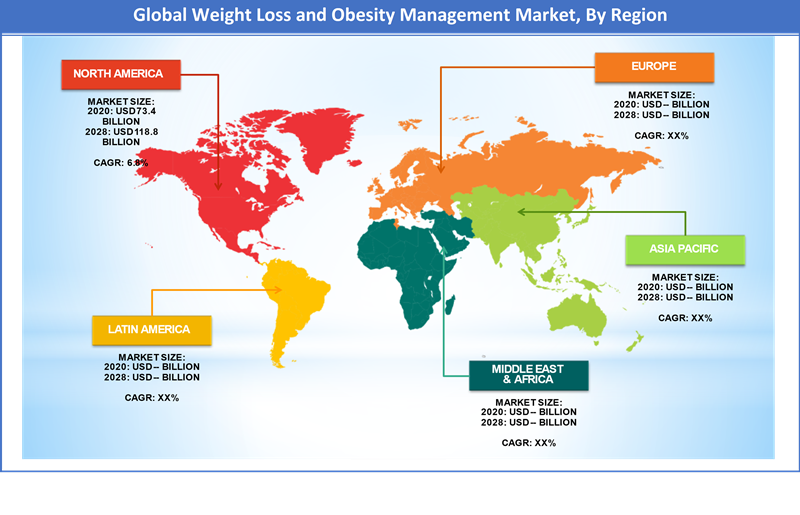

Weight Loss and Obesity Management Market: Regional Analysis

Major factors supporting the growth of the weight loss and weight management market in this region include rising obesity and chronic disease incidence, rising awareness about nutrition and healthy lifestyles, a growing number of fitness centers, and rising disposable income. Because of the growing population of overweight and obese people, a shift toward minimally invasive and noninvasive procedures, and an increase in the incidence of hypertension and diabetes, North America dominates the weight loss and obesity management market.

China is the market leader in the weight loss monitoring market. This attributes to increased awareness amongst individuals and increases in personal income. The rise in disposable income, increase in the number of diabetics, growing awareness of personal well-being, sedentary lifestyles, and the low cost of bariatric surgeries in this region are all factors contributing to this growth. Consumers in this area are more into weight loss supplements, meal replacements, and MRE (Meal Ready to Eat) foods.

Weight Loss and Obesity Management Market: Key Players & Competitive Landscape

Some of the key players in the weight loss and obesity management market are

- Ajinomoto Co. Inc.

- Herbalife International of America Inc.

- Nestlé SA

- PepsiCo

- Johnson Health Tech

- THE COCA-COLA COMPANY

- Nutrisystem Inc.

- Mayo Foundation for Medical Education and Research (MFMER)

- Zafgen Inc.

- WW International Inc.

- Jenny Craig

- Diet Health Inc.

- VLCC

- 24 Hour Fitness USA Inc.

The global weight loss and obesity management market is segmented as follows:

By Diet

- Meals

- Beverages

- Supplements

By Device Type

- Fitness Equipment

- Cardiovascular Training Equipment

- Strength Training Equipment

- Fitness Monitoring Equipment

- Body Composition Analyzers

- Surgical Equipment

- Minimally Invasive Surgical Equipment

- Noninvasive Surgical Equipment

By Industry Type

- Fitness Centers

- Slimming Centers

- Consulting Services

- Online Weight Loss Programs

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Global Weight Loss and Obesity Management Market was valued at USD 273.87 Billion in 2023 and is projected to hit USD 570.70 Billion by 2032.

According to a report from Zion Market Research, the global Global Weight Loss and Obesity Management Market a compound annual growth rate (CAGR) of 8.5% during the forecast period 2024-2032.

Some of the key factors driving the global weight loss and obesity management market growth are increasing number of fitness centers, growing obese population, rise in disposable income in developing countries.

North America region held a substantial share of the weight loss and obesity management market in 2020.This is due to rising obesity and chronic disease incidence, rising awareness about nutrition and healthy lifestyles, growing number of fitness centers, and rising disposable income. Asia Pacific region is projected to grow at a significant rate of 9.4% CAGR.

Some of key players in weight loss and obesity management market are Ajinomoto Co.,Inc., Herbalife International of America, Inc., Nestlé SA, PepsiCo, Johnson Health Tech, THE COCA-COLA COMPANY, Nutrisystem, Inc., Mayo Foundation for Medical Education and Research (MFMER), Zafgen, Inc., WW International, Inc., Jenny Craig, Diet Health, Inc., VLCC, 24 Hour Fitness USA, Inc., among others.

List of Contents

GlobalMarket InsightsWeight Loss and Obesity Management OverviewWeight Loss and Obesity Management Growth FactorsDiet Segment Analysis PreviewWeight Loss and Obesity Management Segment AnalysisGlobalReport ScopeWeight Loss and Obesity Management Regional AnalysisWeight Loss and Obesity Management Key Players Competitive LandscapeThe global weight loss and obesity management market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed