Surgical Equipment Market Trend, Share, Growth, Size, Analysis and Forecast 2032

Surgical Equipment Market By Product Segments(Surgical Sutures and Stapler, Handheld Surgical Devices(Forceps and Spatulas, Retractors, Dilators, Graspers, Auxiliary Instruments, Cutter Instruments, Other), Electrosurgical Devices), By Application Segments(Neurosurgery, Plastic and Reconstructive Surgery, Wound Closure, Obstetrics and Gynecology, Cardiovascular, Orthopedic, Others), By Category Segments(Reusable Surgical Equipment, Disposable Surgical Equipment), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

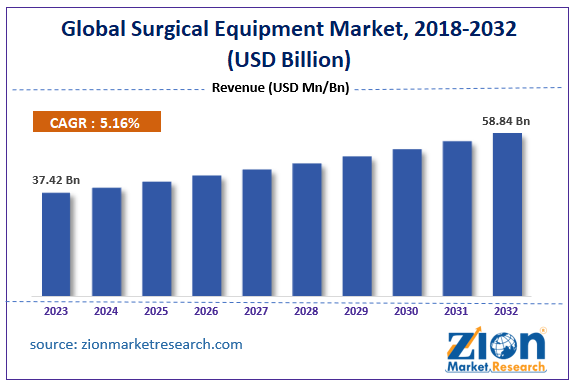

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 37.42 Billion | USD 58.84 Billion | 5.16% | 2023 |

Surgical Equipment Market: Overview

The global Surgical Equipment market size accrued earnings worth approximately USD 37.42 Billion in 2023 and is predicted to gain revenue of about USD 58.84 Billion by 2032, is set to record a CAGR of nearly 5.16% over the period from 2024 to 2032. The study includes drivers and restraints for the surgical equipment market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the surgical equipment market on a global level.

Key Insights

- As per the analysis shared by our research analyst, the global surgical equipment market is estimated to grow annually at a CAGR of around 5.16% over the forecast period (2024-2032).

- In terms of revenue, the global surgical equipment market size was valued at around USD 37.42 Billion in 2023 and is projected to reach USD 58.84 Billion by 2032.

- The growth of the surgical equipment market is being driven by the increasing volume of surgeries and demand for precision-driven, minimally invasive tools.

- Based on product, the surgical sutures and stapler segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the neurosurgery segment is projected to swipe the largest market share.

- In terms of category, the reusable surgical equipment segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

In order to give the users of this report a comprehensive view of the surgical equipment market, we have included a competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein the product, application, category, and regional segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

Surgical Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Surgical Equipment Market |

| Market Size in 2023 | USD 37.42 Billion |

| Market Forecast in 2032 | USD 58.84 Billion |

| Growth Rate | CAGR of 5.16% |

| Number of Pages | 204 |

| Key Companies Covered | Smith & Nephew Plc, KLS Martin Group, Zimmer Holdings, Inc., Johnson & Johnson, Stryker Corporation, Medtronic Plc, Olympus Corporation, Karl Storz GmbH & Co. Kg, B. Braun Melsungen AG, Conmed Corporation, and others. |

| Segments Covered | By Product Segments, By Application, By Category Segments, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The study provides a decisive view of the surgical equipment market by segmenting the market based on product, application, category, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032. The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with it further divided into major countries.

Surgical Equipment Market Growth Analysis

Companies in the healthcare sector that specialize in developing and manufacturing surgical devices and products are part of the surgical equipment and devices business. Surgical equipment is utilized in a wide range of surgical operations, including plastic surgery, neurosurgery, laparoscopic surgeries, urology, cardiovascular surgeries, and more. The increasing occurrence of chronic illnesses in elderly individuals and the growing need for laparoscopic procedures are significant factors driving the worldwide surgical equipment market.

The increasing need for less invasive operations is expected to stimulate market growth for surgical equipment, particularly equipment related to electrosurgeries. The numerous benefits of minimally invasive procedures, such as little blood loss, accurate incisions, fewer side effects, reduced post-surgery complications, shorter hospital stays, quicker recovery times, and high demand across all medical fields, are expected to drive market expansion. Other factors influencing the market are the increasing number of surgical procedures and technological advancements in new product development. One clause in the U.S. Patient Protection and Affordable Care Act (PPACA) mandates a 2.3% excise tax on medical equipment. This tax may create challenges for medical device manufacturers and hinder the expansion of the surgical equipment market. The intense competition characterized by price wars and uncertainties in reimbursement policies would hinder market expansion.

Surgical Equipment Market Regional Segmentation Analysis

According to Products, the surgical sutures and stapler's segment dominates the majority of Surgical Equipment market's revenue. The surgical sutures and staplers segment held the highest revenue share of over 52.0% in 2023 this is due to the fact that sutures and staplers have a high adoption rate due to their rising usage in wound closure operations. The handheld surgical devices segment had the largest share in terms of revenue in 2023 and is anticipated to expand at a good rate over the forecast period. The segment of handheld surgical equipment is also divided into forceps and spatulas, retractors, dilators, graspers, auxiliary instruments, cutter instruments, and others.Surgical Equipment Market

On the basis of Applications, the revenue of the Surgical Equipment market is dominated by the consumer category. The other segments captured the highest revenue market share of more than 25.0% in 2023. The obstetrics and gynecology segment captured the second highest share in 2023 due to the rising rate of childbirth globally and the abrupt increase in the incidence of female reproductive organ diseases, thus leading to a surge in the rate of gynecological surgeries. According to CDC's report, in 2023, there were approximately 1,243,882 cessation surgeries performed in the U.S. Based on application, the market is categorized into neurosurgery, plastic and reconstructive surgery, wound closure, obstetrics and gynecology, cardiovascular, orthopaedic, and others.Surgical Equipment Market

On the basis of Categories, the disposable Surgical Equipment category dominates most of the Surgical Equipment market's revenue. This is due to the fact that disposable Surgical Equipment has gained popularity over time and is utilized more often during procedures, such as orthopaedic, exploratory surgery, plastic and reconstructive surgery, and others. When a healthcare facility is provided with a pre-sterilized instrument, decontamination and a lengthy sterilization process are not needed, and the facility saves money. Moreover, once a tool has been utilized, disinfected, and stored, its cleanliness cannot be ascertained. Disposing of single-use equipment ensures total accounting for every item of inventory and full traceability. A lot number from each piece might be traced to a medical production plant to eliminate discrepancies and issues.

The reusable part is anticipated to post a consistent revenue growth rate over the forecast period. Reusable medical devices, including surgical forceps, endoscopes, and stethoscopes, are reprocessed and reused on numerous patients. These devices are designed and marked for multiple uses and are reprocessed between patients by comprehensive cleaning comprising high disinfection or sterilization. They are made of materials that can withstand repeated reprocessing including manuals are brushing and chemical use.Surgical Equipment Market

On the basis of material, The market for surgical equipment can also be divided on the basis of material utilized in the equipment. The major segments based on material type are stainless steel, titanium, ceramics, and other materials. Stainless steel is widely used material because it is durable and does not corrode. Titanium is also widely used material because it is strong and biocompatible. Ceramics are applied in surgical instruments because they are wear and tear resistant, as well as biocompatible. The need for surgical instruments made of various materials depends on the application and preference of medical practitioners. Generally, manufacturers are constantly developing their materials and designs to address the changing needs of the healthcare sector, leading to an expanding market for surgical instruments

North America holds the largest share of the market for surgical equipment followed by Europe and the Asia Pacific. The growth in North America and the European region is mainly driven by growing aging population, the advent of new technologies, advanced and well-developed healthcare infrastructure, high per capita income, and a favorable regulatory framework. The market for surgical equipment in the Asia Pacific is also expected to witness considerable growth rate due to rising need to fulfill unmet healthcare needs, advancing medical tourism industry, rising prevalence of chronic diseases which require surgical intervention and improving healthcare infrastructure in this region.

Some of the leading players in the surgical equipment market include

- Smith & Nephew Plc

- KLS Martin Group

- Zimmer Holdings, Inc.

- Johnson & Johnson

- Stryker Corporation

- Medtronic Plc

- Olympus Corporation

- Karl Storz GmbH & Co. Kg

- B. Braun Melsungen AG

- Conmed Corporation, and others.

This report segments the global surgical equipment market as follows:

By Product Segments

- Surgical Sutures and Stapler

- Handheld Surgical Devices

- Forceps and Spatulas

- Retractors

- Dilators

- Graspers

- Auxiliary Instruments

- Cutter Instruments

- Other

- Electrosurgical Devices

By Application Segments

- Neurosurgery

- Plastic and Reconstructive Surgery

- Wound Closure

- Obstetrics and Gynecology

- Cardiovascular

- Orthopedic

- Others

By Category Segments

- Reusable Surgical Equipment

- Disposable Surgical Equipment

By Regional Segments

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed