Video KYC Market Size, Share, Growth, Trend, Forecast To 2032

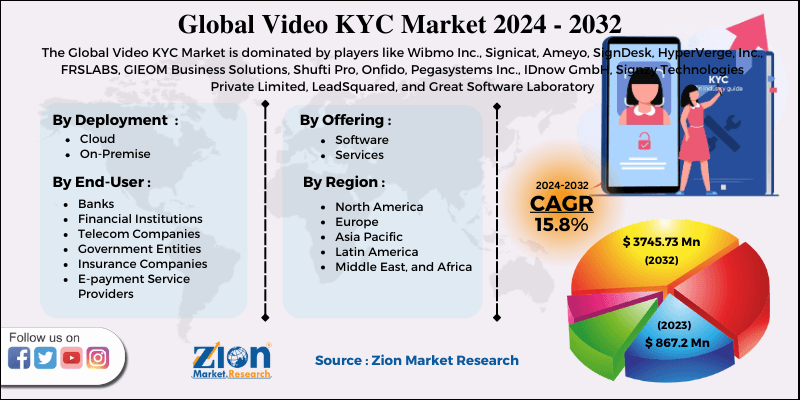

Video KYC Market By Deployment (Cloud and On-Premise), By Offering (Software and Services), By End-User (Banks, Financial Institutions, Telecom Companies, Government Entities, Insurance Companies, and E-payment Service Providers): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

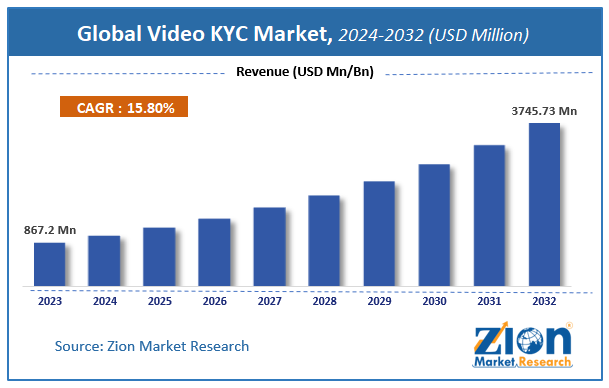

| USD 867.2 Million | USD 3745.73 Million | 15.8% | 2023 |

Video KYC Market Insights

According to a report from Zion Market Research, the global Video KYC Market was valued at USD 867.2 Million in 2023 and is projected to hit USD 3745.73 Million by 2032, with a compound annual growth rate (CAGR) of 15.8% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Video KYC Market industry over the next decade.

Video KYC Market: Overview

Video KYC is a medium via which the end-users can do KYC for their bank accounts in a few minutes. In this procedure, customer KYC documents are checked and their signatures are documented via video call by officer of bank. This move made by financial institutions has helped the customers in avoiding visit to the banks or prevent the requirement of physical presence at banks in these times of COVID pandemic. Onset of AI, AR, Machine Learning, and VR and need for identifying & examining collected information has resulted into humungous demand for Video KYC activities in the ensuing years.

Furthermore, geo-tagging, facial recognition, and liveness identification require Video KYC in detecting the profile authenticity in few minutes. Apart from this, it can also identify geographical site while garnering data as well as doing parallel checks via easily accessible databases. Apparently, video KYC is based on three technologies, namely, Geo sites, cloud storage, cloud solutions, AI, and OCR. In addition to this, completion of video KYC requires acquiring of customer permission, checking the location of the customer, determining liveliness, capturing id proof as well as validating it, and capturing & matching the face of the customer.

Video KYC Market Growth Dynamics

Escalating requirements for financial institutions, both public and private, for developing virtual tools for interacting with customers due to the COVID crisis has enhanced the popularity of Video KYC in recent years. Apart from this, video tools help the firms in garnering customer data and make it easier for retail banks in collecting authentic information related to KYC. In addition to this, automation methods can assist corporate firms integrate external data service providers, KYC utilities, and public registers into the workflows of KYC. This is likely to result in a surge in video KYC penetration in various financial institutes as well as Fintech firms across the globe. All these factors will add massively to the overall market size in the upcoming years.

Furthermore, escalating need for making KYC utility cost-efficient has become a challenging task and this has created a growing demand for value-added services such as Video KYC. This, in turn, will expand the scope of the video KYC market in the foreseeable future.

Video KYC Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Video KYC Market |

| Market Size in 2023 | USD 867.2 Million |

| Market Forecast in 2032 | USD 3745.73 Million |

| Growth Rate | CAGR of 15.8% |

| Number of Pages | 130 |

| Key Companies Covered | Wibmo Inc., Signicat, Ameyo, SignDesk, HyperVerge, Inc., FRSLABS, GIEOM Business Solutions, Shufti Pro, Onfido, Pegasystems Inc., IDnow GmbH, Signzy Technologies Private Limited, LeadSquared, and Great Software Laboratory. |

| Segments Covered | By Deployment, By Offering , By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Asia Pacific Market Size To Witness Exponential Growth Over 2024-2032

The escalating need of the banking industry to strengthen its macroeconomic growth, increase profit margins, expand its customer base across the globe, and increase investments will result in an expansion of the Video KYC industry in Asia Pacific over 2024-2032. Financial firms in the region are focusing on developing digital-based and data-driven technologies. This is likely to result in market penetration in Asia Pacific over the upcoming years. Demand for boosting productivity, optimizing capital, and pursuing strategic growth will trace a favorable roadmap for the business in the sub-continent over the forthcoming years.

An increase in lending activities such as SME enterprise lending activities & retail lending activities as well as thriving wealth management activities will define the industry landscape in region. Efforts made by the regional government in the creation of customer-centric technologies will result in market upswing in Asia Pacific during the forecast period.

Key players profiled in the study include

- Wibmo Inc.

- Signicat

- Ameyo

- SignDesk

- HyperVerge, Inc.

- FRSLABS

- GIEOM Business Solutions

- Shufti Pro

- Onfido

- Pegasystems Inc.

- IDnow GmbH

- Signzy Technologies Private Limited

- LeadSquared, and Great Software Laboratory.

The global Video KYC Market is segmented as follows:

By Deployment

- Cloud

- On-Premise

By Offering

- Software

- Services

By End-User

- Banks

- Financial Institutions

- Telecom Companies

- Government Entities

- Insurance Companies

- E-payment Service Providers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Businesses, particularly in the financial services sector, employ digital identity verification method known as Video KYC (Know Your Customer) to remotely check consumer identities via video chats. It helps businesses to follow KYC rules, which are needed for anti-money laundering (AML) and fraud avoidance, without actual presence.

Several main elements are driving the expansion of the video KYC market: growing need for digital onboarding, regulatory compliance, and biometric verification technology developments.

According to a report from Zion Market Research, the global Video KYC Market was valued at USD 867.2 Million in 2023 and is projected to hit USD 3745.73 Million by 2032.

According to a report from Zion Market Research, the global Video KYC Market a compound annual growth rate (CAGR) of 15.8% during the forecast period 2024-2032.

The escalating need of the banking industry to strengthen its macroeconomic growth, increase profit margins, expand its customer base across the globe, and increase investments will result in an expansion of the Video KYC industry in Asia Pacific over 2024-2032.

Wibmo Inc., Signicat, Ameyo, SignDesk, HyperVerge, Inc., FRSLABS, GIEOM Business Solutions, Shufti Pro, Onfido, Pegasystems Inc., IDnow GmbH, Signzy Technologies Private Limited, LeadSquared, and Great Software Laboratory.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed