e-KYC Market Size, Share, Trends and Analysis 2032

e-KYC Market - By End User (Banks, Financial Institutions, E-payment Service Providers, Telecom Companies, Government Entities, and Insurance Companies): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

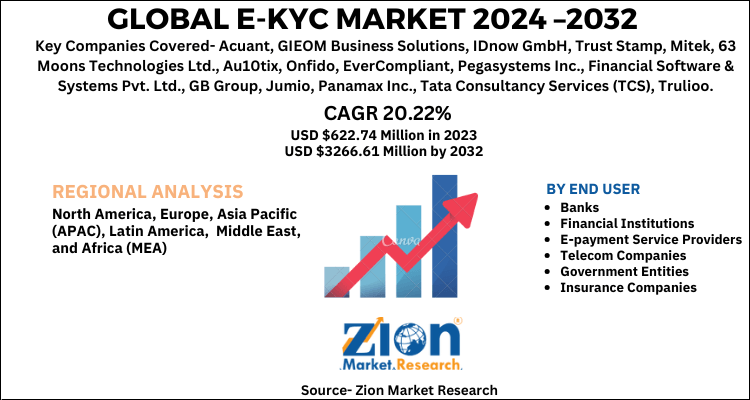

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 622.74 Million | USD 3266.61 Million | 20.22% | 2023 |

e-KYC Market Insights

According to Zion Market Research, the global e-KYC Market was worth USD 622.74 Million in 2023. The market is forecast to reach USD 3266.61 Million by 2032, growing at a compound annual growth rate (CAGR) of 20.22% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the e-KYC industry over the next decade.

Introduction

e- KYC also referred to as electronic – know your customer is used by banks and various other financial institutions. It is a kind of digital id that assist financial institutions in improving risk management operations, safeguarding end-user data against theft & cyber-attacks, and providing effective fraud management. Apart from this, KYC mandates the banks to check the identity of the person before opening an account. Moreover, e-KYC helps banks and other financial corporations to expand their consumer base at minimal expenses. Furthermore, e-KYC helps in eliminating the manual processing of paper documentation and the requirement for in-person verification of the identity of the account holder. Citing an instance, the use of Aadhar card id for KYC registration in India facilitated a bulge in account opening from nearly 49 million in 2016-2017 to 139 million during 2017-2018.

Market Growth Dynamics

Low-assurance interactions contribute majorly towards Cyber security violations and it poses massive risks for the digital economy and can leak the information of customers & banks. This has paved the way for e-KYC activities, thereby driving the market trends. Moreover, e-KYC facilitates online transactions in a safe & easy way and helps in effectively managing a multitude of digital accounts. This activity is most prominently witnessed in developed countries. Nonetheless, failure of technical systems and data breaches along with misuse of personal information can pose a threat to the growth of e-KYC industry in the foreseeable future.

Furthermore, need for strengthening compliance management due to surge in the proportion of frauds are anticipated to steer the business growth over the years ahead. With the onset of connected things, cloud computing, and AI, the market is projected to gain traction over the ensuing years. The growing necessity for reducing unauthorized use of credentials and reducing breach of conduct is likely to pave a way for the growth of the e-KYC market over the forecast timespan.

North America To Account Sizably Towards Overall Market Earnings By 2026

The growth of the market in the sub-continent over the assessment period is credited to the growing need for fraud detection in the countries such as Canada and the U.S. Reportedly, the U.S. witnessed identity fraud in 2016 and this is likely to create new growth opportunities for the e-KYC industry in the sub-continent. Apart from this, a rise in data thefts and cases of cyber-attacks in small & mid-sized firms is predicted to spur the expansion of the e-KYC industry over the forecast timespan.

e-KYC Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | e-KYC Market |

| Market Size in 2023 | USD 622.74 Million |

| Market Forecast in 2032 | USD 3266.61 Million |

| Growth Rate | CAGR of 20.22% |

| Number of Pages | 110 |

| Key Companies Covered | Acuant, GIEOM Business Solutions, IDnow GmbH, Trust Stamp, Mitek, 63 Moons Technologies Ltd., Au10tix, Onfido, EverCompliant, Pegasystems Inc., Financial Software & Systems Pvt. Ltd., GB Group, Jumio, Panamax Inc., Tata Consultancy Services (TCS), Trulioo, and Wipro Technologies |

| Segments Covered | By End User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key participants profiled in the study are

- Acuant

- GIEOM Business Solutions

- IDnow GmbH

- Trust Stamp

- Mitek

- 63 Moons Technologies Ltd.

- Au10tix

- Onfido

- EverCompliant

- Pegasystems Inc.

- Financial Software & Systems Pvt. Ltd.

- GB Group

- Jumio

- Panamax Inc.

- Tata Consultancy Services (TCS)

- Trulioo

- Wipro Technologies.

This report segments the e-KYC market as follows:

Global e-KYC Market: By End User Segment Analysis

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Low-assurance interactions contribute majorly towards Cybersecurity violations and it poses massive risks for digital economy and can leak the information of customers & banks. This has paved a way for e-KYC activities, thereby driving the market trends. Moreover, e-KYC facilitates online transactions in a safe & easy way and helps in effectively managing multitude of digital accounts. This activity is most prominently witnessed in developed countries. Furthermore, need for strengthening compliance management due to surge in the proportion of frauds are anticipated to steer the business growth over the years ahead. With the onset of connected things, cloud computing, and AI, the market is projected to gain traction over the ensuing years.

According to Zion Market Research report, the global e-KYC market size, which accrued revenue worth 0.258 (USD Billion) in 2019 and is anticipated to garner earnings of about 1.016 (USD Billion) by 2026, is set to grow at a CAGR of nearly 22.05% during the period from 2020 to 2026.

North America is likely to make noteworthy contributions towards overall E-KYC Market revenue. The growth of the market in the region over 2020-2026 can be ascribed to growing need for fraud detection in the countries such as Canada and the U.S. Reportedly, the U.S. witnessed an identity fraud in 2016 and this is likely to create new growth opportunities for e-KYC industry in the sub-continent. Apart from this, rise in the data thefts and cases of cyber-attacks in small & mid-sized firms is predicted to spur the expansion of e-KYC industry over the forecast timespan.

The key players profiled in the report include Acuant, GIEOM Business Solutions, IDnow GmbH, Trust Stamp, Mitek, 63 Moons Technologies Ltd., Au10tix, Onfido, EverCompliant, Pegasystems Inc., Financial Software & Systems Pvt. Ltd., GB Group, Jumio, Panamax Inc., Tata Consultancy Services (TCS), Trulioo, and Wipro Technologies.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed