Video-as-a-Service (VaaS) Market Size, Share, Growth Report 2032

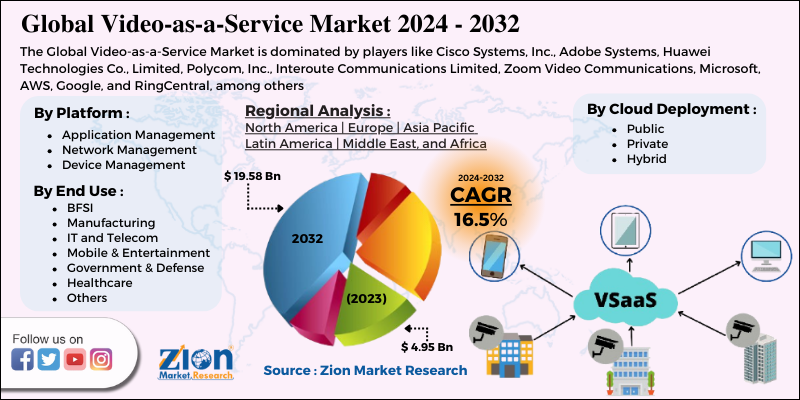

Video-as-a-Service (VaaS) Market by Platform Type (Application Management, Network Management and Device Management), Cloud Deployment Type (Public, Private, and Hybrid), by End Use Industry (BFSI, Manufacturing, IT and Telecom, Mobile and Entertainment, Government and Defense, Healthcare, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

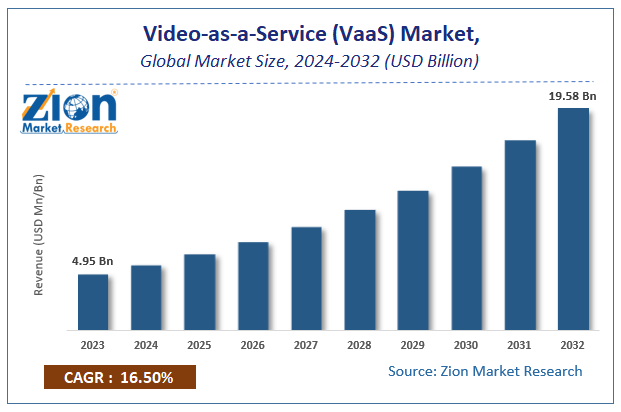

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.95 Billion | USD 19.58 Billion | 16.5% | 2023 |

Video-as-a-Service (VaaS) Market Insights

According to Zion Market Research, the global Video-as-a-Service (VaaS) Market was worth USD 4.95 Billion in 2023. The market is forecast to reach USD 19.58 Billion by 2032, growing at a compound annual growth rate (CAGR) of 16.5% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Video-as-a-Service (VaaS) Market industry over the next decade.

Video-As-A-Service (VaaS) Market Overview

Video-as-a-Service (VaaS) Market allows users to make video calls over the Internet utilizing the service provider's infrastructure. Communication can occur between two persons in separate locations (point-to-point) or between more than two people and devices (multipoint).

Given that the service is primarily hosted on the cloud, customers are not required to download any software to avail of this service. Increased investments in cloud-based video services, lower ownership costs, a substantial move toward digitalization; the rise of the trend of bring-your-own-device to work, the introduction of 5G technology as well as an increase in the number of employees working from home because of the COVID-19 pandemic, have all been major contributors to the growth of Video-as-a-Service (VaaS) market.

The increasing competition in the Video-as-a-Service (VaaS) market has been one of the factors that paved the way for high-quality audio and video conferencing. The key players in the market have increased their investments in the video-as-a-service market due to the rise in the adoption of these services during and post the COVID-19 pandemic.

As many enterprises, small and big businesses, and startups were keen on expanding their cloud services during the pandemic, organizations that provide services like Amazon Web Services and Azure are actively working to make their services available to the general public.

In addition to workplaces, universities, colleges, and schools are also adopting VaaS to facilitate distance learning via video conferencing platforms or by providing recorded lectures. These factors are propelling the video-as-a-service (VaaS) market towards growth.

Growth Factors

Cloud services that are used by businesses are complicated and require a higher ownership cost and at the same time, they are complicated to install. As VaaS services are taken care of by the managed service providers it enables organizations and businesses to reduce their investments in building the infrastructure needed to host these services.

Businesses and organizations have to pay only for the resources they require to use the video conferencing services as the vendors providing cloud services have their service platforms deployed on their own servers. Thus organizations can save money on infrastructure, support costs, and licensing.

5G technology will act as one of the major growth factors for the VaaS market. It will bring in major improvements to cloud computing with its low to characteristics like zero latency that will enable smoother communications via conferencing and recording. The introduction of newer technologies using artificial intelligence and machine learning will spur the adoption of video conferencing over 5G.

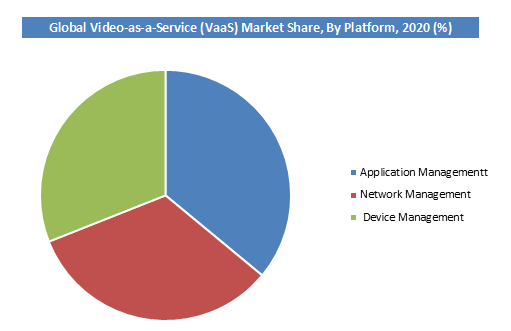

System Segment Analysis Preview

The network management segment held a share of around 30% in 2020. This is attributable to the increase in the number of advanced applications resulting in the growing importance of monitoring and managing the network. The adoption is VaaS is on the rise and network management enables their customers to shift their content distribution networks, computing, storage, and other functions into the cloud. This also increases the flexibility to scale up network components and processing. It also provides features like asset control, network visibility, and Service Level Agreement (SLA) performance management.

End Use Industry Segment Analysis Preview

The healthcare industry segment will grow at a CAGR of over 7% from 2021 to 2028. This is attributable to the fact that healthcare is one of the industries most benefitted from VaaS. It has empowered and enabled hospitals to monitor patients remotely, which becomes a crucial factor, especially for those patients who live in remote areas away from the existing healthcare facilities. It has also become of great importance in cases of accidents in remote areas. In addition to the advantage of real-time visual communication, VaaS also allows doctors, administration, and staff easy access to hospital systems to overlook medical records or laboratory results during a video conference.

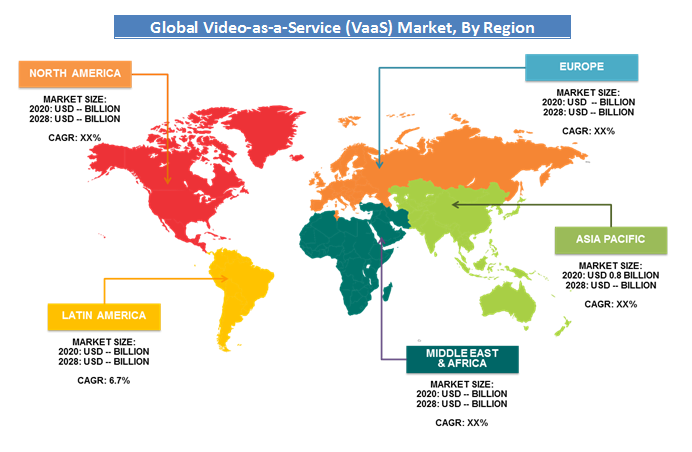

Regional Analysis Preview

The North American region held a share of around 30% in 2020. This is attributable to the investments done by businesses and organizations in outsourcing VaaS solutions. In addition, North American countries have excellent communication infrastructure, which enables VaaS solution providers to provide high-quality services to their customers. Large-scale investments in the implementation of VaaS solutions due to the growth of video conferencing applications are propelling growth in this region.

The Asia Pacific region is projected to grow at a CAGR of 8% over the forecast period. This surge is due to the initiatives undertaken by the government to promote digital infrastructure. Several service providers in the Asia Pacific region are now collaborating with solution providers to improve and adapt services based on local clients' business needs. In APAC's emerging countries, there is a vast untapped opportunity for VaaS providers. The major contributors to the APAC VaaS market are Japan, China, Japan, Australia, and New Zealand. In addition, the presence of a significant number of regional solution providers who offer a variety of services at competitive prices in this region is propelling market growth.

Video-as-a-Service (VaaS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Video-as-a-Service (VaaS) Market |

| Market Size in 2023 | USD 4.95 Billion |

| Market Forecast in 2032 | USD 19.58 Billion |

| Growth Rate | CAGR of 16.5% |

| Number of Pages | 160 |

| Key Companies Covered | Cisco Systems, Inc., Adobe Systems, Huawei Technologies Co., Limited, Polycom, Inc., Interoute Communications Limited, Zoom Video Communications, Microsoft, AWS, Google, and RingCentral, among others |

| Segments Covered | By Platform Type, By Cloud Deployment, By End Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key Market Players & Competitive Landscape

Some of the key players in the Video-as-a-Service (VaaS) market are

- Cisco Systems, Inc.

- Adobe Systems

- Huawei Technologies Co.

- Limited, Polycom, Inc.

- Interoute Communications Limited

- Zoom Video Communications

- Microsoft

- AWS

- RingCentral.

The VaaS market is fragmented, as major players worldwide are working towards innovating their services to deliver cost-beneficial offers to customers, creating fierce competition among market competitors.

The global Video-as-a-Service (VaaS) market is segmented as follows:

By Platform Type

- Application Management

- Network Management

- Device Management

By Cloud Deployment Type

- Public

- Private

- Hybrid

By End Use Industry

- BFSI

- Manufacturing

- IT and Telecom

- Mobile and Entertainment

- Government and Defense

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Video-as-a-Service (VaaS) market was valued at $ 4.95 Billion in 2023.

The global Video-as-a-Service (VaaS) market is expected to reach $ 19.58 Billion by 2032, with an anticipated CAGR of around 16.5% from 2024 to 2032.

Some of the key factors driving the global Video-as-a-Service (VaaS) market growth are increased investments in cloud-based video services, lower ownership costs, a substantial move toward digitalization; the rise of the trend of bring-your-own-device to work, introduction of 5G technology as well as an increase in number of employees working from home because of the COVID-19 pandemic.

North America region held a substantial share of the Video-as-a-Service (VaaS) market in 2020. This is attributable to the investments done by businesses and organizations in outsourcing VaaS solutions. In addition, North American countries have excellent communication infrastructure, which enables VaaS solution providers to provide high-quality services to their customers. Large-scale investments in the implementation of VaaS solutions due to the growth of video conferencing applications are propelling growth this region.

Some of the major companies operating in the Video-as-a-Service (VaaS) market are Cisco Systems, Inc., Adobe Systems, Huawei Technologies Co., Limited, Polycom, Inc., Interoute Communications Limited, Zoom Video Communications, Microsoft, AWS, Google and RingCentral, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed