Vehicle Retarder Market Size, Growth, Global Trends, Forecast 2034

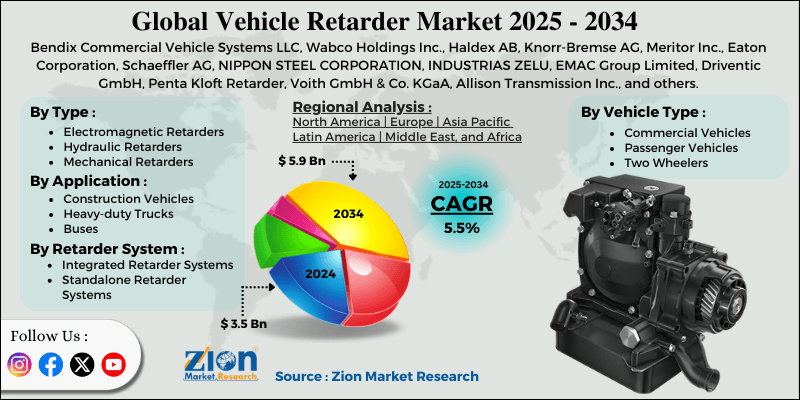

Vehicle Retarder Market By Type (Electromagnetic Retarders, Hydraulic Retarders, Mechanical Retarders, and Exhaust Retarders), By Application (Construction Vehicles, Heavy-duty Trucks, Buses, and Trailers), By Vehicle Type (Commercial Vehicles, Passenger Vehicles, and Two Wheelers), By Retarder System (Integrated Retarder Systems and Standalone Retarder Systems), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

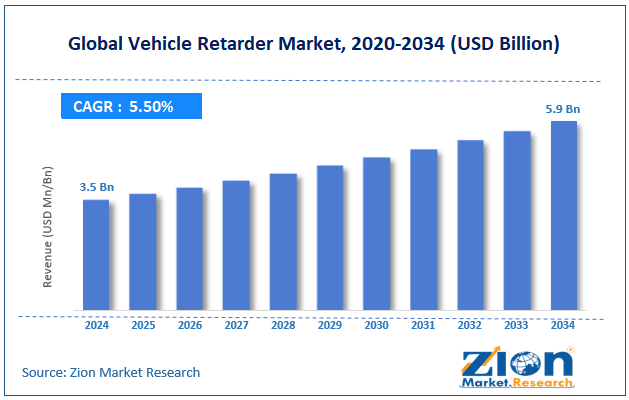

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.5 Billion | USD 5.9 Billion | 5.5% | 2024 |

Vehicle Retarder Industry Perspective:

The global vehicle retarder market size was worth around USD 3.5 billion in 2024 and is predicted to grow to around USD 5.9 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global vehicle retarder market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2025-2034).

- In terms of revenue, the global vehicle retarder market size was valued at around USD 3.5 billion in 2024 and is projected to reach USD 5.9 billion by 2034.

- Increasing e-commerce sector is expected to drive the vehicle retarder market over the forecast period.

- Based on the type, the hydraulic retarders segment is expected to capture the largest market share over the projected period.

- Based on the application, the heavy-duty trucks segment is expected to capture the largest market share over the projected period.

- Based on the vehicle type, the commercial vehicles segment is expected to capture the largest market share over the projected period.

- Based on the retarder system, the integrated retarder systems segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Vehicle Retarder Market: Overview

A vehicle retarder is a supplemental braking device often used on large commercial vehicles, such as trucks and buses. It slows down the vehicle in a controlled way without wearing out the brake pads or drums. It works by making the vehicle's powertrain, engine, transmission, or exhaust system harder to move, which helps keep speeds steady on steep descents, stops brake fade from overheating, and makes protracted braking safer overall. There are several different kinds of retarders, and each one works on a different premise to create drag. There are four kinds of retarders: hydraulic, electromagnetic, mechanical, and exhaust. The vehicle retarder market is being driven by several factors, including the growing focus on road safety & reduction of brake failures, stringent regulations on vehicle safety & heavy commercial vehicles, rising demand for heavy commercial vehicles & buses, the need to reduce maintenance costs of service brakes, and technological advancements in retarder systems. However, the high initial cost of retarder systems poses a major challenge to the vehicle retarder industry.

Vehicle Retarder Market Dynamics

Growth Drivers

How does the growing focus on road safety & reduction of brake failure drive the vehicle retarder industry growth?

The vehicle retarder market is growing because there is more focus on road safety and fewer brake failures. This is because traditional friction brakes often overheat when used for extended periods on steep grades or under heavy loads, leading to brake fade and accidents. Retarders help slow down vehicles without using brake pads by using non-friction methods like hydraulic drag or electromagnetic eddy currents. This converts kinetic energy into heat, thereby helping the vehicle withstand tough conditions in mining, logistics, and city transportation.

Governments in Europe, North America, and emerging markets such as China and India are enforcing stricter global safety rules requiring commercial vehicles to have advanced braking systems to reduce road accidents. They prefer retarders because they remain effective on slippery roads, under heavy loads, and during steep descents. Countries that follow these rules have fewer brake-related accidents, which encourages manufacturers to develop new ideas and more people to adopt them.

For instance, the U.S. Department of Transportation’s National Highway Traffic Safety Administration released its early estimates of traffic fatalities for 2024, projecting that 39,345 people died in traffic crashes.

Restraints

High initial cost of the retarder system is impeding the market growth

The high initial cost of vehicle retarder systems impedes industry growth by making it difficult for fleet operators, especially small- to medium-sized businesses (SMEs) and those in cost-sensitive emerging markets, to afford them. In these markets, the upfront costs of integrating them with transmissions, drivelines, or axles exceed the long-term savings they expect. These costs include not only the purchase of specialized components such as hydraulic rotors, electromagnetic stators, or electronic controllers, but also the installation by skilled professionals, which adds 20–50% to the cost of standard friction brakes.

Also, ongoing maintenance makes the problem worse, as retarders need to be checked, fluids need to be changed (for hydraulic types), and repairs need to be done by experts, which raises operational costs in areas where service infrastructure isn't adequate. This makes it less likely that price-sensitive populations in emerging economies such as India and Southeast Asia will adopt it, even though it offers safety benefits. This means that the market doesn't grow as quickly as it could.

Opportunities

Does technological advancement in vehicle retarders offer a potential opportunity for the vehicle retarder market growth?

Mechanical, hydraulic, and electromagnetic retarder technologies are becoming more efficient, working together more effectively, and performing better. This makes them better for a wider range of automobiles. Traditional mechanical retarders have improved, as they can be controlled more precisely and require less maintenance. Hydraulic retarders, on the other hand, have improved thanks to advanced fluid dynamics and electronic control units (ECUs) that adjust response based on load and road slope.

Electromagnetic retarders, on the other hand, are improving at saving energy and reducing weight. They are noted for being quiet and without causing any friction. This makes them good for both electric commercial vehicles and city buses. The newest generation of retarders has advanced integration technologies that operate with car telematics, adaptive cruise control, and electronic stability programming (ESP). These integrations enable retarders to activate automatically based on vehicle speed, load weight, and road conditions, thereby improving safety without requiring driver intervention.

Also, advances in sensor technology and data analysis enable predictive maintenance of retarder systems, keeping them running at peak performance with the least downtime. As more commercial vehicles adopt electric powertrains, regenerative braking systems are also improving. These devices not only slow the vehicle but also convert kinetic energy into stored electrical energy, which can be used for both braking and recharging the battery. Therefore, these advancements offer a potential opportunity for industry growth.

Challenges

Why does the competition from alternative technology pose a major challenge to vehicle retarder market expansion?

Alternative brake technologies pose a significant challenge to the growth of the vehicle retarder market because they offer cheaper, easier, or more integrated solutions that meet the same safety and efficiency standards, especially in cost-sensitive areas, and as electric vehicles become more popular. Jake brakes and exhaust brakes are examples of engine brakes that slow down a vehicle by releasing compression or creating backpressure. They don't require any extra hardware, which makes them appealing to operators who want to avoid the high costs of installing retarders.

However, noise rules limit their use in some places. Also, regenerative braking in electric and hybrid commercial vehicles uses kinetic energy to recharge batteries, reducing wear on friction brakes and making the vehicles more efficient. This directly competes with hydraulic or electromagnetic retarders in fleets that are focused on sustainability.

As the trend toward car electrification continues, this technology complements EV powertrains, reducing the need for independent retarders. These alternatives make it more difficult for fleet operators to use retarders, particularly in small and medium-sized businesses and in developing nations. This slows down growth rates, even though safety is a concern, because fleet operators prefer built-in options to aftermarket devices. New ideas for hybrid retarder-regenerative setups strive to solve this problem, yet people are stuck in their old ways and don't want to change.

Vehicle Retarder Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Vehicle Retarder Market |

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2034 | USD 5.9 Billion |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 213 |

| Key Companies Covered | Bendix Commercial Vehicle Systems LLC, Wabco Holdings Inc., Haldex AB, Knorr-Bremse AG, Meritor Inc., Eaton Corporation, Schaeffler AG, NIPPON STEEL CORPORATION, INDUSTRIAS ZELU, EMAC Group Limited, Driventic GmbH, Penta Kloft Retarder, Voith GmbH & Co. KGaA, Allison Transmission Inc., and others. |

| Segments Covered | By Type, By Application, By Vehicle Type, By Retarder System, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vehicle Retarder Market: Segmentation

Type Insights

The hydraulic retarders segment dominates the market, capturing over 40% of market share. This dominance is attributable to the growing demand for hydraulic retarders in commercial vehicles, which expands the market by meeting the need for robust, high-torque auxiliary brakes in heavy-duty trucks, buses, and logistics fleets that must contend with steep descents, heavy loads, and frequent stops. These systems are excellent at removing heat because they have oil-filled chambers that create viscous drag between the rotors and stators. This stops brake fade in traditional friction systems and extends their lifespan, which is great news for the booming production of commercial vehicles driven by e-commerce, construction, and infrastructure.

Application Insights

The heavy-duty trucks segment held the largest market share in 2024, at 48%. The rising transportation industry is driving the heavy-duty truck market by increasing demand for robust freight, logistics, and construction hauling amid e-commerce expansion, infrastructure initiatives, and global trade surges. For instance, according to the International Trade Administration, global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, growing at a compound annual growth rate of 14.4%.

Vehicle Type Insights

The commercial vehicle segment is expected to grow rapidly. This growth is primarily driven by rising construction and infrastructure development, especially in developing countries such as China and India. For instance, according to data published by the Press Information Bureau, total infrastructure investment in India has increased significantly, with public- and private-sector contributions shaping the growth trajectory. India's total infrastructure spending has grown exponentially, with budget allocations rising to ₹10 lakh crore in 2023-24.

Retarder System Insights

The integrated retarder systems segment is growing exponentially during the analysis period. These systems let 18–55 MT commercial trucks slow down at all times (52.1% application share). This reduces brake wear in logistics and construction fleets that operate on steep grades, aligns with the trend toward electrification of hybrid and electric vehicles, and requires minimal maintenance. This boosts fleet uptime and safety compliance, driving up demand as more heavy-duty vehicles are produced.

Vehicle Retarder Market: Regional Insights

North America dominates the vehicle retarder market with more than 40% over the projected period. The primary drivers of market development in the region are the growth of the e-commerce sector and infrastructure development. Moreover, the increasing number of traffic accidents in the area is a major catalyst for the market expansion. Additionally, strict regulatory rules, a surge in commercial vehicle production, and the presence of major automakers are propelling industry expansion.

Is the increasing e-commerce boom in the US driving the vehicle retarder market?

The e-commerce boom has significantly increased demand for freight and parcel delivery. As online retail expands, more goods require transportation, storing, and delivery, putting strain on the trucking and logistics industries. Because trucks transport a significant portion of freight in the United States, this expansion results in increased heavy-duty vehicle operations. For instance, the Census Bureau of the Department of Commerce announced that the estimate of U.S. retail e-commerce sales for the second quarter of 2025, adjusted for seasonal variation but not for price changes, was $304.2 billion, an increase of 1.4 percent (±0.9%) from the first quarter of 2025.

Besides, the Asia Pacific is expected to grow at the highest CAGR of 8.9% over the projected period, driven by massive infrastructure investment, which, in turn, is driving demand for heavy-duty trucks in the region. Countries like India and China are capturing the largest share of revenue in the Asia Pacific regional market, driven by increasing online retail.

Vehicle Retarder Market: Competitive Analysis

The global vehicle retarder market is dominated by players like:

- Bendix Commercial Vehicle Systems LLC

- Wabco Holdings Inc.

- Haldex AB

- Knorr-Bremse AG

- Meritor Inc.

- Eaton Corporation

- Schaeffler AG

- NIPPON STEEL CORPORATION

- INDUSTRIAS ZELU

- EMAC Group Limited

- Driventic GmbH

- Penta Kloft Retarder

- Voith GmbH & Co. KGaA

- Allison Transmission Inc.

The global vehicle retarder market is segmented as follows:

By Type

- Electromagnetic Retarders

- Hydraulic Retarders

- Mechanical Retarders

- Exhaust Retarders

By Application

- Construction Vehicles

- Heavy-duty Trucks

- Buses

- Trailers

By Vehicle Type

- Commercial Vehicles

- Passenger Vehicles

- Two Wheelers

By Retarder System

- Integrated Retarder Systems

- Standalone Retarder Systems

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed