Vacuum Insulation Panel Market Size, Share, Trends, Growth & Forecast 2034

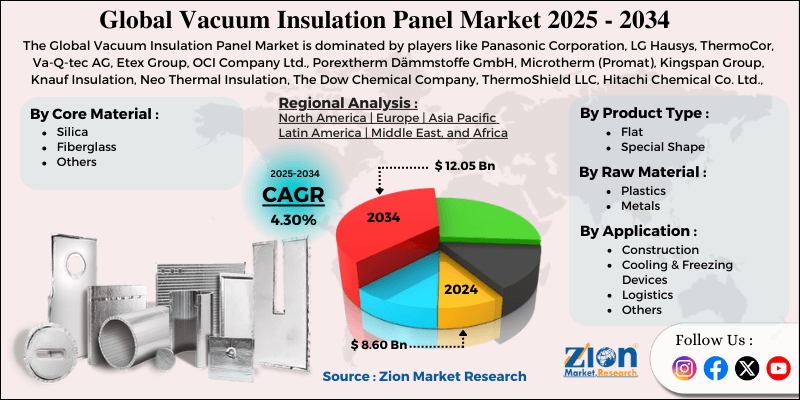

Vacuum Insulation Panel Market By Product (Flat, Special Shape), By Core Material (Silica, Fiberglass, and Others), By Raw Material (Plastics, Metals), By Application (Construction, Cooling & Freezing Devices, Logistics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

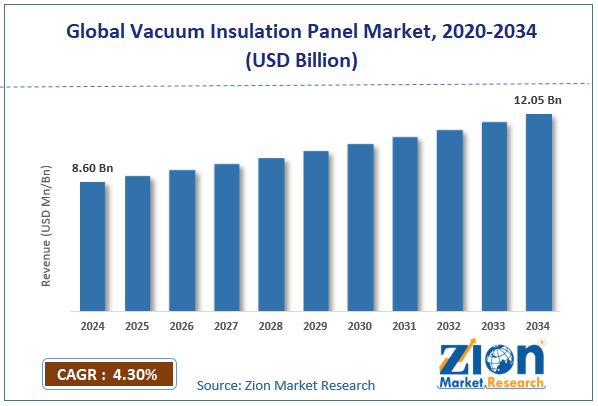

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.60 Billion | USD 12.05 Billion | 4.30% | 2024 |

Vacuum Insulation Panel Market: Industry Perspective

The global vacuum insulation panel market size was worth around USD 8.60 billion in 2024 and is predicted to grow to around USD 12.05 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.30% between 2025 and 2034.

Vacuum Insulation Panel Market: Overview

Vacuum insulation panels are improved thermal insulation materials that offer the lowest thermal conductivity with a vacuum-sealed core, usually made from glass fiber or fumed silica, enclosed in a gas-tight barrier film. These panels provide superior insulation performance compared to conventional materials, while occupying minimal space. The global vacuum insulation panel market is poised for notable growth owing to the rising demand for energy-efficient buildings, progress in cold chain logistics, increasing space constraints, and growing urbanization. Vacuum insulation panels offer high thermal resistance, aiding buildings in meeting strict energy-efficiency rules. Their ultra-thin structure enables better usable space while decreasing cooling and heating needs. Rising adoption of green building standards is amplifying the use of VIP.

Moreover, the cold chain industry largely depends on thermal insulation to preserve pharmaceuticals and food. VIPs maintain accurate temperature ranges in refrigeration units and transport packaging. Growth in vaccine distribution and e-commerce grocery drives this demand. Furthermore, urban real estate is fueling the demand for space-efficient construction materials. VIPs offer high insulation in thin panels, increasing their suitability for compact appliances and buildings. This trend facilitates VIP adoption in commercial and residential infrastructure.

Nevertheless, the global market faces limitations due to factors such as the significant initial cost of vacuum insulation panels and a lack of awareness among end-users. Compared to traditional insulation, vacuum insulation panels are more expensive. Their high material cost and manufacturing complexity restrict their use in budget-conscious projects. This price gap is still a key adoption hindrance. Also, a majority of architects, OEMs, and contractors are unaware of the VIP technology. Lack of awareness and education regarding installation and benefits restricts the adoption. Industry education is improving, but still lags.

Still, the global vacuum insulation panel industry benefits from several favorable factors, including IoT integration, smart refrigeration, and rising pharmaceutical and medical cold chain needs. VIPs enhance energy savings in freezers and smart refrigerators. IoT-based appliances with energy monitoring vastly prefer advanced insulation. This intersection offers growth potential in the global smart home markets. Additionally, vaccines, biologics, and diagnostics still need strict thermal control during transit and storage. VIP packaging promises temperature integrity for long distances and durations. Growth in pharmaceutical and biotech drives this demand.

Key Insights:

- As per the analysis shared by our research analyst, the global vacuum insulation panel market is estimated to grow annually at a CAGR of around 4.30% over the forecast period (2025-2034)

- In terms of revenue, the global vacuum insulation panel market size was valued at around USD 8.60 billion in 2024 and is projected to reach USD 12.05 billion by 2034.

- The vacuum insulation panel market is projected to grow significantly owing to the expansion of the construction industry, growth in smart city projects and urbanization, and increasing use in refrigeration and cold chain logistics.

- Based on product, the flat segment is expected to lead the market, while the special shape segment is expected to grow considerably.

- Based on core material, the silica segment dominates the market, while the fiberglass segment is projected to gain remarkable growth.

- Based on raw material, the plastics segment is the dominating segment, while the metals segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the cooling & freezing devices segment is expected to lead the market compared to the construction segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Vacuum Insulation Panel Market: Growth Drivers

How are miniaturization trends in freezers and refrigerators propelling the global vacuum insulation panel market?

With the inclining consumer preference towards space-efficient and compact appliances, manufacturers are incorporating VIPs to enhance insulation without increasing the size of the unit. VIPs allow up to 25% more usable volume than conventional polyurethane foam insulation, a main selling point in densely populated regions like South Korea and Japan.

LG Electronics introduced a fresh line of premium refrigerators in Southeast Asia and India with a triple-layer vacuum insulation panel in June 2025. They claimed 35% lower energy usage compared to traditional techniques. This product strategy obeys the demand of eco-conscious users and facilitates appliance efficiency regulations across the globe.

Which key technological improvements are fueling the vacuum insulation panel market?

Ongoing commercialization and research and development of novel core materials, such as glass fiber, aerogels, recycled silica, and composites, are significantly enhancing VIP recyclability and performance. Producers are also aiming to address edge thermal bridging and durability issues, which earlier restricted the adoption of VIPs.

The newest advancements comprise moisture-proof sealing, vacuum retention, and multi-layer barrier films, which have increased the product lifespan from simply 5 to 20 years in a few cases. Companies like ThermoCor, Va-Q-tec, and Panasonic are producing next-generation VIPs, ideal for different applications from medical equipment to aerospace, impacting the worldwide vacuum insulation panel market.

Restraints

Disposal challenges and limited recyclability hamper the market

The complex structure of VIPs, usually comprising glass-fiber cores, metalized foils, and laminated multi-layer barrier films, increases the intricacies and cost. Several panels cannot be easily recycled or easily separated into recyclable components, resulting in waste management concerns.

The United Kingdom Environment Agency disclosed guidelines discouraging the use of VIPs in large-scale public housing projects unless producers provide a clear end-of-life recycling roadmap in June 2025. This policy move could significantly hinder the adoption of VIPs in key government-funded infrastructure projects.

Opportunities

Innovation in hybrid insulation systems remarkably drives the market growth

A promising opportunity is offered by hybrid insulation systems that blend VIPS with materials like polyurethane foam, phase change materials, and aerogels. This method balances thermal performance, cost, and mechanical durability, increasing its practicality for wider applications. This opportunity remarkably drives the global vacuum insulation panel industry.

Va-Q-Tec and BASF have jointly developed a novel hybrid insulation panel for EV battery packs, integrating PCM and VIPs to manage heat dissipation and retention, thereby marking a significant advancement in thermal management for the mobility industry.

Challenges

How are retrofitting intricacies challenging the growth of the global vacuum insulation panel market?

While VIPs offer high-performing and thin insulation, their strong structure increases challenges in retrofitting into the current wall cavities. This restricts their usability in old buildings where construction access is restricted and dimensions are non-uniform.

In March 2025, ENEA, the energy agency in Italy, underscored this problem while reviewing Superbonus-funded renovations, citing that vacuum insulation panels were considered non-viable for the majority of 1960s-era construction because of a mismatch with construction formats.

Vacuum Insulation Panel Market: Segmentation

The global vacuum insulation panel market is segmented based on product, core material, raw material, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on product, the global vacuum insulation panel industry is divided into flat and special shapes. The flat panels segment leads the global market due to its widespread use in refrigeration, appliances, and construction, where standard dimensions are highly preferred for mass production and easy installation.

Nonetheless, the special shape panels segment holds a progressive share due to their growing demand for customized applications.

Based on core material, the global market is segmented into silica, fiberglass, and others. The silica VIPs hold a leading share due to their optimal thermal insulation performance, low thermal conductivity, and long service life, all of which are suitable for high-efficiency applications like construction and appliances.

Conversely, the fiberglass segment contributes a remarkable share, preferred for its cost-efficiency and mechanical strength.

Based on raw material, the global vacuum insulation panel market is segmented into plastics and metals. The plastics segment dominates the market due to their broad use in protective layers and VIP barrier films, thanks to their flexibility, lightweight nature, and cost-efficiency.

On the other hand, the metals segment holds a second-leading share since they are primarily valued for their optimal barrier properties against moisture and gas.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Based on application, the global market is segmented into construction, cooling & freezing devices, logistics, and others. The cooling & freezing devices segment holds leadership because of heavy demand for space-saving and energy-efficient insulation in commercial and household appliances.

However, the construction segment ranks second, driven by the growing demand for thermal insulation in green buildings and the need to comply with energy-saving norms, particularly in high-performance and urban building projects.

Vacuum Insulation Panel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Vacuum Insulation Panel Market |

| Market Size in 2024 | USD 8.60 Billion |

| Market Forecast in 2034 | USD 12.05 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 212 |

| Key Companies Covered | Panasonic Corporation, LG Hausys, ThermoCor, Va-Q-tec AG, Etex Group, OCI Company Ltd., Porextherm Dämmstoffe GmbH, Microtherm (Promat), Kingspan Group, Knauf Insulation, Neo Thermal Insulation, The Dow Chemical Company, ThermoShield LLC, Hitachi Chemical Co. Ltd., Turna, and others. |

| Segments Covered | By Product, By Core Material, By Raw Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vacuum Insulation Panel Market: Regional Analysis

What enables Asia Pacific's strong foothold in the global Vacuum Insulation Panel Market?

Asia Pacific is projected to maintain its dominant position in the global vacuum insulation panel market, driven by growing urbanization, a booming construction sector, high production and consumption of refrigeration tools, and the progression of e-commerce and cold chain. Asia Pacific is a forerunner due to its infrastructure expansion and rapid urbanization in nations such as Southeast Asia, India, and China. According to Oxford Economics, the region is projected to account for more than 50% of the worldwide construction activity by 2034. The demand for space-saving and efficient insulation like VIPs is growing remarkably in commercial and residential developments.

Moreover, APAC is a leading hub for the consumption and production of appliances like freezers and refrigerators. China alone produces more than 40% of the world's refrigerators, a majority of which integrate VIPs to enhance energy saving. Growing middle-class appliance ownership and income also fuel the industry's growth.

Asia Pacific's growing food and pharmaceutical sectors are driving demand for cold chain logistics.

Europe maintains its position as the second-leading region in the global vacuum insulation panel industry due to a strong focus on energy-efficient construction, rising retrofit and green building market, and improvements in recycling and sustainable materials. Europe holds several stringent regulations for energy efficiency across the globe. The European Union aims to make all new construction and buildings nearly zero-energy by 2030. This fuels the demand for VIPs in facades, roofs, and walls of commercial and residential structures.

Vacuum Insulation Panel Market: Competitive Analysis

The leading players in the global vacuum insulation panel market are:

- Panasonic Corporation

- LG Hausys

- ThermoCor

- Va-Q-tec AG

- Etex Group

- OCI Company Ltd.

- Porextherm Dämmstoffe GmbH

- Microtherm (Promat)

- Kingspan Group

- Knauf Insulation

- Neo Thermal Insulation

- The Dow Chemical Company

- ThermoShield LLC

- Hitachi Chemical Co. Ltd.

- Turna

Vacuum Insulation Panel Market: Key Market Trends

Increased use in pharmaceutical packaging and cold chain:

The rise in temperature-sensitive biologics and pharmaceuticals is fueling the demand for advanced insulation in cold chain logistics. VIPs offer accurate temperature control for long-duration transport without ample insulation. Reusable vacuum insulation panels are increasingly used for biology and vaccine delivery.

Rise of hybrid VIPs with enhanced performance:

Producers are increasingly developing hybrid VIPs blending core materials like silica with phase change materials or aerogels. These offer enhanced thermal performance, adaptability to extreme temperatures, and extended service life. Hybrid panels are gaining appeal in the automotive, aerospace, and pharma industries.

The global vacuum insulation panel market is segmented as follows:

By Product

- Flat

- Special Shape

By Core Material

- Silica

- Fiberglass

- Others

By Raw Material

- Plastics

- Metals

By Application

- Construction

- Cooling & Freezing Devices

- Logistics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Vacuum insulation panels are improved thermal insulation materials that offer the lowest thermal conductivity with a vacuum-sealed core, usually made from glass fiber or fumed silica, fenced in a gas-tight barrier film. These panels provide superior insulation performance compared to conventional materials, while occupying minimal space.

The global vacuum insulation panel market is projected to grow due to increasing usage in household appliances, growing sustainability initiatives and environmental awareness, and improvements in VIP production.

According to study, the global vacuum insulation panel market size was worth around USD 8.60 billion in 2024 and is predicted to grow to around USD 12.05 billion by 2034.

The CAGR value of the vacuum insulation panel market is expected to be around 4.30% during 2025-2034.

Asia Pacific is expected to lead the global vacuum insulation panel market during the forecast period.

Technological advancements are allowing the development of high-performance VIPs with better thermal resistance, longer lifespans, and reduced thickness. Innovations like automated manufacturing and nanomaterial integration are also expanding application areas and lowering costs.

Macroeconomic factors, such as strict environmental regulations and rising energy costs, will drive demand for energy-efficient insulation solutions like VIPs. However, fluctuating raw material prices and inflation may challenge profitability and investment in large-scale adoption.

The key players profiled in the global vacuum insulation panel market include Panasonic Corporation, LG Hausys, ThermoCor, Va-Q-tec AG, Etex Group, OCI Company Ltd., Porextherm Dämmstoffe GmbH, Microtherm (Promat), Kingspan Group, Knauf Insulation, Neo Thermal Insulation, The Dow Chemical Company, ThermoShield LLC, Hitachi Chemical Co., Ltd., and Turna.

What strategies should stakeholders adopt to stay competitive in the vacuum insulation panel market?

Stakeholders should invest in R&D for cost-effective, thinner, and eco-friendly VIP solutions while expanding strategic partnerships across the cold chain and construction sectors. Emphasizing supply chain optimization and regional manufacturing can also improve market competitiveness.

The report examines key aspects of the vacuum insulation panel market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed