U.S. School Furniture Market Size, Share, Growth Analysis Report - Forecast 2034

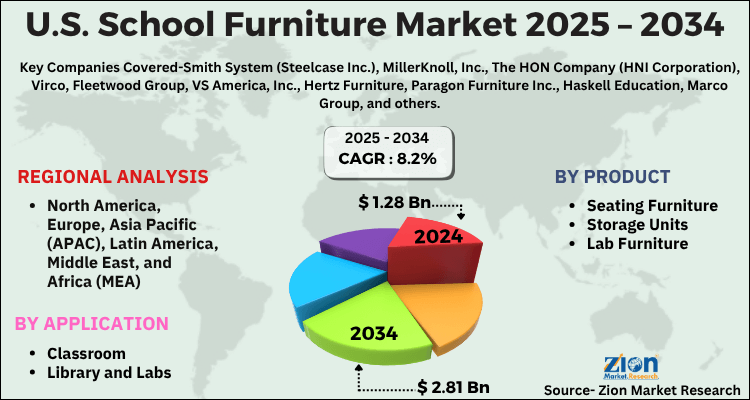

U.S. School Furniture Market By Product (Seating Furniture, Storage Units, Lab Furniture, Others), By Application (Classroom, Library and Labs, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

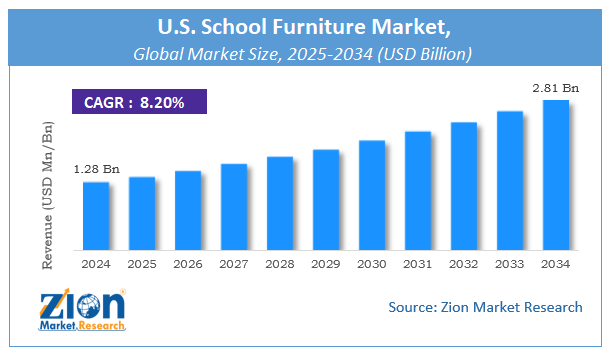

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.28 Billion | USD 2.81 Billion | 8.2% | 2024 |

U.S. School Furniture Market: Industry Perspective

The global U.S. school furniture market size was worth around USD 1.28 Billion in 2024 and is predicted to grow to around USD 2.81 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.2% between 2025 and 2034. The report analyzes the global U.S. school furniture market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the U.S. school furniture industry.

U.S. School Furniture Market: Overview

School furniture is different types of furniture items that are used in education institutes such as colleges, schools, and universities. This includes items such as desks, chairs, tables, cabinets, bookshelves, whiteboards, podiums, and other products that are designed specifically to be used in libraries, classrooms, administrative areas, and laboratories of education facilities. The U.S. school furniture industry refers specifically to the production and distribution of school furniture in the United States, which is one of the world’s most advanced countries. The market encompasses the demand, supply, and trade of school furniture within the country and is influenced by the efforts or undertakings of manufacturers, suppliers, distributors, and retailers of school furniture products. During the forecast period, the growth rate in the market is likely to be steady.

U.S. School Furniture Market: Growth Drivers

Increasing school enrollment rate to propel market growth

The U.S. school furniture market is projected to grow owing to the increasing rate of school enrollment across the United States territory. Although there are claims that the schooling system in this country is currently struggling to meet international standards in terms of effectiveness when compared to other developed nations, nonetheless, it has one of the most well-established schooling ecosystems across the globe.

A report published by the Department of Education claimed that in the fall of 2021, more than 49 million students were enrolled in public schools. This trend was observed in pre-kindergarten until 12th grade. The number of students enrolled in schools in 2021 was higher than the number in 2024. As the population in the country continues to grow, more children are expected to be enrolled in these education facilities since quality education is one of the primary concerns of the national government.

Restraints:

Severe budget constraints to restrict the market growth

Several education facilities, especially public schools in the US, run on limited budgets and resources. This can pose a significant threat to the U.S. school furniture industry expansion goal as school management may refrain from spending heavily on more efficient school furniture or renovation of the old units.

For instance, public schools receive funding depending on property taxes and hence areas with more wealth tend to get more money when compared to poorer areas. There have been growing concerns over the insufficiency of funding received by public schools.

Opportunities:

Increasing adoption of modern learning methods to provide growth opportunities

The U.S. school furniture market is projected to come across several growth opportunities owing to the increasing shift toward modern learning methods such as collaborative learning, project-based learning, and technology integration. These types of learning methods demand furniture that can support the teaching process. Manufacturers can gain more market share by developing innovative furniture solutions that cater to the need for flexible learning spaces, adjustable seating, and technology integration.

Challenges:

Longer sales cycle to challenge market growth

The U.S. school furniture industry may face growth challenges due to the longer sales cycle of school furniture since it tends to be a lengthy process that involves multiple stakeholders during decision-making. Typically, schools have a strict procurement process and it requires necessary approvals from management or committee which can lengthen the time from initial inquiry to final purchase. Furthermore, stricter regulatory compliance measures could lead to loss of revenue as furniture may need to undergo testing and certifications.

Key Insights

- As per the analysis shared by our research analyst, the global U.S. school furniture market is estimated to grow annually at a CAGR of around 8.2% over the forecast period (2025-2034).

- Regarding revenue, the global U.S. school furniture market size was valued at around USD 1.28 Billion in 2024 and is projected to reach USD 2.81 Billion by 2034.

- The U.S. school furniture market is projected to grow at a significant rate due to rising student enrollment, government funding for education, demand for ergonomic and flexible furniture, and increasing focus on modern learning environments.

- Based on Product, the Seating Furniture segment is expected to lead the global market.

- On the basis of Application, the Classroom segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

U.S. School Furniture Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. School Furniture Market |

| Market Size in 2024 | USD 1.28 Billion |

| Market Forecast in 2034 | USD 2.81 Billion |

| Growth Rate | CAGR of 8.2% |

| Number of Pages | 226 |

| Key Companies Covered | Smith System (Steelcase Inc.), MillerKnoll, Inc., The HON Company (HNI Corporation), Virco, Fleetwood Group, VS America, Inc., Hertz Furniture, Paragon Furniture Inc., Haskell Education, Marco Group, and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. School Furniture Market: Segmentation

The U.S. school furniture market is segmented based on application, product, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on application, the regional market segments are library, classroom, and laboratories. The industry witnessed the highest growth in the classroom segment since the types of furniture required in a classroom setting are higher when compared to other areas of an educational facility.

For instance, every classroom needs desks, chairs, whiteboards, storage units, and teacher podiums. These are the minimum components needed to create a fully functional classroom setting. Schools may invest in more variants of furniture depending on their specific needs and budget. Since the classroom is a part of the facility where maximum knowledge transfer occurs, these units must be well-equipped.

Types of furniture used in libraries include bookshelves, study tables, and seating areas whereas laboratories may need specialized workstations, stools, and storage units. As per WeAreTeachers, there are around 90,148 public schools in the US.

Based on product, the regional market is divided into storage units, seating units, and lab furniture. The highest CAGR was observed in the seating units segment which includes desks and chairs. These components form the basic building blocks of any educational facility since students require a spacious and comfortable seating place and hence this segment remains one of the most frequently bought items.

Storage units which include items such as bookshelves, cabinets, and lockers are also common since they are used to store supplies, books, and personal belongings. Despite the demand for storage units being significant, it is relatively less than seating units. Lab furniture is customized and specialized units. The national average of students per public school is around 526 students.

Recent Developments:

- In May 2024, the Texas Senate witnessed the introduction of a new education bill that would allow families to have access to taxpayer money that can be used to send their children to private schools. The bill also focuses on the imposition of new rules that would ensure efficient teaching of sexual and gender orientation in all grades

- In April 2024, Ann Hsu, a former member of the San Francisco school board, announced her intention to start a new private school in the Potrero Hill area. She is an ex-mayor of the city and failed to get a seat in the last elections. The academy is called Bertrand D. Hsu American & Chinese Bicultural Academy and will charge around USD 18,000 per student annually

- In August 2024, Private schools dominated the waivers to reopen amidst the Covid-19 pandemic. Around 90% of the schools that received reopening approvals were private institutes

U.S. School Furniture Market: Regional Analysis

The U.S. school furniture market shows strong regional variation influenced by population density, education infrastructure, and state-level funding initiatives. The Southern region leads the market due to the large student population and ongoing construction of new educational facilities, followed closely by the West, where significant investments in modern and flexible learning environments are driving demand. The Midwest maintains steady growth, supported by efforts to renovate aging schools and adopt ergonomic and sustainable furniture solutions. Meanwhile, the Northeast exhibits a mature market with a focus on upgrading existing schools with innovative, tech-integrated furniture to support 21st-century learning models.

U.S. School Furniture Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the U.S. school furniture market on a global and regional basis.

The global U.S. school furniture market is dominated by players like:

- Smith System (Steelcase Inc.)

- MillerKnoll Inc.

- The HON Company (HNI Corporation)

- Virco

- Fleetwood Group

- VS America Inc.

- Hertz Furniture

- Paragon Furniture Inc.

- Haskell Education

- Marco Group

U.S. School Furniture Market: Segmentation Analysis

The global U.S. school furniture market is segmented as follows;

By Product

- Seating Furniture

- Storage Units

- Lab Furniture

- Others

By Application

- Classroom

- Library and Labs

- Others

U.S. School Furniture Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

School furniture is different types of furniture items that are used in education institutes such as colleges, schools, and universities. This includes items such as desks, chairs, tables, cabinets, bookshelves, whiteboards, podiums, and other products that are designed specifically to be used in libraries, classrooms, administrative areas, and laboratories of education facilities. The U.S. school furniture industry refers specifically to the production and distribution of school furniture in the United States, which is one of the world’s most advanced countries.

The global U.S. school furniture market is expected to grow due to increasing investments in educational infrastructure, evolving teaching methods demanding flexible and ergonomic furniture, a growing student population, and a rising focus on technology integration and sustainable solutions.

According to a study, the global U.S. school furniture market size was worth around USD 1.28 Billion in 2024 and is expected to reach USD 2.81 Billion by 2034.

The global U.S. school furniture market is expected to grow at a CAGR of 8.2% during the forecast period.

North America is expected to dominate the U.S. school furniture market over the forecast period.

Leading players in the global U.S. school furniture market include Smith System (Steelcase Inc.), MillerKnoll, Inc., The HON Company (HNI Corporation), Virco, Fleetwood Group, VS America, Inc., Hertz Furniture, Paragon Furniture Inc., Haskell Education, Marco Group, among others.

The report explores crucial aspects of the U.S. school furniture market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed