Upstream Bioprocessing Market Size Report, Share, Analysis, Growth, 2032

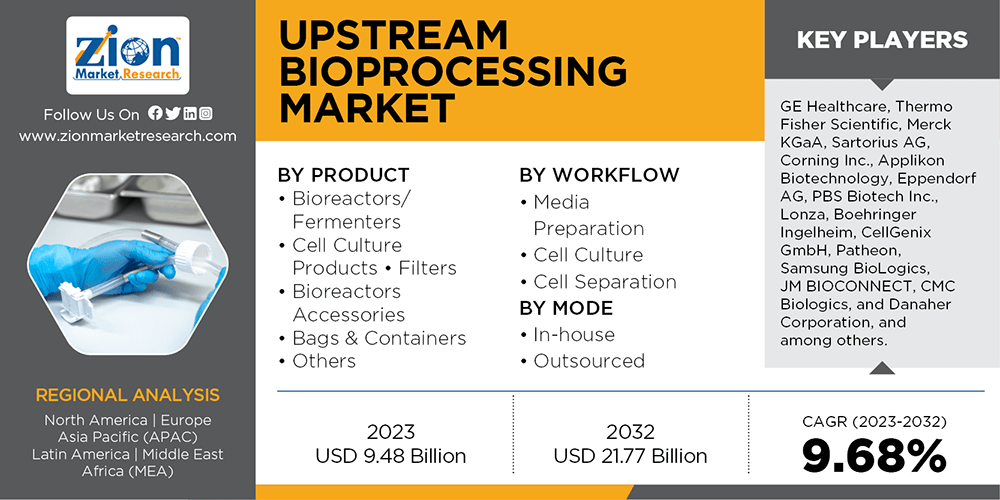

Upstream Bioprocessing Market - By Product (Cell Culture Products, Bioreactors/Fermenters, Filters, Bags & Containers, Bioreactors Accessories And Others), By Workflow (Cell Culture, Media Preparation, And Cell Separation), By Mode (Outsourced And In-House), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.48 Billion | USD 21.77 Billion | 9.68% | 2023 |

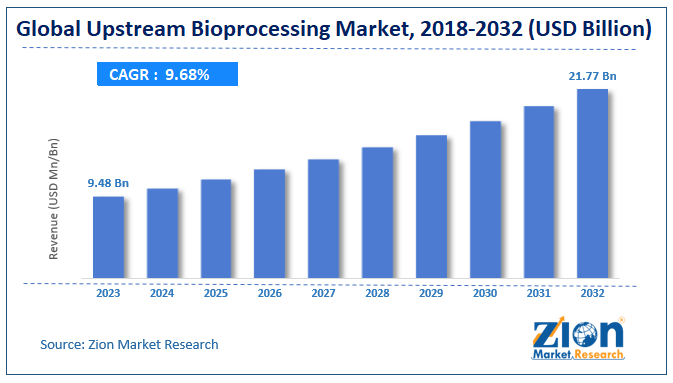

The global demand for upstream bioprocessing market size was valued at approximately USD 9.48 billion in 2023, and is expected to generate revenue of around USD 21.77 billion by end of 2032, growing at a CAGR of around 9.68% between 2024 and 2032.

The report covers forecast and analysis for the upstream bioprocessing market on a global and regional level. The study provides historic data from 2018 along with forecast from 2024 to 2032 based on revenue (USD Million). The study includes drivers and restraints for the upstream bioprocessing market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the upstream bioprocessing market on a global as well as regional level.

In order to give the users of this report a comprehensive view on the upstream bioprocessing market we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all segments are benchmarked based on their market size, growth rate and general attractiveness.

The report provides company market share analysis in order to give a broader overview of the key players in the upstream bioprocessing market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, regional expansion of major participants involved in the upstream bioprocessing market on global and regional basis.

The study provides a decisive view on the upstream bioprocessing by segmenting the market based on workflow, product, mode, and region. All the segments of upstream bioprocessing market have been investigated based on current and forecast demand and trends and the market is forecasted from 2024 to 2032.

Bioprocessing deals with use of living cells (bacteria, animal cells, plat cells) or their components (chloroplasts, enzymes etc.) to obtain desired products. Bioprocess is mainly divided into upstream and downstream processing. The upstream bioprocessing deals with complete processing right from early cell separation/isolation and cultivation, to cell banking and cell culture expansion till final harvest.

Upstream bioprocessing market is driven by increasing research activities for development of biosimilars/biomolecules, small therapeutic peptide and monoclonal antibodies. Increasing chronic disease prevalence across the globe is another major factor that is propelling the growth of upstream bioprocessing market. Need for process optimization and contamination free, safe and efficient production of biomolecules augment the market growth. However, high cost of overall processing and production may hamper the growth of this market. Increasing research to develop novel therapeutic proteins, collaborations among major players and institutes may bring new growth opportunities in the upstream bioprocessing market.

Upstream Bioprocessing Market: Segmentation

Based on product, global upstream bioprocessing market is bifurcated into cell culture products, bioreactors/fermenters, filters, bags & containers, bioreactors accessories and others. Bioreactors/fermenters segment held largest market share in 2018 owing to increasing installations by small and large scale production. Technological advancements, process automation for cost effective, regulatory compliant and safe manufacturing has attributed to growth of bioreactors/fermenters product type segment. Cell culture products segment is expected to grow at highest CAGR over the forecast period owing to increasing demand for cell cultures with higher titer productivity to manufacture biosimilars and monoclonal antibodies (mAbs).

Based on workflow market is segmented into cell culture, media preparation, and cell separation. Cell culture workflow segment held largest market share in 2024 and expected to retain its dominance over the forecast period. Technological advancements such as small scale bioproduction using micro-bioreactors and use of bioinformatics tools, data analysis & management solutions has attributed to high growth of cell culture workflow segment.

Based on mode, upstream bioprocessing market is segmented into outsourced and in-house. In-house mode of bioprocessing held largest market share due to its cost-effectiveness, presence of large number of firms with established in-house manufacturing.

At region level, North America held largest market share of global upstream bioprocessing market in 2024. Presence of major biopharmaceutical companies, increasing investment for research and development of new biomolecules & mAbs, increasing chronic disease burden, presence of developed infrastructure are major factors that propel the market growth in this region. In 2024 Europe was second largest regional market. The growth in Europe is attributed to increasing R&D activities on biosimilar and mAbs production, increasing collaborative research by academic and research institutes with biopharmaceutical players. During the forecast period Asia Pacific will register highest growth rate for upstream bioprocessing market. This is mainly due to increasing number of players focusing on emerging market growth potential.

Upstream Bioprocessing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Upstream Bioprocessing Market Research Report |

| Market Size in 2023 | USD 9.48 billion |

| Market Forecast in 2032 | USD 21.77 billion |

| Growth Rate | CAGR of 9.68% |

| Number of Pages | 255 |

| Key Companies Covered | GE Healthcare, Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Corning Inc., Applikon Biotechnology, Eppendorf AG, PBS Biotech Inc., Lonza, Boehringer Ingelheim, CellGenix GmbH, Patheon, Samsung BioLogics, JM BIOCONNECT, CMC Biologics, and Danaher Corporation, and among others. |

| Segments Covered | By Product, By Workflow, By Mode, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Upstream Bioprocessing Market Key Players

- GE Healthcare

- Thermo Fisher Scientific

- Merck KGaA

- Sartorius AG

- Corning Inc.

- Applikon Biotechnology

- Eppendorf AG

- PBS Biotech Inc.

- Lonza

- Boehringer Ingelheim

- CellGenix GmbH

- Patheon

- Samsung BioLogics

- JM BIOCONNECT

- CMC Biologics

- Danaher Corporation

The report segment of global upstream bioprocessing market as follows:

Global Upstream Bioprocessing Market: By Product

- Bioreactors/Fermenters

- Cell Culture Products

- Filters

- Bioreactors Accessories

- Bags & Containers

- Others

Global Upstream Bioprocessing Market: By Workflow

- Media Preparation

- Cell Culture

- Cell Separation

Global Upstream Bioprocessing Market: By Mode

- In-house

- Outsourced

Global Upstream Bioprocessing Market: By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global upstream bioprocessing market accounted for USD 9.48 billion in 2023 and is expected to reach USD 21.77 billion by 2032.

The CAGR value of the upstream bioprocessing market is expected to be around 9.68% during 2024-2032.

North America held largest market share of global upstream bioprocessing market in 2018. Presence of major biopharmaceutical companies, increasing investment for research and development of new biomolecules & mAbs, increasing chronic disease burden, presence of developed infrastructure are major factors that propel the market growth in this region.

Some key players of the global upstream bioprocessing market are GE Healthcare, Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Corning Inc., Applikon Biotechnology, Eppendorf AG, PBS Biotech Inc., Lonza, Boehringer Ingelheim, CellGenix GmbH, Patheon, Samsung BioLogics, JM BIOCONNECT, CMC Biologics, and Danaher Corporation, and among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed