United Kingdom Technical Textiles Market Size, Share, Report 2034

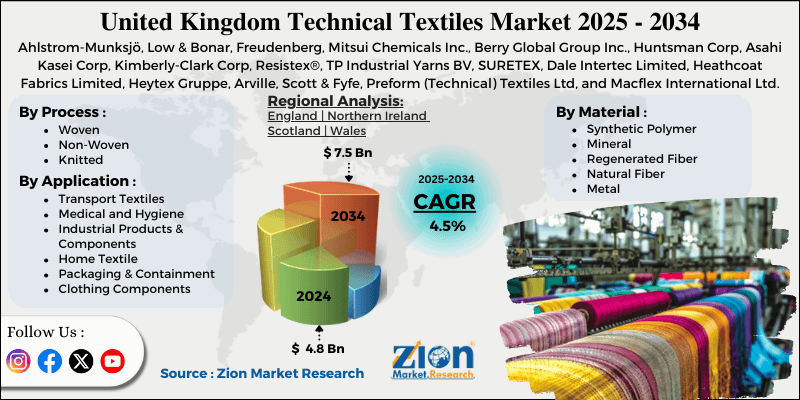

United Kingdom Technical Textiles Market By Process (Woven, Non-Woven, Knitted, and Others), By Material (Synthetic Polymer, Mineral, Regenerated Fiber, Natural Fiber, Metal, and Others), By Application (Transport Textiles, Medical and Hygiene, Industrial Products & Components, Home Textile, Packaging and Containment, Clothing Components, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

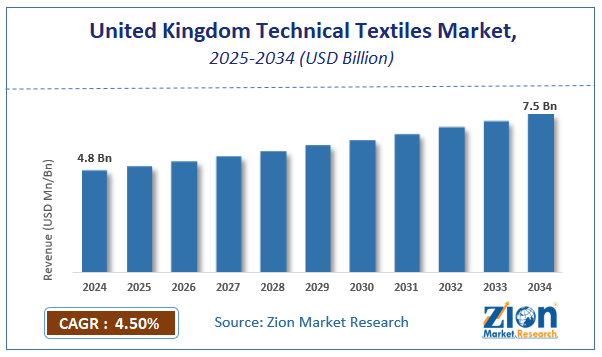

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.8 Billion | USD 7.5 Billion | 4.5% | 2024 |

United Kingdom Technical Textiles Industry Prospective:

The United Kingdom Technical Textiles market size was worth around USD 4.8 billion in 2024 and is predicted to grow to around USD 7.5 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the United Kingdom Technical Textiles market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034).

- In terms of revenue, the United Kingdom Technical Textiles market size was valued at around USD 4.8 billion in 2024 and is projected to reach USD 7.5 billion by 2034.

- The growing demand from the automotive sector is expected to drive the United Kingdom Technical Textiles market over the forecast period.

- Based on the process, the woven segment is expected to hold the largest market share over the forecast period.

- Based on the material, the synthetic polymer segment is expected to dominate the market expansion over the projected period.

- Based on the application, the transport textiles segment is expected to dominate the market expansion over the projected period.

United Kingdom Technical Textiles Market: Overview

Technical textiles comprise a class of fabrics and materials engineered to emphasize their functional and performance characteristics rather than aesthetic or decorative purposes. These textiles have been created to exhibit excellent strength, durability, and resistance to chemicals and fire, among other traits. Such characteristics make them widely used across industries, including automotive, healthcare, construction, agriculture, and protective wear. Technical textiles differ substantially from conventional textiles, such as clothing and those used in home interiors; they are often produced using modern techniques, including nonwoven bonding, coating, lamination, and weaving with high-tenacity synthetic fibers, such as polyester, nylon, aramids (e.g., Kevlar), and carbon composites. Consequently, these include airbags and geotextiles for soil stabilization, medical implants, and fire-resistant suits.

United Kingdom Technical Textiles Market Dynamics

Growth Drivers

How do the sustainability and circularity requirements drive the UK technical textiles market growth?

The requirements of sustainability and circularity are changing the entire market situation and becoming a major growth driver for the UK technical textiles sector. They influence the selection of materials, purchasing policies, and product design across the most important end-use sectors. The manufacturers and end users are being drawn in by the UK’s net-zero commitments, extended producer responsibility (EPR) rules, and tighter waste-reduction targets to replace traditional resource-intensive materials with high-performance technical textiles that have a longer life, are lighter, and are less environmentally harmful.

In construction and infrastructure, the principles of the circular economy are not only leading to the quicker utilization of geotextiles, insulation textiles, and reinforcement fabrics with longer lifespans, which consume less raw materials and are more energy-efficient, but also support green buildings and climate-resilient projects that are more energy-efficient. In healthcare and PPE, sustainability pressures are driving the replacement of single-use products with reusable, recyclable medical textiles such as engineered gowns, drapes, and barrier fabrics, which not only control infection but also reduce waste and emissions throughout their lifecycles. The same phenomenon occurs in automotive, aerospace, and industrial sectors, where these sectors are increasingly using lightweight, recyclable, bio-based technical textiles to contribute to emissions reduction and circular material flows. All these developments are creating a market for recycled polymers, mono-material nonwovens, eco-friendly coatings, and take-back or recycling systems; thus, demand for advanced technical textiles is getting a boost, and the UK market is experiencing continuous growth.

Restraints

Will skills shortages in manufacturing and advanced materials pose a significant restraint to the UK technical textiles market growth?

A major impediment to the growth of technical textiles in the UK is the lack of requisite skills among the factory and advanced materials sectors. The entire value chain of the UK manufacturing industry, including advanced and specialized areas such as technical textiles, is currently experiencing a critical shortage of skilled personnel. Surveys report that some manufacturers have a major problem finding and hiring skilled workers, and the shortage is widespread among production operatives, technicians, and engineers needed to operate high-tech machines and integrate new materials and technologies. Such a skill gap has a negative impact on the technical textiles market in many ways.

First, the introduction of new high-performance products is constrained by the scarcity of specialized expertise in advanced materials, automated processes, and quality control. In addition, the lack of experts in automation, robotics, digital manufacturing, and materials science can obstruct the adoption of productivity-enhancing technologies that most technical textile producers increasingly rely on to remain competitive, maintain the flow of innovative, sustainable products, and so on. The impact is compounded by a chronic structural issue in the UK labor market: an aging workforce, a lack of recruitment into technical trades, and improperly trained new entrants in advanced manufacturing skills. Overcoming the gap through governmental investment in apprenticeships and training programs is one of the ongoing efforts; however, until these actions lead to a more competent workforce, labor shortages will keep the UK technical textiles sector's growth very much limited and its capacity to fully realize its potential.

For instance, according to the latest Office for National Statistics (ONS) figures, there were 61,000 manufacturing job vacancies in the UK as of September 2024.

Opportunities

Does the increasing product innovation and launch offer a potential opportunity for the UK technical textiles industry growth?

The UK technical textiles industry greatly benefited from product innovation and new product launches, which expanded application areas and enhanced the value proposition of technical textile solutions across different sectors. The technical textiles industry is being transformed and diversified rapidly by advanced materials, smart and functional fabrics, and new manufacturing technologies. Demand is generated for products that extend beyond their traditional uses.

For example, UK companies and researchers are combining 3D printing, AI manufacturing, and smart textile technologies to produce fabrics that not only perform better but also monitor health, offer new features, and so on—thereby inviting applications in sectors such as medical wearables, automated manufacturing, and smart consumer goods. For instance, in July 2023, The Rivertex Technical Fabrics Group launched Rivercyclon® 605 SD, an innovative 100% recyclable fabric series applicable in a variety of outdoor applications, including rain and sun coverings and outdoor furniture materials. Its outstanding UV resistance, thanks to the solution dyeing method, makes it waterproof as well.

Challenges

Supply-chain risk and lead-time volatility pose a major challenge to market expansion

Risks related to supply chain volatility and lead-time variability are among the main hurdles the technical textiles market in the United Kingdom must overcome to gain acceptance. The problems in question directly affect manufacturers’ capacity to deliver products consistently, manage costs, and respond to customer demand quickly. Producers of technical textiles usually rely on intricate global supply networks for the most important raw materials, namely highly advanced fibers, polymers, coatings, and specialty chemicals. A global disruption—caused by geopolitical tensions, trade realignments, shipping delays, or port congestion—can halt the flow of these essential inputs, disrupt production schedules, and increase procurement costs.

United Kingdom Technical Textiles Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | United Kingdom Technical Textiles Market |

| Market Size in 2024 | USD 4.8 Billion |

| Market Forecast in 2034 | USD 7.5 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 280 |

| Key Companies Covered | Ahlstrom-Munksjö, Low & Bonar, Freudenberg, Mitsui Chemicals Inc., Berry Global Group Inc., Huntsman Corp, Asahi Kasei Corp, Kimberly-Clark Corp, Resistex®, TP Industrial Yarns BV, SURETEX, Dale Intertec Limited, Heathcoat Fabrics Limited, Heytex Gruppe, Arville, Scott & Fyfe, Preform (Technical) Textiles Ltd, and Macflex International Ltd., among others. |

| Segments Covered | By Process, By Material, By Application and By Region |

| Regions Covered | England, Northern Ireland, Scotland, Wales |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

United Kingdom Technical Textiles Market: Segmentation

By Process

The woven segment is expected to hold the largest market share over the forecast period. The segment's expansion can be attributed to several factors, such as versatility, strength, and adaptability in the most demanding end-use sectors. Woven technical textiles are the first choice in applications where the very qualities of high tensile strength, durability, dimensional stability, and performance under load are required—this includes, for example, industrial filtration fabrics, protective garments, geotextiles, automotive parts, and structural reinforcement materials, areas, moreover, where the demand for performance is constantly growing. A wide range of such vital applications naturally drives high sales volumes and substantial revenue for woven fabrics in the technical textiles category.

By Material

The synthetic polymer segment is expected to hold a prominent market share during the forecast period. The main factor behind this strong revenue increase is that technical textiles based on synthetic polymers (like polyester, polypropylene, polyamide/nylon, and other engineered polymer fibers) not only provide excellent mechanical and functional properties (i.e., high tensile strength, flexibility, chemical resistance, and durability in demanding conditions) but also are cost-effective. These properties render synthetic polymer textiles ideal for performance-critical applications in major industries, including automotive, industrial filtration, protective clothing, healthcare, and construction.

By Application

The transport textiles segment dominates the market. The UK fabrics industry's transport sector comprises specialized fabrics and high-performance materials used in various cars and aircraft. Among these are the inner parts such as seat covers, carpets, and headliners, along with airbags and restraint systems, reinforcement fabrics for composites, acoustic/thermal insulation, and specialized safety textiles. The main driver of this segment's growth is the ongoing demand for high-performance materials that not only boost efficiency but also enhance vehicle comfort and safety. On the other hand, UK automotive production is trying to recover and reorient itself through the adoption of new, lighter, and electrified cars—resulting in more and more use of the very technical textiles that contribute to reducing vehicle weight and enhancing energy performance; thus, the trend is for higher revenues for the textile products focused on transport.

United Kingdom Technical Textiles Market: Competitive Analysis

The United Kingdom Technical Textiles market is dominated by players like-

- Ahlstrom-Munksjö

- Low & Bonar

- Freudenberg

- Mitsui Chemicals Inc.

- Berry Global Group Inc.

- Huntsman Corp

- Asahi Kasei Corp

- Kimberly-Clark Corp

- Resistex®

- TP Industrial Yarns BV

- SURETEX

- Dale Intertec Limited

- Heathcoat Fabrics Limited

- Heytex Gruppe

- Arville

- Scott & Fyfe

- Preform (Technical) Textiles Ltd

- Macflex International Ltd.

- among others.

United Kingdom Technical Textiles market is segmented as follows:

By Process

- Woven

- Non-Woven

- Knitted

- Others

By Material

- Synthetic Polymer

- Mineral

- Regenerated Fiber

- Natural Fiber

- Metal

- Others

By Application

- Transport Textiles

- Medical and Hygiene

- Industrial Products & Components

- Home Textile

- Packaging and Containment

- Clothing Components

- Others

UK Technical Textiles Market, By Geography

- England

- Northern Ireland

- Scotland

- Wales

Table Of Content

Methodology

FrequentlyAsked Questions

Which key factors will influence the United Kingdom Technical Textiles market growth over 2025-2034?

What are the emerging trends and innovations impacting the United Kingdom Technical Textiles market?

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed