Travel Medical Insurance Market Size, Share, Global Trends, Growth 2034

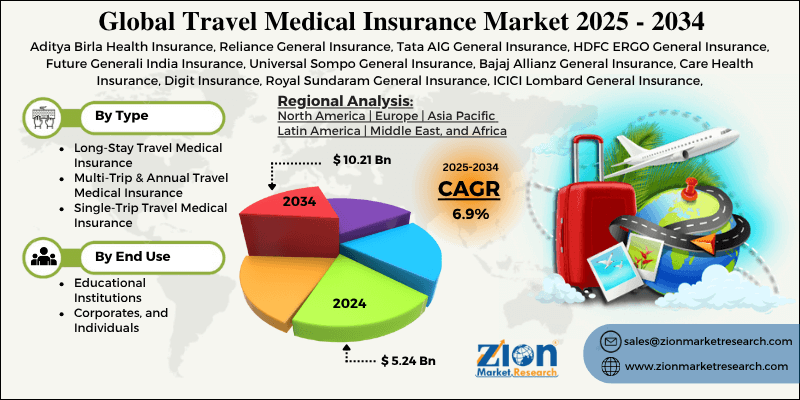

Travel Medical Insurance Market By Type (Long-Stay Travel Medical Insurance, Multi-Trip & Annual Travel Medical Insurance, and Single-Trip Travel Medical Insurance), By End-User (Educational Institutions, Corporates, and Individuals), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

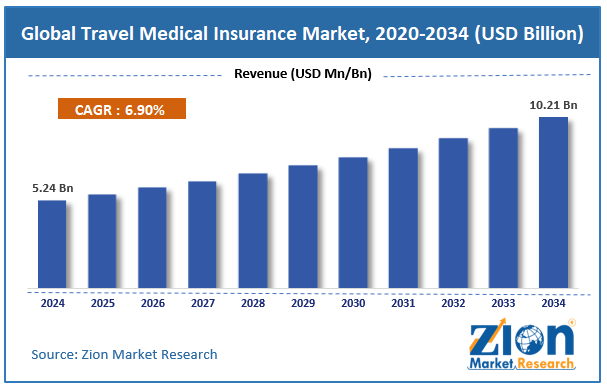

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.24 Billion | USD 10.21 Billion | 6.90% | 2024 |

Travel Medical Insurance Industry Perspective:

The global travel medical insurance market size was worth around USD 5.24 billion in 2024 and is predicted to grow to around USD 10.21 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.90% between 2025 and 2034.

Travel Medical Insurance Market: Overview

Travel medical insurance is a short-term health insurance to cover emergencies during international travel. It covers unexpected medical illnesses or injuries. The travel medical insurance plans help reimburse expenses incurred during travel abroad in case of a medical condition that may arise during the trip. The cost of travel medical insurance may change depending on the plan choice, destination country, and the presence of any underlying medical conditions. Travel insurance experts recommend purchasing a medical insurance plan to cover medical expenses during travel at least 14 days before the journey begins. However, certain visa applications require receipts for travel medical insurance to be submitted at the time of applying for a visa.

During the forecast period, the demand for travel medical insurance is expected to continue growing. The increasing number of international travelers worldwide, along with the rising rate of government mandates, will help the industry thrive, according to research. On the other hand, the high cost of travel medical insurance and ongoing economic uncertainty may impact the final revenue generated by the market.

Key Insights:

- As per the analysis shared by our research analyst, the global travel medical insurance market is estimated to grow annually at a CAGR of around 6.90% over the forecast period (2025-2034)

- In terms of revenue, the global travel medical insurance market size was valued at around USD 5.24 billion in 2024 and is projected to reach USD 10.21 billion by 2034.

- The travel medical insurance market is projected to grow at a significant rate due to the growing number of international travelers worldwide.

- Based on the type, the single-trip travel medical insurance segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user, the corporate segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Travel Medical Insurance Market: Growth Drivers

Growing number of international travelers worldwide will drive the market demand rate

The global travel medical insurance market is expected to be led by a growing number of international travelers worldwide. One of the primary factors for increasing travel across borders is the rising disposable income of the general population across the globe. The rising number of business travelers has further helped the travel & tourism industry thrive in the last few years. Growing transcontinental business partnerships and global expansion are key promoters of a surge in business travelers.

According to official reports, the world witnessed over 440 million corporate trips in 2024. The number is expected to increase in the next few years. On the other hand, the international tourism industry is flourishing as more people are willing to spend on travel-based experiences. Regional governments worldwide are investing heavily in upgrading tourism infrastructure to attract more travel enthusiasts, further creating demand for international travel.

However, medical emergencies in a foreign country can be expensive, depending on the type of injury or health condition. Travel medical insurance provides cushioning to travelers against extreme financial stress caused by sudden medical crises.

Rising levels of travel risks worldwide may further contribute to the industry’s overall revenue

Awareness among travelers about the several risks and threats that may emerge during an international visit has widened. The increasing rate of geopolitical tensions and rising incidents of terrorist or extremist violence across the globe, including in developed nations, has helped generate higher adoption of medical insurance during travel. These policies are extremely helpful in case of a sudden travel disruption that may have medical repercussions.

For instance, in April 2025, reports suggested that a Korean tourist was fatally shot in the Philippines by a motorcycle gang. The growing rate of such incidents is expected to generate more demand in the global travel medical insurance market.

Travel Medical Insurance Market: Restraints

Expenses associated with medical insurance during travel can limit market expansion

The global industry for travel medical insurance is expected to be restricted due to the high cost of premiums associated with insurance. For instance, the average cost of single-trip coverage may range between USD 50 and USD 100, depending on several external factors.

Furthermore, the insurance policies may not cover all types of medical emergencies. The complicated terms & conditions (T&C) of travel medical insurance may further limit the market expansion rate.

Travel Medical Insurance Market: Opportunities

Growing number of insurance providers and strategic partnerships to generate growth opportunities

The global travel medical insurance market is expected to generate growth opportunities due to the surge in the number of insurance providers. The increasing number of options in the industry allows potential buyers to make wider choices, thereby helping revenue grow.

For instance, in May 2025, AXA Partners US announced the launch of a new range of travel insurance products. The agency aims to improve the experience of US residents planning to visit European nations. The new regime will include Schengen Advantage, Schengen Essential, and Schengen Annual. The Schengen Advantage offers higher benefits compared to conventional visa requirements, while the annual version is best suited for multiple trips.

Similarly, in May 2025, Allianz Partners Australia launched a travel insurance product specially for cruise-based tourism. The new launch comes in collaboration with Norwegian Cruise Line (NCL). The expansion of product portfolios by travel medical insurance providers will open new avenues for future expansion.

Travel Medical Insurance Market: Challenges

Economic uncertainty worldwide to challenge market expansion in the long run

The global travel medical insurance industry is expected to be challenged by the rising levels of economic uncertainty across the globe. Rising levels of geopolitical tensions and travel advisories against certain countries, among others, may impact the overall revenue generated by the market in the coming years. In addition, consumer awareness about the benefits of travel medical insurance, along with the surging incidences of false claims, can further affect the final growth rate of the market.

Travel Medical Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Travel Medical Insurance Market |

| Market Size in 2024 | USD 5.24 Billion |

| Market Forecast in 2034 | USD 10.21 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 213 |

| Key Companies Covered | Aditya Birla Health Insurance, Reliance General Insurance, Tata AIG General Insurance, HDFC ERGO General Insurance, Future Generali India Insurance, Universal Sompo General Insurance, Bajaj Allianz General Insurance, Care Health Insurance, Digit Insurance, Royal Sundaram General Insurance, ICICI Lombard General Insurance, IFFCO Tokio General Insurance, Cholamandalam MS General Insurance, SBI General Insurance, Star Health, Allied Insurance., and others. |

| Segments Covered | By Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Travel Medical Insurance Market: Segmentation

The global travel medical insurance market is segmented based on type, end-user, and region.

Based on the type, the global market segments are long-stay travel medical insurance, multi-trip & annual travel medical insurance, and single-trip travel medical insurance. In 2024, the highest growth was listed in the single-trip travel medical insurance segment. Occasional travelers are among the leading types of consumers participating in international travel programs. Moreover, rising mandates on medical insurance policies, while visa applications are further fueling the segmental revenue. According to official estimates, more than 69.9% of international travelers from India undertook a travel medical insurance policy.

Based on the end-user, the global market divisions are educational institutions, corporates, and individuals. In 2024, the corporate segment emerged as the highest revenue generator for the market. Growing number of business professionals flying across continents for work purposes is promoting higher segmental revenue. According to market research, the average working employee travels to international sites approximately 38% of the time each year.

Travel Medical Insurance Market: Regional Analysis

Europe to generate the highest revenue during the forecast period

The global travel medical insurance market is expected to be driven by Europe during the projection period. One of the primary documents required for applying for a Schengen visa, which grants access to specific European countries, is travel insurance, including medical coverage. In addition to this, the rising rate of travel & tourism across major European nations will further encourage regional market expansion. According to the European Commission (EC), Europe registered more than 3 billion nights spent across tourist accommodation throughout the region.

In May 2025, OneBefore, a Managing General Agent (MGA) with expertise in travel insurance among other domains, announced the launch of the ‘Travel Europe’ product in collaboration with Freedom Insurance Services. North America is a prominent market and will deliver significant CAGR in the coming years.

The rising rate of business tourism across North American countries will fuel regional market expansion. In May 2025, Arch RoamRight, a US-based travel insurance solution provider, launched its 2025 Travel Insurance Playbook. The guide is designed to help travel industry professionals as the sector witnesses technological evolution.

Travel Medical Insurance Market: Competitive Analysis

The global travel medical insurance market is led by players like:

- Aditya Birla Health Insurance

- Reliance General Insurance

- Tata AIG General Insurance

- HDFC ERGO General Insurance

- Future Generali India Insurance

- Universal Sompo General Insurance

- Bajaj Allianz General Insurance

- Care Health Insurance

- Digit Insurance

- Royal Sundaram General Insurance

- ICICI Lombard General Insurance

- IFFCO Tokio General Insurance

- Cholamandalam MS General Insurance

- SBI General Insurance

- Star Health

- Allied Insurance

The global travel medical insurance market is segmented as follows:

By Type

- Long-Stay Travel Medical Insurance

- Multi-Trip & Annual Travel Medical Insurance

- Single-Trip Travel Medical Insurance

By End-User

- Educational Institutions

- Corporates, and Individuals

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Travel medical insurance is a short-term health insurance to cover emergencies during international travel.

The global travel medical insurance market is expected to be led by a growing number of international travelers worldwide.

According to study, the global travel medical insurance market size was worth around USD 5.24 billion in 2024 and is predicted to grow to around USD 10.21 billion by 2034.

The CAGR value of the travel medical insurance market is expected to be around 6.90% during 2025-2034.

The global travel medical insurance market is expected to be driven by Europe during the projection period.

The global travel medical insurance market is led by players like Aditya Birla Health Insurance, Reliance General Insurance, Tata AIG General Insurance, HDFC ERGO General Insurance, Future Generali India Insurance, Universal Sompo General Insurance, Bajaj Allianz General Insurance, Care Health Insurance, Digit Insurance, Royal Sundaram General Insurance, ICICI Lombard General Insurance, IFFCO Tokio General Insurance, Cholamandalam MS General Insurance, SBI General Insurance, and Star Health and Allied Insurance.

The report explores crucial aspects of the travel medical insurance market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed