Global Tire Cord and Tire Fabrics Market Size, Share, Growth Analysis Report - Forecast 2034

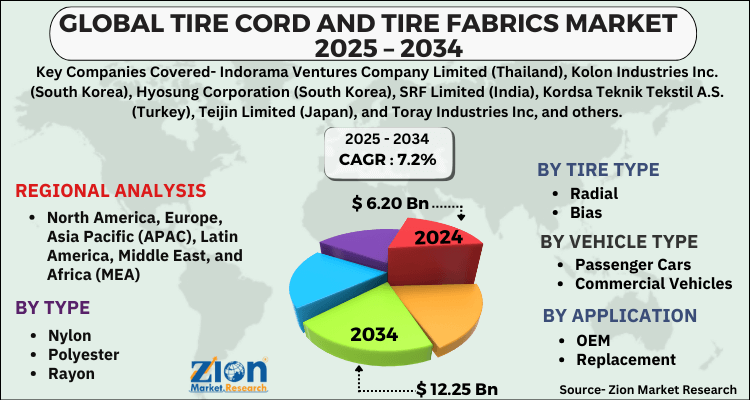

Tire Cord and Tire Fabrics Market By Type (Nylon, Polyester, Rayon, and Others (Aramid fibers, hybrid, PEN)), By Tire Type (Radial and Bias), Vehicle Type (Passenger Cars and Commercial Vehicles), Application (OEM and Replacement), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

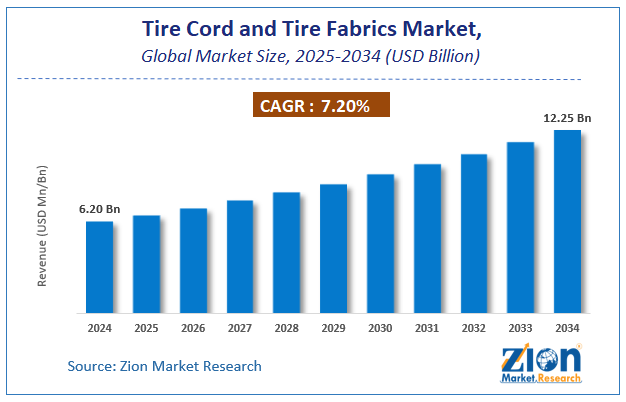

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.20 Billion | USD 12.25 Billion | 7.2% | 2024 |

Tire Cord and Tire Fabrics Market Industry Perspective:

The global tire cord and tire fabrics market size was worth around USD 6.20 Billion in 2024 and is predicted to grow to around USD 12.25 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.2% between 2025 and 2034. The report analyzes the global tire cord and tire fabrics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the tire cord and tire fabrics industry.

Tire Cord and Tire Fabrics Market: Overview

A tire cord is a type of cloth composed of high-quality textile yarns. It has excellent tensile strength, abrasion resistance, and controlled deformations. During on-road execution, the tire cord provides shock resistance from tension, weight, and ultimate strength. A tire cord is important in providing robust support for rubber tires. In the forecast period, the rise in demand for passenger automobiles in developing economies would drive the expansion of the tire cord textiles market. Investment in the manufacture of these fabrics has the potential to generate income opportunities for the key players in the worldwide market. In addition, the increased demand for eco-friendly tire cord textiles will create further chances for the tire cord fabrics market to grow in the future years. Moreover, the rise in global sales of construction and mining equipment is likely to propel the tire cord textiles market forward. It is expected that the growing demand for fuel-efficient vehicles will enhance the global tire cord market.

The tire cord is a reinforcing machine that is used to provide stability to the tires. The tire cord is made from high tenacity and continuous filament with the help of processes such as twisting plying and others. These processes make the tire fatigue resistant, impact resistant, and it has high adhesion. This tire cords and fabrics help to provide stability, safety, and comfort to the vehicles. Various types of tires are used in a vehicle which varies according to the region.

Usually, the tires are made of a material that is not biodegradable which after been exhausted are difficult to decompose. This has shifted the manufacturers’ attention towards usage of bio-based material for the manufacture of the tires. The key players are now shifting focus towards the manufacture of tires with the material that is easy to decompose and also improves the efficiency of the vehicle. Increase in the production and sales of automobiles are one of the major factors that are driving the growth of the market. According to an article published recently by the Automotive Sales, the top three brands in the U.S. auto market had a sales growth of around 15.0% in the year 2017. The Toyota Motors North America Inc. in October 2017 reported overall sales of 188,434 units.

This increase in the requirement of the vehicles in various regions is expanding the growth of the market. This demand for advanced tires is adding comfort and improving the ride quality. The major players in the market are making various developments through various researches for the growth of the market. However, competitions among the key players act as a restraint factor for the market. However, robust growth in the automotive industry is expected to provide many opportunities for the key players working in the global tire cord and tire fabrics market.

Key Insights

- As per the analysis shared by our research analyst, the global tire cord and tire fabrics market is estimated to grow annually at a CAGR of around 7.2% over the forecast period (2025-2034).

- Regarding revenue, the global tire cord and tire fabrics market size was valued at around USD 6.20 Billion in 2024 and is projected to reach USD 12.25 Billion by 2034.

- The tire cord and tire fabrics market is projected to grow at a significant rate due to growing automotive industry, increasing demand for durable and fuel-efficient tires, advancements in tire manufacturing technologies, and the rising need for high-performance materials in tire production.

- Based on Type, the Nylon segment is expected to lead the global market.

- On the basis of Tire Type, the Radial segment is growing at a high rate and will continue to dominate the global market.

- Based on the Vehicle Type, the Passenger Cars segment is projected to swipe the largest market share.

- By Application, the OEM segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Tire Cord and Tire Fabrics Market: Driver

The automotive industry is increasing its demand for tire cord fabric.

Tire cord fabric is a sort of industrial fabric that is made using high tenacity yarns in the warp direction and threads with low resistance in the weft direction to keep warn yarns held in place. Controlled deformation, high strength, abrasion resistance, and other features are provided by a tire cord-coated fabric for tires used in the automobile sector. Tire cord textiles are reinforcing materials for tires that are designed to keep tires in shape and sustain vehicle weight, and they have a substantial impact on tire performance. Improving road infrastructure and increasing the disposable income of middle-class consumers are propelling the developing-country vehicle market. As a result of the aforementioned considerations, the use of tire cord fabrics from automobiles is expected to dominate during the projection period.

Tire Cord and Tire Fabrics Market: Restraint

Fluctuation of prices in the Automobile Industry

The continual change in fuel pricing has had a considerable impact on the automobile industry. Along with this, the change in disposable income, inflammation, and stringent government policies regarding automobiles affect the price of automobiles. Price variations in the automobile sector may provide further challenges to the expansion of the tyre cord textiles market in the near future.

Increase in Retreading practice

Retreading is a method that allows us to reuse our old tires. In this approach, a worn casing from a tire with good structural quality is removed and subjected to a process that totally renews the tread and sidewall rubber. The sector is expected to have a negative impact on market growth over the forecast period due to the increased desire for retreading commercial vehicles.

Tire Cord and Tire Fabrics Market: Segmentation

The Tire Cord and Tire Fabrics Market is segregated based on type, tire type, vehicle type, and application.

By type, the market is classified into Nylon, Polyester, Rayon, and Others (Aramid fibers, hybrid, PEN). The nylon category is expected to have the greatest growth in terms of value in the tires cord fabric market. The nylon market is likely to rise further over the forecast period due to the rising demand for high-strength tire cord materials from a variety of vehicle types, including passenger cars, lightweight vehicles, and heavyweight vehicles. The polyester segment accounted for a sizable share of the worldwide tire cord textiles market in the forecast period. Polyester tire cords have a wide range of applications in the construction of passenger car tires due to their minimal shrinkage, high strength, and low cost. The product is also becoming more popular as a component in the production of hybrid tire cord textiles.

By tire type, the market is classified into Radial and Bias. The radial tires sector is expected to account for the largest share of the total market during the forecast period. Radial tires are becoming more popular due to their increased longevity, stability, temperature performance, wear resistance, and greater fuel efficiency. The steel belts in radial tires are positioned at a 90-degree angle with the tread line, allowing the tire's sidewall and tread to function independently of one another. As a result, radial tires have less sidewall flex and make more contact with the ground. Radial tires are commonly employed in passenger cars and light commercial vehicles. The bias tire category is expected to grow at a significant rate over the forecast period because of its low cost, adaptability to tough terrain, and capacity to carry big loads. However, the product's high rolling resistance value and reduced wear resistance, as well as sensitivity to overheating, are projected to limit segment expansion.

By vehicle type, the market is categorized into Passenger cars and Commercial vehicles. In the forecast period, the passenger car sector emerged as the market leader. The segment's rise is mostly due to factors such as the rising demand for passenger automobiles in developing nations, as well as the rising need for long-lasting, fuel-efficient tires. Growing regulatory support for the deployment of electric vehicles is expected to boost demand for tire cord fabrics throughout the projected period. Over the forecast period, the commercial vehicle segment is expected to grow at a considerable rate. Commercial vehicles, such as buses, trucks, and trailers, transport huge loads and require more tire replacements. Thus, product penetration in the commercial vehicle category is expected to be driven by the longer lifecycle and durability associated with the usage of tire cord fabric.

In terms of Application, the global tire cord and tire fabrics market is categorized into OEM and Replacement.

Tire Cord and Tire Fabrics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Tire Cord and Tire Fabrics Market |

| Market Size in 2024 | USD 6.20 Billion |

| Market Forecast in 2034 | USD 12.25 Billion |

| Growth Rate | CAGR of 7.2% |

| Number of Pages | 160 |

| Key Companies Covered | Indorama Ventures Company Limited (Thailand), Kolon Industries Inc. (South Korea), Hyosung Corporation (South Korea), SRF Limited (India), Kordsa Teknik Tekstil A.S. (Turkey), Teijin Limited (Japan), and Toray Industries Inc, and others. |

| Segments Covered | By Type, By Tire Type, By Vehicle Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Tire Cord and Tire Fabrics Market: Regional Landscape

The Asia Pacific region held the largest Tire Cord Fabrics Market share, during the forecast period and is expected to maintain its dominance during the forecast period. The existence of a sizable vehicular population, as well as the local availability of natural rubber, a major raw material required for tire production, have led to the Asia Pacific area emerging as a global tire production hub. The Asia-Pacific region is home to the world's major tire cord fabric producers. Furthermore, as a result of the increasing e-commerce (which has resulted in growth in the logistics industry), construction, and mining industries, demand for commercial vehicles has been constantly increasing.

The North American market will grow at a significant rate over the forecast period. The growing popularity of electric vehicles was the key driver driving product demand. Furthermore, rising regulatory support for reducing automotive emissions is expected to boost growth. The existence of large automotive and tire manufacturing companies, as well as a growing emphasis on lowering greenhouse gas emissions, are some of the primary reasons driving product demand. Moreover, due to the rise in the governing support, it is anticipated that the market will grow in the coming years.

Tire Cord and Tire Fabrics Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the tire cord and tire fabrics market on a global and regional basis.

The global tire cord and tire fabrics market is dominated by players like:

- Indorama Ventures Company Limited (Thailand)

- Kolon Industries Inc. (South Korea)

- Hyosung Corporation (South Korea)

- SRF Limited (India)

- Kordsa Teknik Tekstil A.S. (Turkey)

- Teijin Limited (Japan)

- Toray Industries Inc

The global tire cord and tire fabrics market is segmented as follows:

By Type

- Nylon

- Polyester

- Rayon

- Others (Aramid fibers, hybrid, PEN)

By Tire Type

- Radial

- Bias

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Application

- OEM

- Replacement

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Tire cord and tire fabrics are strong textile materials used as reinforcement in tires to provide strength, stability, and shape. Made from materials like polyester, nylon, or steel, they help tires withstand pressure, improve durability, and enhance performance.

The global tire cord and tire fabrics market is expected to grow due to increasing production and sales of automobiles worldwide, coupled with the rising demand for high-performance and durable tires.

According to a study, the global tire cord and tire fabrics market size was worth around USD 6.20 Billion in 2024 and is expected to reach USD 12.25 Billion by 2034.

The global tire cord and tire fabrics market is expected to grow at a CAGR of 7.2% during the forecast period.

Asia-Pacific is expected to dominate the tire cord and tire fabrics market over the forecast period.

Leading players in the global tire cord and tire fabrics market include Indorama Ventures Company Limited (Thailand), Kolon Industries Inc. (South Korea), Hyosung Corporation (South Korea), SRF Limited (India), Kordsa Teknik Tekstil A.S. (Turkey), Teijin Limited (Japan), and Toray Industries Inc, among others.

The report explores crucial aspects of the tire cord and tire fabrics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed