Tighter Recycled Fiber Market Size, Share, Trends, Growth & Forecast 2034

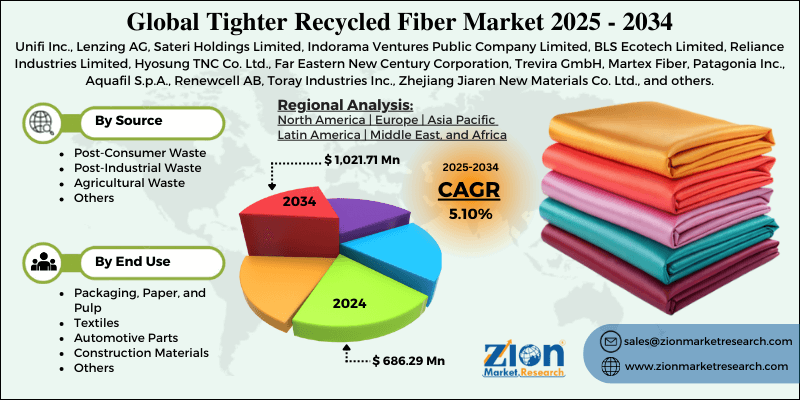

Tighter Recycled Fiber Market By Source (Post-Consumer Waste, Post-Industrial Waste, Agricultural Waste, and Others), By End Use Industry (Packaging, Paper and Pulp, Textiles, Automotive Parts, Construction Materials, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

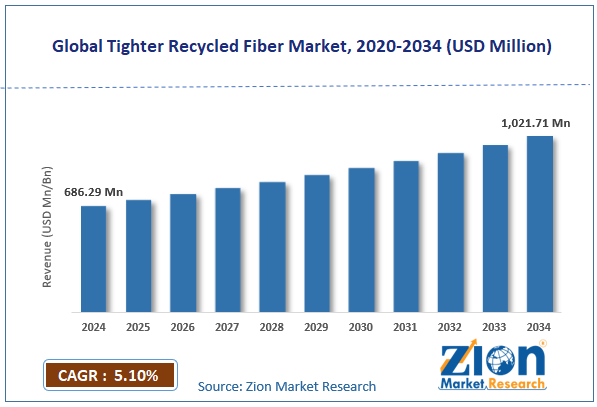

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 686.29 Million | USD 1021.71 Million | 5.10% | 2024 |

Tighter Recycled Fiber Industry Perspective:

The global tighter recycled fiber market size was worth around USD 686.29 million in 2024 and is predicted to grow to around USD 1021.71 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global tighter recycled fiber market is estimated to grow annually at a CAGR of around 5.10% over the forecast period (2025-2034)

- In terms of revenue, the global tighter recycled fiber market size was valued at around USD 686.29 million in 2024 and is projected to reach USD 1021.71 million by 2034.

- The tighter recycled fiber market is projected to grow significantly owing to the growing demand for sustainable textiles, expanding applications in the apparel and fashion industry, and technological improvements in fiber recycling processes.

- Based on the source, the post-consumer waste segment is expected to lead the market, while the post-industrial waste segment is expected to grow considerably.

- Based on end-use industry, the textiles segment is expected to lead the market compared to the automotive parts segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Tighter Recycled Fiber Market: Overview

Tighter recycled fiber is a high-quality recycled textile fiber made from post-industrial textile or post-consumer waste, dedicated for use in apparel and new fabrics. These fibers undergo advanced processing methods to obtain enhanced strength, consistency, and durability, making them ideal for premium uses in diverse sectors. The global tighter recycled fiber market is poised for notable growth owing to the growing sustainability awareness, strict environmental regulations, and growing demand from the fashion industry. Global awareness over carbon footprint reduction and sustainability is pressuring the leading companies and brands to adopt recycled fibers. Consumers are largely opting for eco-friendly textiles and apparel, propelling the demand for tighter recycled fibers. Initiatives like corporate ESG commitments and the UN Sustainable Development Goals back this trend.

Governments in North America, Europe, and the Asia Pacific are imposing environmental regulations to control textile wastage. Policies like the EU's Circular Economy Action Plan encourage textile recycling and reuse. These norms are fueling companies to integrate recycled fibers into their processes. Furthermore, the leading fashion brands are incorporating tighter recycled fibers into their collections to meet sustainability objectives. Fast fashion is under scrutiny, and brands like Adidas, H&M, and Levi's are surging in the use of recycled fibers.

Nevertheless, the global market faces limitations due to factors such as high production costs and quality inconsistency in recycled fibers. Processing textile waste into high-quality, tighter recycled fibers involves advanced solutions and significant power consumption. This remarkably increases the price as compared to virgin fibers in a few cases. Price-sensitive markets usually find this challenging for adoption. Despite improvements, recycled fibers can still experience variability in color, quality, and texture. Inconsistent supply decreases brand confidence, mainly for high-end fashion brands. This remains a barrier to industry growth.

Still, the tighter recycled fiber industry benefits from several favorable factors, including integration in luxury fashion and development in the automotive and technical textile sectors. Luxury brands are increasingly incorporating sustainable materials to support their ESG goals. Tighter recycled fibers with premium quality standards can hold this high-value segment, offering strong revenue potential. Also, the rising demand for eco-friendly materials in industrial textiles and automotive interiors provides a massive opportunity. Tighter recycled fibers meet the durability and performance standards required for these applications.

Tighter Recycled Fiber Market: Growth Drivers

How do improvements in recycling propel the tighter recycled fiber market growth?

Improvements in NIR sorting, melt filtration, and hot washing are enhancing purity and production in recycled fiber production. For instance, PET recycling facilities are achieving contaminant levels below 50 ppm, allowing textile-grade uses. Chemical recycling processes, such as depolymerization, are scaling rapidly; in 2023, brands like Eastman and Carbios declared multi-hundred-kiloton capacity projects.

Traceability solutions like digital watermarks and blockchain promise compliance with several certifications, including Global Recycled Standards. These enhancements improve supply reliability and offer prospects in the premium end-use markets for recycled fibers, impacting the tighter recycled fiber market.

Does the price volatility of supply security and virgin materials drive the growth of the tighter recycled fiber market?

Varying crude oil prices and supply disturbances make virgin fiber costs unpredictable, raising recycled fiber's economic appeal. Energy price shocks and geopolitical stresses have elevated price pressure on virgin polymers, enhancing competitiveness for recycled substitutes. Large FMCG firms now hedge risks by locking multi-year agreements for recycled feedstock to stabilize supply. This risk and cost benefit fuels the adoption of tighter-spec recycled packaging, industrial, and textile applications.

Tighter Recycled Fiber Market: Restraints

Standards compliance, traceability & greenwashing risk unfavorably impact tighter recycled fiber market progress

Buyers primarily require GRS/RCS or comparable certification, along with mass-balanced controls, chain-of-custody, audits, and data management. Mid and small-sized recyclers face documentation pressures due to time-consuming onboarding cycles that last months before qualification. Allegations of mis-declared recycled content in packaging and apparel have heightened scrutiny, prompting costly testing, segregation, and digital traceability pilots. Progressing rules will further tighten proof needs, increasing compliance costs in the coming period.

Tighter Recycled Fiber Market: Opportunities

How do blockchain applications and digital traceability present favorable prospects for tighter recycled fiber market expansion?

The growth of digital tools, such as digital watermarks and blockchain-based chain of custody, is enhancing trust in recycled content claims. The United States and EU regulations on green claims (draft 2024) will require verified data, auditable processes, and traceability technology as a value driver for certified fibers. Brands are actively associating with technology platforms like Circularise and TextileGenesis to ensure GRS/RCS compliance in supply chains. This creates fresh service layers for recyclers who integrate data transparency with fiber production. These solutions will help premium positioning of tighter-spec fibers for controlled markets, impacting the progress of the tighter recycled fiber industry.

Tighter Recycled Fiber Market: Challenges

Competition from alternative circular solutions restricts the growth of the market

Beyond chemical and mechanical recycling, substitutes like reuse models, bio-based polymers, and fiber regeneration systems compete for sustainability budgets. The leading apparel brands are exploring regenerative fibers like Spinnova and Circulose, which bypass conventional recycling loops. In the same way, reusable packaging systems offer intricacies to the single-use formats that fuel rPET demand. This competitive outlook means TRF players cannot rely solely on regulatory pull; instead, they should focus on advancing pricing, technology, and collaborations. Failure to differentiate tight-spec fibers from these substitutes could lead to market share loss, despite growing circular economy policies.

Tighter Recycled Fiber Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Tighter Recycled Fiber Market |

| Market Size in 2024 | USD 686.29 Million |

| Market Forecast in 2034 | USD 1,021.71 Million |

| Growth Rate | CAGR of 5.10% |

| Number of Pages | 211 |

| Key Companies Covered | Unifi Inc., Lenzing AG, Sateri Holdings Limited, Indorama Ventures Public Company Limited, BLS Ecotech Limited, Reliance Industries Limited, Hyosung TNC Co. Ltd., Far Eastern New Century Corporation, Trevira GmbH, Martex Fiber, Patagonia Inc., Aquafil S.p.A., Renewcell AB, Toray Industries Inc., Zhejiang Jiaren New Materials Co. Ltd., and others. |

| Segments Covered | By Source, By End Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Tighter Recycled Fiber Market: Segmentation

The global tighter recycled fiber market is segmented based on source, end-use industry, and region.

Based on the source, the global tighter recycled fiber industry is divided into post-consumer waste, post-industrial waste, agricultural waste, and others. The post-consumer waste segment registered a substantial share of the market owing to the immense availability of discarded garments, apparel from end-users, and home textiles. Rising clothing consumption and fast-fashion trends have added to high volumes of post-consumer textile waste, increasing the significance of post-consumer waste as a primary raw material source for recycled fibers.

On the other hand, the post-industrial waste segment holds a second leading share in the market. It comes from the production scraps, defective goods, and fabric offcuts in textile manufacturing units. The segment grows progressively due to the easily recyclable and relatively clean nature of the waste, although its availability is lower than that of post-consumer waste.

Based on end-use industry, the global tighter recycled fiber market is segmented as packaging, paper and pulp, textiles, automotive parts, construction materials, and others. The textile segment holds leadership in the market because of the enormous use of recycled fibers in home furnishings, apparel, and fashion products. The surging demand for sustainable fabrics by worldwide fashion brands and user preference for environmentally-friendly clothing are fueling the segmental dominance.

Conversely, the automotive parts segment ranks second in the market since it primarily uses recycled fibers in seat upholstery, car interiors, and insulation materials to obey the sustainability targets and lightweight design goals. Automakers' green initiatives and stringent emission regulations amplify their ranking as the second-leading domain.

Tighter Recycled Fiber Market: Regional Analysis

What enables the Asia Pacific to have a strong foothold in the global Tighter Recycled Fiber Market?

Asia Pacific is projected to maintain its dominant position in the global tighter recycled fiber market, thanks to its strong textile manufacturing hubs, ample raw material availability, and cost-efficient labor and manufacturing advantages. Asia Pacific registers for more than 60% of the total textile and apparel production, with economies like Bangladesh, China, India, and Vietnam being forerunners. This large-scale manufacturing produces significant post-industrial textile waste, serving as a primary source for recycled fibers. The region's prominence in apparel directly fuels the demand for sustainable fibers.

Moreover, the region generates enormous volumes of textile waste, with China alone producing over 26 million textile waste yearly. High consumption of fast fashion products also contributes to the availability of post-consumer waste. This enormous supply of raw material makes the region a cost-effective location for recycling processes.

Additionally, APAC offers cheap labor and lower production costs than the Western regions, increasing the economic viability of manufacturing recycled fibers. This cost-benefit appeals to the international and domestic brands to source recycled fibers from the region. Therefore, the region boasts a dominant position in the global market.

Europe maintains its position as the second-leading region in the global tighter recycled fiber industry due to high sustainability awareness among users, strict textile waste norms, and rising demand in the automotive and technical textiles industry. European users strongly prefer eco-friendly products, with 67% of EU users favoring sustainability in purchasing decisions. This rising awareness forces retailers and brands to integrate recycled fibers more closely into their fashion collections.

Sustainable fashion is today a mainstream demand in the region. The EU needs member states to separately collect textile waste by 2025, generating a strong supply stream for recycled fiber production. Economies like Germany and France have launched (EPR) Extended Producer Responsibility schemes for textiles, compelling manufacturers to adopt recycled fibers in their supply chains.

Moreover, Europe's automotive sector, especially in France and Germany, is integrating recycled fibers into automotive interiors to meet the sustainability goals. Also, the demand for recycled fibers in industrial fabrics and technical textiles is surging, backed by the region's emphasis on green manufacturing.

Tighter Recycled Fiber Market: Competitive Analysis

The leading players in the global tighter recycled fiber market are:

- Unifi Inc.

- Lenzing AG

- Sateri Holdings Limited

- Indorama Ventures Public Company Limited

- BLS Ecotech Limited

- Reliance Industries Limited

- Hyosung TNC Co. Ltd.

- Far Eastern New Century Corporation

- Trevira GmbH

- Martex Fiber

- Patagonia Inc.

- Aquafil S.p.A.

- Renewcell AB

- Toray Industries Inc.

- Zhejiang Jiaren New Materials Co. Ltd.

Tighter Recycled Fiber Market: Key Market Trends

Growing use in performance apparel and sportswear:

Sportswear brands are actively using tighter fibers to generate high-performance fabrics with moisture control and durability. The prominent brands like Nike and Adidas are committing to 100% recycled polyester in ‘activewear collections' by 2030. This trend denotes the surging demand for functional and sustainable materials in the athletic apparel sector.

Expansion of circular fashion models:

Fashion brands are using circular strategies like take-back programs and closed-loop recycling systems. For instance, Zara and H&M have introduced textile collection initiatives to reuse post-consumer waste in fresh fiber production. This trend amplifies the supply of raw materials for tighter recycled fibers and backs sustainability goals.

The global tighter recycled fiber market is segmented as follows:

By Source

- Post-Consumer Waste

- Post-Industrial Waste

- Agricultural Waste

- Others

By End Use Industry

- Packaging, Paper, and Pulp

- Textiles

- Automotive Parts

- Construction Materials

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Tighter recycled fiber is a high-quality recycled textile fiber made from post-industrial textile or post-consumer waste, dedicated for use in apparel and new fabrics. These fibers undergo advanced processing methods to obtain enhanced strength, consistency, and durability, making them ideal for premium uses in diverse sectors.

The global tighter recycled fiber market is projected to grow due to the rising environmental awareness among consumers, the growth of circular economy initiatives, and increasing corporate sustainability commitments.

According to study, the global tighter recycled fiber market size was worth around USD 686.29 million in 2024 and is predicted to grow to around USD 1021.71 million by 2034.

The CAGR value of the tighter recycled fiber market is expected to be around 5.10% during 2025-2034.

The textiles and apparel industry will offer significant growth prospects in the tighter recycled fiber market because of the rising demand for sustainable fashion and circular economy initiatives.

Macroeconomic factors, such as stricter environmental regulations, rising disposable incomes, and global sustainability commitments, will boost demand for tighter recycled fibers across industries.

North America is expected to lead the global tighter recycled fiber market during the forecast period.

China is a key contributor to the global tighter recycled fiber market due to its high availability of textile waste, huge textile manufacturing base, and substantial investments in recycling solutions.

The key players profiled in the global tighter recycled fiber market include Unifi Inc., Lenzing AG, Sateri Holdings Limited, Indorama Ventures Public Company Limited, BLS Ecotech Limited, Reliance Industries Limited, Hyosung TNC Co., Ltd., Far Eastern New Century Corporation, Trevira GmbH, Martex Fiber, Patagonia, Inc., Aquafil S.p.A., Renewcell AB, Toray Industries, Inc., and Zhejiang Jiaren New Materials Co., Ltd.

The report examines key aspects of the tighter recycled fiber market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed