Luxury Sunglasses Market Size, Share, Trends, Growth & Forecast 2034

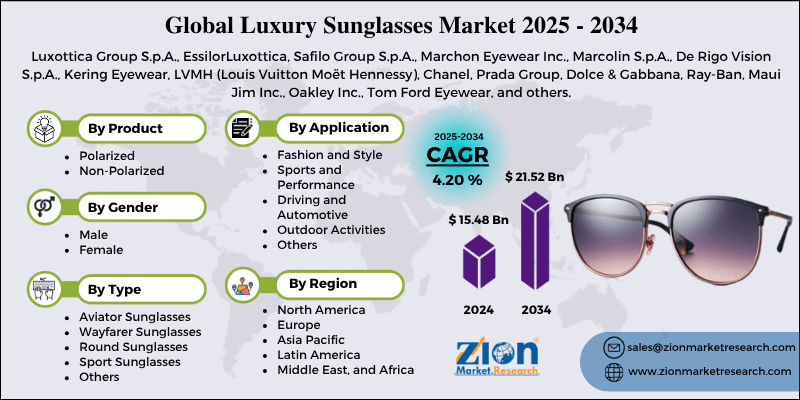

Luxury Sunglasses Market By Product (Polarized, Non-Polarized), By Type (Aviator Sunglasses, Wayfarer Sunglasses, Round Sunglasses, Sport Sunglasses, and Others), By Gender (Male, Female), By Application (Fashion and Style, Sports and Performance, Driving and Automotive, Outdoor Activities, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

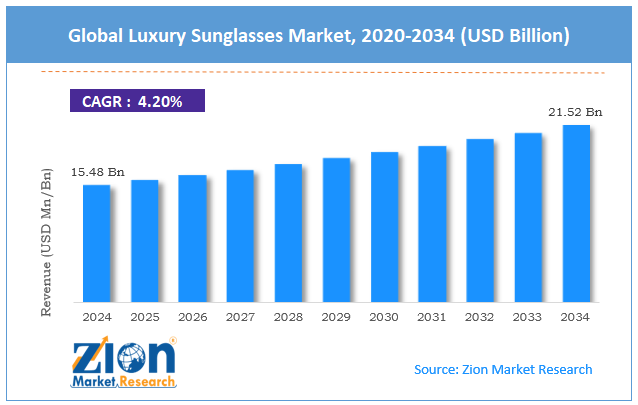

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.48 Billion | USD 21.52 Billion | 4.20% | 2024 |

Luxury Sunglasses Industry Perspective:

The global luxury sunglasses market size was approximately USD 15.48 billion in 2024 and is projected to reach around USD 21.52 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.20% between 2025 and 2034.

Luxury Sunglasses Market: Overview

Luxury sunglasses are high-quality eyewear products that blend functionality, fashion, and premium craftsmanship. These sunglasses are designed with cutting-edge materials to offer UV protection and style, usually produced by renowned designer brands. These products are seen as fashion statements and status symbols, and are endorsed by influencers and celebrities. The global luxury sunglasses market is poised for notable growth, driven by the increasing disposable income of consumers, shifting lifestyle trends, and the development of luxury retail chains and e-commerce platforms. The growing number of high-net-worth individuals and upper-middle-class users worldwide is remarkably fueling the demand for luxury products, including sunglasses.

According to 2024 reports, the global population of high-net-worth individuals increased by 5.1%, driving demand for high-end fashion accessories. Moreover, currently, consumers are increasingly prioritizing lifestyle alignment, identity expression, and aesthetics through accessories. As fashion becomes a key element of personal branding, luxury sunglasses are now considered essential fashion accessories. The growth of omni-channel strategies by brands like Prada and Gucci has improved accessibility to luxury eyewear. Virtual try-ons, exclusive e-commerce, and online customization are shifting consumers into a tech-savvy consumer base.

Nevertheless, the global market faces limitations due to factors such as the presence of imitation products in the market and the restricted shelf life resulting from fast fashion trends. The availability of fake luxury brands dilutes brand image and hampers genuine sales. Luxury imitation products account for more than 60% of the worldwide counterfeit trade in fashion accessories, according to the OECD. The frequent shift in fashion styles causes high-class sunglasses to become outdated, creating challenges for long-term customer retention and inventory management.

Still, the global luxury sunglasses industry benefits from several favorable factors like sustainable eyewear collections, personalization and customization, and limited-edition drops. Introducing eco-friendly frames and packaging may appeal to eco-conscious users and position brands as future-ready. Offering engraved initials, tailor-made options, or limited-edition pieces may attract the ultra-premium consumer segment, thereby improving brand exclusivity. Collaborations with artists, designers, or celebrities generate brand buzz and limited-edition hype, driving sales through scarcity-led marketing.

Key Insights:

- As per the analysis shared by our research analyst, the global luxury sunglasses market is estimated to grow annually at a CAGR of around 4.20% over the forecast period (2025-2034)

- In terms of revenue, the global luxury sunglasses market size was valued at around USD 15.48 billion in 2024 and is projected to reach USD 21.52 billion by 2034.

- The luxury sunglasses market is projected to grow significantly due to rising demand for UV protection, increasing awareness of eye health, and strong heritage appeal and brand loyalty.

- Based on product, the polarized segment is expected to lead the market, while the non-polarized segment is expected to grow considerably.

- Based on type, the aviator sunglasses segment is the largest segment, while the wayfarer sunglasses segment is projected to witness substantial revenue growth over the forecast period.

- Based on gender, the female segment holds a remarkable share, while the male segment is anticipated to gain substantial growth in the future.

- Based on application, the fashion and style segment is expected to lead the market compared to the driving and automotive segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by North America.

Luxury Sunglasses Market: Growth Drivers

Surging travel and tourism retail sector post-pandemic propels the market growth

Luxury sunglasses are the leading selling products in travel retail and airport duty-free outlets. With international travel rebounding after the pandemic, the travel retail sector has witnessed a strong resurgence.

Majorly in early 2025, Luxottica Group reported that travel retail sales of luxury eyewear progressed by 31% YoY, with Europe and Southeast Asia being the leading growth regions. Brands typically introduce limited-edition and travel-exclusive models, which encourage impulse purchases from business travelers and affluent tourists.

Health awareness and growing demand for UV protection fuel the market growth

The rising awareness of eye health and the long-term risks of UV exposure is another key driver in the luxury sunglasses market. High-quality sunglasses usually offer optimal UV protection, blue-light filtering, and polarization, which attracts a larger audience.

In 2024, a Vision Council report stated that 49% of sunglasses buyers in the United States prefer UV protection, and high-class brands have answered with technical advancements. For instance, Maui Jim launched a fresh luxury collection presenting lenses with better glare reduction and improved UV400 protection.

Luxury Sunglasses Market: Restraints

Brand imitation and counterfeit products hamper the market progress

The proliferation of imitation luxury sunglasses remains a significant hindrance to the luxury sunglasses market. Counterfeit products, typically sold through unauthorized local markets and retailers, often feature a genuine high-class design but are sold at remarkably lower prices.

In March 2024, police in Italy seized more than 3,50,000 fake sunglasses imitating brands like Gucci, Dior, and Ray-Ban. These imitative products not only reduce sales of the original brands but also harm their reputation when poor-quality knock-offs are associated with premium names.

Luxury Sunglasses Market: Opportunities

Personalization and customization trends favorably impact the market growth

There is a growing demand for customized and bespoke luxury sunglasses, particularly among ultra-high-net-worth individuals and fashion-conscious consumers. Customization options, such as the choice of lens color, personalized engravings, monogrammed initials, AI-style recommendations, and frame materials, help enhance exclusivity—a vital factor in luxury purchasing behavior.

Cartier and Bulgari Eyewear have launched in-store customization lounges at select boutiques in New York and Paris, allowing customers to personalize their sunglasses with handcrafted elements. This key opportunity is expected to considerably fuel the global luxury sunglasses industry over the estimated period.

Luxury Sunglasses Market: Challenges

Import barriers and regulatory compliance restrict the growth of the market

Varying regulatory frameworks, safety certifications, and import duties in countries offer financial and operational challenges for luxury sunglasses manufacturers. Compliance with UV protection standards, environmental regulations, and material restrictions, such as the prohibition of banned chemicals in frames or lenses, varies by region. Brands should tailor their labeling, product designs, and supply chains to each target market, which can negatively impact costs and complexity.

In 2025, the European Union adopted stringent rules on waste reduction and packaging sustainability, which impacted luxury eyewear companies that use multi-materials or ornate packaging.

Luxury Sunglasses Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Luxury Sunglasses Market |

| Market Size in 2024 | USD 15.48 Billion |

| Market Forecast in 2034 | USD 21.52 Billion |

| Growth Rate | CAGR of 4.20% |

| Number of Pages | 214 |

| Key Companies Covered | Luxottica Group S.p.A., EssilorLuxottica, Safilo Group S.p.A., Marchon Eyewear Inc., Marcolin S.p.A., De Rigo Vision S.p.A., Kering Eyewear, LVMH (Louis Vuitton Moët Hennessy), Chanel, Prada Group, Dolce & Gabbana, Ray-Ban, Maui Jim Inc., Oakley Inc., Tom Ford Eyewear, and others. |

| Segments Covered | By Product, By Type, By Gender, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Luxury Sunglasses Market: Segmentation

The global luxury sunglasses market is segmented based on product, type, gender, application, and region.

Based on product, the global industry is divided into polarized and non-polarized. The polarized segment registered a larger market share due to its functionality in reducing glare and enhancing visual clarity, particularly in outdoor settings.

On the other hand, the non-polarized segment held a considerable share, owing to fashion-oriented buyers who prefer design over function.

Based on type, the global market is segmented as aviator sunglasses, wayfarer sunglasses, round sunglasses, sport sunglasses, and others. The aviator sunglasses segment held a dominant market share due to their timeless design and collaborations with iconic personalities and premium fashion brands.

Conversely, the wayfarer sunglasses segment registered a second-leading share, primarily due to their square and bold frames, as well as their strong fashion appeal.

Based on gender, the global luxury sunglasses market is segmented as male and female. The women's segment registered a substantial market share, fueled by higher fashion consciousness, strong alignment with designer trends, and frequent accessory purchases.

However, the male segment, although historically understated, has progressed due to the influence of celebrity endorsements, fashion media, and growing brand awareness.

Based on application, the global market is segmented as fashion and style, sports and performance, driving and automotive, outdoor activities, and others. The fashion and style segment holds a notable market share, as luxury sunglasses are primarily purchased as fashion accessories.

Nonetheless, the driving and automotive segment held a second-leading share, impacted by the growing prominence of polarized sunglasses that reduce glare and improve visibility during driving.

Luxury Sunglasses Market: Regional Analysis

Europe to witness significant growth over the forecast period

Europe is projected to maintain its dominant position in the global luxury sunglasses market, owing to the strong presence of luxury brands, high consumer spending on high-end products, and robust retail infrastructure and distribution. Europe houses iconic luxury fashion brands like Dior, Gucci, and Prada, which majorly propel the worldwide premium eyewear segment. These brands set global fashion trends, constantly introduce high-quality sunglasses collections, and drive innovation. According to reports, the region accounted for more than 35% of the worldwide luxury fashion industry in 2024, underscoring its prominence in related segments, such as sunglasses.

Furthermore, European consumers, primarily in the UK, Germany, France, and Italy, have high per-capita spending on high-quality accessories. Notably, Western Europe is the leading region for luxury discretionary spending, with a typical yearly spend of €1,250 per luxury user. This behavior propels continuous demand for luxury sunglasses as fashion essentials. Europe holds a well-established ecosystem of premium retail outlets, optical stores, and boutiques, offering a broader range of luxury eyewear. Brands embrace exclusive showrooms and flagship stores to deliver immersive brand experiences.

Moreover, Europe's digital luxury retail sector is progressing rapidly, with online sales expected to account for more than 24% of overall luxury purchases in the region by 2024, driving increased accessibility.

North America maintains its position as the second-largest region in the global luxury sunglasses industry, thanks to the strong presence of key luxury retail chains, the influence of celebrity culture, and the high demand for eyewear among vehicle owners. North America boasts a well-developed network of luxury department stores and retailers, including Nordstrom, Neiman Marcus, and Saks Fifth Avenue. These stores offer curated luxury collections from a diverse range of leading brands.

Likewise, the United States influencer and entertainment market plays a significant role in shaping fashion trends, particularly in accessories such as premium eyewear. Social media influencers and celebrities frequently endorse luxury eyewear, resulting in an immediate surge in demand. A 2024 Deloitte survey disclosed that 67% of luxury shoppers in the region are led by celebrity endorsements or online brand marketing.

Additionally, with high personal car ownership rates in Canada and the United States, luxury polarized sunglasses are in demand for fueling safety and comfort. North American users place a high value on performance and function, favoring premium brands that combine glare reduction with fashion. According to data, polarized lenses accounted for more than 60% of luxury sunglasses sales in the United States in 2024.

Luxury Sunglasses Market: Competitive Analysis

The major operating players in the global luxury sunglasses market include:

- Luxottica Group S.p.A.

- EssilorLuxottica

- Safilo Group S.p.A.

- Marchon Eyewear Inc.

- Marcolin S.p.A.

- De Rigo Vision S.p.A.

- Kering Eyewear

- LVMH (Louis Vuitton Moët Hennessy)

- Chanel

- Prada Group

- Dolce & Gabbana

- Ray-Ban

- Maui Jim Inc.

- Oakley Inc.

- Tom Ford Eyewear

Luxury Sunglasses Market: Key Market Trends

Smart and tech-integrated sunglasses:

Luxury sunglasses are evolving with integrated technology features, including voice assistants, in-built audio, and AR capabilities. Associations like Ray-Ban Meta Smart Glasses underscore the fusion of functionality and fashion. This trend reflects the growing interest in wearable technology among tech-savvy consumers seeking products with more than just aesthetic value.

Rise of online luxury eyewear retailing:

Digital-first strategies and premium direct-to-consumer platforms are transforming how users purchase luxury sunglasses. In 2024, more than 25% of global luxury eyewear sales came from online stores, supported by high-resolution previews and AR tools. E-commerce growth is robust among younger demographics, who seek personalized and convenient experiences.

The global luxury sunglasses market is segmented as follows:

By Product

- Polarized

- Non-Polarized

By Type

- Aviator Sunglasses

- Wayfarer Sunglasses

- Round Sunglasses

- Sport Sunglasses

- Others

By Gender

- Male

- Female

By Application

- Fashion and Style

- Sports and Performance

- Driving and Automotive

- Outdoor Activities

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Luxury sunglasses are high-quality eyewear products that blend functionality, fashion, and premium craftsmanship. These sunglasses are crafted with cutting-edge materials to provide UV protection and style, often produced by renowned designer brands. These products are seen as fashion statements and status symbols, and are endorsed by influencers and celebrities.

The global luxury sunglasses market is projected to grow due to the rise in lifestyle and fashion awareness, improvements in frame materials and lenses, and the introduction of customized and limited-edition product offerings.

According to study, the global luxury sunglasses market size was worth around USD 15.48 billion in 2024 and is predicted to grow to around USD 21.52 billion by 2034.

The CAGR value of the luxury sunglasses market is expected to be around 4.20% during 2025-2034.

Europe is expected to lead the global luxury sunglasses market during the forecast period.

The key players profiled in the global luxury sunglasses market include Luxottica Group S.p.A., EssilorLuxottica, Safilo Group S.p.A., Marchon Eyewear, Inc., Marcolin S.p.A., De Rigo Vision S.p.A., Kering Eyewear, LVMH (Louis Vuitton Moët Hennessy), Chanel, Prada Group, Dolce & Gabbana, Ray-Ban, Maui Jim, Inc., Oakley, Inc., and Tom Ford Eyewear.

The report examines key aspects of the luxury sunglasses market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed