Global Medical Tubing Market Size, Share, Growth Analysis Report - Forecast 2034

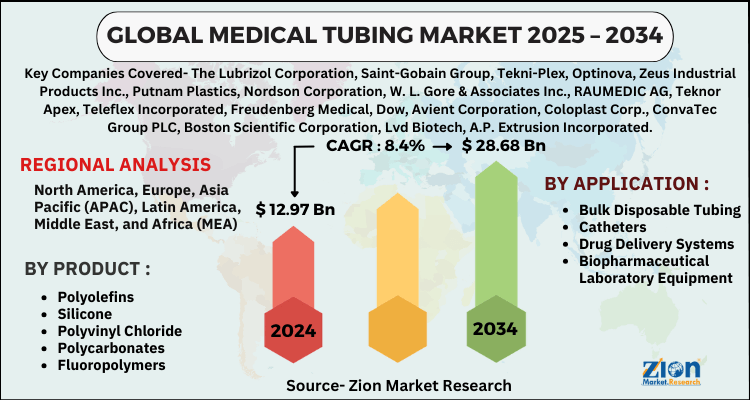

Medical Tubing Market By Product (Polyolefins, Silicone, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, and Others), By Application (Bulk Disposable Tubing, Catheters, Drug Delivery Systems, Biopharmaceutical Laboratory Equipment, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.97 Billion | USD 28.68 Billion | 8.4% | 2024 |

Medical Tubing Market Size

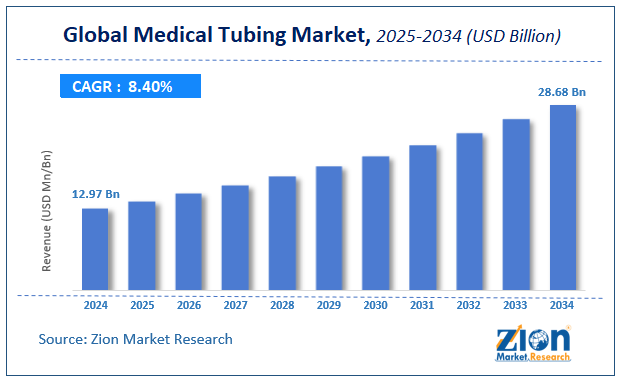

The global medical tubing market size was worth around USD 12.97 Billion in 2024 and is predicted to grow to around USD 28.68 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.4% between 2025 and 2034.

The report analyzes the global medical tubing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the medical tubing industry.

Medical Tubing Market: Overview

A hollow cylindrical pipe referred as "medical tubing" is utilized to transmit gas and liquid using devices. It is produced using nylon, silicone, polyethylene, polyvinyl chloride (PVC), and thermoplastic elastomers (TPE). Few of its applications include catheters, fluid management, peristaltic pumps, drainage, bio-pharmaceutical laboratory equipment, intravenous (IVs), breathing equipment, and anesthesia. Medical tubing has several qualities, comprising resistance to temperature, abrasion, and pressure, as well as flexibility, hardness, and durability. It is readily applicable to the human body because it is made from recyclable plastic and does not cause allergic or adverse reactions. Due to its high level of purity, medical tubing can survive extremely demanding mechanical conditions. As a result, it is frequently utilized in medical labs, ambulatory surgical centers, hospitals, and clinics.

Key Insights

- As per the analysis shared by our research analyst, the global medical tubing market is estimated to grow annually at a CAGR of around 8.4% over the forecast period (2025-2034).

- Regarding revenue, the global medical tubing market size was valued at around USD 12.97 Billion in 2024 and is projected to reach USD 28.68 Billion by 2034.

- The medical tubing market is projected to grow at a significant rate due to increasing demand for minimally invasive procedures, expansion of the healthcare sector, and technological innovations in biocompatible materials.

- Based on Product, the Polyolefins segment is expected to lead the global market.

- On the basis of Application, the Bulk Disposable Tubing segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Medical Tubing Market: Growth Drivers

Increasing demand for medical tubes across a range of medical devices to drive the market growth

Many different medical procedures involve tubes, including delivering fluids and medications, performing minimally invasive surgery, providing interventional therapy, and using ventilators and intravenous therapy (IVs). Cardiovascular catheterizations are used to diagnose and treat a variety of heart conditions, including driving catheters with medical tubing to locate narrowing blood vessels, unclog arteries, check pump performance, perform biopsies, diagnose congenital heart defects, and locate problems with heart valves. Cardiorespiratory disorders are becoming more common, which has increased demand for medical devices that employ a lot of medical-grade tubes. This is anticipated to boost demand for medical tubes in a variety of medical devices and propel the global medical tubing market expansion.

Medical Tubing Market: Restraints

Health issues related to the insertion of medical tubes hampering the market growth

Medical tubing market growth is being restrained by health issues related to tube insertion, such as diarrhea, skin breakdown or anatomic disturbance, dislodged or blocked feeding tubes, and metabolic concerns like hyperglycemia and hyperphosphatemia. Another important issue impeding market expansion is the rising prevalence of catheter-associated urinary tract infections (CAUTI) among adult patients utilizing indwelling urinary catheters (IUC). Further predicted market growth restraints include discomfort and other issues related to tube insertion and removal.

Medical Tubing Market: Opportunities

Rising product launches along with the latest technology features provide lucrative opportunities for the market expansion

The global medical tubing market for medical tubing manufacturers is anticipated to see significant development prospects as a result of the rising launches of sophisticated medical tubing solutions with cutting-edge technological features. For instance, an Israeli firm, ART Medical Ltd., created a revolutionary sensor-based smart tube in 2017 that enables healthcare professionals to gather thorough patient data while lowering the risk of medical consequences. By utilizing sensors built into the tubes, this cutting-edge medical device may collect patient information such as feeding requirements, salivation, and urine output. It gives real-time information, including the precise placement of the tube, and assists in controlling the feeding process.

Medical Tubing Market: Challenges

Stringent and time-consuming approval process act as a major challenge for the market expansion

The commercialization of medical products is hampered by burdensome and time-consuming regulatory procedures. Because medical tubing comes into direct contact with the body, safety and the avoidance of health risks are significant considerations for these tubing. Various authorities, like the FDA, NSA, and others, established standards for the production of medical tubing. The time needed to complete the approval process and the regulatory criteria vary by region. Additionally, the approval procedure differs depending on the kind of medical device. Thus, act as a major challenge for market expansion.

Medical Tubing Market: Segmentation

The global medical tubing market is segmented based on product, application and region

Based on product, the global market is bifurcated into polyolefins, silicone, polyvinyl chloride, polycarbonates, fluoropolymers and others. The polyvinyl chloride segment held the largest market share in 2021 and is expected to show its dominance during the forecast period. The demand for PVC-based medical devices has increased as a result of a rise in the usage of single-use, pre-sterilized medical equipment. Moreover, blood bags and other non-breakable containers, which are essential in healthcare, are made using PVC. The preferred material for these kinds of devices is soft PVC.

Being thin and nearly impervious to tearing, it is perfect for speedy and efficient emergency care of accident patients. Furthermore, PVC is the softest and most flexible material that can be used to produce disposable medical devices due to its unique qualities. The medical equipment is made as comfortable as possible owing to its softness; PVC, for example, is the best material to use in neo-natal wards for newborn and premature babies. When wearing medical gloves, healthcare professionals can also appreciate the softness. PVC-based medical devices also don't make any noise and keep odors from escaping, enhancing comfort and hygiene. Thus, this will drive segment growth over the forecast period.

Based on application, global medical tubing is categorized into bulk disposable tubing, catheters, drug delivery systems, biopharmaceutical laboratory equipment, and others. Bulk disposable tubing is expected to dominate the market during the forecast period. For a variety of uses, such as blood transfusion, IV transfusion, respiratory tubing, and others, bulk disposable tubing is available. Similarly, it is used to administer fluids and medications straight into a person's blood. The demand for bulk disposable tubing used in healthcare facilities is anticipated to rise as a result of an aging population and government spending to build new and upgrade existing healthcare facilities.

Medical Tubing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Tubing Market |

| Market Size in 2024 | USD 12.97 Billion |

| Market Forecast in 2034 | USD 28.68 Billion |

| Growth Rate | CAGR of 8.4% |

| Number of Pages | 254 |

| Key Companies Covered | The Lubrizol Corporation, Saint-Gobain Group, Tekni-Plex, Optinova, Zeus Industrial Products Inc., Putnam Plastics, Nordson Corporation, W. L. Gore & Associates Inc., RAUMEDIC AG, Teknor Apex, Teleflex Incorporated, Freudenberg Medical, Dow, Avient Corporation, Coloplast Corp., ConvaTec Group PLC, Boston Scientific Corporation, Lvd Biotech, A.P. Extrusion Incorporated, and Elkem ASA, and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments:

- In May 2022, HelixFlexTM, a high-purity thermoplastic elastomer TPE tubing intended for use in pharmaceutical and biopharmaceutical applications, was introduced by Freudenberg Medical, a producer of medical and pharmaceutical equipment, components, and tubing. In addition to its current line of silicone tubing and fluid transfer solutions for bioprocessing, pharmaceutical and vaccine production, filling and sampling, peristaltic pumping, laboratory, and medical device applications, Freudenberg has expanded its product line for the pharma industry.

- In February 2022, Imperative Care Inc. introduced Zoom POD Aspiration Tubing, the company's latest advancement in stroke care, which also comprises the Zoom 88 Large Distal Platform for neurovascular access, four Zoom Aspiration Catheters in various sizes, and the Zoom Pump with accessories. The Zoom POD is built into the aspiration tube, reducing the distance between aspiration and filtration while retaining full aspiration power.

Medical Tubing Market: Regional Analysis

North America is expected to dominate the market during the forecast period

North America accounted for the largest global medical tubing market share of more than 35% and is expected to continue this pattern during the forecast period. The rising incidence of chronic diseases and the aging population, the rise in product releases, the demand for minimally invasive treatments, and rising strategic initiatives by major market players are the main drivers fueling the growth of the North American medical tubing market. In the region, the US hold the largest market share over the analysis period. For instance, according to the Kidney Disease Statistics for the United States, which were updated in July 2022, chronic kidney disease (CKD) affects more than one in seven persons in this country, and it is projected that 37 million Americans have kidney disease.

Urinary catheter demand will rise as the prevalence of CKD in the nation rises, propelling the market. Additionally, increasing product launches and approval is one of the significant factors that penetrate the market growth during the forecast period. For instance, in August 2021, SKATER Mini-Loop Drainage Catheters, which will be inserted through the skin under imaging guidance as a minimally invasive method to remove or drain an unwanted fluid collection, were introduced by Argon Medical Devices, Inc. in the United States. In November 2021, the FDA granted permission to The Flume Catheter Business Ltd. (TFCC) to commercialize the FLUME catheter in the United States. TFCC is a medical device company committed to creating a superior replacement for the Foley indwelling urinary catheter. Thus, the aforementioned facts support the market expansion in the region.

Besides, the Asia Pacific market is expected to grow at the highest CAGR during the forecast period. The growth in the region is attributed to the consumers' per capita income increasing rapidly, while the population is growing significantly. The Gross National Income (GNI) of China increased by 2.12% from 2019 to 2020, which is anticipated to increase middle-class consumers' purchasing power and empower them to pay for better healthcare services. In addition, it is anticipated that high population expansion would lead to a greater increase in the elderly population. For instance, the National Statistical Office (NSO) estimates that the share of old people in India will increase by 13.1% by 2031. The senior population's increasing need for medical tubes to deliver fluids and medications is anticipated to fuel market revenue growth.

Medical Tubing Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the medical tubing market on a global and regional basis.

The global medical tubing market is dominated by players like:

- The Lubrizol Corporation

- Saint-Gobain Group

- Tekni-Plex

- Optinova

- Zeus Industrial Products Inc.

- Putnam Plastics

- Nordson Corporation

- W. L. Gore & Associates Inc.

- RAUMEDIC AG

- Teknor Apex

- Teleflex Incorporated

- Freudenberg Medical

- Dow

- Avient Corporation

- Coloplast Corp.

- ConvaTec Group PLC

- Boston Scientific Corporation

- Lvd Biotech

- A.P. Extrusion Incorporated

- and Elkem ASA

The global medical tubing market is segmented as follows;

By Product

- Polyolefins

- Silicone

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- and Others

By Application

- Bulk Disposable Tubing

- Catheters

- Drug Delivery Systems

- Biopharmaceutical Laboratory Equipment

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The Global medical tubing market is expected to grow due to increasing demand for minimally invasive medical devices, rising healthcare investments, and advancements in biocompatible tubing materials.

According to a study, the Global medical tubing market size was worth around USD 12.97 Billion in 2024 and is expected to reach USD 28.68 Billion by 2034.

The Global medical tubing market is expected to grow at a CAGR of 8.4% during the forecast period.

North America is expected to dominate the medical tubing market over the forecast period.

Leading players in the Global medical tubing market include The Lubrizol Corporation, Saint-Gobain Group, Tekni-Plex, Optinova, Zeus Industrial Products Inc., Putnam Plastics, Nordson Corporation, W. L. Gore & Associates Inc., RAUMEDIC AG, Teknor Apex, Teleflex Incorporated, Freudenberg Medical, Dow, Avient Corporation, Coloplast Corp., ConvaTec Group PLC, Boston Scientific Corporation, Lvd Biotech, A.P. Extrusion Incorporated, and Elkem ASA, among others.

The report explores crucial aspects of the medical tubing market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed