Testing as a Service (TaaS) Market Size, Share, Trends, Growth & Forecast 2034

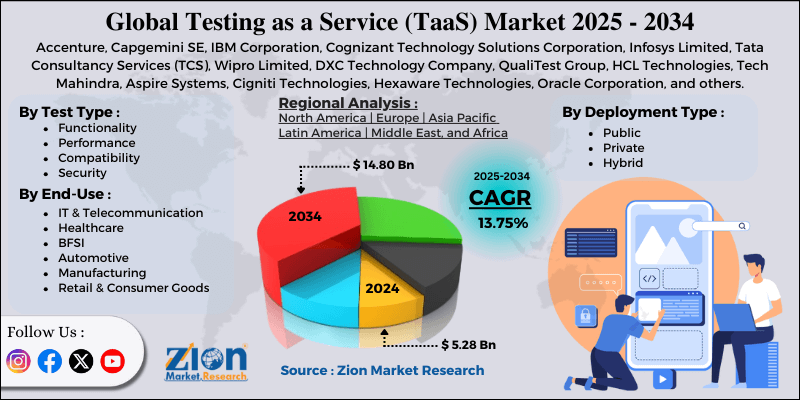

Testing as a Service (TaaS) Market By Test Type (Functionality, Performance, Compatibility, Security, Compliance, and Others), By Deployment Type (Public, Private, Hybrid), By End-Use (IT & Telecommunication, Healthcare, BFSI, Automotive, Manufacturing, Retail & Consumer Goods, Energy & Utilities, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

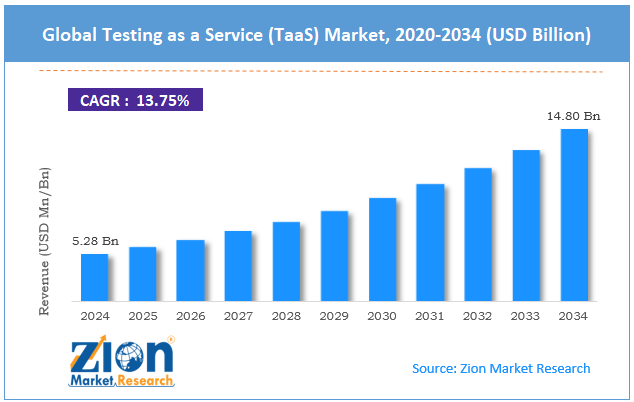

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.28 Billion | USD 14.80 Billion | 13.75% | 2024 |

Testing as a Service (TaaS) Industry Perspective:

The global Testing as a Service (TaaS) market size was around USD 5.28 billion in 2024 and is projected to reach USD 14.80 billion by 2034, with a compound annual growth rate (CAGR) of roughly 13.75% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global Testing as a Service (TaaS) market is estimated to grow annually at a CAGR of around 13.75% over the forecast period (2025-2034)

- In terms of revenue, the global Testing as a Service (TaaS) market size was valued at around USD 5.28 billion in 2024 and is projected to reach USD 14.80 billion by 2034.

- The Testing as a Service (TaaS) market is projected to grow significantly owing to the rapid adoption of cloud technologies, the broader adoption of Agile and DevOps development methodologies, and demand for faster time-to-market and more frequent release cycles.

- Based on test type, the functionality segment is expected to lead the market, while the performance segment is expected to grow considerably.

- Based on deployment type, the public segment is the dominating segment, while the private segment is projected to witness sizeable revenue over the forecast period.

- Based on end-use, the IT & telecommunications segment is expected to lead the market, followed by the BFSI segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Testing as a Service (TaaS) Market: Overview

Testing as a Service is a cloud-based model in which companies outsource their software testing tasks to an external provider that delivers testing tools, expertise, and environments on demand. It allows organizations to scale testing resources quickly, reduce labor and infrastructure costs, and access different specialized testing capabilities without maintaining them in-house. The global Testing as a Service (TaaS) market is projected to grow substantially, driven by the adoption of Agile/DevOps, cloud migrations, and modern architectures, as well as the shortage of skilled QA professionals. Agile and DevOps practices require continuous, rapid testing to support frequent releases. TaaS offers on-demand environments and scalable automation to meet this speed. It allows faster delivery without compromising quality.

Moreover, cloud-native and microservices systems raise testing complexity. TaaS providers supply ready cloud-based test platforms that reduce setup effort. This accelerates validation of distributed applications. Furthermore, companies struggle to find professionals in security, automation, and performance testing. TaaS solves this gap by offering specialized skills promptly. It improves capability without long-term hiring costs.

Although drivers exist, the global market is challenged by factors like data privacy and security concerns, limited control over testing processes, and integration issues with legacy systems. Outsourcing testing exposes sensitive data and code to external vendors. This increases the risks associated with compliance violations or breaches. Highly regulated industries remain cautious in adopting TaaS.

Working with 3rd party testers may hamper visibility into test execution. Companies usually worry about timely reporting and quality standards. This lack of control restricts adoption. Similarly, proprietary or older systems may not smoothly align with TaaS platforms. Integration needs customization, which may increase cost and time. This slows adoption among legacy-heavy businesses.

Even so, the global Testing as a Service (TaaS) industry is well-positioned due to the growth of cross-platform, IoT, and mobile apps, integration of AI/ML-based Testing, and the growing need for compliance and security testing. Expanding device infrastructure needs extensive compatibility testing. TaaS providers already maintain large fleets of devices and farms. This ranks them suitable to capture surging demand. AI-based test generation and predictive analysis enhance defect detection and speed. TaaS vendors that integrate AI offer more automated, more innovative solutions. This remarkably improves service value. Cyber threats and regulations are growing worldwide. TaaS providers offering dedicated security testing can stand out. This creates high-value service opportunities.

Testing as a Service (TaaS) Market Dynamics

Growth Drivers

How does the integration of automation and AI in Testing drive the Testing as a Service (TaaS) market?

Improvements in machine learning and AI have transformed the testing process. Smart test automation tools can generate test cases, predict areas vulnerable to failure, enhance test packages, and adapt to changing codebases. This automation primarily speeds up Testing, reduces human error, and improves coverage – a factor increasingly vital in modern agile/DevOps pipelines. Subsequently, several businesses have come to prefer TaaS providers that offer AI-powered testing services. As AI-based tools progress, their effectiveness and efficiency make TaaS more valuable and attractive.

How is the demand for cost-effective and scalable QA solutions fueling the Testing as a Service (TaaS) market?

Maintaining in-house testing teams and infrastructure can be expensive, requiring licensing, hardware, ongoing maintenance, and skilled human resources. For several medium or small businesses, or for companies running bursty or periodic development cycles, this cost is usually unjustifiable. TaaS – with its pay-as-you-go model, enables companies to access well-developed testing services as required, scaling up or down depending on project requirements. This flexibility lowers capital expenditure and operational overhead, making QA accessible to a broader range of businesses. This cost efficiency remains a significant incentive for adopting TaaS, thereby propelling the Testing as a Service (TaaS) market.

Restraints

Integration complexity with existing infrastructure and processes unfavorably impacts the market progress

Several businesses use legacy systems, hybrid on-premise + cloud architectures, and custom internal workflows; integrating an external TaaS solution flawlessly into these environments is challenging. These efforts may be significant, as they require aligning environments, tools, CI/CD pipelines, and test data with the provider's infrastructure.

For companies with tightly coupled or bespoke systems, this integration overhead reduces the appeal of TaaS, potentially balancing the time/cost benefits. Therefore, businesses may avoid or delay TaaS adoption, preferring to maintain in-house control rather than invest in integration.

Opportunities

How is the Testing as a Service (TaaS) market opportune to the growing need for security, compliance, and performance testing?

Given regulatory requirements and the complexity of applications like IoT, cloud, and mobile, businesses need strong security, performance, and compliance, as well as testing. TaaS companies that offer specialized Testing beyond basic functionality have a strong opportunity in these services. This provides a high-value niche for TaaS providers, distinguishing them beyond simple generic Testing, thus positively impacting the growth of the Testing as a Service (TaaS) industry.

Challenges

Variation in quality and lack of standardization across providers restrict the market growth

Since TaaS providers differ in their tools, methodologies, expertise, and infrastructure, there can be inconsistencies in coverage, service quality, and reliability. Without industry-wide standards, clients may struggle to assess whether a given provider meets their requirements, which can lead to uncertainty. For critical systems, particularly in regulated industries, this uncertainty may prompt companies to hesitate about outsourcing testing. This challenge also complicates businesses' vendor selection.

Testing as a Service (TaaS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Testing as a Service (TaaS) Market |

| Market Size in 2024 | USD 5.28 Billion |

| Market Forecast in 2034 | USD 14.80 Billion |

| Growth Rate | CAGR of 13.75% |

| Number of Pages | 212 |

| Key Companies Covered | Accenture, Capgemini SE, IBM Corporation, Cognizant Technology Solutions Corporation, Infosys Limited, Tata Consultancy Services (TCS), Wipro Limited, DXC Technology Company, QualiTest Group, HCL Technologies, Tech Mahindra, Aspire Systems, Cigniti Technologies, Hexaware Technologies, Oracle Corporation, and others. |

| Segments Covered | By Test Type, By Deployment Type, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Testing as a Service (TaaS) Market: Segmentation

The global Testing as a Service (TaaS) market is segmented by test type, deployment type, end-use, and region.

Based on test type, the global Testing as a Service (TaaS) industry is divided into functionality, performance, compatibility, security, compliance, and others. The functionality segment holds a dominant share of the market, as almost every software product requires thorough validation of core features before release. It assures that applications behave as intended in workflows, integrations, and user interactions. Businesses prioritize this test type since it directly impacts user experience and defect prevention. Its broad applicability in all industries maintains its rank as the leading one.

Based on deployment type, the global Testing as a Service (TaaS) market is segmented into public, private, and hybrid. The public segment holds a substantial market share due to its cost-effectiveness, on-demand access to testing tools, and scalability. It helps businesses run tests without investing in infrastructure and supports agile and CI/CD workflows. The benefits make it the ideal choice for most companies.

Based on end-use, the global market is segmented into IT & telecommunication, healthcare, BFSI, automotive, manufacturing, retail & consumer goods, energy & utilities, and others. The IT & telecommunication industry captures a remarkable share because it fuels most demand for software development, speedy product rollouts, and digital services. These businesses need extensive Testing in performance, compatibility, functionality, and security, usually at frequent intervals. As the backbone of cloud-native solutions and worldwide software deployment, this segment accounts for the largest share of TaaS revenues.

Testing as a Service (TaaS) Market: Regional Analysis

Why is North America outperforming other regions in the global Testing as a Service (TaaS) Market?

North America is likely to maintain its leadership in the Testing as a Service (TaaS) market, driven by substantial market share, advanced IT infrastructure, leading providers, and high demand across major industries. North America accounts for nearly 39.2% of the global market, reflecting its well-developed software industry. Businesses widely adopt TaaS to manage large-scale, complex applications effectively. This steady demand maintains the region's leading rank.

Moreover, the area features advanced IT infrastructure, early DevOps integration, and high cloud adoption, which support continuous TaaS deployment. Leading worldwide TaaS providers operate locally and offer enterprise-grade solutions. These factors strengthen the region's industry dominance. Major industries such as BFSI, healthcare, and IT/Telecom drive extensive TaaS adoption for security, compliance testing, and performance. Companies prioritize quality to ensure reliability and regulatory adherence. This strong market demand surges regional leadership.

Europe continues to hold the second-highest share in the Testing as a Service (TaaS) industry, driven by substantial market share, growing regulatory and compliance-driven demand, and developed IT infrastructure and established providers. Europe accounts for nearly a quarter of the global TaaS industry, making it the second-largest region. Businesses are progressively adopting outsourced Testing to ensure reliable, faster software delivery. The steady demand reflects Europe's quality-driven and mature software landscape.

Moreover, stringent data protection and regulatory standards fuel businesses to adopt strong testing practices. TaaS providers guarantee compliance, security, and reliability across healthcare, finance, and other regulated industries. This regulatory pressure sustains robust demand for professional testing services. Europe's advanced IT infrastructure, DevOps practices, and broader cloud adoption aid TaaS deployment. Several regional and global service providers offer enterprise-grade testing solutions. This supportive ecosystem strengthens the region's strong market rank.

Testing as a Service (TaaS) Market: Competitive Analysis

The leading players in the global Testing as a Service (TaaS) market are:

- Accenture

- Capgemini SE

- IBM Corporation

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Tata Consultancy Services (TCS)

- Wipro Limited

- DXC Technology Company

- QualiTest Group

- HCL Technologies

- Tech Mahindra

- Aspire Systems

- Cigniti Technologies

- Hexaware Technologies

- Oracle Corporation

Testing as a Service (TaaS) Market: Key Market Trends

Growing demand for security and compliance testing:

Growing cyber threats and stringent requirements are fueling the demand for compliance and security testing in TaaS. Providers offer regulatory validation and vulnerability assessments as core services. This assures applications are reliable, secure, and legally compliant.

Shift to cloud-based and cloud-native Testing:

Cloud adoption and microservices require cloud-native, scalable testing environments. TaaS allows elastic resource allocation and continuous integration with DevOps pipelines. This allows global teams to test applications effectively in diverse conditions.

The global Testing as a Service (TaaS) market is segmented as follows:

By Test Type

- Functionality

- Performance

- Compatibility

- Security

- Compliance

- Others

By Deployment Type

- Public

- Private

- Hybrid

By End-Use

- IT & Telecommunication

- Healthcare

- BFSI

- Automotive

- Manufacturing

- Retail & Consumer Goods

- Energy & Utilities

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Testing as a Service is a cloud-based model in which companies outsource their software testing tasks to an external provider that delivers testing tools, expertise, and environments on demand. It allows organizations to scale testing resources quickly, reduce labor and infrastructure costs, and access different specialized testing capabilities without maintaining them in-house.

The global Testing as a Service (TaaS) market is projected to grow due to the increasing complexity of software applications and systems, the growing integration of AI and machine learning into Testing, and the escalating use of IoT, mobile, and cross-platform applications.

According to a study, the global Testing as a Service (TaaS) market size was around USD 5.28 billion in 2024 and is projected to reach USD 14.80 billion by 2034.

The CAGR value of the Testing as a Service (TaaS) market is expected to be around 13.75% during 2025-2034.

The value chain of the global TaaS industry includes requirement analysis, test planning, test environment setup, test execution, defect management, and reporting/feedback.

Macroeconomic factors such as economic slowdowns, currency volatility, and fluctuations in IT spending may affect TaaS pricing, adoption, and investment in new testing technologies.

North America is expected to lead the global Testing as a Service (TaaS) market during the forecast period.

The United States is a significant contributor to the global Testing as a Service (TaaS) market, driven by high cloud adoption, a mature IT industry, and the presence of leading TaaS providers.

The key players profiled in the global Testing as a Service (TaaS) market include Accenture, Capgemini SE, IBM Corporation, Cognizant Technology Solutions Corporation, Infosys Limited, Tata Consultancy Services (TCS), Wipro Limited, DXC Technology Company, QualiTest Group, HCL Technologies, Tech Mahindra, Aspire Systems, Cigniti Technologies, Hexaware Technologies, and Oracle Corporation.

The report examines key aspects of the Testing as a Service (TaaS) market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed