Robotics as a Service (RaaS) Market Size, Share, Trends, Growth and Forecast 2034

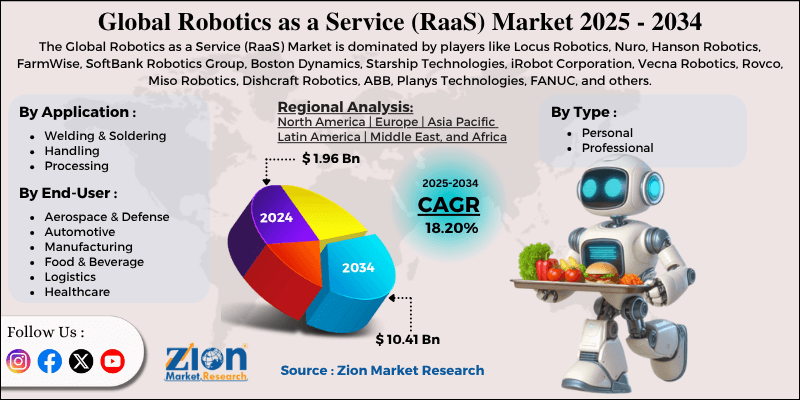

Robotics as a Service (RaaS) Market By Type (Personal and Professional), By Application (Welding & Soldering, Assembling & Disassembling, Handling, Processing, and Others), By End-User Vertical (Media & Entertainment, Aerospace & Defense, Automotive, Manufacturing, Food & Beverage, Logistics, Healthcare, Space Exploration, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

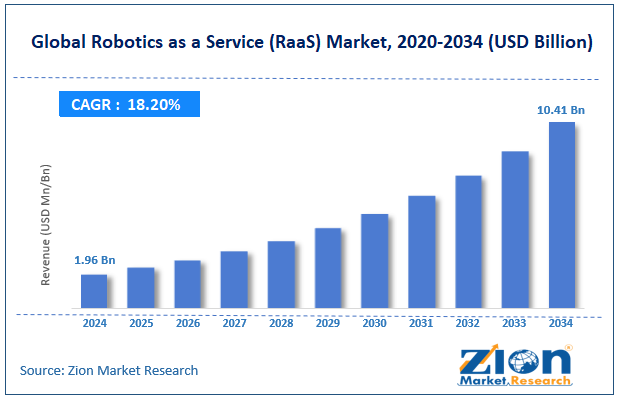

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.96 Billion | USD 10.41 Billion | 18.20% | 2024 |

Robotics as a Service (RaaS) Industry Perspective:

The global robotics as a service (RaaS) market size was worth around USD 1.96 billion in 2024 and is predicted to grow to around USD 10.41 billion by 2034, with a compound annual growth rate (CAGR) of roughly 18.20% between 2025 and 2034.

Robotics as a Service (RaaS) Market: Overview

Robotics-as-a-service (RaaS) is a subscription-based model allowing end-users to obtain services from robotic solution offering companies. RaaS facilitates an extensive number of users to seek advanced robotic services at minimal investment. The companies can subscribe to a dynamic number of robots depending on business needs.

The rising adoption of robotic solutions across major industries and for personal use has helped the RaaS industry thrive in the last few years. Robotics-as-a-service model works similarly to a software-as-a-service (SaaS) platform. The end-user company obtains a legitimate license for using service or industrial robots for a nominal fee.

The continued use of RaaS will require the client company to make recurring payments until the end of the contract. The main benefits of leveraging robotics-as-a-service offerings include lowered cost of investments for RaaS seekers, scalability, and higher flexibility. The increasing number of robotics-as-a-service providers is expected to aid the industry's growth rate during the forecast period.

However, challenges such as limited customization and integration of RaaS with existing systems may dilute the overall revenue generated by the industry players.

Key Insights:

- As per the analysis shared by our research analyst, the global robotics as a service (RaaS) market is estimated to grow annually at a CAGR of around 18.20% over the forecast period (2025-2034)

- In terms of revenue, the global robotics as a service (RaaS) market size was valued at around USD 1.96 billion in 2024 and is projected to reach USD 10.41 billion by 2034.

- The robotics as a service market is projected to grow at a significant rate due to the increasing demand for robots across industries.

- Based on the type, the professional segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user vertical, the logistics segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Robotics as a Service (RaaS) Market: Growth Drivers

Increasing demand for robots across industries will fuel the market expansion rate

The global robotics as a service (RaaS) market is expected to be driven by the increasing demand for robotic solutions across major end-user industries. The emergence and rapid penetration of Industry 5.0 trends are expected to generate more demand for advanced robots in industrial settings.

The Fifth Industrial Revolution deals with working as an integration of advanced technologies, such as robots and humans, to ensure optimal business outputs and improved working conditions. Industrial robots have started making their way into critical industries such as manufacturing, aerospace, healthcare, and others.

A growing number of companies worldwide are seeking novel and cost-effective ways of integrating robotic assistance in factory settings due to the advantages offered by the technology.

For instance, industrial robots can work around the clock, resulting in faster production cycles. They also perform high-risk jobs such as lifting heavy weights with minimal ease. This attribute improves the workplace safety of human employees. As the integration of advanced robotic solutions across industries continues to grow, RaaS industry players can expect more yield.

Growing construction of advanced warehousing facilities to propel industry growth trends

One of the largest and most significant users of industrial robots is the logistics and warehousing industry. The demand for next-generation robotic solutions is especially high in smart warehouses catering to the storage needs of companies across industries.

Some prominent features of smart warehousing include robotics & autonomous mobile robots, automated storage & retrieval systems, real-time tracking & Internet of Things (IoT), and other advanced engineering solutions. The global robotics as a service (RaaS) industry is expected to be fueled by the increasing construction and development of smart warehouses worldwide.

According to a recent update, the US is expected to register more than USD 8.91 billion worth of distribution and warehousing projects in the coming years. The emergence and quick growth of the e-commerce industry have been pivotal to increased demand for intelligent warehousing solutions.

Robotics as a Service (RaaS) Market: Restraints

Limited customization of robotic solutions to restrict market expansion

The global robotics as a service (Raas) industry is expected to witness restricted growth due to the limited customization options available for end-users. Each company has specific requirements in terms of robotic applications. RaaS providers may fail to meet these expectations, restricting their overall revenue in the long term.

In addition, the exhaustive resources required to train existing employees and systems to work in coherence with new robotic solutions may also limit the overall market expansion rate.

Robotics as a Service (RaaS) Market: Opportunities

Surge in the number of players in the industry to generate growth opportunities

The global robotics as a service (Raas) market is projected to generate growth opportunities due to the surge in the number of players in the market. Multiple options foster constructive competition within the industry. It also ensures end-users have access to a wider range of solutions across a price range and business requirements.

In March 2025, Primech AI Pte. Ltd., a Singapore-based leading player in the industry, announced the launch of its novel RaaS business segment. The company is currently the owner of HYTRON, which is an efficient autonomous cleaning robot. Primech plans to counter existing challenges such as operational costs, hygiene standards, and labor shortages in the cleaning industry.

In January 2025, Serve Robotics, an autonomous delivery company, announced that it had received funding of USD 86 million. The company’s total investment currently stands at USD 167 million in 2024. Serve Robotics has already proven its track record by serving clients such as 7-Eleven and Uber, among other partners.

In addition, according to the International Federation of Robotics, sales of service-based automated systems increased by 30% in 2024 compared to the previous year. Such statistics are an indication of the increased applications of service-based robots across the globe.

Robotics as a Service (RaaS) Market: Challenges

Regulatory concerns and integration challenges with existing systems to dilute market revenue

The global robotics as a service industry is projected to be challenged by the growing regulatory concerns associated with the use of robots across factory settings. Market research indicates growing doubts over robots replacing human employees in workplace settings.

In addition, challenges associated with ensuring that a new RaaS system can be integrated with existing legacy systems of a company may also dilute the market revenue rate.

Robotics as a Service (RaaS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Robotics as a Service (RaaS) Market |

| Market Size in 2024 | USD 1.96 Billion |

| Market Forecast in 2034 | USD 10.41 Billion |

| Growth Rate | CAGR of 18.20% |

| Number of Pages | 212 |

| Key Companies Covered | Locus Robotics, Nuro, Hanson Robotics, FarmWise, SoftBank Robotics Group, Boston Dynamics, Starship Technologies, iRobot Corporation, Vecna Robotics, Rovco, Miso Robotics, Dishcraft Robotics, ABB, Planys Technologies, FANUC, and others. |

| Segments Covered | By Type, By Application, By End-User Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Robotics as a Service (RaaS) Market: Segmentation

The global robotics as a service (RaaS) market is segmented based on type, application, end-user vertical, and region.

Based on the type, the global market segments are personal and professional. In 2024, the highest growth was listed in the professional segment. The increasing applications of robots in the e-commerce sectors, warehousing facilities, and other service-based industries will fuel segmental growth revenue. Singapore, for instance, currently has 770 robots per 10,000 employees. The protocol ensures a balance between job opportunities for human resources and the integration of advanced technologies in the workplace.

Based on application, the global robotics as a service (RaaS) industry is divided into welding & soldering, assembling & disassembling, handling, processing, and others.

Based on the end-user vertical, the global market divisions are media & entertainment, aerospace & defense, automotive, manufacturing, food & beverage, logistics, healthcare, space exploration, and others. In 2024, the highest revenue was generated by the logistics industry. The increasing demand for delivery robots and the rising scope of application in the warehousing segment will fuel segmental revenue during the projection period. China recorded an increase of over 16.9% in terms of industrial robots in operations across factory settings in the country.

Robotics as a Service (RaaS) Market: Regional Analysis

Asia-Pacific to emerge as the fastest-growing market during the forecast period

The global robotics as a service (RaaS) market will be led by Asia-Pacific during the forecast period. Countries such as Singapore, China, Japan, and South Korea will emerge as the fastest revenue generators. Singapore, for instance, is a country with limited human resources. The growing economy has well-established guidelines promoting the development and application of robots across sectors.

In March 2025, Singapore witnessed the launch of RoboNexus by the National Robotics Program (NRP). It is an accelerator program aiming to amplify efforts by robotics startups and small & medium enterprises (SMEs). South Korea, on the other hand, has been leading the regional space for several years.

In November 2023, the South Korean government introduced some amendments to the Intelligent Robots Development and Distribution Promotion Act, which allowed industrial robots to be used in outdoor settings as well.

In April 2024, Kakao Mobility Corp., a leading South Korean ride-hailing app operator, announced the launch of a robot delivery service using CLOi ServeBots developed by LG. Increased adoption of the robotics-as-a-service model in large-scale manufacturing facilities across Asia-Pacific will be critical to the region’s overall revenue.

Robotics as a Service (RaaS) Market: Competitive Analysis

The global robotics as a service (RaaS) market is led by players like:

- Locus Robotics

- Nuro

- Hanson Robotics

- FarmWise

- SoftBank Robotics Group

- Boston Dynamics

- Starship Technologies

- iRobot Corporation

- Vecna Robotics

- Rovco

- Miso Robotics

- Dishcraft Robotics

- ABB

- Planys Technologies

- FANUC

The global robotics as a service (RaaS) market is segmented as follows:

By Type

- Personal

- Professional

By Application

- Welding & Soldering

- Assembling & Disassembling

- Handling

- Processing

- Others

By End-User Vertical

- Media & Entertainment

- Aerospace & Defense

- Automotive

- Manufacturing

- Food & Beverage

- Logistics

- Healthcare

- Space Exploration

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed