Sustainable Aviation Fuel Market Size, Share, Trends, Growth 2034

Sustainable Aviation Fuel Market By Fuel Type (Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas-to-Liquid), By Aircraft Type (Fixed Wings, Rotorcraft, and Others), By Technology (HEFA-SPK, FT-SPK, HFS-SIP, ATJ-SPK), By Platform (Commercial, Regional Transport Aircraft, Military Aviation, Business & General Aviation, Unmanned Aerial Vehicles), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.94 Billion | USD 149.10 Billion | 57.50% | 2024 |

Sustainable Aviation Fuel Industry Perspective:

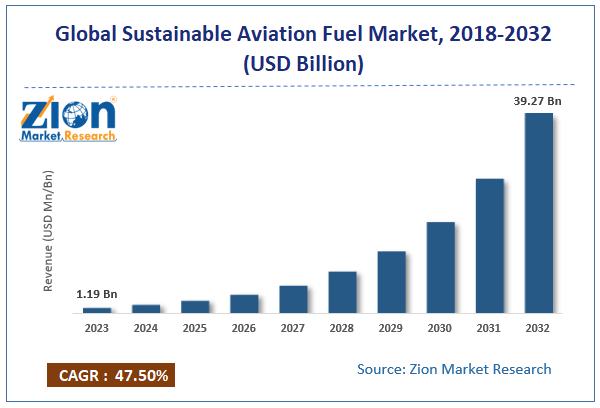

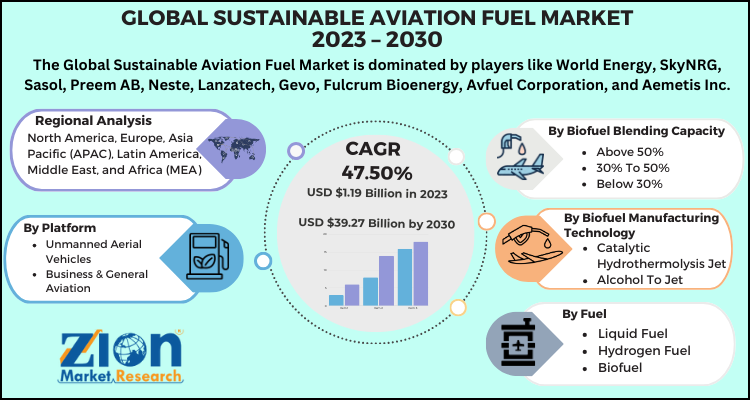

The global sustainable aviation fuel market size was worth around USD 3.94 billion in 2024 and is predicted to grow to around USD 149.10 billion by 2034, with a compound annual growth rate (CAGR) of roughly 57.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the sustainable aviation fuel market is anticipated to grow at a CAGR of 57.50% during the forecast period (2024-2032).

- The global sustainable aviation fuel market was estimated to be worth approximately USD 3.94 billion in 2023 and is projected to reach a value of USD 149.10 billion by 2032.

- The growth of the sustainable aviation fuel market is being driven by aviation industry’s urgent need to reduce carbon emissions and meet global sustainability targets.

- Based on the fuel type, the biofuel segment is growing at a high rate and is projected to dominate the market.

- On the basis of aircraft type, the fixed wings segment is projected to swipe the largest market share.

- In terms of technology, the HEFA-SPK segment is expected to dominate the market.

- Based on the platform, the commercial segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

What is Sustainable Aviation Fuel?

Sustainable Aviation Fuel (SAF) is a bio-based or synthetic jet fuel derived from renewable resources, designed to replace conventional fossil-based jet fuel. SAF offers a significant reduction in lifecycle carbon emissions, making it a crucial component in the aviation industry's efforts to achieve net-zero emissions by 2050.

Sustainable Aviation Fuel Market: Overview

Sustainable aviation fuel is a renewable alternative to traditional jet fuel, obtained from sustainable feedstocks like municipal waste, agricultural residues, algae, and cooling oil. It offers up to 80% reduction in greenhouse emissions over the fuel's lifecycle, while maintaining compatibility with fueling infrastructure and existing aircraft engines. The global sustainable aviation fuel market is projected to witness substantial growth driven by the airline sustainability commitment, technological improvements in production pathways, and growing air passenger traffic. Leading airlines like British Airways, Delta, and United have committed to achieving net-zero emissions by 2050. SAF adoption is a core component of their tactics, with long-term procurement agreements being contracted to secure supply. This commitment is fueling continuous industry demand.

Although drivers exist, the global market is challenged by factors like feedstock competition and availability, and underdeveloped production infrastructure. The low availability of sustainable feedstocks, such as agricultural residues and waste oils, creates supply barriers. These feedstocks are also highly demanded for renewable diesel and biodiesel, escalating competition. In addition, blending facilities and SAF refineries are fewer in number, with a majority situated only in regions like Europe and North America. This hampers the accessibility for airlines operating in developing markets.

Moreover, advancements in conversion solutions are enhancing SAF production and decreasing production costs. Companies are improving processes to use different feedstocks effectively. This increases the scalability of SAF production and makes it economically practical. Furthermore, the worldwide aviation market is rebounding post-pandemic, with IATA anticipating passenger numbers to double by 2040. Elevated air traffic directly surges fuel consumption, increasing the significance of SAF adoption for balancing growth with emissions reduction.

Even so, the global sustainable aviation fuel industry is well-positioned due to scaling production capacity and progressing feedstock advancements. Significant investments in bio-refineries, such as World Energy's California facility and Neste’s Singapore expansion, will remarkably fuel worldwide SAF supply. Scaling production will enhance affordability and decrease unit costs.

Moreover, research and development into non-traditional feedstocks like captured CO2, municipal solid waste, and algae offers a way to plenty of low-cost SAF sources. These advancements can bypass existing feedstock competition problems.

Sustainable Aviation Fuel Market: Growth Drivers

How is the acceptance of high-integrity lifecycle carbon reductions fueling the sustainable aviation fuel market progress?

Aviation's climate strategy pivots on fuels with verifiable lifecycle cuts. CORSIA (ICAO) moved into wider implementation in 2024-2026, tightening accepted sustainability criteria and methodologies for SAF.

This compliance-grade carbon value is monetized. Airlines' decreasing reported emissions exposure can trim ETS-CORSIA liabilities. At the same time, producers earn higher credits in LCFS if they drive CI lower (for instance, via renewable power, green hydrogen, or CCUS on ethanol feedstocks). The global sustainable aviation fuel market is hence rewarding projects that can document traceability and additionality, increasing investment into digital MRV and lower-CI feedstocks.

How is cost curve pressure: scale, credits, and better logistics propelling the sustainable aviation fuel market?

The price delta remains the central brake, but it's easing at the margin. Based on the region and feedstock, SAF premiums have commonly ranged $2 to $4/gal above Jet-A. With IRA + LCFS, specific United States lanes can compress this to sub-$1-$2/gal efficient premiums for qualifying low-CI volumes, mainly for HEFA and some ATJ routes tied to low-CI ethanol.

Supply chain and scale optimization are progressing. More pipeline-grade SAF, on-airport blending, and multi-airline pooling decrease logistic costs. Indexed SAF price benchmarks and forward curves launched by price reporting agencies in 2023-2024 are allowing structured and hedging offtakes, enhancing bankability.

Sustainable Aviation Fuel Market: Restraints

Costly and limited feedstock availability negatively impacts market progress

Current SAF production is led by HEFA (Hydroprocessed Esters and Fatty Acids) pathways, depending on animal fats, waste oils, and vegetable oils. These feedstocks face competition from biodiesel, renewable diesel, and oleochemicals, increasing prices, and are finite.

The EWABA (European Waste-Based Biodiesel Association) cautioned in 2024 that waste oil imports, especially from Asia, are under scrutiny for traceability concerns, possibly tightening supply. Meanwhile, scaling next-gen feedstocks like lignocellulosic biomass, municipal solid waste, and CO2-derived e-fuels needs logistics and infrastructure that remain underdeveloped.

Sustainable Aviation Fuel Market: Opportunities

How do airline climate and corporate commitments present favorable prospects for the sustainable aviation fuel market?

Large corporations are committing to decreasing Scope 3 emissions, comprising business travel, while airlines are planning to be net-zero by 2050. In 2023-2024, carriers like Lufthansa, Delta, Air France-KLM, and United contracted multi-year offtake pacts for billions of gallons of SAF, usually at fixed-price terms to secure supply.

Corporate programs like ‘Book & Claim’ are progressing rapidly – United’s Eco-Skies Alliance and Shell’s Avelia platform experienced distribution sell-out in 2023-2024. These commitments ultimately fuel the sustainable aviation fuel industry.

Sustainable Aviation Fuel Market: Challenges

Infrastructure limitations for distribution and blending restrict the growth of market

Only a small number of airports, mainly in Europe and North America, have SAF integrated into their fueling systems. Many others depend on off-site blending or costly trucking. In 2024, fewer than 60 airports across the globe had regular SAF supply, according to IATA.

Without significant investment in hydrant injection, on-site storage, and blending, meeting 2030 mandates will require ineffective workarounds, increasing costs for producers and airlines.

Recent Development

- In February 2025, Neste and DHL Group extended their partnership to cut logistics emissions by exploring Neste’s renewable solutions, including renewable diesel (HVO100) and sustainable aviation fuel (SAF). The initiative supports DHL’s ambition to reach net-zero greenhouse gas emissions by 2050, with plans to develop a commercial model enabling DHL to source up to 300,000 tons of unblended SAF annually from Neste by 2030. The partnership also considers the use of renewable diesel to decarbonize DHL’s road transport and help meet interim sustainability goals.

- In February 2025, Gevo and Axens expanded their strategic alliance to accelerate sustainable aviation fuel (SAF) development via the ethanol-to-jet (ETJ) pathway, combining Axens' Jetanol™ and Gevo's ethanol-to-olefins technologies to reduce costs and risks and boost SAF adoption in aviation.

- In January 2025, Topsoe partnered with Chuangui New Energy to supply technology and services for producing sustainable aviation fuel (SAF) and renewable diesel.

- In December 2024, Shell Catalysts & Technologies and Yilkins partnered to commercialize an integrated Shell XTL1 Process with Yilkins’ torrefaction technology, providing a flexible, scalable solution for producing sustainable aviation fuel (SAF) from varied low-carbon feedstocks.

Sustainable Aviation Fuel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sustainable Aviation Fuel Market |

| Market Size in 2024 | USD 3.94 Billion |

| Market Forecast in 2034 | USD 149.10 Billion |

| Growth Rate | CAGR of 57.50% |

| Number of Pages | 214 |

| Key Companies Covered | Neste, World Energy, LanzaJet, Gevo Inc., Fulcrum BioEnergy, Velocys, Red Rock Biofuels, Honeywell UOP, Aemetis Inc., BP Biofuels, TotalEnergies, Shell Aviation, Alder Fuels, Virent Inc., Carbon Clean Solutions, and others. |

| Segments Covered | By Fuel Type, By Aircraft Type, By Technology, By Platform, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sustainable Aviation Fuel Market: Segmentation

The global sustainable aviation fuel market is segmented based on fuel type, aircraft type, technology, platform, and region.

Based on Fuel Type, the global sustainable aviation fuel industry is divided into biofuel, hydrogen fuel, power to liquid fuel, and gas-to-liquid. The biofuel segment holds leadership since it is broadly used SAF type and is commercially developed.

Conversely, the power to liquid segment holds second rank in the market, driven by improvements in synthetic fuel production using captured CO2 and renewable electricity.

Based on Aircraft Type, the global market is segmented into fixed wings, rotorcraft, and others. The fixed wings segment holds a leading share in the worldwide market, accounting for the majority of cargo and commercial aviation operations globally.

On the other hand, rotorcraft represent the second-largest segment, with SAF adoption emerging in helicopters used for emergency services, defense, and offshore operations.

Based on Technology, the global sustainable aviation fuel market is segmented as HEFA-SPK, FT-SPK, HFS-SIP, and ATJ-SPK. The HEFA-SPK leads the market due to its established supply chains, cost-effectiveness, and broad ASTM approval for blending up to 50% with a conventional jet fuel.

Nonetheless, the FT-SPK segment is the second-leading segment, benefiting from its ability to convert a broad range of feedstocks like forestry residues, municipal solid waste, and biomass into high-quality SAF.

Based on Platform, the global market is segmented as commercial, regional transport aircraft, military aviation, business & general aviation, and unmanned aerial vehicles. The commercial segment dominates the market, driven by the high fuel consumption of cargo airlines and passengers worldwide.

However, the military aviation ranks second, with defense agencies essentially testing and installing SAF to enhance energy security and decrease emissions.

Sustainable Aviation Fuel Market: Regional Analysis

What gives North America a competitive edge in the global Sustainable Aviation Fuel Market?

North America is likely to sustain its leadership in the sustainable aviation fuel market due to large-scale airline commitments, advanced production infrastructure, and technological dominance, as well as significant R&D investment. Key regional carriers like Alaska, Delta Air Lines, and United Airlines have contracted multi-year SAF purchase agreements, assuring continuous demand. United Airlines alone is committed to buying more than 3 billion gallons of SAF in the upcoming years. This long-term commitment fuels production investments and assures a stable industry infrastructure.

Additionally, the United States houses the world's leading SAF production facilities. By 2025, the region is predicted to hold more than 1.5 billion liters of yearly SAF production capacity. This infrastructure benefit promises a scalable and secure supply chain for international and domestic airlines. The region also houses the leading SAF technology advancers like Gevo, LanzaJet, and BioEnergy. These companies pioneer pathways like FT-SPK and ATJ-SPK, besides the leading HEFA-SPK technique. Significant public-private R&D funding boosts commercialization schedules and improves production efficacy.

Europe continues to secure the second-highest share in the sustainable aviation fuel industry owing to robust regulatory mandates, established airline commitments, and strategic projects and partnerships. Europe holds a second-leading position in the worldwide market due to stringent regulations, such as the ReFuelEU Aviation initiative, which mandates a 2% SAF blend by 2025, increasing to 70% by 2050. This lawfully binding target forces fuel suppliers and airlines to amplify SAF adoption. The European Green Deal also backs this shift by integrating SAF into the continent's broader decarbonization strategy.

Major European carriers like British Airways and Air France-KLM have committed to major SAF purchases to meet corporate and regulatory sustainability targets. These commitments offer long-term demand stability for producers. Europe also houses high-profile SAF partnerships like BP-Neste associations and TotalEnergies’s SAF plants in France. The continent also backs innovative feedstock projects, comprising algae-based fuel programs in Spain and municipal waste-to-fuel initiatives in the United Kingdom. These associations increase production capacity and diversify the SAF supply base.

Sustainable Aviation Fuel Market: Competitive Analysis

The leading players in the global sustainable aviation fuel market are:

- Neste

- World Energy

- LanzaJet

- Gevo Inc.

- Fulcrum BioEnergy

- Velocys

- Red Rock Biofuels

- Honeywell UOP

- Aemetis Inc.

- BP Biofuels

- TotalEnergies

- Shell Aviation

- Alder Fuels

- Virent Inc.

- Carbon Clean Solutions

Sustainable Aviation Fuel Market: Key Market Trends

Diversification of feedstocks:

Producers are expanding their feedstocks beyond traditional sources like used cooking oil to include municipal solid waste, algae, and captured CO2. This variation helps address supply barriers and backs scaling production without competition with food crops. Research and development in new feedstocks is appealing to government grants and significant venture capital.

Increasing blending requirements and government mandates:

Regions and countries are adopting binding SAF blending commands, such as California's LCFS-based targets and the EU's 2% by 2025, compelling airlines to integrate SAF into their operations. These regulations are creating predictable market demand and motivating global alignment in sustainability norms.

The global sustainable aviation fuel market is segmented as follows:

By Fuel Type

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

- Gas-to-Liquid

By Aircraft Type

- Fixed Wings

- Rotorcraft

- Others

By Technology

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

By Platform

- Commercial

- Regional Transport Aircraft

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicles

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sustainable aviation fuel is a renewable alternative to traditional jet fuel, obtained from sustainable feedstocks like municipal waste, agricultural residues, algae, and cooling oil. It offers up to 80% reduction in greenhouse emissions over the fuel's lifecycle, while maintaining compatibility with fueling infrastructure and existing aircraft engines.

The global sustainable aviation fuel market is projected to grow due to volatility in fossil fuel prices, increasing environmental mandates for carbon reduction, and growing public awareness of aviation’s ecological impact.

According to study, the global sustainable aviation fuel market size was worth around USD 3.94 billion in 2024 and is predicted to grow to around USD 149.10 billion by 2034.

The CAGR value of the sustainable aviation fuel market is expected to be around 57.50% during 2025-2034.

By 2034, the HEFA-SPK technology is projected to lead the SAF market due to its scalability, maturity, and strong policy support.

North America is expected to lead the global sustainable aviation fuel market during the forecast period.

The United States is a significant contributor to the global SAF market, driven by strong federal incentives like the Inflation Reduction Act and state-level LCFS programs. Its active airline offtakes, large production capacity, and technology advancements make it a leader in SAF deployment.

The key players profiled in the global sustainable aviation fuel market include Neste, World Energy, LanzaJet, Gevo Inc., Fulcrum BioEnergy, Velocys, Red Rock Biofuels, Honeywell UOP, Aemetis Inc., BP Biofuels, TotalEnergies, Shell Aviation, Alder Fuels, Virent Inc., and Carbon Clean Solutions.

Strict carbon reduction targets and mandates like EU ReFuelEU and CORSIA, along with U.S. IRA incentives, are fueling SAF growth, while feedstock and sustainability rules shape production.

The report examines key aspects of the sustainable aviation fuel market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

List of Contents

Sustainable Aviation FuelIndustry Perspective:Key Insights:What is Sustainable Aviation Fuel?OverviewGrowth DriversRestraintsOpportunitiesChallengesRecent DevelopmentReport ScopeSegmentationRegional AnalysisCompetitive AnalysisKey Market TrendsThe global sustainable aviation fuel market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed