Specialty Feed Additives Market Size, Share, And Growth Report 2032

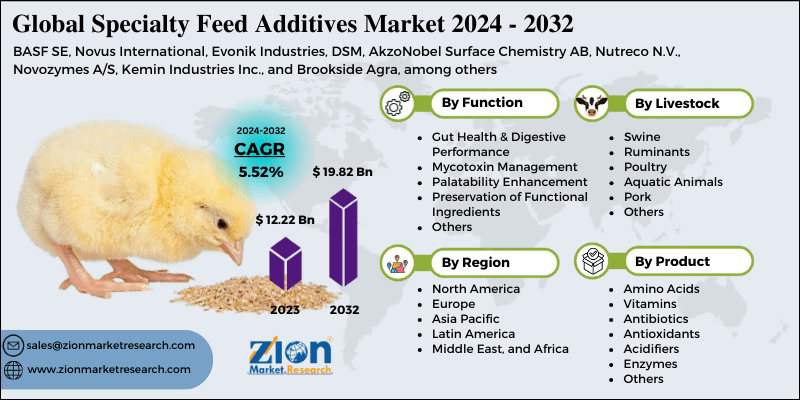

Specialty Feed Additives Market by Function (Gut Health & Digestive Performance, Mycotoxin Management, Palatability Enhancement, Preservation of Functional Ingredients and Others), by Livestock (Swine, Ruminants, Poultry, Aquatic Animals, Pork and Others), by Product (Amino Acids, Vitamins, Antibiotics, Antioxidants, Acidifiers, Enzymes and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

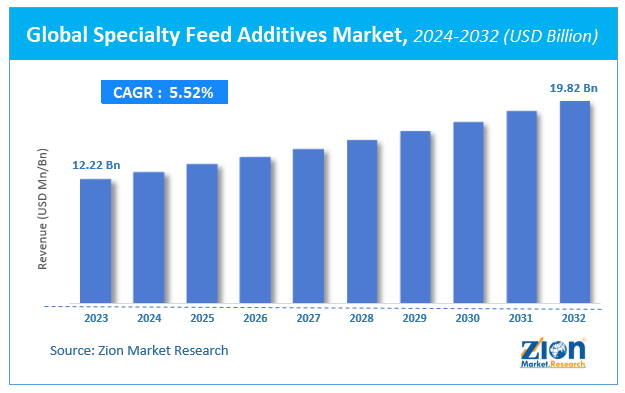

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.22 Billion | USD 19.82 Billion | 5.52% | 2023 |

Specialty Feed Additives Market Size

According to a report from Zion Market Research, the global Specialty Feed Additives Market was valued at USD 12.22 Billion in 2023 and is projected to hit USD 19.82 Billion by 2032, with a compound annual growth rate (CAGR) of 5.52% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Specialty Feed Additives Market industry over the next decade.

Specialty Feed Additives Market: Overview

Specialty feed additives are supplements added to animal feed to enhance nutrition, improve health, and boost performance. They include probiotics, enzymes, vitamins, minerals, and amino acids, tailored for specific benefits like better digestion, disease resistance, and growth promotion in livestock and poultry.

The adding up of specialty feed additives such as sweeteners and flavors aids to improve the flavor of the feed. This in turn leads to a huge feed consumption by the livestock animals thus making them perform well. As a result, these flavor enhancers are seeing significant growth and gaining market share in the worldwide specialty feed additives industry. Furthermore, rising animal product usage and the prevalence of diseases in livestock animals such as swine flu, avian flu, and foot-and-mouth infections exacerbate security and apprehension concerns, and are the most crucial elements for the worldwide specialty feed additives market.

COVID-19 Impact Analysis

More than 100 nations have been affected by the COVID-19 epidemic, which will have a substantial impact on the compound feed and additives market in 2020. The coronavirus disease (COVID-19) pandemic is spreading rapidly and claiming human lives all over the world. To slow the spread of the virus and save lives, lockdowns, isolation, and broad closures are required. The coronavirus outbreak is having an influence on worldwide economic activity. Because feed is such an important component in the development of various livestock animals, feed additives are an important component in the manufacture of nutrition-fortified feed. This nutrient-rich feed aids animals in maintaining their health, reproduction, lactation, and brand equity. The raw ingredient supply chain has been influenced by the pandemic and lockdown, affecting consumption and manufacturing patterns around the world. Because animals cannot acquire enough nourishment from conventional feed, feed additives containing vitamins, fatty acids, amino acids, and trace minerals are added to their daily meal.

Specialty Feed Additives Market: Growth Factors

The major growth factors of Specialty Feed Additives Market are: Infectious illness is prevalent in typical farmed animals at a high rate, the current high rate of disease infliction in common farm animals is the most essential element attributed to the thriving expansion of the worldwide specialty feed additives market. With animal health being so closely linked to commercial success, it is becoming increasingly important for firms and individuals that own and manage these animals to ensure that they are free of hazardous infections, diseases, and parasites.

Innovations in animal husbandry, Increased cost efficiency, enhanced animal welfare, improved working conditions, better production monitoring and improved provision of essential production data are just a few of the advantages of new technology. Electronic records, milking, heat detection walk-over-weighing, auto-drafting, genetic improvement, feeding, barn environment optimization, and health recording are some of the primary technologies that livestock farmers require.

Specialty Feed Additives Market: Segmentation

Livestock Segment Analysis

As a result of the rise in diseases such as avian flu, stricter laws and standards have been implemented, driving greater demand for specialized chemicals. Furthermore, worldwide chicken meat production is predicted to grow at a rapid pace, resulting in increased demand for poultry feed over the forecast period. The growth is likely to be driven by rising pork consumption in North America, Europe, and Asia Pacific. The top producers and consumers of swine feed are Canada, Brazil, the United States, and China. In these regions, this factor is expected to boost demand for feed and feed additives. The feed is divided into three categories: grower feed, sow feed, and pig starter feed, depending on the stage of growth. As a result, suitable formulations and rations must be provided at each stage of growth.

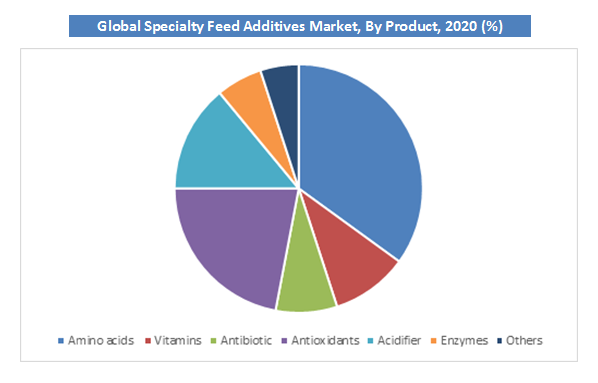

Product Segment Analysis

The Specialty feed additives market is divided into amino acids, vitamins, antibiotics, antioxidants, acidifiers, enzymes, and others based on product. In terms of revenue, amino acids accounted for 35% of the overall market in 2020. Growing consumer awareness regarding the benefits related with the use of feed additives to reduce the prevalence of diseases has supported the demand. Amino acids square measure thought of as macromolecule building blocks for eutherian health. Amino acids square measure answerable for enhancing gut health, food intake, copy, and metastasis, among others. totally different sorts of amino acids embody threonine, tryptophan, lysine, and essential amino acid. essential amino acid is primarily utilized in the pork business, whereas essential amino acid is preponderantly utilized in the poultry business. Antibiotics in animal feed boost growth and help to avoid disease.

Specialty Feed Additives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Specialty Feed Additives Market |

| Market Size in 2023 | USD 12.22 Billion |

| Market Forecast in 2032 | USD 19.82 Billion |

| Growth Rate | CAGR of 5.52% |

| Number of Pages | 120 |

| Key Companies Covered | BASF SE, Novus International, Evonik Industries, DSM, AkzoNobel Surface Chemistry AB, Nutreco N.V., Novozymes A/S, Kemin Industries Inc., and Brookside Agra, among others |

| Segments Covered | By Function, By Livestock, By Product and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Specialty Feed Additives Market: Regional Analysis

In terms of volume, North America accounted for 21% of the global market share in 2020. The demand for meat is projected to continue to be driven by strict meat quality rules. Furthermore, demand is expected to be fueled by the high availability of raw materials such as dextrose, maize, and corn over the projection period. Because of the vast number of regional and global industry participants, the specialized feed additives market in North America is extremely competitive and consolidated.

With a large economy based on livestock and agriculture, Asia Pacific is expected to be a highly capable area of interest for major participants in the global specialty feed additives market. Due to strong economic growth in rising economies such as China, Indonesia, and India, the region has seen a significant increase in demand. Growing population and growing living standards have boosted regional meat demand, which is expected to continue to increase product demand.

Specialty Feed Additives Market: Competitive Players

Some of key players in Specialty Feed Additives market are:

- BASF SE

- Novus International

- Evonik Industries

- DSM

- AkzoNobel Surface Chemistry AB

- Nutreco N.V.

- Novozymes A/S

- Kemin Industries Inc.

- Brookside Agra

The Global Specialty Feed Additives Market is segmented as follows:

By Function

- Gut Health & Digestive Performance

- Mycotoxin Management

- Palatability Enhancement

- Preservation of Functional Ingredients

- Others

By Livestock

- Swine

- Ruminants

- Poultry

- Aquatic Animals

- Pork

- Others

By Product

- Amino Acids

- Vitamins

- Antibiotics

- Antioxidants

- Acidifiers

- Enzymes

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Specialty feed additives are supplements added to animal feed to enhance nutrition, improve health, and boost performance. They include probiotics, enzymes, vitamins, minerals, and amino acids, tailored for specific benefits like better digestion, disease resistance, and growth promotion in livestock and poultry.

According to study, the Specialty Feed Additives Market size was worth around USD 12.22 billion in 2023 and is predicted to grow to around USD 19.82 billion by 2032.

The CAGR value of Specialty Feed Additives Market is expected to be around 5.52% during 2024-2032.

North America has been leading the Specialty Feed Additives Market and is anticipated to continue on the dominant position in the years to come.

The Specialty Feed Additives Market is led by players like BASF SE, Novus International, Evonik Industries, DSM, AkzoNobel Surface Chemistry AB, Nutreco N.V., Novozymes A/S, Kemin Industries Inc., and Brookside Agra, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed