Poultry Feed Market Size, Share, And Growth Report 2032

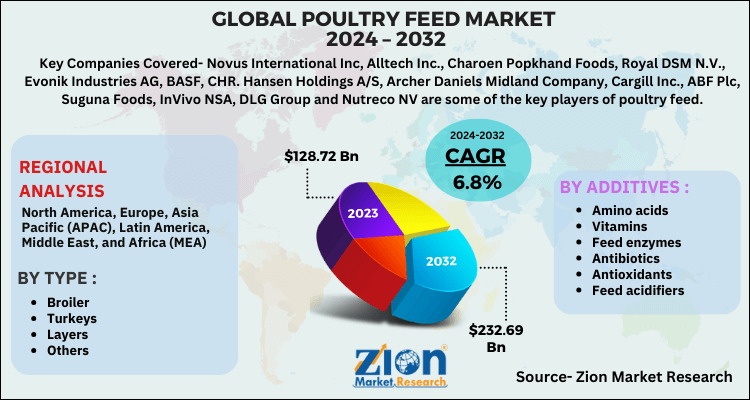

Poultry Feed Market Report By Type (Broiler, Turkeys, Layers, Others), By Additives (Amino acidsm, Vitamins, Feed enzymes, Antibiotics, Antioxidants, Feed acidifiers), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

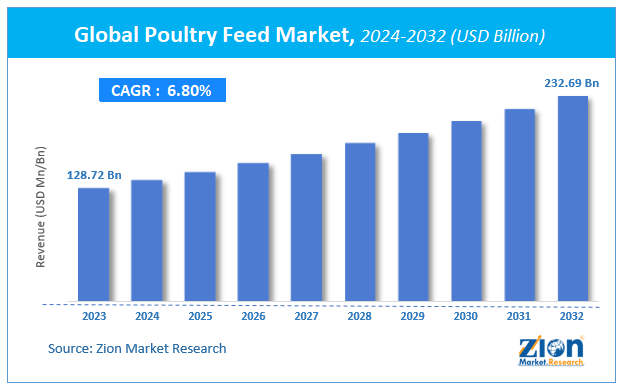

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 128.72 Billion | USD 232.69 Billion | 6.8% | 2023 |

Poultry Feed Market Size

According to Zion Market Research, the global Poultry Feed Market was worth USD 128.72 Billion in 2023. The market is forecast to reach USD 232.69 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.8% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Poultry Feed Market industry over the next decade.

Poultry Feed Market: Overview

The changing life style has led to increase in consumption of protein rich foods. Poultry is one the most economical and protein rich source of food. Poultry also provides eggs which is also protein rich source of food. The millennia’s are one of the main market drivers as they prefer healthy food. The market offers variety of products for on the different customers. Demand for poultry products are always rising as the global population is always increasing so is the demand of poultry products.

Research and innovations are constantly happening to come up with new feeding products so that they weigh more than usual. Quality and demand, and price are the key factors in determining the growth of Poultry Feed Market across globe. To control the inflation is price many manufacturers are trying new feeding options to capture maximum share in the market.

COVID-19 Impact Analysis

The global Poultry Feed Market has witnessed a decrease in the sales for short term owing to the lockdown placed by various countries. People were forced to stockpile food and things they need. This led an increased price of Poultry meat like products. Online delivery and better logistics have increased the consumption of such products. Thaw the manufacturing was hampered during early lockdown phase but was later allowed due to its growing demand and ease in restrictions. The restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the world markets are slowly opening to their full potential and theirs a surge in demand of equipment’s required. The market would remain bullish in upcoming year.

Poultry Feed Market: Growth Factors

Growing awareness among millennia’s for healthy lifestyle has led to increase in sale of Poultry products. With the increase in demand of poultry products, Poultry Feed Market is also in demand. New products are being tried out to see what the result on their poultry is. Protein rich content products are one of the main reasons for the sudden demand in broilers farming. Increase in consumption of eggs per capita has also increase drastically over a period of last decade. Poultry feeds are a source of rich proteins and minerals for poultry as its source of energy and balanced nutrition’s.

Easy availability of these products is some of the main reasons for Poultry Feed Market have grown constantly. With better logistics in place more and more demand of better quality poultry fees has added to its sale. Effective marketing to hit their target audiences has made us understand the importance of right marketing.

Poultry Feed Market: Segmentation

Broiler Segment Analysis Preview

Broiler segment held a share of around XX% in 2020. Broiler is one of the favorite meats available out there to consume and are produced mostly for meat. Broiler Meat is one of the best sellers across the globe. Broiler Meat is consumed mostly for their rich proteins across the globe. APAC region consumed more Broiler Meat then compared to other regions.

Product Segment Analysis Preview

Amino acid is considered as one of the main ingredients in poultry feed market. The use of amino acid is to increase rapidly over the forecasted period of time. Amino acid helps dependency on soybean in animal diet.

Poultry Feed Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Poultry Feed Market |

| Market Size in 2023 | USD 128.72 Billion |

| Market Forecast in 2032 | USD 232.69 Billion |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 180 |

| Key Companies Covered | Novus International Inc, Alltech Inc., Charoen Popkhand Foods, Royal DSM N.V., Evonik Industries AG, BASF, CHR. Hansen Holdings A/S, Archer Daniels Midland Company, Cargill Inc., ABF Plc, Suguna Foods, InVivo NSA, DLG Group and Nutreco NV are some of the key players of poultry feed among others |

| Segments Covered | By Type, By Additives, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Poultry Feed Market: Regional Analysis

The Asia Pacific region held a share of about 8.6% in 2020. This is attributable to the presence of top companies such as Novus International Inc, Alltech Inc., Charoen Popkhand Foods, Royal DSM N.V., Evonik Industries AG, BASF, among others. Moreover, this surge is due to the increasing consumption of poultry products in countries like China, India, and South Korea, Japan etc. APAC is forecasted to have highest growth in poultry feed market around the globe. Eating habits in this has changed in recent times and this has attracted many renowned and local players to offer more products to lure more consumer base.

The North American region is projected to grow at a CAGR of XX% over the forecast period. The increase in Convenience and varieties offered by market player has led to increase in sale of Processed Meat market in this region. The growth is prominent in broiler and turkey segments.

Poultry Feed Market: Competitive Players

Some of key players in Poultry Feed Market are:

- Novus International Inc

- Alltech Inc.

- Charoen Popkhand Foods

- Royal DSM N.V.

- Evonik Industries AG

- BASF

- CHR. Hansen Holdings A/S

- Archer Daniels Midland Company

- Cargill Inc.

- ABF Plc

- Suguna Foods

- InVivo NSA

- DLG Group

- Nutreco NV

This report segments the poultry feed market as follows:

Global Poultry Feed Market: Type Segment Analysis

- Broiler

- Turkeys

- Layers

- Others

Global Poultry Feed Market: Additives Segment Analysis

- Amino acids

- Vitamins

- Feed enzymes

- Antibiotics

- Antioxidants

- Feed acidifiers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed