Specialty Chemicals Market Size, Share, Trends, Growth and Forecast 2032

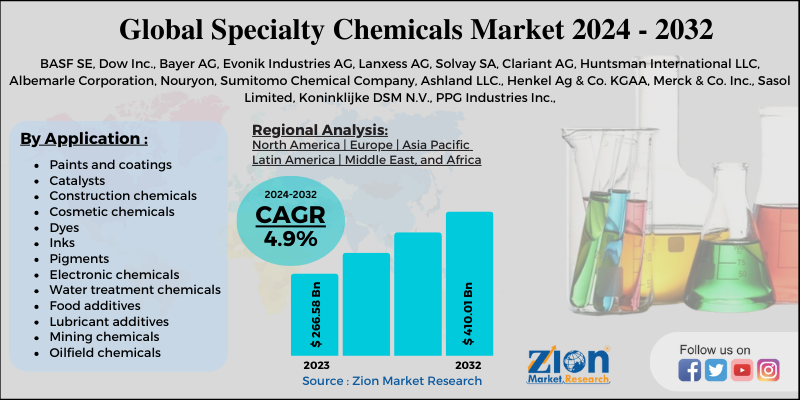

Specialty Chemicals Market By Crop Type (Paints and Coatings, Catalysts, Construction Chemicals, Cosmetic Chemicals, Dyes, Inks, and Pigments, Electronic Chemicals, Water Treatment Chemicals, Food Additives, Agrochemicals, Industrial and Institutional Cleaners, Lubricant Additives, Mining Chemicals, Oilfield Chemicals, Adhesives and Sealants, Plastic Additives, Rubber Processing Chemicals, Specialty Polymers, Textile Chemicals, Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

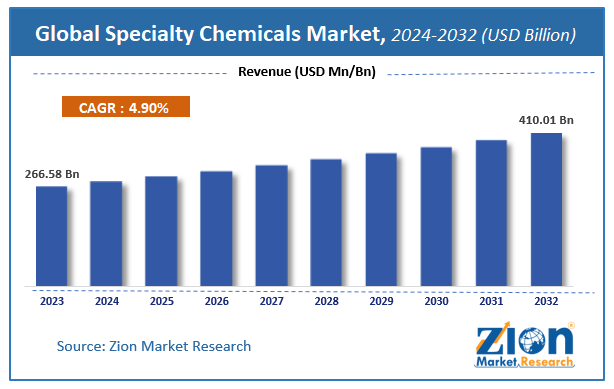

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 266.58 Billion | USD 410.01 Billion | 4.9% | 2023 |

Specialty Chemicals Market Insights

Zion Market Research has published a report on the global Specialty Chemicals Market, estimating its value at USD 266.58 Billion in 2023, with projections indicating that it will reach USD 410.01 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.9% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Specialty Chemicals industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Specialty Chemicals Market: Overview

Specialty chemicals are particular chemical products that help in providing variety of effects to various industries that they cater to such as textile, ink additives, construction, oil & gas, cosmetics, and food. Specialty chemicals can be single-chemical formulations or entities whose composition greatly influences the performance of the customers’ product. On the basis of their purpose and efficiency, certain chemicals are used. In this market, continuous R&D has facilitated the development of products with optimum and advanced characteristics. This is one of the major factors driving this market 's growth. Noticeable demand from Asian countries such as India and China has emerged with rapid industrialization. Investment in construction and infrastructure growth projects in the Asia-Pacific region has been growing.

Global Specialty Chemicals Market: Growth Factors

Some of the main growth opportunities are innovation and R&D, as the market is largely consumer-driven. The focus of the manufacturer on delivering creative and custom-made product offerings for target applications and satisfying the demand of specific customers has driven investment in research and development, thereby driving the development of innovative specialty chemicals and expanding the product portfolio of the industry.

The need for user-friendly and environmentally-friendly specialty chemicals has been prompted by concerns about the adverse effects of traditional chemicals on the environment and humans. Therefore, the attention of many players has moved towards the production and marketing of specialty chemicals in order to outperform traditional manufacturers of fine and commodity chemicals.

Global Specialty Chemicals Market: Segmentation

The Specialty Chemicals market is fragmented based on application.

By application, the market is divided into paints and coatings, catalysts, construction chemicals, cosmetic chemicals, dyes, inks, and pigments, electronic chemicals, water treatment chemicals, food additives, agrochemicals, industrial and institutional cleaners, lubricant additives, mining chemicals, oilfield chemicals, adhesives and sealants, plastic additives, rubber processing chemicals, specialty polymers, textile chemicals, others. \

The automotive industry is expected to remain a lucratively rising market with a strong demand for weight reduction and cost-saving end-use adhesives, lubricants, paints, and coatings. The product demand for end-use pharmaceuticals and nutraceuticals has been driven by the awareness and increasing acceptance of a healthier lifestyle among consumers.

Specialty Chemicals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Specialty Chemicals Market |

| Market Size in 2023 | USD 266.58 Billion |

| Market Forecast in 2032 | USD 410.01 Billion |

| Growth Rate | CAGR of 4.9% |

| Number of Pages | 110 |

| Key Companies Covered | BASF SE, Dow Inc., Bayer AG, Evonik Industries AG, Lanxess AG, Solvay SA, Clariant AG, Huntsman International LLC, Albemarle Corporation, Nouryon, Sumitomo Chemical Company, Ashland LLC., Henkel Ag & Co. KGAA, Merck & Co. Inc., Sasol Limited, Koninklijke DSM N.V., PPG Industries Inc., 3M, H.B. Fuller, among others |

| Segments Covered | By Type, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Specialty Chemicals Market: Regional Analysis

The Asia-Pacific area dominated the market for specialty chemicals and is likely to maintain its place during the forecast period , owing to robust construction sector growth , increased demand for cosmetic products , increased investment and development in the increasing performance of the electrical and electronics industries, increased demand for packaging adhesives and plastics, and increased demand for packaging products.

Region-wise, the global market is segregated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Global Specialty Chemicals Market: Competitive Players

The specialty chemicals market is led by players like:

- BASF SE

- Dow Inc.

- Bayer AG

- Evonik Industries AG

- Lanxess AG

- Solvay SA

- Clariant AG

- Huntsman International LLC

- Albemarle Corporation

- Nouryon

- Sumitomo Chemical Company

- Ashland LLC.

- Henkel Ag & Co. KGAA

- Merck & Co. Inc.

- Sasol Limited

- Koninklijke DSM N.V.

- PPG Industries Inc.

- 3M

- H.B. Fuller

The specialty chemicals market is segmented as follows:

By application

- Paints and coatings

- Catalysts

- Construction chemicals

- Cosmetic chemicals

- Dyes

- Inks

- Pigments

- Electronic chemicals

- Water treatment chemicals

- Food additives

- Agrochemicals

- Industrial and institutional cleaners

- Lubricant additives

- Mining chemicals

- Oilfield chemicals

- Adhesives and sealants

- Plastic additives

- Rubber processing chemicals

- Specialty polymers

- Textile chemicals

Specialty Chemicals Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Speciality chemicals are chemicals that are manufactured for specific applications and possess distinctive properties that are specifically designed to satisfy specific performance criteria or requirements. Speciality chemicals are frequently produced in lesser quantities and are intended for specific applications, in contrast to commodity chemicals, which are produced in large quantities and used in a wide range of applications.

The demand for speciality chemicals is being driven by the growth of emerging markets, particularly in Asia-Pacific and Latin America. Increasing consumer expenditure, rapid industrialisation, and urbanisation in these regions all contribute to market expansion.

Zion Market Research has published a report on the global Specialty Chemicals Market, estimating its value at USD 266.58 Billion in 2023, with projections indicating that it will reach USD 410.01 Billion by 2032.

Zion Market Research has published a report on the global Specialty Chemicals Market is expected to expand at a compound annual growth rate (CAGR) of 4.9% over the forecast period 2024-2032.

The Asia-Pacific area dominated the market for specialty chemicals and is likely to maintain its place during the forecast period , owing to robust construction sector growth , increased demand for cosmetic products , increased investment and development in the increasing performance of the electrical and electronics industries, increased demand for packaging adhesives and plastics, and increased demand for packaging products.

BASF SE, Dow Inc., Bayer AG, Evonik Industries AG, Lanxess AG, Solvay SA, Clariant AG, Huntsman International LLC, Albemarle Corporation, Nouryon, Sumitomo Chemical Company, Ashland LLC., Henkel Ag & Co. KGAA, Merck & Co. Inc., Sasol Limited, Koninklijke DSM N.V., PPG Industries Inc., 3M, H.B. Fuller, among others

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed