Global Elevator Market Size, Share, Growth Analysis Report - Forecast 2034

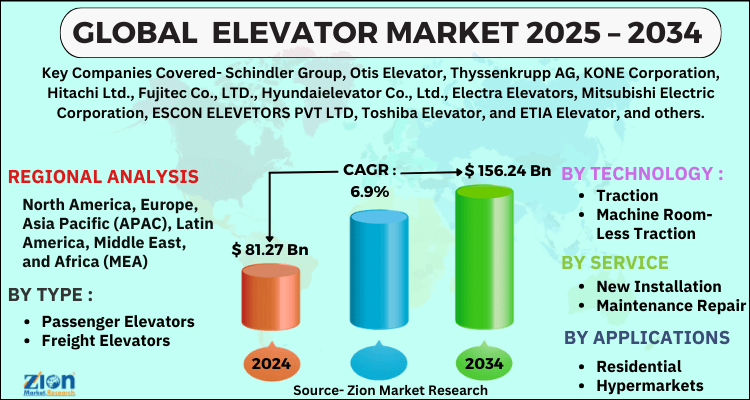

Elevator Market By Type (Passenger Elevators, Freight Elevators, and Others), By Technology (Traction, Machine Room-Less Traction, and Hydraulic), Service (New Installation, Maintenance Repair, Modernization, and Others), Applications (Residential, Hypermarkets, Malls, Corporate Offices, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

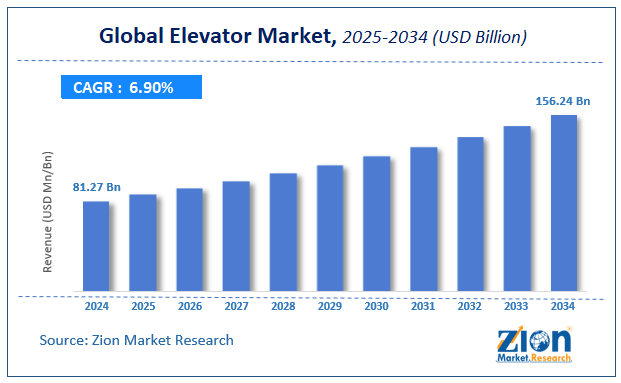

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 81.27 Billion | USD 156.24 Billion | 6.9% | 2024 |

Elevator Market: Industry Perspective

The global elevator market size was worth around USD 81.27 Billion in 2024 and is predicted to grow to around USD 156.24 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.9% between 2025 and 2034. The report analyzes the global elevator market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the elevator industry.

Elevator Market: Overview

An elevator is a closed cabin operated by an electrical machine with pump hydropower, counterweight systems, or traction cables to rise above. They are mobility solutions and are quite commonly used in high-rise buildings. They move in the vertical direction with the help of a shaft to ascend above the specified level. It enables up-down movement where materials and people are transferable to any floor. They have electric motors to power up the upward motion and traction wires to lift themselves above a certain level.

Many tall and high-rise buildings are facilitated with lifts and it also serves on big commercial platforms. It aids people to climb any multistoried buildings and also luggage or loads to ascend a certain floor. They are extensively used in the construction industries to transport builders and goods from one floor to another.

Many new residential infrastructure products have made lifts a mandatory amenity to serve people on climbing floors. They come with different internal capacities and sizes to accommodate people and goods. The main means of transporting goods and movement inside the building is through elevators.

The smart elevator is the next phase of the vertical transport system that is controlled by advanced hardware and software systems. Elevators are responsible for 8 to 10 percent of the energy consumed in a building, as new, smarter, connected elevators not only reduce wasting time but also save a lot of money. Elevators are mainly used in residential buildings, hotels, hospitals, sports facilities, offices, and airports, so smart technology is likely to be in high demand as efficiency in these various avenues.

Key Insights

- As per the analysis shared by our research analyst, the global elevator market is estimated to grow annually at a CAGR of around 6.9% over the forecast period (2025-2034).

- Regarding revenue, the global elevator market size was valued at around USD 81.27 Billion in 2024 and is projected to reach USD 156.24 Billion by 2034.

- The elevator market is projected to grow at a significant rate due to urbanization, high-rise buildings, and smart elevators.

- Based on Type, the Passenger Elevators segment is expected to lead the global market.

- On the basis of Technology, the Traction segment is growing at a high rate and will continue to dominate the global market.

- Based on the Service, the New Installation segment is projected to swipe the largest market share.

- By Applications, the Residential segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Elevator Market: Growth Drivers

Increasing demand for infrastructure development, construction of high-rise buildings, and modernizations, coupled with innovations like smart elevators fuels market growth

The increasing need for infrastructure development, rampant construction of high-rise buildings, huge investments in construction industries, and convenient residential & non-residential venues drive market growth. Many developing countries have developed megacities and smart cities where the leverage of elevators becomes prominent thereby increasing their demand.

There has been a rampant emergence of smart elevators along with the increasing attention on safety regulations which is anticipated to drive market growth. Rising population and modernization also add up to the growth of the global market as it would invariably increase the number of residential buildings. Suitable trends in emerging economies propel the growth of the elevator market to a large extent as well.

There has also been considerable technological advancement in the form of the integration of circuit boards, new controllers, new belts, and machine room elevators which boosts the market rate. An increase in commercial projects during recent times is also going to improve the leverage of elevators augmenting market growth globally.

Elevator Market: Restraints

Government regulations & policies controlling lifts and incidences of accidents involving elevators hamper the market growth

Elevators are prone to be the major causes of accidents and injuries that provoke authorities to enact safety standards and laws to prevent them. This triggers a high maintenance and scrutiny system to be in place with the elevators to safeguard people from any fatalities. The cost of this maintenance and securing a proper scrutiny mechanism restricts the global elevator market growth to some extent.

Elevator Market: Opportunities

Introduction of smart elevators as a part of modernization and technological advancement provides a lucrative opportunity for market expansion

There has been an increase in high-rise buildings and smart cities which calls for more convenient mobility systems. Many technological advancements in elevators are happened in recent times to improve efficiency in inter-building movements. Smart elevators are one such advancement that triggers an opportunity for market growth. There is also an ample rise in the construction of tall and high-rise buildings which increases the demand for elevators thereby providing an opportunity for the elevator market.

Elevator Market: Challenges

Significant increase in the demand for elevators in the residential industries poses a challenge to the market

Residential accounts for the largest consumer of elevators and there has been a global rise in the construction of residential buildings in recent times. The residential market is driven by the sophistication of living standards in developing countries. This induces an increasing demand for elevators which puts a burden on the manufacturers to produce more elevators to fulfill the growing demand of the residential market. This increase in demand poses a challenge for the global elevator market to increase its supply to cater to the upcoming new residential projects.

Strict government regulations to scrutinize safety standards in elevators pose a challenge to the market

Safety requirements and protocols regulated by the government to manufacture lifts put a burden on the manufacturers to comply with them. Fatal incidents happen mostly on the elevators and there is an increased pressure to scrutinize the production of lifts by complying with the safety rules implemented. The rules protect and maintain the operations of elevators preventing them from any defects that could cause accidents. This factor poses a challenge for the supply of elevators thereby affecting the market as well.

Elevators Market: Segmentation

The global elevator market is segmented based on type, technology, service, application, and region.

Based on Type, the global elevator market is divided into passenger elevators, freight elevators, and others. The Passenger elevator segment dominates the elevator market, fueled by increasing urbanization, high-rise infrastructure development, and the demand for smart, AI-powered, and energy-efficient elevators. However, the Freight elevator segment continues to grow, supported by industrial expansion, warehouse automation, and the need for durable and high-capacity lifting solutions.

On the basis of Technology, the global elevator market is bifurcated into traction, machine room-less traction, and hydraulic.

By Service, the global elevator market is segmented into new installation, maintenance repair, modernization, and others. The New Installation segment dominates the elevator market, driven by rapid urban development, smart city projects, and increasing demand for high-performance elevator systems. However, the Maintenance & Repair segment remains crucial for ensuring long-term safety and operational efficiency, while the Modernization segment is gaining momentum as older elevators undergo upgrades for energy efficiency, compliance, and enhanced user experience.

In terms of Application, the global elevator market is categorized into residential, hypermarkets, malls, corporate offices, and others.

Elevator Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Elevator Market |

| Market Size in 2024 | USD 81.27 Billion |

| Market Forecast in 2034 | USD 156.24 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 185 |

| Key Companies Covered | Schindler Group, Otis Elevator, Thyssenkrupp AG, KONE Corporation, Hitachi Ltd., Fujitec Co., LTD., Hyundaielevator Co., Ltd., Electra Elevators, Mitsubishi Electric Corporation, ESCON ELEVETORS PVT LTD, Toshiba Elevator, and ETIA Elevator, and others., and others. |

| Segments Covered | By Type, By Technology, By Service, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Elevators Market: Regional Landscape

Asia Pacific region leads the market share as the largest consumer

Asia Pacific region leads the global market as the largest consumer and producer of elevators. The abundance and proximity of raw materials coupled with relatively lesser labor costs for the production of lifts increase the demand and production in this region.

The increasing scope of elevators in North America for residential, commercial, and some infrastructure projects on the rise elevates the market rate in this region. Industrialization, growing geriatric population, rising disposable income, and a focus on convenient lifestyle drive market growth in the North American region.

Recent Development:

In Feb 2021, Schindler collaborated with citizen hotels to provide modernization and service for elevators in all existing and newly constructed buildings.

In October 2020, Hitachi acquired a share in Yungtay Engineering to strengthen the elevator business.

Elevator Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the elevator market on a global and regional basis.

The global elevator market is dominated by players like:

- Schindler Group

- Otis Elevator

- Thyssenkrupp AG

- KONE Corporation

- Hitachi Ltd.

- Fujitec Co. Ltd.

- Hyundaielevator Co. Ltd.

- Electra Elevators

- Mitsubishi Electric Corporation

- ESCON ELEVETORS PVT LTD

- Toshiba Elevator

- ETIA Elevator

- Others.

The global elevator market is segmented as follows:

By Type

- Passenger Elevators

- Freight Elevators

- Others

By Technology

- Traction

- Machine Room-Less Traction

- Hydraulic

By Service

- New Installation

- Maintenance Repair

- Modernization

- Others

By Applications

- Residential

- Hypermarkets

- Malls

- Corporate Offices

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

An elevator is a vertical transportation device used to move people or goods between different floors of a building. It operates using electric motors and a system of cables or hydraulics, providing convenient and efficient access in multi-story structures.

The global elevator market is expected to grow due to rapid urbanization, increasing high-rise building construction, and advancements in smart elevator technologies.

According to a study, the global elevator market size was worth around USD 81.27 Billion in 2024 and is expected to reach USD 156.24 Billion by 2034.

The global elevator market is expected to grow at a CAGR of 6.9% during the forecast period.

Asia-Pacific is expected to dominate the elevator market over the forecast period.

Leading players in the global elevator market include Schindler Group, Otis Elevator, Thyssenkrupp AG, KONE Corporation, Hitachi Ltd., Fujitec Co., LTD., Hyundaielevator Co., Ltd., Electra Elevators, Mitsubishi Electric Corporation, ESCON ELEVETORS PVT LTD, Toshiba Elevator, and ETIA Elevator, and others., among others.

The report explores crucial aspects of the elevator market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed