Securities Brokerages And Stock Exchanges Market Size, Share, Trends, Growth and Forecast 2034

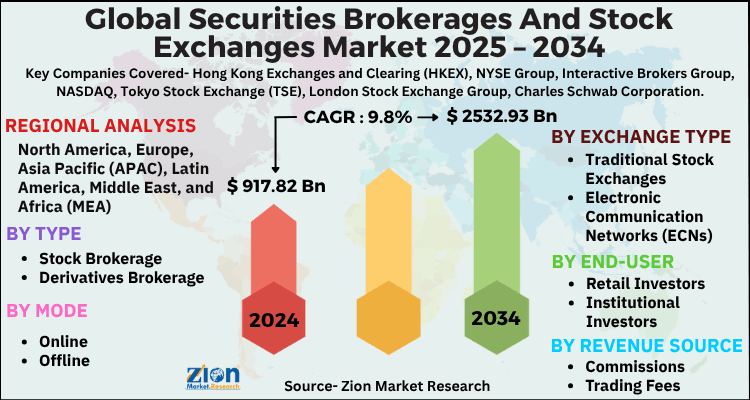

Securities Brokerages And Stock Exchanges Market By Type (Stock Brokerage, Derivatives Brokerage, Commodities Brokerage, and Other Brokerage Services), By Mode (Online and Offline), By Exchange Type (Traditional Stock Exchanges, Electronic Communication Networks (ECNs), and Alternative Trading Systems (ATS)), By End-user (Retail Investors and Institutional Investors), By Revenue Source (Commissions, Trading Fees, Advisory Services, and Data Services), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

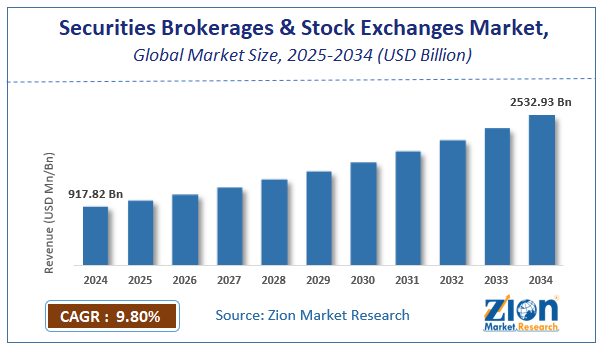

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 917.82 Billion | USD 2532.93 Billion | 9.8% | 2024 |

Securities Brokerages And Stock Exchanges Market: Industry Perspective

The global securities brokerages and stock exchanges market size was worth around USD 917.82 billion in 2024 and is predicted to grow to around USD 2532.93 billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.8% between 2025 and 2034. The report analyzes the global securities brokerages and stock exchanges market's drivers, restraints/challenges, and the effect they have on the demand during the projection period. In addition, the report explores emerging opportunities in the securities brokerages and stock exchanges industry.

Securities Brokerages And Stock Exchanges Market: Overview

Securities brokerages represent a securities business unit helping a person or a company carry out the purchase, sale, or exchange of securities in return for a fee, commission, or some other form of remuneration. In the financial market, securities are defined as any financial instrument that holds significant value and can be traded between involved parties. The word ‘securities’ can be considered an umbrella term that includes all financial aspects such as mutual funds, bonds, stocks, and exchange-traded investments or funds that can be bought or sold. Stocks, on the other hand, are a type of security that when bought, gives the buyer a share of ownership in a firm or a company. Stocks are also known as equities.

A stock exchange is a platform where multiple buyers and sellers can come together to undertake trading of financial tools for specified hours in a day and certain days in a week which is generally from Monday to Friday. Some examples of popular and dominant stock exchanges in the world are the New York Stock Exchange, Nasdaq, Shanghai Stock Exchange, London Stock Exchange, BSE, and many others.

Key Insights

- As per the analysis shared by our research analyst, the global securities brokerages and stock exchanges market is estimated to grow annually at a CAGR of around 9.8% over the forecast period (2025-2034).

- Regarding revenue, the global securities brokerages and stock exchanges market size was valued at around USD 917.82 billion in 2024 and is projected to reach USD 2532.93 billion by 2034.

- The securities brokerages and stock exchanges market is projected to grow at a significant rate due to rising retail and institutional investment, digital trading platforms, financial market expansion, and increasing demand for alternative investment products.

- Based on Type, the Stock Brokerage segment is expected to lead the global market.

- On the basis of Mode, the Online segment is growing at a high rate and will continue to dominate the global market.

- Based on the Exchange Type, the Traditional Stock Exchanges segment is projected to swipe the largest market share.

- By End-user, the Retail Investors segment is expected to dominate the global market.

- In terms of Revenue Source, the Commissions segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Securities Brokerages And Stock Exchanges Market: Growth Drivers

Knowledge of a wider range of investment products to drive demand in the market

The global securities brokerages and stock exchanges market is projected to grow since these agencies are equipped with expertise and knowledge on a diverse range of investment products. Since stock exchanges are filled with millions of sellers or buyers, it can be difficult to navigate through all the available products and make the best decision for oneself. This is when securities brokerages come to play a role as they have people employed who understand the financial market in and out and can offer excellent advice to people who enroll for the service allowing them to enhance the chances of improving profit margins.

Higher volatility in the securities and stock exchanges to drive more people toward brokerage firms

In the wake of current political tension between several countries with the Russia and Ukraine war being a crucial influencer, the security and stock exchange transactions have become extremely volatile and unpredictable. For instance, in February 2023, Adani Group, one of India’s largest conglomerates called off its USD 2.5 billion share sale due to the massive impact of a research report published by Hindenburg that criticized the company’s short-selling tactics. Such incidents along with a drastic fall in the share price of Adani Group following the report led to a total investor’s loss of INR 51,294 crores.

Rising number of players aiming for wealth creation, management, and retirement to create higher revenue

The global securities brokerages and stock exchanges market players are expected to benefit from the increasing number of people trading in the securities and stock markets. With more people allocating the majority of their savings in these markets, the demand for efficient securities brokerages and companies providing services in stock exchanges is likely to grow as people seek experts who can guide them in the otherwise intimidating world of financial trading.

Securities Brokerages And Stock Exchanges Market: Restraints

High risks associated with stock and securities trading restrict market expansion

One of the key risks in the securities brokerages and stock exchanges industry is the high risks that are associated when trading in stocks and securities. For instance, one cannot make any profits when buying a stock. The final profits or any financial trade occurring on stocks depend on the company’s performance and the external political or social environment supporting it. In case a company falls out of favor, investors may lose their money without any time to change their portfolio or a changes in case of higher investments.

Frequent loss of customers to impacting the market growth trend

Security brokerages are prone to losing customers frequently. This is because it is possible that once a consumer has learned enough, they may wish to invest or trade on their own since the price of stock brokerage services is generally high. For instance, in India, the brokerage fees range between 0.01% to 0.5% of the final transaction value. As the value increases, the brokerage fees automatically rise.

Securities Brokerages And Stock Exchanges Market: Opportunities

Adoption of modern technology in the market to create growth opportunities

With the changing outside world and technology taking over almost all industries, firms operating in the global securities brokerages and stock exchanges market have also adopted modern technology to reach a broader group of audience and improve their customer services. Some of the most used technologies include Machine Learning (ML) and Artificial Intelligence (AI). They are used to improve risk assessment, conduct algorithmic trading, and predictive analysis among several other tasks such as using chatbots for dealing with new and old customers or managing customer portfolios. A recent survey by the Association of National Exchanges Market of India suggests that almost 71% of all stock brokers are planning to shift toward technology-driven services.

Securities Brokerages And Stock Exchanges Market: Challenges

Detecting and managing fraud is a crucial challenge that needs more attention

The securities brokerages and stock exchanges industry companies are highly prone and vulnerable to cyber-attacks and fraud. These incidents can either be caused by external agents such as hackers or internally by company employees passing company information to other firms such as competitors. In July 2023, Can Fin Homes, a financial service company, lost 8% in shares after reporting a fraud of INR 38.5 crores. In May 2023, it was reported that India’s top 3 brokers were under the radar of regulatory officials due to money laundering and illegal trading suspicions.

Securities Brokerages And Stock Exchanges Market: Segmentation Analysis

The global securities brokerages and stock exchanges market is segmented based on type, mode, exchange type, end-user, revenue source, and region.

Based on Type, the global securities brokerages and stock exchanges market is divided into stock brokerage, derivatives brokerage, commodities brokerage, and other brokerage services. In recent times, the stock brokerage segment has registered surging investments, especially after COVID-19. The rising awareness, increasing number of service providers, growing interest of common people in the share market, and higher return on investment, when traded correctly, are some of the driving factors in the favor of the segment.

On the basis of Mode, the global securities brokerages and stock exchanges market is bifurcated into online and offline.

By Exchange Type, the global securities brokerages and stock exchanges market is split into traditional stock exchanges, electronic communication networks (ECNs), and alternative trading systems (ATS).

In terms of End-user, the global securities brokerages and stock exchanges market is categorized into retail investors and institutional investors.

By Revenue Source, the global securities brokerages and stock exchanges market is divided into commissions, trading fees, advisory services, and data services.

Securities Brokerages And Stock Exchanges Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Securities Brokerages And Stock Exchanges Market |

| Market Size in 2024 | USD 917.82 Billion |

| Market Forecast in 2034 | USD 2532.93 Billion |

| Growth Rate | CAGR of 9.8% |

| Number of Pages | 210 |

| Key Companies Covered | Hong Kong Exchanges and Clearing (HKEX), NYSE Group, Interactive Brokers Group, NASDAQ, Tokyo Stock Exchange (TSE), London Stock Exchange Group, Charles Schwab Corporation, Euronext, Morgan Stanley, CME Group, and others. |

| Segments Covered | By Type, By Mode, By Exchange Type, By End-user, By Revenue Source, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Securities Brokerages And Stock Exchanges Market: Regional Analysis

North America to continue its growth streak in the coming period

The global securities brokerages and stock exchanges market will witness the highest growth in North America with the US leading with the largest part of the regional market share. The United States of America is home to one of the world’s business financial trading hubs called the Financial District where the New York Stock Exchange (NYSE) is located. According to reports, the NYSE has a total equity market capitalization of USD 25 trillion. In addition to this, key security brokerage firms are headquartered in the US. These giants handle assets worth over a billion dollars. This includes companies such as Fidelity Investments and Charles Schwab. The former handles discretionary assets worth USD 3.8 trillion while the latter manages USD 7.5 trillion.

Due to the higher prevalence of the financial industry, consumer awareness is tremendous in the US. More people are aware of the importance of brokerage firms and companies providing expertise in stock markets. Around 158 million US adults are known to trade in stocks regularly as per a survey by the Gallup Group. Asia-Pacific is projected to grow at a significant rate. The Shanghai Stock Exchange is one of the leading stock exchanges in Asia and the world. Moreover, rising middle-income groups and growing awareness are likely to drive regional growth.

Securities Brokerages And Stock Exchanges Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the securities brokerages and stock exchanges market on a global and regional basis.

The global securities brokerages and stock exchanges market is dominated by players like:

- Hong Kong Exchanges and Clearing (HKEX)

- NYSE Group

- Interactive Brokers Group

- NASDAQ

- Tokyo Stock Exchange (TSE)

- London Stock Exchange Group

- Charles Schwab Corporation

- Euronext

- Morgan Stanley

- CME Group

The global securities brokerages and stock exchanges market is segmented as follows;

By Type

- Stock Brokerage

- Derivatives Brokerage

- Commodities Brokerage

- Other Brokerage Services

By Mode

- Online

- Offline

By Exchange Type

- Traditional Stock Exchanges

- Electronic Communication Networks (ECNs)

- Alternative Trading Systems (ATS)

By End-user

- Retail Investors

- Institutional Investors

By Revenue Source

- Commissions

- Trading Fees

- Advisory Services

- Data Services

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Securities brokerages represent a securities business unit helping a person or a company carry out the purchase, sale, or exchange of securities in return for a fee, commission, or some other form of remuneration.

The global securities brokerages and stock exchanges market is projected to grow since these agencies are equipped with expertise and knowledge on a diverse range of investment products.

According to a study, the global securities brokerages and stock exchanges market size was worth around USD 917.82 Billion in 2024 and is expected to reach USD 2532.93 Billion by 2034.

The global securities brokerages and stock exchanges market is expected to grow at a CAGR of 9.8% during the forecast period.

North America is expected to dominate the securities brokerages and stock exchanges market over the forecast period.

Leading players in the global securities brokerages and stock exchanges market include Hong Kong Exchanges and Clearing (HKEX), NYSE Group, Interactive Brokers Group, NASDAQ, Tokyo Stock Exchange (TSE), London Stock Exchange Group, Charles Schwab Corporation, Euronext, Morgan Stanley, and CME Group, among others.

The report explores crucial aspects of the securities brokerages and stock exchanges market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed