Respiratory Syncytial Virus Vaccine Market Size, Share, Trends, Growth 2034

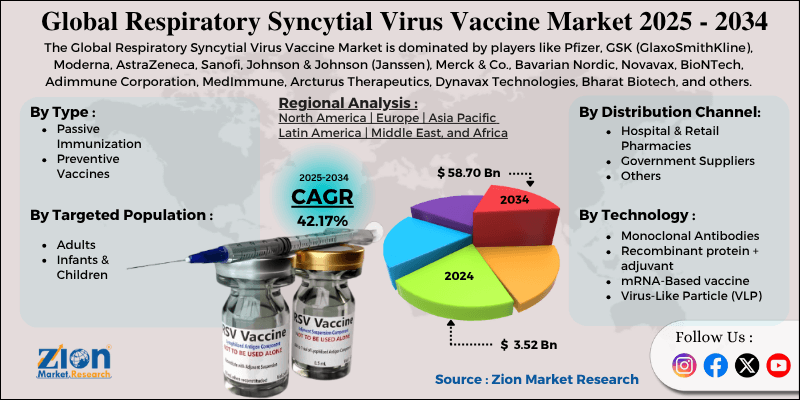

Respiratory Syncytial Virus Vaccine Market By Type (Passive Immunization, Preventive Vaccines), By Technology (Monoclonal Antibodies, Recombinant Protein + Adjuvant, mRNA-Based Vaccine, Virus-Like Particle [VLP]), By Targeted Population (Adults, Infants & Children), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

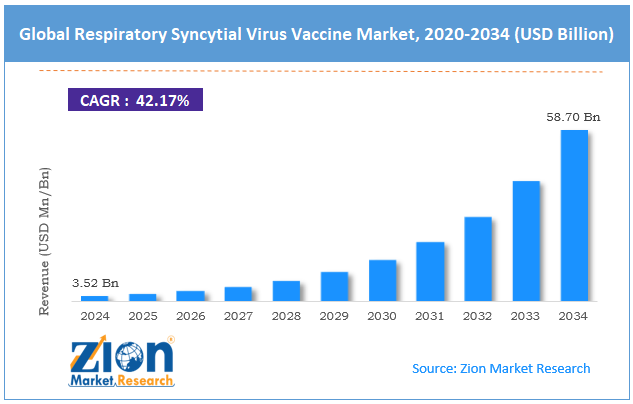

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.52 Billion | USD 58.70 Billion | 42.17% | 2024 |

Respiratory Syncytial Virus Vaccine Industry Perspective:

The global respiratory syncytial virus vaccine market size was worth around USD 3.52 billion in 2024 and is predicted to grow to around USD 58.70 billion by 2034, with a compound annual growth rate (CAGR) of roughly 42.17% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global respiratory syncytial virus vaccine market is estimated to grow annually at a CAGR of around 42.17% over the forecast period (2025-2034)

- In terms of revenue, the global respiratory syncytial virus vaccine market size was valued at around USD 3.52 billion in 2024 and is projected to reach USD 58.70 billion by 2034.

- The respiratory syncytial virus vaccine market is projected to grow significantly due to increasing mortality and hospitalization rates associated with severe RSV cases, regulatory approvals of first-generation RSV vaccines, and technological advancements in vaccine platforms (protein subunit, mRNA, vector).

- Based on type, the preventive vaccines segment is expected to lead the market, while the passive immunization segment is expected to grow considerably.

- Based on technology, the monoclonal antibodies segment dominates the market, while the recombinant protein + adjuvant segment is projected to gain a substantial share in the coming years.

- Based on the targeted population, the adults segment is the dominating segment, while the infants & children segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the hospital & retail pharmacies segment is expected to lead the market compared to the government suppliers segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Respiratory Syncytial Virus Vaccine Market: Overview

Respiratory syncytial virus vaccines are designed to prevent lower respiratory tract infections caused by the RSV virus, which primarily affects older adults, infants, and immunocompromised individuals. After years of research challenges, the industry experienced developments in 2023-24 with the first EMA- and FDA-approved RSV vaccines for maternal immunization and older adults to protect newborns. The global respiratory syncytial virus vaccine market is projected to witness substantial growth driven by the high clinical burden in geriatrics and infants, regulatory approvals for commercialization, and the growing geriatric population worldwide. RSV causes major hospitalizations among older adults and infants, creating an urgent need for preventive care. Worldwide, millions of infants are hospitalized every year due to RSV-associated lower respiratory infections. This high-disease burden fuels healthcare providers and governments to prioritize vaccination programs.

Moreover, EMA and FDA approvals for RSV vaccines like Abrysvo and Arexvy have allowed immediate industry entry. These approvals validate the efficacy and safety of RSV immunization for the maternal population and adults. Regulatory support accelerates the adoption and motivates further spending in vaccine development. Furthermore, the aging worldwide population amplifies the target market for RSV vaccines. By 2030, the number of individuals over 60 years will grow remarkably, expanding the pool of at-risk adults. This demographic shift fuels long-term demand for RSV vaccination initiatives.

Although drivers exist, the global market is challenged by factors such as the high cost of novel vaccines and uneven reimbursement across different geographies. Premium pricing of RSV vaccines restricts access in price-sensitive regions. Some doses are high-priced ($200-$300) in the U.S. market, limiting the adoption. High costs create obstacles for mass immunization in the middle- and low-income economies. Insurance coverage differs broadly in economies, delaying the surge. In Latin America, the Asia Pacific, and parts of the Middle East, reimbursement is restricted. Uneven support limits extensive adoption in the developing nations.

Even so, the global respiratory syncytial virus vaccine industry is well-positioned due to maternal immunization scale-up and LMIC industry entry through tiered pricing models. Vaccinating pregnant women offers newborn protection during early life. Scaling material programs can significantly prevent substantial infant hospitalizations. This strategy elevates the total target population for RSV vaccines. Additionally, differential pricing and worldwide procurement programs can open huge emerging markets. Associations with UNICEF and GAVI can increase volume sales. Access growth supports long-term revenue growth in low-income nations.

Respiratory Syncytial Virus Vaccine Market Dynamics

Growth Drivers

How is rising awareness and education on RSV prevention boosting the respiratory syncytial virus vaccine market?

Healthcare awareness campaigns underscoring the seriousness of RSV infections are adding to elevated vaccine acceptance. Social media campaigns, maternal health initiatives, and pediatric healthcare programs have educated adults and caregivers regarding RSV risks. For instance, the CDC's 'Protect Your Baby from RSV' campaign in 2024 reported a 40% rise in inquiries on RSV vaccination among pregnant women. These awareness programs are influencing adult and parental decisions to vaccinate, thereby expanding the market for both pediatric and adult RSV vaccines. The combination of awareness and vaccine availability is hence boosting the growth of the respiratory syncytial virus vaccine market worldwide.

How do the improvements in vaccine technology fuel the respiratory syncytial virus vaccine market?

Recent innovations in mRNA, vector-based platforms, and recombinant proteins are accelerating RSV vaccine development. Pfizer and Moderna have completed phase 3 trials for older adults, presenting efficiency over 80% in averting severe RSV disease. FDA approval of maternal and adult RSV vaccines in 2023 has elevated investor confidence in these advanced technologies. Subsequently, both prominent biotech startups and pharma companies are progressively investing in advanced RSV solutions.

Restraints

Regulatory challenges and delays restrict the market's progress

RSV vaccines experience regulatory scrutiny because of the vulnerability of target populations, comprising older adults and infants. Regulatory approval schedules differ significantly in nations, delaying industry entry. For example, while the United States FDA approved RSV for older adults in 2023, approval in countries such as parts of Africa and India is still pending as of 2024. Differences in clinical trial needs, post-marketing surveillance, and safety evaluations add to the complexity. These regulatory challenges raise time-to-market and decrease the immediate potential for vaccine manufacturers.

Opportunities

How does integration with routine immunization schedules open lucrative opportunities for the respiratory syncytial virus vaccine market development?

Incorporating RSV vaccines into current childhood immunization programs offers an opportunity for high coverage in the respiratory syncytial virus vaccine industry. National Health Agencies and the WHO are assessing RSV vaccination alongside routine vaccines like influenza and DTP.

In 2024, the European CDC advises adding RSV vaccination to pediatric and adult immunization schedules in pilot programs, raising expected uptake. Integration decreases logistical costs and enhances public compliance. These initiatives can create long-term and steady industry demand while strengthening public health outcomes.

Challenges

Limited cold-chain infrastructure restricts the market growth

RSV vaccines usually need strict storage conditions, with mRNA-based ones requiring ultra-cold temperatures. Several middle and low-income nations lack the necessary cold-chain infrastructure, hampering broader distribution. For example, rural clinics in sub-Saharan Africa experience major logistical obstacles in transporting and storing vaccines safely. Infrastructure restrictions decrease industry penetration and raise operational costs. Investment in cold-chain expansion is essential but remains a significant challenge for worldwide deployment.

Respiratory Syncytial Virus Vaccine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Respiratory Syncytial Virus Vaccine Market |

| Market Size in 2024 | USD 3.52 Billion |

| Market Forecast in 2034 | USD 58.70 Billion |

| Growth Rate | CAGR of 42.17% |

| Number of Pages | 215 |

| Key Companies Covered | Pfizer, GSK (GlaxoSmithKline), Moderna, AstraZeneca, Sanofi, Johnson & Johnson (Janssen), Merck & Co., Bavarian Nordic, Novavax, BioNTech, Adimmune Corporation, MedImmune, Arcturus Therapeutics, Dynavax Technologies, Bharat Biotech, and others. |

| Segments Covered | By Type, By Technology, By Targeted Population, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Respiratory Syncytial Virus Vaccine Market: Segmentation

The global respiratory syncytial virus vaccine market is segmented based on type, technology, targeted population, distribution channel, and region.

Based on type, the global respiratory syncytial virus vaccine industry is divided into passive immunization and preventive vaccines. The preventive vaccines segment is the leading segment due to its high demand from extensive maternal and adult vaccination programs.

On the other hand, the passive immunization segment ranks second in the market because monoclonal antibodies are primarily targeted at high-risk infants, which restricts their broader industry penetration.

Based on technology, the global market is segmented into monoclonal antibodies, recombinant protein + adjuvant, mRNA-based vaccine, and Virus-Like Particle (VLP). The monoclonal antibodies segment holds a leading share because of their immediate protective effect in high-risk infants and robust clinical adoption.

Conversely, the recombinant protein + adjuvant segment ranks second since it offers broad immunization for maternal populations and adults with well-developed safety and regulatory approvals.

Based on the targeted population, the global respiratory syncytial virus vaccine market is segmented into adults and infants & children. The adults segment holds a substantial share since regulatory-approved vaccines for older adults and maternal immunization programs are fueling elevated adoption.

However, the infants & children segment holds a second position since current pediatric vaccine trials and monoclonal antibodies are increasing coverage but are restricted in scale.

Based on distribution channel, the global market is segmented into hospital & retail pharmacies, government suppliers, and others. The hospital & retail pharmacies segment holds a dominating market share because of direct access to patients, strong private sector acceptance, and elevated vaccination convenience.

Nonetheless, the government segment holds a second-leading position because public immunization programs fuel volume, although coverage is usually restricted to specific high-risk populations.

Respiratory Syncytial Virus Vaccine Market: Regional Analysis

Why does North America hold a dominant position in the global Respiratory Syncytial Virus Vaccine Market?

North America is likely to sustain its leadership in the respiratory syncytial virus vaccine market due to early regulatory approvals, high disease burden, and strong healthcare infrastructure. North America, mainly the United States, is a leader in approving RSV vaccines for maternal adult immunization, comprising Pfizer’s Abrysvo and GSK’s Arexvy. Early approvals enabled immediate industry commercialization and high acceptance among target populations. Regulatory dominance ranks the region ahead of Asia Pacific and Europe.

Moreover, RSV causes major hospitalizations in the United States, with nearly 177,000 older adults hospitalized every year and millions of infants affected worldwide. This elevated number fuels both private and public demand for preventive measures. The disease burden directly translates into surged vaccine adoption rates.

Furthermore, North America holds a broader network of clinics, hospitals, and retail pharmacies, aiding vaccine distribution. Advanced cold chain logistics provide storage of temperature-sensitive RSV vaccines and timely delivery. This infrastructure supports effective industry penetration and high vaccination coverage.

Europe continues to secure the second-highest share in the respiratory syncytial virus vaccine industry due to public awareness, vaccination programs, reimbursement support, insurance, and an aging population. National health agencies actively promote maternal and adult vaccination through seasonal advisories and awareness campaigns. Physicians advised RSV immunization to pregnant women and older adults. These programs raise vaccine acceptance in multiple European countries.

In several Western European nations, RSV vaccines are reimbursed under public health schemes or private insurance. This decreases out-of-pocket costs and motivates wider adoption. Financial support promises industry accessibility for high-risk groups. Additionally, Europe holds the fastest-growing older adult population worldwide, with more than 20% of citizens aged 65 or older by 2025. This demographic is vulnerable primarily to RSV-associated complications. The large geriatric population sustains steady demand for vaccines.

Respiratory Syncytial Virus Vaccine Market: Competitive Analysis

The leading players in the global respiratory syncytial virus vaccine market are:

- Pfizer

- GSK (GlaxoSmithKline)

- Moderna

- AstraZeneca

- Sanofi

- Johnson & Johnson (Janssen)

- Merck & Co.

- Bavarian Nordic

- Novavax

- BioNTech

- Adimmune Corporation

- MedImmune

- Arcturus Therapeutics

- Dynavax Technologies

- Bharat Biotech

Respiratory Syncytial Virus Vaccine Market: Key Market Trends

Adoption of advanced vaccine technologies:

mRNA, virus-like particle (VLP), and recombinant protein + adjuvant platforms are extensively developed and deployed. These solutions improve safety, efficacy, and speed of production. Advancements in vaccine platforms are transforming competitive differentiation among manufacturers.

Integration with seasonal immunization campaigns:

RSV vaccination is integrated alongside COVID and influenza booster campaigns in many regions. Seasonal targeting assures high acceptance during peak RSV case months. This approach enhances patient compliance and operational efficiency.

The global respiratory syncytial virus vaccine market is segmented as follows:

By Type

- Passive Immunization

- Preventive Vaccines

By Technology

- Monoclonal Antibodies

- Recombinant protein + adjuvant

- mRNA-Based vaccine

- Virus-Like Particle (VLP)

By Targeted Population

- Adults

- Infants & Children

By Distribution Channel

- Hospital & Retail Pharmacies

- Government Suppliers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Respiratory syncytial virus vaccines are designed to prevent lower respiratory tract infections caused by the RSV virus, which primarily affects older adults, infants, and immunocompromised individuals. After years of research challenges, the industry experienced developments in 2023-24 with the first EMA- and FDA-approved RSV vaccines for maternal immunization and older adults to protect newborns.

The global respiratory syncytial virus vaccine market is projected to grow due to the rising global RSV infection burden among infants and the elderly, strong government and NGO support for pediatric immunization, and the speedy global launch strategies and commercialization by major players.

According to study, the global respiratory syncytial virus vaccine market size was worth around USD 3.52 billion in 2024 and is predicted to grow to around USD 58.70 billion by 2034.

The CAGR value of the respiratory syncytial virus vaccine market is expected to be around 42.17% during 2025-2034.

Macroeconomic factors like government vaccination budgets, rising healthcare spending, and increasing disposable income will drive higher RSV vaccine adoption and market growth in the near future.

North America is expected to lead the global respiratory syncytial virus vaccine market during the forecast period.

The key players profiled in the global respiratory syncytial virus vaccine market include Pfizer, GSK (GlaxoSmithKline), Moderna, AstraZeneca, Sanofi, Johnson & Johnson (Janssen), Merck & Co., Bavarian Nordic, Novavax, BioNTech, Adimmune Corporation, MedImmune, Arcturus Therapeutics, Dynavax Technologies, and Bharat Biotech.

The competitive landscape is structured around a few global pharmaceutical leaders, such as Pfizer, GSK, and Moderna, dominating through strategic partnerships, product approvals, and geographic expansion.

RSV vaccine pricing trends show premium pricing in high-income regions with gradual tiered and subsidized pricing emerging in the middle- and low-income nations.

The report examines key aspects of the respiratory syncytial virus vaccine market, providing a detailed analysis of current growth factors and restraints, along with future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed