Respiratory Disease Testing Market Size, Share, Growth Report 2032

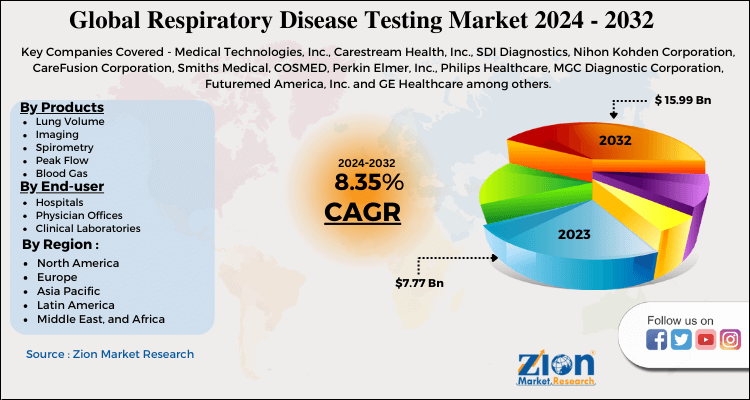

Respiratory Disease Testing Market by Product (Lung Volume, Imaging, Spirometry, Peak Flow, Blood Gas, and Other Tests), By End-user (Hospitals, Physician Offices, and Clinical Laboratories): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

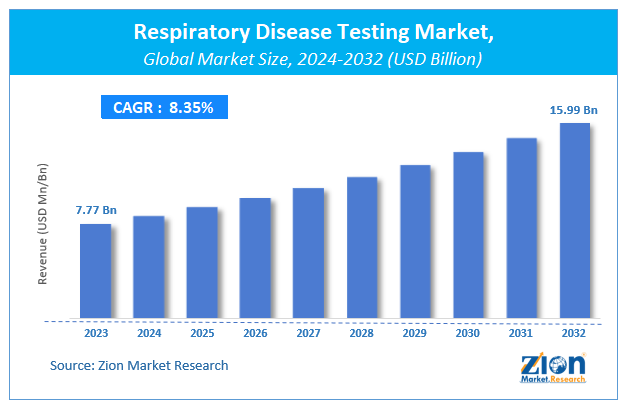

| USD 7.77 Billion | USD 15.99 Billion | 8.35% | 2023 |

Respiratory Disease Testing Market Insights

According to a report from Zion Market Research, the global Respiratory Disease Testing Market was valued at USD 7.77 Billion in 2023 and is projected to hit USD 15.99 Billion by 2032, with a compound annual growth rate (CAGR) of 8.35% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Respiratory Disease Testing Market industry over the next decade.

Respiratory Disease Testing Market: Overview

The respiratory system is one of the vital systems of the human body. The respiratory system plays an important role in breathing. Breathing is usually habitual and is controlled automatically by the respiratory center at the base of the brain. In addition, the respiratory system also helps to stabilize blood-alkaline balance (pH), remove toxic waste and regulate temperature. Respiratory diseases inhibit this usual operation of the respiratory system and are usually caused as a result of the inhalation of dangerous agents, smoking, and unhealthy lifestyles.

The respiratory tract performs the function of inhaling oxygen from the atmosphere into the lungs, transferring of the oxygen to the blood, and exhaling carbon dioxide outside of the body. Breathing is usually habitual, controlled automatically by the respiratory center at the base of the brain. In addition, the respiratory system also helps to stabilize blood-alkaline balance (pH), remove toxic waste and regulates temperature. Respiratory diseases inhibit this usual operation of the respiratory system and are usually caused as a result of the inhalation of dangerous agents, smoking, and unhealthy lifestyles. Besides this other factors such as genetic factors, infections either indirectly or directly may also cause respiratory ailments. There are many disorders and infections of the respiratory system. Infections occur more commonly in the respiratory tract as compared to other organs in the body. The respiratory testing devices aid in detecting chronic or acute respiratory diseases; which is very necessary for the treatment to people with respiratory damages.

Respiratory tests such as spirometry, lung volume, peak flow test, imaging, blood gas test, and few other tests are used to diagnose the respiratory disease. Equipment used to detect pulmonary abnormalities hold immense potential due to increasing prevalence of various respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), cystic fibrosis, and pneumonia. More than 200 million people globally are suffering from asthma, and there have more than 3 million deaths worldwide due to COPD. Moreover, technological advancements and growing aged population would drive the global respiratory disease testing market. However, portable spirometers and low adoption rate of digital radiography may curb the growth of respiratory disease testing market during the forecast period. However, the budding market in Asia-Pacific can act as a potential opportunity for respiratory disease testing market during the forecast period.

Request Free Sample

Request Free Sample

Respiratory Disease Testing Market: Growth Factors

Respiratory tests such as spirometry, lung volume, peak flow test, imaging, blood gas test, and a few other tests are used to diagnose respiratory disease. Equipment used to detect pulmonary abnormalities hold immense potential due to the increasing prevalence of various respiratory diseases Moreover, technological advancements and a growing aged population would drive the global respiratory disease testing market. However, portable spirometers and the low adoption rate of digital radiography may curb the growth of the respiratory disease testing market during the forecast period. However, the budding market in Asia-Pacific can act as a potential opportunity for the respiratory disease testing market during the forecast period.

Respiratory Disease Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Respiratory Disease Testing Market |

| Market Size in 2023 | USD 7.77 Billion |

| Market Forecast in 2032 | USD 15.99 Billion |

| Growth Rate | CAGR of 8.35% |

| Number of Pages | 140 |

| Key Companies Covered | Medical Technologies, Inc., Carestream Health, Inc., SDI Diagnostics, Nihon Kohden Corporation, CareFusion Corporation, Smiths Medical, COSMED, Perkin Elmer, Inc., Philips Healthcare, MGC Diagnostic Corporation, Futuremed America, Inc. and GE Healthcare among others. |

| Segments Covered | By Products, By End-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Respiratory Disease Testing Market: Segment Analysis Preview

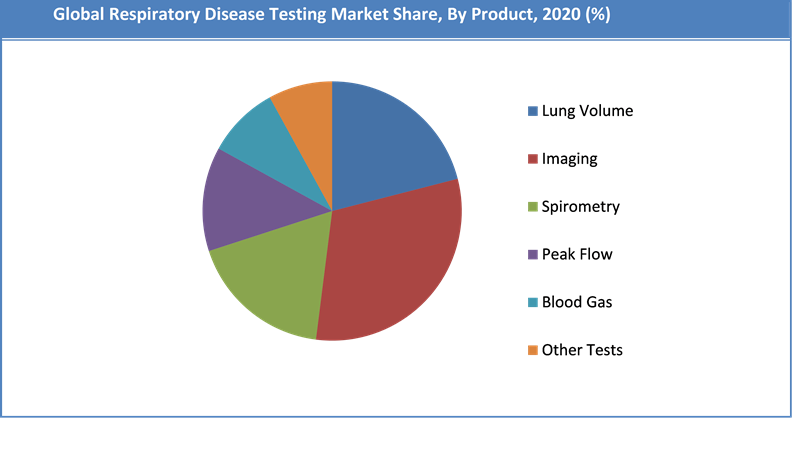

Based on the type of the test, the global respiratory disease testing market has been segmented into imaging tests, peak flow tests, blood gas tests, spirometry, lung volume test, and other tests. The imaging test segment holds the largest share of the global respiratory disease testing market. The global respiratory disease testing market is segmented into three major end-user segments i.e. physician offices, hospitals, and clinical laboratories. Hospitals hold the largest market share of the respiratory disease testing market in 2020.

Based on the type of the test, the global respiratory disease testing market has been segmented into imaging test, peak flow test, blood gas test, spirometry, lung volume test, and other tests. The imaging test segment holds the largest share of the global respiratory disease testing market. The dominance of the segment was mainly due to high demand for imaging tests, especially X-ray. In addition, doctors insist for these tests as they are considered the primary tests for diagnosis of respiratory diseases. While the spirometry test segment is projected to be the fastest growing segment during the forecast period due to its effectiveness and accurate diagnostic results in a short period of time.

The global respiratory disease testing market is segmented into three major end-user segments i.e. physician offices, hospitals, and clinical laboratories. Hospitals hold the largest market share of respiratory disease testing market in 2015. Hospitals hold more than 50% share of global respiratory disease testing market. The segment dominated the market as most of the respiratory diagnostic instruments, particularly X-ray machines are mostly available in hospitals. Moreover, doctors favor in-house diagnostic tests for their patients in comparison to outside patients.

North America holds the largest market share for respiratory disease testing in 2015. The dominance of the region was primarily due to rise popularity of portable devices, increasing the prevalence of respiratory diseases and growing demand for home health care devices and services. The respiratory disease testing market in Asia-Pacific is expected to grow at the fastest growth rate during the forecast period. Latin America is projected to expand at a noticeable growth rate during the forecast period.

Respiratory Disease Testing Market: Regional Analysis Preview

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa are key regional segments of the global respiratory disease testing market. North America holds the largest market share for respiratory disease testing in 2020. The dominance of the region was primarily due to the rising popularity of portable devices, increasing the prevalence of respiratory diseases, and growing demand for home health care devices and services. The respiratory disease testing market in Asia-Pacific is expected to grow at the fastest growth rate during the forecast period. Latin America is projected to expand at a noticeable growth rate during the forecast period.

Respiratory Disease Testing Market: Key Players & Competitive Landscape

Some of the major players in the global Respiratory Disease Testing market include:

- Medical Technologies, Inc.

- Carestream Health, Inc.

- SDI Diagnostics

- Nihon Kohden Corporation

- CareFusion Corporation

- Smiths Medical

- COSMED

- Perkin Elmer, Inc.

- Philips Healthcare

- MGC Diagnostic Corporation

- Futuremed America, Inc.

- GE Healthcare among others.

The global Respiratory Disease Testing Market is segmented as follows:

By Products

- Lung Volume

- Imaging

- Spirometry

- Peak Flow

- Blood Gas

- Other Tests

By End-user

- Hospitals

- Physician Offices

- Clinical Laboratories

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of The Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Respiratory Disease Testing Market was valued at USD 7.77 Billion in 2023.

The global Respiratory Disease Testing Market is expected to reach USD 15.99 Billion by 2032, with a CAGR of around 8.35% between 2024-2032.

Some of the key factors driving the global Respiratory Disease Testing Market growth are increasing prevalence of various respiratory diseases and growing aged population.

North America is expected to remain the dominant region over the forecast period. North America followed by Asia-Pacific and Europe in terms of demand for Respiratory Disease Testing.

Some of the major players of global Respiratory Disease Testing market Medical Technologies, Inc., Carestream Health, Inc., SDI Diagnostics, Nihon Kohden Corporation, CareFusion Corporation, Smiths Medical, COSMED, Perkin Elmer, Inc., Philips Healthcare, MGC Diagnostic Corporation, Futuremed America, Inc. and GE Healthcare among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed